According to the Digital Banking Report, 2018 Trends and Predictions, banks are most focused on improving consumer experiences and the customer journey. The report shows that around 61% of retail banks will be working on making customer relationships better, closely followed by implementing AI and cognitive computing at 57%.

So why are retail banking organizations focusing on experiences?

The primary target for a retail bank is not just to get a consumer to open a bank account with their bank or credit union. It is about engaging that consumer enough to up-sell and cross-sell other retail products like debit cards, credit cards, loans, insurance, and so on. When a customer engages in all these purchases, it marks the beginning of a long-term relationship with the customer/member and the financial institution.

However, it isn’t as easy as it seems. To facilitate a seamless customer activation process, followed by regular engagement, retail banks and credit unions need more than just account details of their customers. To keep households hooked onto their banking services, financial services organizations are steadily adopting marketing automation tools.

Contrary to popular belief that a marketing automation tool only automates marketing messages, these tools enable retail banks to understand their customers better and devise marketing campaigns around them.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Marketing Automation and The Customer Relationship

An advanced marketing automation tool comes equipped with features that help banks and credit unions get a deeper understanding of what each of their customers and members are expecting. This includes tracking household activities across website and app, as well as tying together any offline conversation that they might have with a banking representative.

In other words, a marketing automation tool offers financial institution a unified lead profiling and 360-degree lead overview.

- Unified lead profiling: Tying together all lead information, online and offline, in a central system to offer consistent customer experience across all platforms and devices.

- 360-degree lead overview: Having all the lead details in one place from day one to the last conversation, online and offline, put together; along with lead behavior, activity, and purchase history.

Before talking about building relationships, it is essential to understand the process of converting a lead into a customer. Usually, there are two possible scenarios for a retail bank that hosts a properly functioning website.

Scenario #1: Visitors that browse through your products and services, and leaves without taking any action. These are your anonymous (cold) leads.

Scenario #2: Visitors that subscribe to your website updates and become your potential leads. These are warm leads.

Anonymous prospects make up a large chunk of your website visitors. Some may be genuinely interested, while some may not. However, letting them leave the sales funnel without any engagement can be a loss.

To convert these anonymous visitors into leads, financial institutions can:

- Track and monitor the activities of visitors to understand what kind of product or services they are looking for.

- Create retargeting ads for these visitors to engage them and get them to subscribe.

- Use ad orchestration features to show only relevant messages with exclusive offers or benefits to trigger actions.

In short, retail banking organizations can use marketing automation tools to create a buyer’s persona for each of these visitors and educate them thoroughly to convert cold leads into warm leads. Once they have converted into warm leads, it brings us to the second scenario.

It is essential to put the marketing and sales team together when dealing with relationship building within a bank or credit union. Using a Customer Relationship Management (CRM) tool with your marketing automation platform can add value to your campaigns.

What is Bidirectional CRM?

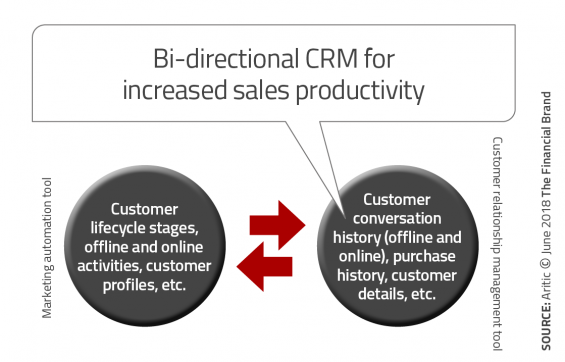

A bidirectional CRM is a two-way CRM that does more than just storing customer information and conversation histories. It integrates with a marketing automation tool to update its customer/member information based on latest activities as updated in the automation tool, and vice-versa. This keeps the sales and marketing teams on the same page with lead/customer history from the beginning.

Retail banking organizations can use automated drip campaigns across multiple marketing channels like mobile push notifications, SMS, and emails to educate their leads and trigger a faster activate rate. By tracking lead behavior and using features like lead scoring, retail banks can know the exact buyer’s stage and when to connect with a sales rep.

Financial organizations can also cap the frequency of messages each lead will receive in a specific time-span based on their lead behavior analysis so that marketing campaigns are not over-done or under-done.

Campaigns with relevant and valuable content offer leads with the requisite information to migrate from ‘awareness’ stage to ‘purchase’ phase more quickly. These lead nurturing campaigns are aimed to trigger conversions better (and mostly faster).

What Happens After Conversion?

Once a lead becomes a customer, nurturing doesn’t stop there. In fact, at that moment a new kind of nurturing begins to make way for additional product sales.

When a new customer or member opens an account with a bank or credit union (this also includes those who have visited the branch without any prior website activity), organizations can do the following to build a more personalized relationship with their customers:

- Send welcome communication to households to kick start a new relationship on a personalized level.

- Create onboarding drip series to help customers understand how the bank functions, what are the immediate steps for them to take, and also introduce how online and digital banking works.

- Devise various marketing campaigns based on new updates, loan interests, offers, etc.

- Create social media campaigns and track all social interactions.

- Standardize loan origination, maintenance, renewals, and reminders through task listing, calendars, and mobile alerts.

- Analyze customer and member profiles, behavior, and purchase history to create a pipeline forecasting the next steps; i.e., predictive customer analysis.

- Delight customers/members with exclusive offers and unparalleled support via phone banking, online chat, in-person and email to make them advocates for your institution.

- Develop email campaigns based on birthdays and anniversaries.

- Automate alerts for transactional messages via SMS and emails.

The entire relationship building strategy is aimed at making households satisfied with banking products and services. The more the customers/members are satisfied, the more will they consider making investments with the same institution and spread the word within their social network (which may result in the inflow of new leads).

Retail banking organizations are focusing on relationship building to create a healthy social brand image and goodwill among their customers and members. The best way to do that is to opt for a comprehensive marketing automation solution that comes with a host of integration options and easy-to-use tags.