The importance of leveraging consumer insight and data is more important than ever in financial services. New tools and technologies make advanced data analytics available for all sized organizations, while digital channels and the desire for personalized offers make the investment in data analytics mandatory for success.

Unfortunately, while the use of advanced analytics for insight-driven marketing is one of the most important trends in marketing, it still ranks low on the list of priorities according to the 2017 State of Financial Marketing study published by the Digital Banking Report.

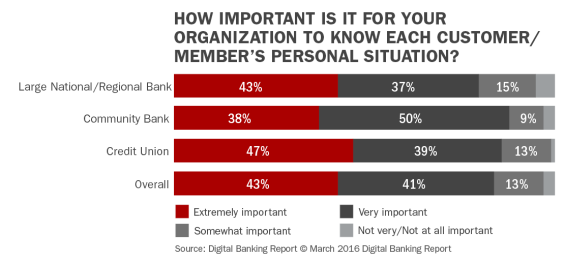

It’s not that the banking industry doesn’t recognize the importance of knowing their customers. According to the report, “The Power of Personalization in Banking,” all institution types and asset ranges agreed on the importance of knowing their customers’ and members’ personal financial situation and financial behavior. In fact, more than 80% of organizations surveyed thought it was either ‘very’ or ‘extremely’ important to know their customers’ financial situation.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Changing Sales Strategies

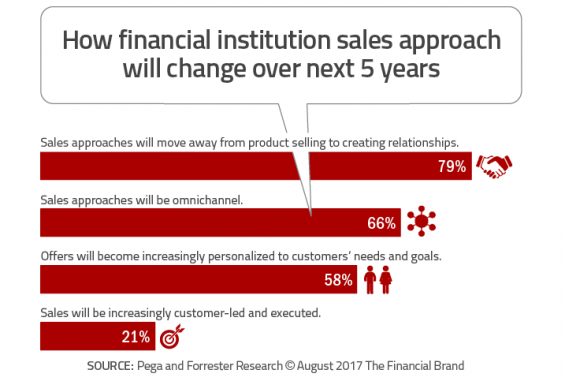

In a global study of salespeople and professionals supporting sales tools at financial services firms with $100M+ in assets conducted by Forrester Consulting on behalf of Pega, nearly 8 out of 10 respondents agreed that the industry will evolve its sales approach to a relationship-based model over the next 5 years. They also believed the sales efforts would be omnichannel (66%), with personalized offers (58%) and may be driven by the customer (21%).

Interestingly, the Forrester/Pega study found that financial marketers believed customers will expect personalized offers and financial guidance more than being able to execute the purchase easily.

Listen In: Does Your CRM Enable Relationship Selling?

The Benefits of Relationship Selling

The study found that most financial institutions were at the midpoint of their journey towards being able to provide relationship-based selling as opposed to being product focused. While roughly 30% they were doing a decent job with the concept, close to one in five were still pushing products.

Those institutions who were further along their relationship-based selling journey saw the following benefits:

- Increased revenue

- Increased sales

- Increased referrals

- Increased satisfaction and loyalty

- Greater use of self-service products

Challenges Faced With Relationship Selling

Building a relationship-based strategy is not easy. With the need to use real-time customer data and build an internal logic around what services should be offered at what time, many have leveraged outside resources to assist with the process of generating highly personalized engagement. According to the study, just slightly over one quarter (28%) believe they can provide highly personalized experiences today.

Beyond being able to access real-time insights internally, organizations are feeling pressures on the outside to improve their delivery of products and services. Almost 7 out of 10 organizations felt the pressure from fintech vendors to do better than what they are able to do today.

When organizations were asked what were the major challenges with their current selling tools that are available to address the desire to provide a personalized, relationship-based sales platform, the availability of eta insights from across the organization was again at the top of the list. In addition, having the right technology to deliver on the promise was also found to be a significant challenge.

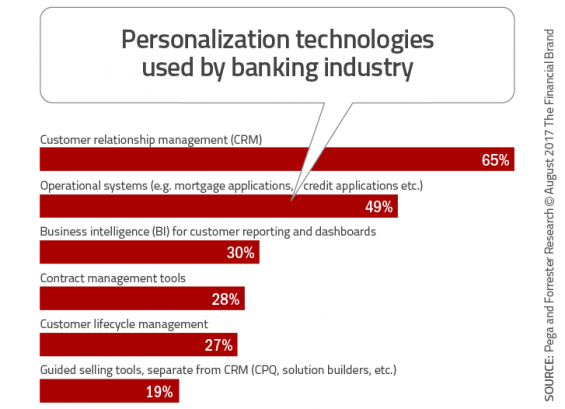

As can be seen, most organizations are still using traditional CRM systems or operational systems to support a personalized interaction. Far fewer organizations are using the more sophisticated tools that are paramount in delivery of a real-time, customer-centric solution.

So, while more than 60% of organizations agree that a shift towards-relationship-based selling is needed, they are limited in their ability to deliver these solutions by the data and tools available. Six out of ten organizations surveyed believed that a multilayered and integrated platform was needed to replace their traditional CRM systems. A full 71% of these organizations believed such a platform would be “very valuable”.

Actions Needed to Move the Sales Process Forward

With customers demanding more personalized and efficient interactions, and with current solutions not being able to deliver on these expectations, the challenge is to build a better sales process moving forward. This goes beyond simply understanding basic customer insights. There is a need to understand customer needs, behaviors and interactions to move from a product-push to an advisory relationship. This is far different from today’s environment, where products are offered based on the financial institution’s product goals as opposed to the customer’s needs.

When asked which tools would be helpful in delivering on the ‘personalization promise,’ the ability to leverage artificial intelligence was by far the most mentioned tool (88%), with proactive authorization/approval capabilities being the next most mentioned capability (46%). The need for AI and machine learning was expected to have the greatest growth over the next 2 years as well.

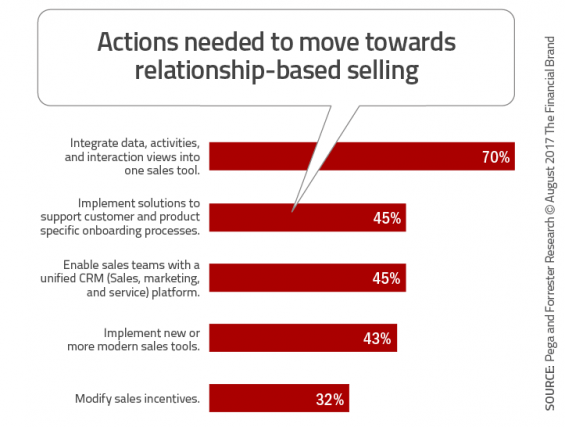

For firms committed to building a relationship-based sales process for the future, their most mentioned action was to integrate data and to provide a more unified CRM platform. Being able to distribute the output of these systems to the appropriate personnel throughout the organization was also found to be imperative.

“Many banks struggle to shift from product-based to relationship-based selling, but failure is not an option if they expect to provide compelling customer experiences,” said Ron Wellman, global director and industry principal, CRM for financial services, Pegasystems. “By implementing a unified CRM platform powered with AI, banks can satisfy customer demands by intelligently guiding sales teams to deliver the most relevant recommendations to clients. This increases client satisfaction and positions banks as trusted advisors for the long-term.”

Delivering on the ‘Personalization Promise’

Consumers want their financial institution to be a seamless part of their daily life, expecting everything to happen with their individual needs and behaviors in mind. This is what firms like Amazon, Facebook and other large tech firms deliver – and this is what today’s consumer has come to expect. This means communicating with the consumer at the right time, right place, right channel and on the appropriate device. They want their primary financial institution to know them, look out for them and reward them.

It’s one thing to know what the consumer wants and what should be done to provide a differentiated and contextual consumer experience. It is far different to be able to deliver on the ‘personalization promise’. It is clear that we are definitely not there yet. A key component of this deliverable is the ability to provide these insights in real time through digital channels.

Since integrated customer insight is required for better timed and targeted offers and for more custom communication, the development of a better personalization strategy supports the top priorities of financial institutions today. In fact, it could be argued that these strategies are required for survival in a marketplace that is becoming more competitive and where consumers are more demanding.

The successful financial services organization in the future (legacy banking organizations or fintech start-ups) will differentiate themselves by the ability to deliver relationship-based selling solutions to enhance the customer’s daily life. If we can accomplish this, we will earn the trust and loyalty of our customers.