According to Adam Dell, Head of Product for Marcus by Goldman Sachs, traditional banks and credit unions are not prepared to compete with new digital challengers. At the Fortune Brainstorm Finance conference, Dell said, “There are two kinds of incumbent banks: There are banks that are screwed, and there are banks that don’t know they’re screwed.”

At the same conference, Harit Talwar, the head of Marcus, provided an idea of his organization’s strategy when he said, “Our purpose is to disrupt the distribution and consumption of financial services – pretty much what Amazon has done, and is doing, to retail, or what Apple did to the music industry.”

The question is: Are traditional banking organizations prepared for this level of transformation? More specifically, do these institutions understand what is needed to become a digital competitor?

Read More:

- Consumer Use of Fintechs For Banking Services Skyrockets

- Build Your Digital Banking Strategy on a Mobile-First Foundation

- Do the Majority of Americans Really ‘Want’ to Use a Branch?

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Marcus: Digital Transformation at Scale

The Marcus case study illustrates that digital technology has the potential to transform the banking industry.

In 2016, Goldman Sachs launched Marcus in less than a year with a platform built from scratch. A branchless consumer bank, Marcus currently has over 4 million customers, $48 billion in deposits and $5 billion in personal loans. It generates more than $1 billion in deposits a month and is partnering with Apple on a new credit card. Marcus was even rated the highest in customer satisfaction for personal loans by J.D. Power.

Not burdened by legacy back-office systems or expensive real estate, Marcus is able to integrate acquisitions of existing organizations (like GE’s consumer bank and financial management tool Clarity Money), quickly launch new innovations, and offer very favorable interest rates. There is also a strong commitment to fund this new retail banking organization that is committed to no fees, simple disclosures and frictionless deposit and loan initiation.

The Impact of a Changing Consumer

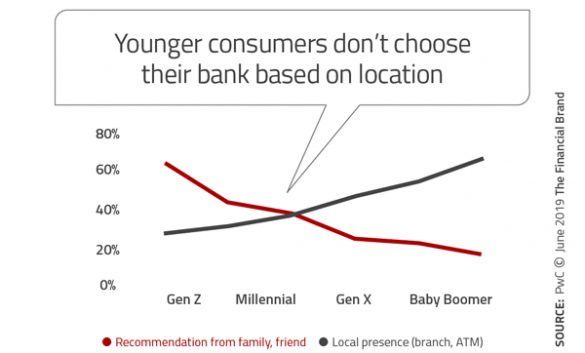

One of the primary differences between a traditional consumer and a digital consumer is the way they want to interact with their bank or credit union. In the 2019 Consumer Digital Banking Survey, PwC found age-related differences in primary bank selection as well as in how consumers define their primary bank.

For instance, while half the consumers over 35 selected their primary bank based on the location of a branch or ATM, only 30% of consumers under 35 did the same. Instead, younger consumers rely more on referrals for their choice of primary financial institution.

Beyond the criteria for selecting a primary bank, PwC found that the definition of ‘primary bank’ also differed by age. Younger consumers don’t view the checking account as the foundation of this definition, but instead look at which organization(s) provide the greatest overall transactional ease. For instance, PayPal, Venmo or Apple Pay may be viewed as a ‘primary bank’ as opposed to where deposits are held.

With changing selection criteria and definitions of primary bank occurring, the importance of immediate assistance and the ability to open any type of account through a mobile device increases in importance. So does the integration of social channels in customer journey mapping.

Finally, while the survey indicated that the branch may still be important, the importance goes down for younger consumers and in the middle ranges of wealth ($50K-$750K).

Banks Need to Deliver More Than a Shiny Veneer

Up until now, most attempts by traditional financial institutions to transform to being a ‘digital bank’ look more like a shiny veneer on an antique foundation. There often is not an appetite to recreate the foundation from scratch, and even less of an appetite to fund the development of an organization that could replace an existing legacy bank.

Read More: Was Chase Bank’s Digital-Only Spinoff a Viable Strategy?”

Let’s be clear, becoming a digital organization is not easy. Chris Skinner, best-selling author and publisher of The Finanser daily blog, says, “Many traditional banking leaders know they must change fundamentally, but it’s difficult to break the shackles of old business models.” It is even more difficult to move from what’s comfortable at a time when the industry is making so much money.

In an exclusive interview with The Financial Brand, Skinner continued, “Banks that are doing digital well are changing organizational structures and moving infrastructure to the cloud. They’re moving towards being completely flexible and agile — studying the organizational structures of the Amazons and Alibabas of the world. They are nothing like traditional banks even though they are traditional banks.”

Misunderstood Metrics Breed Complacency

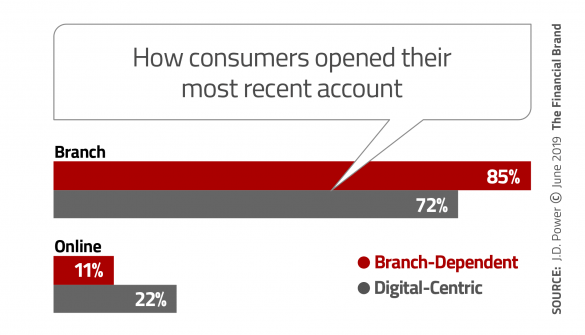

Beyond not experiencing the level of ‘pain’ that usually is associated with encouraging change, a reason why many financial institutions are not moving quickly to embrace digital transformation is because of metrics that are very misleading. For instance, almost every banking industry research report indicates that the majority of account openings are done in the branch.

An example of such research comes from J.D. Power, that found that a typical bank opens only 10%-15% of new accounts online (even though larger banks have significantly better digital opening results). These numbers are misleading because:

- Most financial institutions do not have simple end-to-end digital opening capabilities.

- When a consumer is required to finish a digital opening in a branch, the process gets ‘derailed’, with last touch attribution indicating an end-to-end branch opening.

In other words, consumers use a branch usually because they are ‘forced to’, not because they are ‘branch-dependent’. This is similar to saying a consumer wants to visit a mall or retail store instead of shopping online. If the consumer could get a positive experience digitally, they would prefer digital engagement.

Can Branch-Centric Banks Compete In Digital Age?

Traditional financial institutions have several competitive disadvantages to a digital bank that is built from the ground up without the legacy infrastructure.

- Digital banking operations do not have legacy systems that were created more than 40 years ago. New digital banks are built for digital.

- The availability and use of consumer data is easier with digital banking organizations, making personalization and real-time engagement possible. Many traditional banking organizations still have end-of-day transaction processing.

- Digital banking operations are much more agile and can respond to opportunities (and threats) faster than traditional banks.

- Without the cost of physical branches, digital banks can offer much more favorable rates and lower (or non-existent) fees. Marcus pays rates much higher than what is paid by banks with extensive branch networks.

Possibly most importantly, traditional financial institutions usually do not want to build an alternative brand that could steal the majority of accounts from the legacy organization, either for political or financial reasons. Unfortunately, over time, the choice may not be in the hands of legacy banks — the decision may be made by an increasing number of consumers who prefer digital alternatives and have increasing options in the marketplace.