The banking industry is trying to respond to an increasingly turbulent business environment, where legacy leadership and existing cultures are being challenged. In many instances, the legacy culture becomes a barrier to required change needed to become digital banking organizations.

Not only do leaders need to articulate a vision for a future of increasing customer expectations, greater competition, new delivery channels and advancing technology, but also provide the resources to become digital financial technology organizations.

Never has there been a greater need for transformational change as opposed to incremental adjustments to “business as usual.” As part of the research for the 2020 Retail Banking Trends and Priorities report, we looked at the anticipated retail banking trends for 2020, and the underlying priorities articulated by financial institutions globally. The results present a very important question: Is the banking industry moving fast enough to meet the needs of the consumer and to compete against highly agile competition?

Never has there been a greater need for transformational change as opposed to incremental adjustments to “business as usual.” As part of the research for the 2020 Retail Banking Trends and Priorities report, we looked at the anticipated retail banking trends for 2020, and the underlying priorities articulated by financial institutions globally. The results present a very important question: Is the banking industry moving fast enough to meet the needs of the consumer and to compete against highly agile competition?

For the ninth consecutive year, we surveyed a panel of global financial services leaders from Asia, Africa, North America, South and Central America, Europe, the Middle East and Australia for their thoughts on retail banking and credit union trends and strategic priorities. Instead of a crowdsourced panel, we added in-depth interviews from industry analysts, advisors, authors and fintech influencers who provided deeper understanding into the key trends.

While there was some encouraging movements in both the projected trends and strategic priorities indicated by the banks, credit unions and solution providers questioned, most of the movements were more modest than required and sometimes misguided, given the realities of the marketplace.

“As we enter a new decade, banks and credit unions must rethink their strategies and priorities as data and analytics is applied to product development, distribution, innovation, back office support and improved customer experiences. Now is the time for a ‘disruptive mindset’ in banking.”

By collecting insights from banks and credit unions globally, ranking the trends and strategic priorities, conducting exclusive interviews with business leaders and including extensive analysis on the progress of digital transformation, we have developed the most comprehensive annual trend report in the banking industry. For the fifth consecutive year, the research, analysis and Digital Banking Report were sponsored by Temenos.

Get the 2020 Retail Banking Trends Report

Read More:

- Top Digital Banking Transformation Trends for 2021

- 7 Essentials of Digital Banking Transformation Success

- COVID Hiked Digital Banking Users But Improved CX Keeps Them There

- Data Reveals a Surprise Driver of CX Satisfaction in Banking

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Fractional Marketing for Financial Brands

Services that scale with you.

A Look Back: 2019 Retail Banking Trends

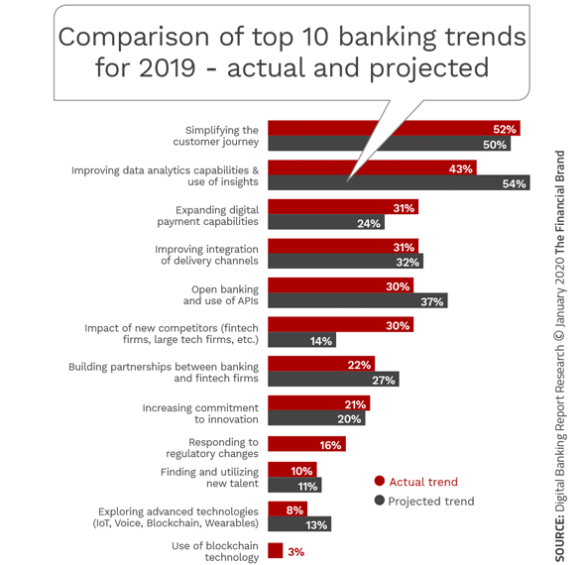

As part of this year’s research, we asked survey respondents to note the top ten trends that they saw looking back to 2019. We then compared these responses to the projections that were made last year as part of the 2019 Retail Banking Trends and Predictions report (now available for free download).

As can be seen below, the top five trends projected at the beginning of 2019 were significantly different than what actually was thought to have occurred last year. For instance, while use of data and advanced analytics was anticipated to be the top trend for 2019 (54%), most organizations believed that improving the customer experience was actually the top trend (52%), with the actual trend of data and analytics dropping by more than 10%.

The other major variance between what was projected at the beginning of 2019 and what organizations believed actually occurred was in the area of digital payments (24% vs. 31%) and the impact of new competitors (from 14% to 30%). In the rear view mirror lookback at 2019, we also saw a modest decrease in the impact of open banking APIs and partnerships with fintech firms.

Top 10 Retail Banking Trends for 2020

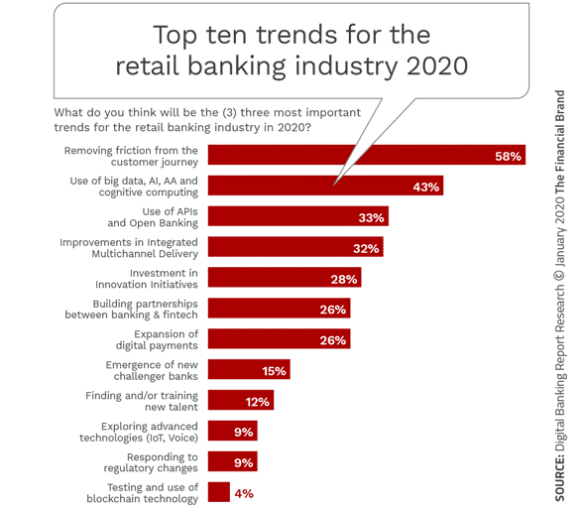

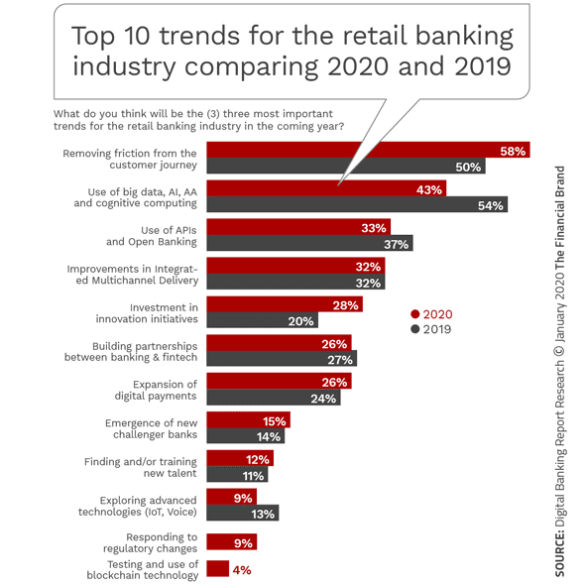

The ranking of the top ten trends and predictions was done by providing a list of trends identified by a panel of leading industry influencers and asking banks, credit unions and the supplier community globally to provide their top three predictions for 2020.

The trends and predictions reflect that planning and trends continue to be a modest movement from previous year’s plans. Instead of “blowing up the past,” most organizations simply modify previous strategies. And while all organizations state a mission of digital transformation, digitalization and innovation initiatives, use of cloud technologies, application of advanced analytics and embracing new distribution alternatives continue to be very modest at best.

These initiatives have driven the top three trends and predictions for 2020:

- Customer-centric perspective and the elimination of friction from the customer journey (58%).

- Real-time intelligent data integration through the use of AI, advanced analytics and cognitive computing (43%).

- Use of APIs for the transformation to an open banking platform (33%).

Read More:

- Crisis as a Catalyst for Leadership, Digital Transformation & Cultural Growth

- Digital Transformation Demands a Culture of Innovation

- What the Surge in Fintech Launches Signals for Banking’s Future

Get the 2020 Retail Banking Trends Report

Interestingly, after a one-year drop from the top trend, the importance of improving the customer experience regained the top trend position, moving last year’s top trend of integrating data and analytics to the second position. This is highly disconcerting given that the drop in mentions was greater than 10% at a time when data and advanced analytics is the foundation for the experience most institutions state they desire.

Somewhat surprisingly, the importance of open banking APIs remained in the third position across all geographic segments despite being viewed as ‘not meeting expectations’ in 2019. This positioning becomes debatable at a time that very few organizations outside of Europe and China are currently implementing open banking strategies.

What is encouraging is the significant increase in prominence of the investment in innovation this year compared to 2019. As we found in the Digital Banking Report, State of Digital Banking Transformation, there is a very strong positive correlation between innovation and digital transformation maturity. If organizations focus on innovation to the degree anticipated, this will bode well for the industry.

As has been the case over the past several years, the overall list of top 10 trends identified by the financial services industry has remained relatively consistent over time. This year-to-year consistency could be a symptom of a greater problem, however.

The banking industry is transforming incrementally as opposed to dynamically. Disruptive transformation within the banking industry will require the development of partnerships or expanded collaboration with outside organizations. It will also require modernization of outdated technologies and the rethinking of legacy processes and organization structures. The timing of this transformation will differ from one organization to another, but the need for new thinking is non-negotiable.

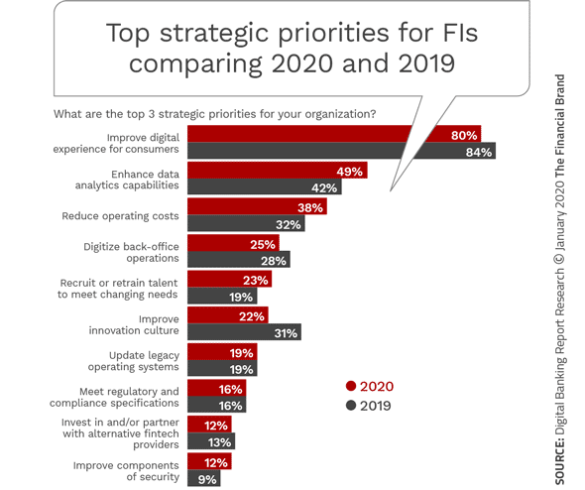

Top 10 Strategic Priorities for 2020

When we asked financial services organizations worldwide about their top three strategic priorities for 2020, the order of priorities remained relatively consistent from 2019 to 2020, with one major exception. Despite stating that investment in innovation would be a much more significant trend in 2020 than in 2019, the emphasis on “improving the innovation culture” saw the steepest drop from last year.

The only explanation for this would be if organizations believed they already have a strong innovation culture, which we have found not to be true in the 2019 Innovation in Retail Banking report (available for free download).

The prioritization of reducing operating costs remained in relatively the same position as last year, but with the importance rising. Of modest concern is that the prioritization of digitizing back office operations went down in 2020 while the importance of updating legacy systems remained static. This reinforces an ongoing trend of modest incremental changes in priorities from year to year as opposed to any bold moves which can transform an organization.

The priority of recruiting and training talent remained relatively static for 2020, leaving many financial institutions vulnerable in the future as the impact of automation and technology continues to impact the future of work.

Digital Transformation Maturity 2020

Despite significant investment in digital transformation across all industries, only one in five consumers report any significant improvement in the experiences received, according to a study conducted by Temenos. And while the banking industry performed better than most industries studied, it is possible that this rating was biased by lower initial consumer expectations.

One issue is that consumers do not believe that businesses are investing in digital initiatives that result in meaningful outcomes. In fact, consumers underestimated the number of businesses that are investing heavily in important digital initiatives (such as data security, mobile access, customer support, etc.) by at least 50%. Part of the problem may be that only 28% of digital transformation initiatives are started with customer needs being the priority (68% were business-process-centered, with 4% being employee-centered).

“The fact that only one in five consumer respondents felt any significant improvement demonstrates the enormous opportunity that remains for businesses to leverage digital for customer loyalty, service levels, convenience, and commerce.” – Thomas E. Hogan, president of Temenos USA

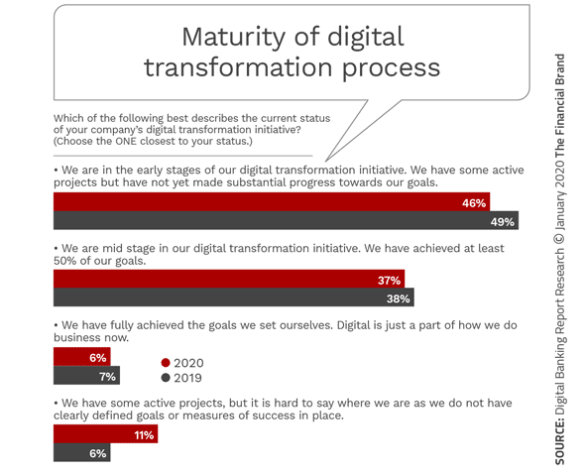

The fact that most organizations are also just beginning their digital transformation efforts indicates that many are playing “catch up.” In banking, 46% of organizations indicated that they were in the early stages of digital transformation. In comparison, only 6% considered digital transformation to be overarching with another 37% stating that their organization was in “mid-stage.”

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Get the 2020 Retail Banking Trends Report

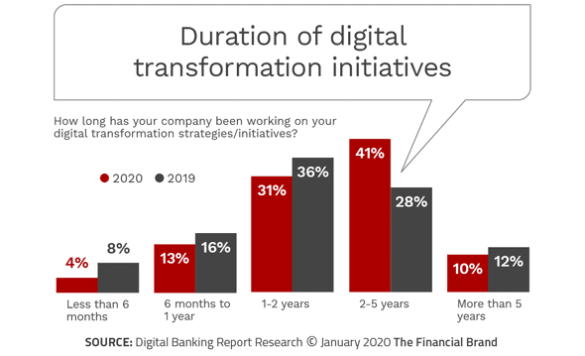

When asked how long organizations have been working on digital transformation, the vast majority of institutions have been working on digital initiatives for one-five years (72%). 17% of organizations have only begun the process (under one year), while 10% of banks and credit unions have been engaged in digital transformation for more than five years.

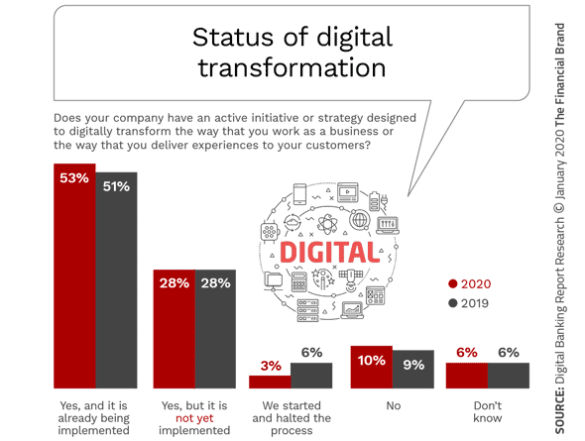

According to the research associated with the 2020 Retail Banking Trends and Priorities report, only half of the organizations surveyed have a strategy in place for digital transformation. Another 28% state that their organization has a strategy, but that the strategy has not been implemented. This is almost exactly the same results as were reported in 2019.

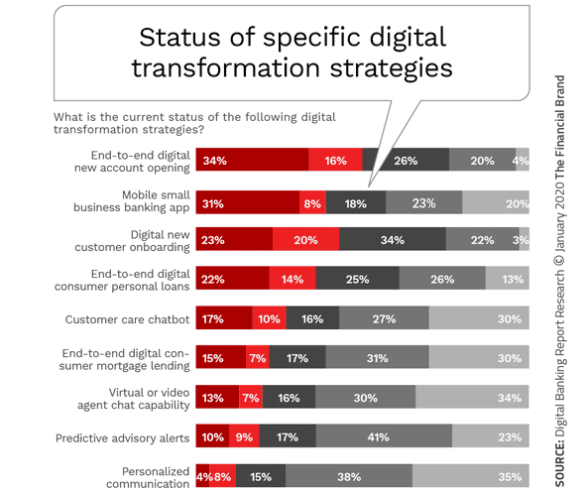

As has been found in other recent surveys around digital transformation by the Digital Banking Report, the respondents to this year’s Retail Banking Trends and Predictions report found that only one-third of organizations had digitally transformed the most basic functions (new account opening and small business mobile banking), with one quarter having made progress on digital onboarding and digital lending applications.

As we have said in the past, these are the bare minimum expectations of consumers wanting to simplify their lives with digital banking relationships. It should be noted that, based on more in-depth research we have done on digital transformation and new account opening, that the digitalization of the new account opening process is most likely overstated.

Finally, in order to meet the increased expectations of consumers around a digital relationship, there needs to be both a high level of personalization as well as the ability to provide proactive and real-time alerts based on transactions. Virtually no organization has achieved this level of digital transformation.

A Look Forward: Banking Industry Challenges

The banking industry continues a positive earnings streak, with profitability increasing to new post-crisis levels. That said, these earnings could be at risk as markets appear more vulnerable than a year ago and competition for traditional banking business continues to increase.

Much of this competition is occurring in areas of traditional strength for legacy banks (payments, lending, small business), with digital players continuing to make inroads. Unfortunately, response to the requirement for digital transformation continues to be slow in most instances.

Anticipating ongoing disruption over the next decade, financial institutions must move from an iteration mentality to embracing disruption of legacy banking models. New partnerships and alliances should be considered, to increase the speed of innovation and to better integrate data, advanced analytics and contextual delivery of services. Banks and credit unions should also focus on social responsibility and financial inclusion.

As we enter a new decade, banks and credit unions must modernize their technology infrastructure, enhance their data management strategies, upgrade their talent, and improve the customer experience.