As digital lending competition increases, lenders must take advantage of new technologies and capabilities that make engagement simpler and faster. Beyond converting paper to a digital document, a digital loan reduces the steps and automates many processes to turn borrowing into a very quick, painless process.

It’s clear that the traditional consumer borrowing process leaves a lot to be desired in terms of borrower experience. Digital technology is transforming the consumer loan industry by providing borrowers with greater simplicity, efficiency and transparency. Those organizations that can use digital technology to process applications, deliver decisions and provide funding quickly on the device(s) of choice will win going forward.

The convenience of being able to apply with minimal manual inputs, provide and sign documents electronically, at any time, from any device is enticing to potential customers. To enable this efficiency will require a complete digitization of back-office process, however, not just digitizing paper documents.

To determine the potential of digital lending and the strategies being used to simplify the overall loan process, we conducted research of financial institutions globally to become the core of the 63-page 2018 Guide to Digital Lending Digital Banking Report. In addition, the report solicited additional insights from other sources, presents industry case studies and looks at the competitive playing field to help organizations be better positioned for the future changes in the consumer lending ecosystem.

As more organizations are seeking to provide simplified borrowing and improve the consumer loan experience, this research provides a road map for implementation and for setting key performance indicators (KPIs). More importantly, we hope that banks and credit unions will use the insight in this report to take action on developing improved digital lending solutions that will resonate in an increasingly crowded marketplace.

Below are 12 of the most important things that every financial institution should consider when developing a digital lending strategy. The charts are a sample of the 33 charts included in the 2018 Guide to Digital Lending report.

Read More:

- Improve Lending Results with Digital Marketing

- The Rise of the Digital-Only Banking Customer

- Advanced Analytics And The Future of Digital Lending

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

1. Eliminate Friction and Provide Consistency Across Channels.

While your institution has many different steps to a lending process, involving various departments, the consumer should be offered a seamless, frictionless experience. This includes providing the opportunity to upload supporting documentation without leaving the application as well as the ability to receive a decision in minutes as opposed to hours/days/weeks.

2. Cross-Channel Support.

Your digital loan origination solution must support the ability for the user to switch methods of engagement, whether on a mobile device, online or in a branch. The look and feel of the process should be the same regardless of the channel. A truly frictionless digital process goes beyond application submissions and includes back-end processing for your staff.

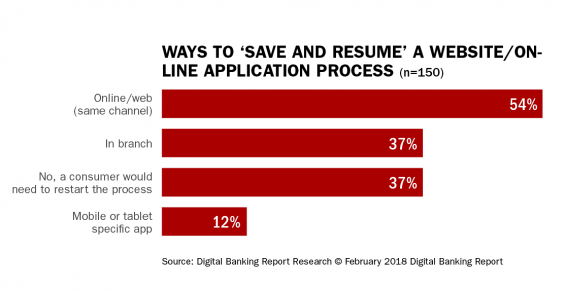

3. Save and Resume Functionality.

Consumers are on their own timeline and not yours. They may not have everything they need with them when they start their borrowing process, so it is important that your digital solution offers the ability to save an application at any point in the process and resume at a later time … potentially on a different channel. This functionality helps mitigate abandoned applications.

4. Robust Decision Engine.

The benefits of a digital lending process that consumers look for the most are convenience and speed. If your digital application process is streamlined, but the time to receive a decision is longer than expected, the overall experience suffers. This may require a complete reboot of your loan origination system’s decision engine with the potential to even rethink how approvals are determined. There are organizations that have found a way to provide a 30-second loan decision … how long does your decisioning take?

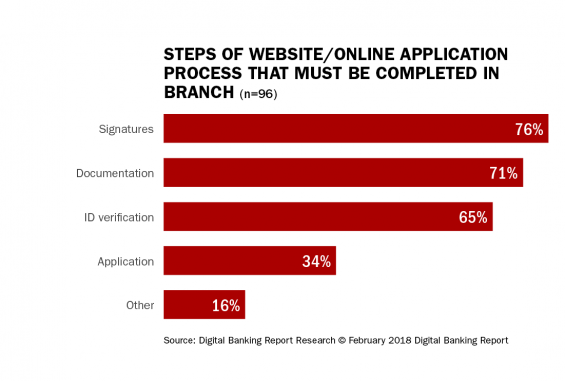

5. Availability of eSignatures.

Simplifying the application, engagement and approval processes are the foundation to excellent digital lending. However, if the consumer is required to visit a physical facility to sign loan documents, expectations are disrupted. Having eSignature functionality is a key component to providing an excellent digital lending experience.

6. Core Systems Integration.

Providing pre-fill functionality is expected when it comes to the digital loan application process, eliminating the need for a current customer to provide information that is already on file at your organization. Core system integration can allow for the retrieval of key data components for the prefill process to occur. Some organizations are also leveraging social media identities to assist in the pre-fill process.

7. Process Transparency.

When a loan process moves from human interaction to digital engagement, there is an increase in the need for transparency. This includes not only information about the steps and timing that the consumer can expect with their application, but also a post-approval sharing of loan details. You may even decide to have a digital comparison option available where the consumer can determine the right loan for their needs.

8. Data Field Configurability.

As opposed to having different apps for each loan type, the digital application process should be able to be configured, in real time, as the customer determines the type of loan desired. As opposed to a confusing engagement process that is set in stone for all loan products, the information collected should only be what is required for the specific loan desired, with unneeded fields being invisible to the customer.

9. Open APIs.

Existing silos within your organization and the availability of lending options that may be superior to what you can offer at this time may require the use of open banking APIs. This allows your organization to be flexible regarding products, services and functionalities, eliminating the need for a complete rebuild of the back-office with each enhancement. Planning your own integrations will also allow you to take advantage of emerging new channels and fintech solutions that can refer applications easily into your loan and deposit ecosystems.

10. Information Validation and Security.

Moving from physical to digital channels requires added diligence regarding security and privacy. All information provided by your applicants needs to be verified quickly and accurately. This ranges from income, to employment to the identity of the applicant. There are several options that can verify employment status and income as well as biometric options that can assist in verifying the applicant. In many cases, these digital security capabilities are more accurate than were possible with physical channels.

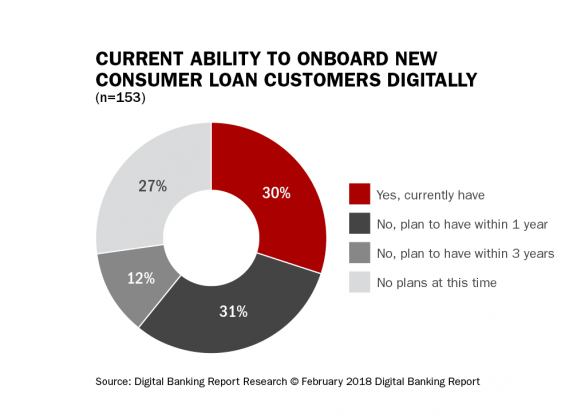

11. Digital Onboarding.

Unfortunately, many lending relationships (especially indirect loans and mortgages) result in single-account relationships. This defies logic since a closed loan provides some of the most robust insight into the needs and behaviors of a consumer. A multi-channel new customer onboarding process can use the insights collected during the loan application process to create highly personalized offers that can be delivered instantly. Integrating the onboarding process as part of the digital loan customer lifecycle will improve both loyalty and revenue.

12. Seamless Cross-Selling.

Customer retention can be traced directly to relationship depth, so it is important to make the most of your opportunities to get your applicants into multiple services. Similar to the onboarding process, integration of deposit and lending application platforms makes the process easy by using data already collected on the loan application for opening deposit services (and visa versa). It is best to provide offers on the service initially wanted by the customer to sell other services.

Purchase the Report

The 63-page 2018 Guide to Digital Lending Digital Banking Report sponsored by CRIF Lending Solutions, provides insight into the progress being made by financial institutions globally in the area of digital consumer lending. Beyond a review of goals and investments, this report delves deeply into the strategies, effectiveness, challenges and gaps in delivering an exception consumer lending experience.

The 63-page 2018 Guide to Digital Lending Digital Banking Report sponsored by CRIF Lending Solutions, provides insight into the progress being made by financial institutions globally in the area of digital consumer lending. Beyond a review of goals and investments, this report delves deeply into the strategies, effectiveness, challenges and gaps in delivering an exception consumer lending experience.

The report includes the results of a survey of more than 200 financial services organizations worldwide. The report has 63 pages of analysis and 33 charts/graphs. There are also guest articles from market leaders on digital consumer lending.

Subscribers to The Digital Banking Report and those wishing to purchase the complete report can access it immediately by clicking here.