Few would dispute that Millennials caught many banks and credit unions flat-footed. But some financial marketers now think they learned their lesson, and that they are ready for Gen Z.

“That’s resoundingly not true,” says Jason Dorsey, President at The Center for Generational Kinetics, and one of the world’s foremost authorities on marketing to younger consumers.

His advice for financial institutions is simple. “Take the time to understand this generation now, rather than taking five or more years playing catch-up, is critically important,” he recommends. “They really are a distinctly different generation.”

How so? Superglue a smartphone to your hand, and build your everyday life around social media. Then you may begin to get Gen Z. They live in a world where, for them, social media is a key part of their reality, not a sideshow. And life experienced through the internet and most importantly the ever-present mobile device blends into physical being.

These are among the findings in new research released by The Center for Generational Kinetics. Born between 1996 and 2005, Gen Z consumers say they would rather graduate with less debt than Millennials face, even if it means having a degree from a less prestigious schools. Many in this generation are already worrying about saving for retirement. They take more pride in saving than in spending, and will bring their business to financial providers recommended by a new generation of influencers.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

More Judicious With Money

The center’s State of Gen Z report points out that while Millennials and Gen Zers lived through some of the same formative times, the effect those times had on each generation are markedly different.

“Some people say that Gen Z struggled through the Great Recession,” says Dorsey. Not so — they were far too young. But the period still left impressions.

“They saw people — their parents — lose their homes,” Dorsey explains. “They saw young adults — Millennials — struggle as they entered the workforce facing high unemployment and wage stagnation, saddled with tremendous student debt.” With parents discussing the difficulties they and other families wrestled with, young Gen Z couldn’t help but be affected.

“Gen Z is much more fiscally conservative than Millennials. They lean toward sales and thrift stores, rather than brand names at the mall.”

As a result, Gen Z favors savings and frugality. “Gen Z is much more fiscally conservative than Millennials,” Dorsey says. “They lean toward sales and thrift stores, rather than brand names at the mall.”

While 38% of the generation is still receiving money from parents, one in four has a part-time job and an almost equal number takes on odd jobs or other short-term work. Normally kids spend their hard-earned dollars with wild abandon. Not the case with Gen Z.

“As they start earning their own money, we see them saving,” Dorsey says.

Research reveals that Gen Z understands “that they are going to have to work harder and longer, that they need to save their money, that they need to be really responsible with credit and how they feel about debt, and that they really want to be self-reliant.”

Dorsey suggests that Gen Z consumers could wind up paying cash for more things, or making larger down payments, which could impact consumer lending and credit card usage. However, there is a potential upside for mortgage lenders.

“They may bring down the average age of first-time home buyers,” says Dorsey, “They’ll be in a position to buy a house earlier because they won’t have the enormous student loan debt Millennials do. They’ll have money saved up for a down payment. This could bode well for mortgage lending.”

Gen Z: Mobilely Upward, Not Upwardly Mobile

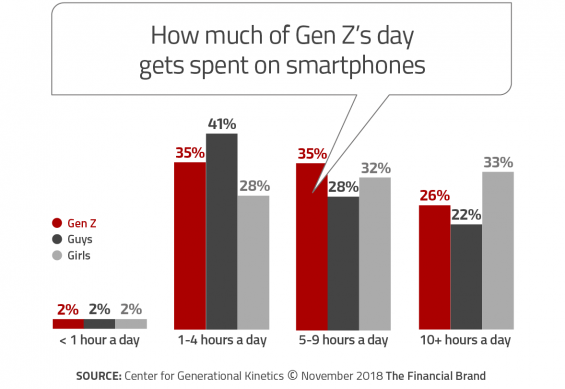

The study found that 95% of Gen Z consumers currently have a smartphone. Having one’s own device and participating in multiple different communication streams is creating a generation of total electronic immersion.

“Gen Z essentially seems to view their smartphones as an extension of themselves,” observes Dorsey.

“Anyone who has spent more than five minutes with Gen Z knows that this generation doesn’t just have smartphones for emergencies,” the report states. “They use their phones. Constantly.”

The study reveals that Gen Z is not only constantly connected, but also constantly connecting. “A stunning 65% of Gen Z says they are on their smartphones after midnight a few times a week or more often,” the report states. “Of these, 29% confess they are on their smartphones after midnight every night!” By contrast, a third fewer Millennials said they are on their phones so much.

Savings Apps, Not Piggy Banks or Jars of Coins

You’re not going to see Gen Z showing up often with jars or piggy banks full of change. For one thing, more and more of their “cash” transactions are cashless, via Venmo, and, increasingly, Zelle.

“Gen Z is not opening up their desktop computer to do banking,” says Dorsey plainly. “They’re going straight to their phone, and they expect the experience to be seamless, easy, and very intuitive.”

“Many Gen Zers have apps on their phones that allow them to save, often into an emergency account,” Dorsey continues. In focus groups his organization holds with consumers, Gen Z participants frequently like to show off how they’ve used this app or that to save. It’s almost conspicuous non-consumption.

“It may not be huge amounts right now, but there’s a pride with which Gen Zers share how much they’ve saved.”

“It’s fascinating,” says Dorsey. “It may not be huge amounts right now, but there’s a pride with which they share how much they saved. That’s going to increase as more and more of them enter the workforce.” Dorsey notes that past research by his firm found that 12% of Gen Z consumers have already started retirement savings.

Banks and credit unions should be offering savings apps targeted to this mobile-wedded generation, with about the same timing that the youth-banking programs of yore were typically introduced.

“Everything to them is mobile or digital and right now a mobile app for that initial account is the missing link,” says Dorsey.

Another wrinkle of mobility is that the stickiness of family recommendations about who to bank with may not hold as securely — if at all.

“It used to be that Mom, Dad, or someone else had a banking relationship and the children started their banking accounts there,” says Dorsey. “But the risk now is that they won’t create that sense of connection when they’re young. Now they go off to college or a job, and they have no connection with that bank or credit union. Instead they look online to see who pays the highest rates on savings. Who’s paying bonuses for new accounts? Or they’ll go online and ask friends where they bank.”

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Social Media Becomes a Dominant Force

Up until Gen Z, a sense that social media presence could still be treated as optional existed in some financial circles. No longer — financial marketers had better plan on living where Gen Z lives. The research suggests social will be the medium for reaching and influencing Gen Z for years, “if not decades,” to come.

“Social media is a huge component of Gen Z’s mobile lives,” according to the study, “some might call it a dependence.”

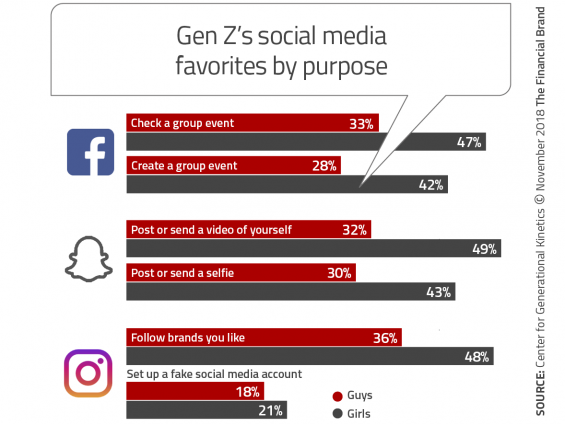

In fact, different social platforms tend to have devotees by purpose, and these preferences can vary by gender.

“Females are more immersed and therefore more susceptible to comparing themselves and their lives to what they see on social media and even gauging their happiness and self-worth accordingly.”

The report also points out that Gen Z trusts ads seen on YouTube more than any other kind of advertising, including radio, print, and traditional TV.

Welcome to Age of the Influencer

A key aspect for Gen Zers is the role of “influencers” on their product choices and preferences, their decisions, and their attitudes.

“Influencers now occupy a platform of authority previously know to celebrities and star athletes,” the report notes. Nearly half of this generation follows more than ten social media influencers. An influencer is someone with a large following who shares opinions, research, and more. (Fashion companies are known to send samples of new lines to bloggers, for example, to build demand.)

“When Gen Z finds a social media influencer, they think, ‘Wow, they’ve got a lot of followers, therefore I can trust them.'”

In this sphere, expertise may take a back seat — the number of followers drives credibility. “Gen Z’s trust isn’t necessarily attached to the influencer having degrees, deep experience, or other traditional way of proving they understand an area they’re commenting or teaching on,” says Dorsey. When Gen Z finds a social media influencer, they think, “Wow, they’ve got a lot of followers, therefore I can trust them.”

Dorsey says traditional institutions who want to remain relevant must respond with “influencer campaigns.”

“Find people who can really relate to this new generation,” Dorsey says, “who can create a variety of content, videos, and more to put out there to educate Gen Z, to show them that you understand their viewpoint, are here for them, and have solutions tailored to them. That’s a huge opportunity, because lots of banks and credit unions will not do that.”

Dorsey suggests that institutions look for influencers “that already have some level of following that aligns with the mission and culture of the bank or credit union. You’re not looking to get the pro football player who might have been a spokesperson 20 years ago.” The influencer could even be relatively local — even a younger banker — so long as they have a strong following or have become known for the topic.

“For Gen Z, local can trump national or even global,” Dorsey says.

But don’t blow the connection once made. Dorsey warns that the whole effort should not be sending Gen Z consumers to a website designed for their parents or grandparents, or is too slow, or just plain clunky.

Street Cred: Online Reviews Steer Gen Z’s Decisions

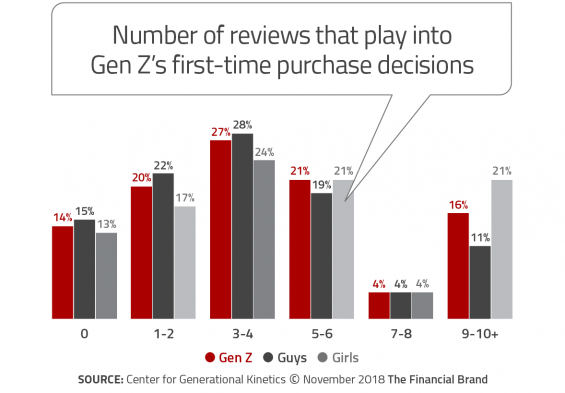

The connected nature of Gen Z overlays traditional purchase influences like friends and family. These factors can still play a part — though it may be digitally — but the report makes the point that the view of complete and anonymous strangers also has a strong pull.

This is seen in the many ways internet users can access reviews of companies and services online. Gen Z women seek input from reviews especially heavily.

Dorsey recommends the following steps to help with reviews and ratings:

- Google reviews. This is a prime place to track reviews and respond to them. Ask consumers who have had a great experience with your institution to write Google reviews.

- Yelp reviews. Gen Z respects Yelp, so keep up with what’s being said about your institution, responding to the negative ones, and working to promote the values of the financial institution.

- Facebook. Millennials and Gen X favor Facebook more than Gen Z, but it’s good to monitor Facebook to understand its reputational impact when Gen Z Googles you.

- Glass Door. Gen Z believes that how you treat your employees ultimately affects how you treat consumers.

Three Action Steps To Take on Gen Z

Dorsey recommends financial marketers improve their institution’s Gen Z outreach with these steps:

1. Show your app to Gen Z. Ask a group who have never seen your mobile app look at it. Observe them as they try to figure out how to use it. You will learn more in five to ten minutes watching a 20-something do that than anything else.

2. Have Gen Z evaluate your online ratings and reviews. What do they think about what the come across? Sometimes you’ll find the things you’re most sensitive or worried about are not an issue to them. But something else might jump out. Alternatively, they might suggest better ways your institution could have responded.

3. Ask Gen Z consumers to visit your branches. Ask them what you can do that would make branches a better experience for them.