Gen Z is coming into its own now that its older members are graduating college and starting their careers. The upper end of this large group of consumers — roughly 18 to 25 as of 2020 — increasingly needs the support and services of financial institutions. And the rest of the generation is worthy of early attention as well. Although there is some disagreement about the date range, generally speaking Gen Zers were born between 1995 and 2015.

Because members of each generation are influenced by the events and trends that help shape their expectations and behaviors, segmenting and targeting consumers based on their generation can boost marketing performance.

The six insights on Gen Z laid out below are based on a survey of 1,000 financial services customers by Yes Marketing. For each insight we give one or more examples of how large and small financial brands are adapting their products and marketing to appeal to the preferences of this emerging generation.

1. Gen Z Is Less Trusting

Financial brands are going to have to work harder to earn Gen Z’s trust. Our research indicates that they are less trusting than preceding generations. When we asked financial consumers to rank their reasons for using a financial services provider they had never worked with, only 14% of 18-21 year-olds and 19% of 22-37 year-olds included “trust in the company to protect personal information” in their top three choices. This compares to a third of 38-52 year-olds and nearly half of 53-71 year-olds that cite trust as a factor.

Advice for marketers: Help build trust by establishing yourself as a financial mentor. Create content that is focused on educating young consumers about the basics of banking and investing and create products that are specifically designed to meet their needs. In addition, make sure your brand has clear messaging about security and how you will handle consumer information.

Brand example – Key Bank. The big superregional establishes trust by providing guidance for young consumers through its Financial Wellness Center. Gen Zers benefit from helpful and relevant tips on navigating life after graduating college, including information about the cost to rent an apartment as a new graduate, or how to negotiate their salary after receiving an offer.

Brand example – SF Fire Credit Union. For many young renters in pricey San Francisco, coming up with a first-and-last month’s rent deposit is hard to manage. SF Fire Credit Union establishes themselves as a trusted ally and shows they understand the struggle of Gen Z consumers in the city’s famously expensive rental market by offering rental deposit loans. In addition, they offer small loans for bicycles, appealing to a generation that is supportive of alternative transportation.

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind. Read More about The Financial Brand Forum Kicks Off May 20th This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness. Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

The Financial Brand Forum Kicks Off May 20th

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

2. Gen Z Expects You to Meet Them Where They Are

Young people are on the go more than any other generation before them, and rely on technology to get things done while they zip around. Gen Z is not just fluent in mobile technology — they are dependent on it. This generation is much more likely to prioritize the ability to manage services via mobile as an important factor for choosing a new financial institution. 42% of 18-21 year-olds include mobile banking capability in their top-three considerations, as do nearly as many 21-37 year-olds (37%). Mobile is also important to just over a third of 38-52 year-olds, but just 18% of 53-71 year-olds say the same.

Advice for marketers: To keep pace with this audience, your mobile game needs to be “on fleek.” Financial marketers can make their brand more appealing to Gen Z by ensuring that consumers can manage their financial tasks like payments, requesting credit increases, or getting answers to their questions through mobile apps. From a messaging standpoint, letting young consumers know how your brand can help them manage their finances while they are on the go can improve your standing as well.

Brand example – Synchrony Bank. The online-only bank created their “save like a hero” campaign in partnership with Marvel. The multichannel campaign included augmented reality (AR) and experiential components as well as traditional media like a TV spot that featured a fighter pilot who is inspired by Captain Marvel to save like a hero. The commercial highlights the brand’s mobile app which includes a visual savings tracker, designed for reaching goals on the go.

Read More: 13 Major Insights Into Gen Z Driving Banking Behaviors

Brand example – U.S. Bank. The fifth-largest bank in the U.S. launched an award-winning email campaign to tout the benefits of using their debit card for small purchases. The campaign’s concise copy and clean visuals get straight to the point — perfect for busy Gen Z consumers.

3. Gen Z Relies On the Advice of Others

Perhaps it’s no surprise that the youngest consumers count on the advice of friends and family more than older generations. Our research found that two-thirds of 18-21 year-olds and just over half (56%) of 21-37 year-olds say negative word-of-mouth has deterred them from using financial services companies they haven’t previously used.

In addition, young financial services customers are more likely to have learned about a new financial institution through rate comparison sites like Penny Hoarder or Nerdwallet. One-quarter of 18-21 year-olds and 17% of 22-37 year-olds indicate this versus 13% on average across all generations.

Advice for marketers: While Gen Z consumers rely on their friends and family for input, they are also adept at using the vast resources of the internet to research on their own. Shine a spotlight on your brand’s reputation and strengths by highlighting positive reviews and sharing them with your younger audience.

Brand example – Ally Bank. Ally focused on this point with a funny campaign encouraging consumers to take note of the bank’s positive reviews and urging them not to settle for a “two-star bank.” The creative used a variety of clever taglines like: “You wouldn’t trust a 2-star sushi restaurant.” To compliment the campaign, the brand created fake ads for a few of these imaginary one- or two-star businesses including Sam Smiley Dental and Mike Mekanic. In addition, Ally Bank incorporated interactive banner ads on websites where consumers go to obtain ratings on products and services.

4. Young Consumers Want To Interact with Your Brand On Their Terms

Gen Z is more likely to say they hear from financial brands too frequently across almost all channels than older generations. Gen Zers want to approach brands on their terms and don’t like being disrupted. Specifically, 37% of 18-21 year-olds say they receive emails too frequently, compared to just under a quarter (24%) of 22-37 year-olds, 22% of 38-52 year-olds and just 8% of 53-71 year-olds. In addition, one quarter of 18-21 year-olds say they receive text messages too frequently.

Advice for marketers: Focus on being there when and where Gen Z consumers need you. While financial brands have historically been more cautious about experimenting on the newest social channels, like TikTok, some brands are finding success by getting creative on more established youth channels and meeting younger consumers in their natural habitat.

Brand example – American Express. The card company harnesses the power of Instagram influencers with their #AmexAmbassadors program. Amex partners with hundreds of Instagram accounts with varying audience size and topic interests — from celebrities to travel enthusiasts — who receive perks like being invited to exclusive experiences and parties.

Read More: Financial Marketing Channels Evolve as Gen Z Starts Banking

5. Experience-Based Perks Will Earn Their Loyalty

Gen Z consumers overall are less loyal, with 40% of 18-21 year-olds and 35% of 22-37 year-olds saying they are considering switching financial institutions (compared to only 12% and 9% of the two oldest generations). Further, Gen Zers want to be rewarded for their loyalty in different ways than older generations. 35% of 18-21 year-olds and 40% of 22-37 year-olds say early access to new products/services is their most preferred loyalty reward. In addition, 29% of 18-21 year-olds and 22% of 22-37 year-olds say access to perks is their number one reward.

Advice for marketers: Gen Z differs from Millennials in many ways, but when it comes to loyalty rewards, Gen Z shares the Millennial trend of craving experiences over things. Financial brands can consider providing experience-based perks over the points-based systems preferred by older generations. Marketers can also build connections by creating campaigns and content that touch on the desire for experiences and adventure.

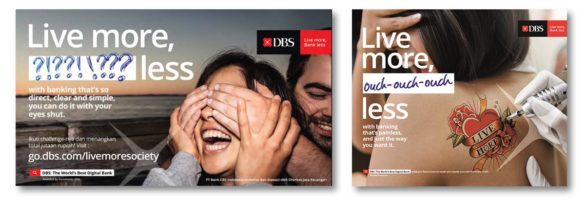

Brand example – DBS Bank. Singapore’s DBS Bank released their “Live More, Bank Less” campaign to highlight how the brand gives consumers more time to focus on what matters — living life and having experiences. The campaign delivered multiple taglines that address the needs of different customer segments, including ones that appealed to younger consumers who place high value on experiences.

6. Don’t Forget Minors … and Their Parents

Since a portion of Gen Z is still minors, you can make connections to them by way of their parents. Financial institutions can create messages that resonate with parents who want to give their kids a head start and teach financial responsibility while also appealing to the children themselves.

Brand example – BECU. Washington State-based BECU’s Early Saver account is a great example of a financial product that fosters a connection both with parents and their children. The account provides educational content designed for parents and kids — like tips for raising money-smart kids and teen’s top money questions — allowing both groups to expand their financial knowledge.

Brand example – Obee Credit Union. The Cub Account of Obee Credit Union includes perks designed to please kids and their parents. The brand’s financial literacy program was created to educate the youngest consumers about money management. Obee also provides specialized youth services like programs for first-time borrowers and sponsors scholarships for local students.

By following the lead of these savvy financial institutions, other banks and credit unions can align their brand for the up-and-coming Gen Zers by understanding their values and expectations and designing products, content, and campaigns that fit their unique traits.