Customer engagement can not be achieved in a day, week or a month. It is the foundation of a relationship that includes trust, dialogue, a steady growth in service ownership and a growth in share of wallet if done correctly. The alternative to focusing on building customer engagement is a relationship that does not meet its full potential or customer attrition.

According to Gallup research entitled, The Financial and Emotional Benefits of Fully Engaged Bank Customers, the tangible benefits of a fully engaged customer that is both attitudinally loyal and emotionally attached to the bank include the following:

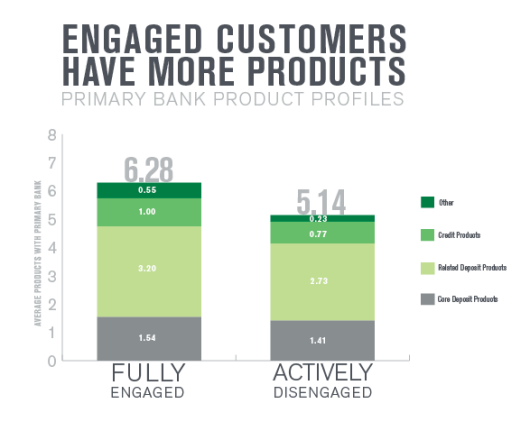

- Increased Revenues, Wallet Share and Product Penetration: Customers who are fully engaged bring $402 in additional revenue per year to their primary bank compared with those who are actively disengaged, 10% greater wallet share in deposit balances and 14% greater wallet share in investments. Fully engaged customers also average 1.14 additional product categories with their primary bank than do customers who are ‘actively disengaged’.

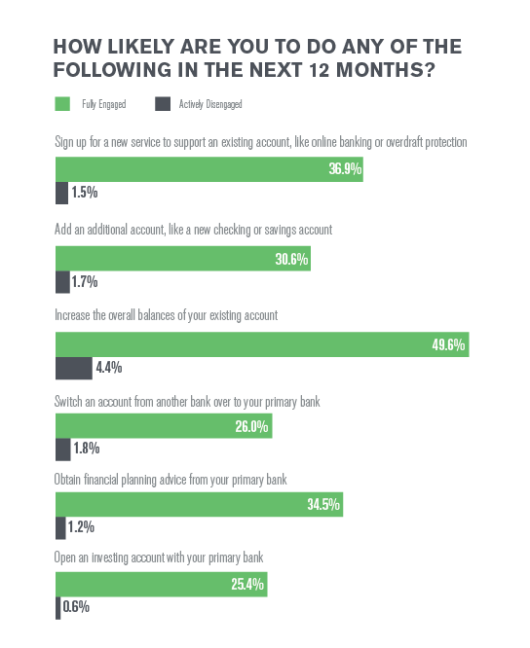

- Greater Purchase Intent and Consideration: An engaged customer not only holds more accounts at their primary bank, they also look to that same bank when considering future needs. At a time when so much of the shopping process is done online, improving your bank’s chances of being in the customer’s consideration set is important.

- Becoming a Financial Partner: Less tangible, but no less important, the Gallup research showed that an engaged customer builds a bond with their bank or credit union that every financial institution would covet. According to the research 54 percent of engaged customers strongly agree that their bank helps their financial dreams come true and a similar percentage believe their bank makes their life more enjoyable. Most importantly, 71 percent of engaged customers say they will use their current bank for the rest of their life.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Here are the secrets to setting the foundation for strong customer engagement:

1. Improve Acquisition Targeting

Customer engagement begins before a new customer even opens an account. With today’s depth of data and processing capability, it is possible to find new prospects that are similar to the best customers who already have accounts at a financial institution. By building acquisition models that look at product usage, financial behavior and relationship profitability, opening accounts that have limited potential for engagement or growth is reduced.

Beyond demographic, financial behavior and product use modeling, geographic modeling is also important since the strongest potential trade areas are not always clearly defined by branch radius mapping.

2. Change the Conversation

One of the key elements of building an engaged customer relationship begins with the conversation during the initial account opening process. To build trust, the conversation must focus on making sure the customer believes that you are genuinely interested in getting to know them, are willing to look out for them and that, over time, you will reward them for their business/loyalty.

This early conversation needs to focus more on capturing insight from the customer and discussing the value different products and services will have from the customer perspective as opposed to simply discussing features. The goal is to illustrate to the customer that the products and services being sold will meet their unique financial and non-financial needs.

Some of the insight that should be collected (beyond the basics) includes:

- Financial objectives

- Primary financial decision maker in the household (it is often the wife)

- Communication channel preference(s)

- Accounts held elsewhere (balance details are not as important as knowing the category)

Unfortunately, research studies indicate that the majority of branch personnel have difficulty having in-depth conversations with customers around needs and the value of an organization’s services. In other words, having a firm grasp of product knowledge is no longer enough. The initial focus should also be on sales quality as opposed to sales quantity.

Interestingly, some financial institutions have begun utilizing iPads to collect insight directly from the customer. While seeming less personal, an iPad new account questionnaire standardizes the collection process and usually is able to collect far more personal information than the bank or credit union employee is comfortable collecting.

3. Communicate Early and Often

It is interesting how banks and credit unions set objectives for expanding a customer relationship and engagement and then establish arbitrary rules around communication frequency and cadence. It is not uncommon for a bank to limit the number of ‘touches’ to one a month or less despite the fact that a new customer has been shown to desire significantly more interaction as part of their new

relationship.

In fact, research from J.D. Power has found that the optimum number of communication messages during the first 90 day period from both a customer satisfaction and relationship growth perspective is seven ‘touches’ across various communication channels.

An example of an onboarding engagement communications plan is shown below. The contacts below don’t include additional media such as online and mobile banking messaging, ATM messaging, digital retargeting, etc. It is important to remember that at the very least, an engagement communications plan should include a ‘thank you’ message within the first 5 days of the account opening (from either as new or existing customer).

| Focus | Messages Sent | Mobile | ||

|---|---|---|---|---|

| Day 1 | Welcome & Activation |

Welcome Kit Preapproved Offer |

Email Capture | Mobile Capture |

| Day 2 | Thank You | Welcome Email | Welcome Text | |

| Day 5 | Utilization | New Account Follow-Up ‘Go With’ Service Discussion |

Alert Notification Sign-Up |

Alert Notification Text |

| Days 7-30 |

Utilization & Engagement |

Branch Phone Check-In Engagement Letter |

Engagement Email (Direct Deposit/Online BillPay) |

Engagement Text (Direct Deposit) |

| Days 30-60 |

Utilization & Engagement |

Branch Engagement Call |

Day 30 Engagement Email Day 45 Utilization Email |

Engagement Text (Mobile Deposit) |

| Days 60-90 |

Engagement & Cross-Sell |

Call Center Relationship Expansion |

Modeled Engagement Service Email |

Engagement Text Rewards Offer |

| Days 90-180 |

Cross-Sell | Call Center Relationship Expansions |

Modeled Service Cross-Sell |

Modeled Service Cross-Sell |

4. Personalize The Message

Despite the amount of insight that we collect on a new customer and the processing power most financial institutions have at their disposal, recent research studies show that more than 50 percent of engaged customers get mistargeted communication. This includes communication about a product/service the customer already owns or about a service that is not in alignment with the insight that the customer shared with the institution.

Today’s consumer has come to expect well targeted and personalized communication. Anything less and trust already achieved is lost. This is especially true with financial services, where the customer has provided very personal information and expects this insight to be used for their advantage.

To build engagement, it is best to build an engagement service sales grid that indicates what services should be emphasized in communication given current product ownership. Engagement communication is not a ‘one size fits all’ dialogue. It should reflect the relationship in real-time.

5. Build Trust Before Selling

As in any relationship, it is imperative that a strong foundation of trust is established before moving the relationship forward. In banking, this equates to providing the necessary information required to best use the service opened before trying to sell another product or service.

If a customer opens a new checking account, the services that should be discussed include:

- Direct Deposit

- Online BillPay

- Online Banking

- Mobile Banking

- Privacy Protection/Security Services

Education around additional enhancements to a checking account that can further build an engaging relationship include:

- Mobile Deposit Capture

- Rewards Program

- Account to Account Transfers

- P2P Transfers

- Electronic Statements

- Notification Alerts

During this relationship growth process, additional insight into the customer’s needs should be collected whenever possible with personalized communication reflecting this new insight.

6. Reward Engagement

Unfortunately, the adage “If you build it, they will come” doesn’t usually apply in banking. While we may build great products and provide new, innovative services, customers often require additional encouragement to use a product optimally and for engagement to grow the way we would desire.

As a result, offers are often required to stimulate the desired behavior. In the development of offers, banks and credit unions should keep in mind that the offer should be built on the product(s) already held as opposed to the product or service being sold. This is because, especially in financial services, a customer doesn’t completely understand the benefits of the new service. Therefore, if the new account is a checking account, the offer should be one that reduces the cost of the checking, provides an added benefit to the checking or reinforces the checking relationship.

Potential offers could include waived fees or optimally enhanced level(s) of rewards for a specific action or limited duration. The benefit of using rewards would be that a reward program is a strong engagement tool itself.

7. Gear To The Mobile Customer

While direct mail and phone are highly effective in building an engaging relationship, the use of email and SMS texting can significantly improve results because of mobile communication consumption patterns. The reading of email on mobile devices recently surpassed desktop consumption indicating that most messages should be geared to a person who is either on the go or multi-tasking (or both).

To communicate with the mobile customer, email and SMS texting should be direct and to the point. The customer does not want to know everything about the account, they want to know what’s in it for them and how do they respond. While links should be used to provide additional product information if needed, a ‘single click’ option should be available to say “yes.”

With regard to links, many financial institutions have found that using short form videos is the best way to generate understanding and response. Excellent videos around online bill pay, mobile deposit capture and A2A/P2P transfers can not only educate, but immediately link to the “yes” button to close the sale.

When using educational sales videos, it is important to remember that the video should be short (under 30 seconds) and built for mobile consumption first. While a video built for mobile will always play well on larger devices, the opposite is usually not true.

8. Keep The Dialogue Going

A customer usually doesn’t react to the first message you send. Instead, they may need several alternative forms of encouragement to take action and to expand their relationship. As a result, the use of digital retargeting and sequential communication becomes important.

Digital retargeting could include reaching out to people who visited (and left) your website or did not respond to a landing page message. Retargeting can also be done for people who open emails but don’t respond, click online sales banners or are wandering the web shopping for services you provide.

Some of the most interesting forms of retargeting today include the ability to retarget customers or prospects who you have sent postal mail but want to reach them either on their computer or their phone as well. While only available on about 30-40% of households currently, response rates can be increased significantly by combining both online and offline messaging.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

9. Test and Learn

Unfortunately, there is no single formula for success for customer engagement in banking. Because of the difference in market areas, competition, product lines and customer profiles, all of the above secrets of engagement can take on different forms for different institutions. The key is to continue to test your engagement process for optimal efficiency and effectiveness.

Some of the primary variables to test as you build your communications plan include:

- Cadence of communication (how much)

- Sequence of communication (when)

- Channel of communication (how)

- Target audiences (to whom)

- Products marketed (what)

- Offers

The most important lesson for an agile test and learn process is that perfect insight usually takes too long in today’s quickly changing environment. As a result, it is sometimes best to make a quick ‘go/no go’ decision as opposed to a highly detailed analysis that may not yield significantly better results given the expense.

In an era of reduced fee income, increasing competition and a more demanding customer, the benefit of selling a standalone checking accounts will only get an organization so far in terms of revenue growth. It is no longer enough for bankers to be knowledgeable about product options; they need to help customers understand how each option will fit into their overall lifestyle. Banks need to invest in the personnel, support systems and communication process that will allow them to have the continued dialogue they need to build long-term, profitable customer relationships.

The benefits of this communication are real and imperative for success.