Before there were so many online and digital options available, the path consumers took to open a new account or service was relatively consistent. People would walk into a branch, ask some questions, take brochures to do additional research, and open an account with the ‘winning’ financial institution.

Today the “journey” is often strictly digital, taking place from the comfort of a desk or home or even while walking down the street on a mobile device. Multiple channels often are used – but usually not the branch – as the consumer determines which brand to use and which account to open. Along each step of the digital journey, banks and credit unions need to convince people to pick them and not a competitor.

Winning at each step of this journey is not easy, but mapping the consumer’s journey can help banks and credit unions get more than their share of potential new business. At each stage, the experience provided is a primary differentiator — price and product are no longer the sole consumer considerations. Customer journey mapping provides a better understanding of how consumers interact and engage with your brand, and how to be the right channel at the right time.

With research finding that more than 50% of customer experience is based on the message and content received, it is clear why organizations need to focus on their consumer communication. Understanding the customer journey is the foundation of this improved communications process, helping to reinforce an overall cultural change.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Reason to Use Journey Mapping? Improved CX

”Tying customer communication to easier account opening or engagement is a missed customer journey opportunity.”

While customer journey mapping is not a new concept, most organizations, including financial institutions, are relative newcomers to the process. According to research from MyCustomer, in association with Quadient, 67% of respondents currently use customer journey mapping. However, roughly a third of those who have employed customer journey mapping have been doing so for less than a year, with another third having less than three year’s experience with the tool.

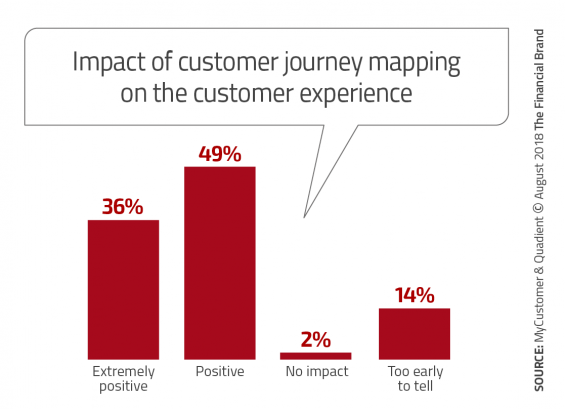

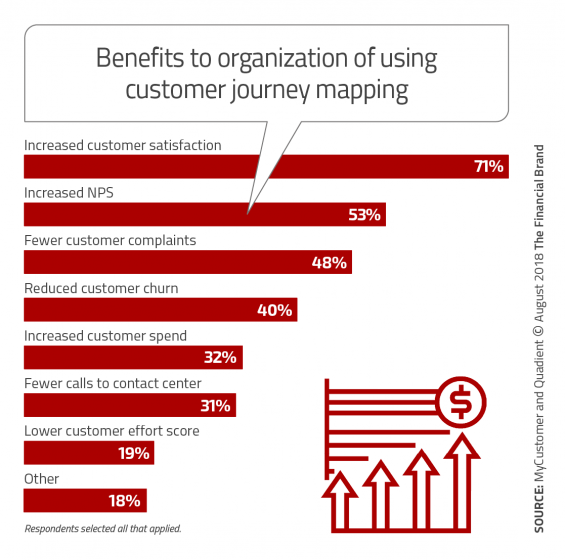

The reason for a greater use of customer journey mapping is because it works. According to the research, 85% of those using customer journey mapping report a positive or very positive impact on their customer experience. In addition, 71% stated that the mapping projects resulted in improved customer satisfaction, a drop in complaints (48%) and reduced churn (40%).

Despite the benefits of customer journey mapping, an opportunity exists in trying to combine improved communication with a reduction of effort needed to complete a process. When asked about benefits, a reduced ‘effort score’ was one of the lower noted benefits to journey mapping. The connection of communication and engagement is often a missed opportunity.

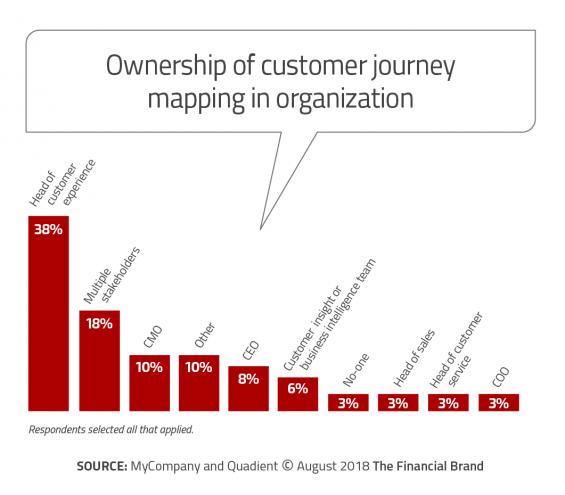

Those organizations that have been using journey mapping the longest report the greatest returns and also are more likely to be using third-party support. Overall, 71% of organizations manage customer journey mapping internally, with 35% having the process led by the head of customer experience. It was found that the results of journey mapping were positively correlated to the organizations that had the highest level ownership.

How to Implement Customer Journey Mapping

While everyone agrees that personalizing the communication is more important than ever, just knowing who you’re talking to isn’t enough. You need to align what the consumer wants to accomplish when they come to your website, and how they want to proceed from there. Mapping out the customer journey from the first interaction to the last will show if the consumer is accomplishing their goals in the most preferred manner. This takes consumer data.

No two journey maps are exactly the same. Different customer journey experts will design the journey differently, and the journey is different based on the product/service being mapped. Most will include the following steps:

Build consumer personas: Use research to determine the process used as consumers first visit your site, through research, purchase, and ongoing engagement.

Align consumer goals with the journey: The consumer comes to your site to solve a problem or answer a question. Determine the path they take (or should take) to find what they want.

Categorize touchpoints: Match the touchpoints your customer visits with the relevant stage of their journey. This may include multiple touchpoints to complete a process (account opening). The key is to simplify each stage as much as possible to eliminate abandonment.

Measure results: Where do potential customers diverge from the path you had intended? Where do they leave the process altogether? What is the rate of goal completion compared to the number of consumers who started a process?

Repair and replace: Determine where friction occurs and prioritize solutions to avoid abandonment, long processes, etc.

How consumers engage with your brand isn’t a linear process. Unfortunately, getting people from point A to point B without abandonment or requiring help doesn’t always happen. Consumers may even skip steps to improve ease of engagement. But understanding the engagement positives and negatives will improve the consumer experience and increase revenues.

What Stands in Your Way

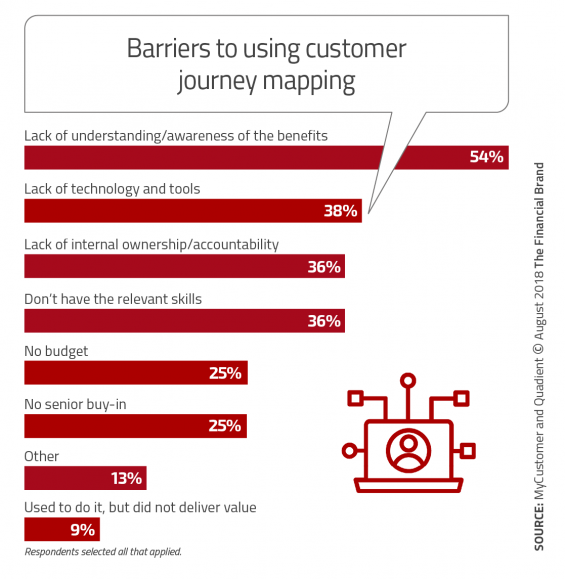

Despite the benefits of customer journey mapping, not every financial institution has a program in place, while other organizations may not have a program that is delivering results. Some of the hurdles that Quadient found include organizations that stated they lacked understanding and awareness of the benefits of journey mapping (54%). In addition, a quarter of organizations noted that there was a lack of senior management buy-in, while a third said that there was a lack of technology/tools (38%); a lack of appropriate skills (36%); and a lack of project ownership (36%).

More and more consumers are shifting from offline to online, using digital tools to help them with their purchasing decisions. As online interactions and digital purchases grow in importance, consumers are likely to use search, online review sites and social networks as a first step in their purchase decision.

According to Salesforce, “With more touchpoints comes more complexity in servicing consumer needs successfully. A customer journey map should help highlight areas where technology can ease the burden and challenges faced by your business. By optimizing and improving the experiences along each step of the journey, you’ll be building improved relationships with your customers that will lead to greater loyalty.”