Two mothers sit on a park bench, watching their offspring on the playground. Mom #1 observes to Mom No. 2, “Your son is very intelligent.” Mom #2 sighs, shakes her head and responds, “Yeah, but he’s not interested in learning.”

This vignette perfectly encapsulates the relationship between artificial intelligence (AI) and machine learning. Although the two terms are big buzzwords in financial services marketing today, they’re not interchangeable. AI is the idea of machines being able to perceive the world, as well as think, reason, and make decisions just like humans. It uses complex algorithms to manipulate data, learn from it, and then decide on a subsequent action based on what has been learned.

AI is deployed to analyze and generate recommendations based on data that is too voluminous and complex for humans to digest regardless of the manpower assigned or where judgment calls are not needed.

Machine learning is the process of understanding the relationship between a set of outcomes and (typically) unstructured information, where there is no need to optimize the efficiency of the process because of the vast amount of computing power available. It differs from its cousin statistical learning in one key area, statistical learning uses the fundamentals of statistics to efficiently understand relationships, whereas machine learning can use almost every data combination to find the answer. Machine learning is the guts of AI.

Too few financial marketers understand the difference and connection between AI and machine learning. What’s more, although both technologies have been transforming the way financial institutions do business for some time, many marketers struggle to understand how their bank or credit union should be using these tools to help with customer acquisition and retention (and more).

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Machine Learning in Action

Although marketers may not think of it this way, financial institutions, just like other companies, have been using machine learning for a while now.

For example, the job-testing technology used in employee recruitment is machine learning in action, and it’s an application of machine learning that’s proven highly effective. A study by the National Bureau of Economic Research (NBER) found hiring managers who used and paid attention to automated job testing when hiring low-skilled service sector workers had more successful outcomes and higher employee retention than those who ignored test recommendations.

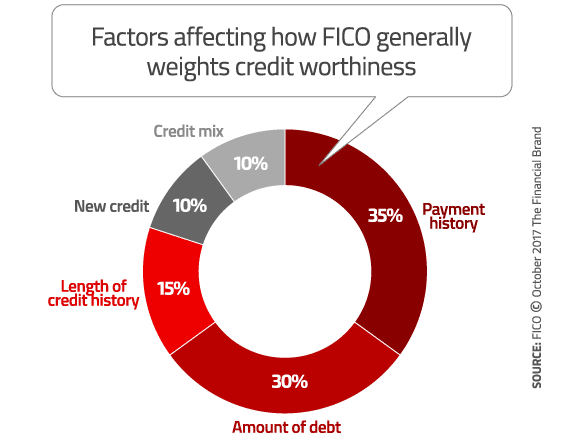

One of my favorite examples in the financial services sector is something that has been around for over 40 years, the FICO score. FICO’s computers are using complex algorithms to get a precise look into someone’s creditworthiness based upon a variety of factors:

Machine learning also plays a role in fraud detection, product recommendation, and much more.

Given the already powerful presence of machine learning in financial institutions, it’s a natural — and potentially highly profitable — progression to rely on machine learning to support marketing objectives.

Read More: Using Machine Learning To Multiply Your Digital Marketing ROI

Optimizing Marketing Through Machine Learning

Applying machine learning to marketing objectives can help financial institutions achieve better results. Here are four ways machine learning can help financial institutions optimize customer acquisition and retention efforts:

1. Offer and Click Optimization. Modern account holders expect a high level of personalization from every business they deal with, especially their financial institutions. Maximizing the relevancy of offers is a key aspect of personalization.

Machine learning can help optimize the customer experience, ensuring that every time a customer visits a financial institution’s website, stops in a branch, or engages on the phone, the bank or credit union will be able to provide them with the best possible journey — one that leads toward conversion and deeper engagement. New machine learning tools are available that can dynamically “tailor” a website based on the visitor’s past search history.

Imagine every time a customer visits a financial institution’s website, he or she is presented with a completely different experience depending on what is going on in their life at that time and what they did on their last visit. Such a personalized experience could help minimize the number of clicks needed to achieve their objective for the visit, and maximize the impact of every interaction with the website.

2. Improving Onboarding. The first 90 to 120 days of a new bank/customer relationship are critical for most financial institutions. This honeymoon period is a financial institution’s first and best chance to create a fully engaged, loyal customer. Account holders’ experience during the onboarding phase needs to be optimized so banks can make the most of the relationship from the very start.

Machine learning allows financial institution marketers to predict the next relevant product to offer, as well as the best channels and messaging that will capture the new account holder’s attention — and keep it. By providing consumers and businesses with more relevant information, products and services, a financial institution can be perceived as a more valuable partner, rather than as someone just pushing products.

3. Creating a Cross-Channel Experience. Customers don’t rely on a single channel for interacting with their financial institutions; they exist in all channels, both digital (mobile apps, mobile banking) and physical (bank branches, direct mail). Too often financial institutions have separate online and offline profiles for their customers. Machine learning can help marketers cross between the offline and online worlds.

For example, retailers send out letters to consumers who abandon online shopping carts without completing a purchase. Financial institutions can use machine learning to take a similar approach. Machine learning can also help banks and credit unions build out true omnichannel profiles of every customer, bringing together offline data like physical location and online metrics such as website visits. This profile can then be used to create better offers delivered via any channel.

4. More Accurate Attribution. Attribution is one of the greatest struggles for financial institution marketers. Too often, it’s challenging (or impossible) to draw a direct line between the achievement of a desired customer behavior and a marketing initiative that drove it. When this happens, marketers either don’t get the credit (and corresponding budget) they’re due, or inappropriate attribution takes place.

For example, Procter and Gamble was attributing much of its success to a new digital campaign. One day, they shut down the campaign but the results continued, proving the success only appeared to be a result of the digital campaign.

Machine learning can help financial institutions link actions a consumer or business takes back to one or more marketing activities. It can help banks and credit unions learn which marketing initiatives had the most impact, and create true attribution.

The Future of Machine Learning

Artificial intelligence and machine learning are constantly improving, and they promise to continue expanding financial institutions’ abilities to better serve customers and shareholders. Meanwhile, as innovation continues, financial marketers can already use existing machine learning tools to achieve maximum impact from their customer acquisition and retention efforts.

Purchase the Report

Kesna Lawrence is one of several industry experts who contributed to the Digital Banking Report, AI in Banking: The Next Frontier in Customer Experience, sponsored by Deluxe and the BAI. This report provides insight into the strategies, tactics, trends and level of deployment of artificial intelligence (AI) solutions at financial institutions globally. Beyond a benchmark study, there is analysis of alternative functionality such as chatbots, voice technology, and personalization as well as recommendations for organizations wanting to build AI solutions.

Kesna Lawrence is one of several industry experts who contributed to the Digital Banking Report, AI in Banking: The Next Frontier in Customer Experience, sponsored by Deluxe and the BAI. This report provides insight into the strategies, tactics, trends and level of deployment of artificial intelligence (AI) solutions at financial institutions globally. Beyond a benchmark study, there is analysis of alternative functionality such as chatbots, voice technology, and personalization as well as recommendations for organizations wanting to build AI solutions.

The report is based on a survey of close to 300 financial services executive worldwide and includes 56 pages of analysis and 30 charts.