Every year, we survey a panel of over 100 global financial services leaders for their thoughts on retail banking and credit union trends and predictions. The crowdsource panel including bankers, credit union executives, industry analysts, advisors, authors and fintech followers from Asia, Africa, North America, South and Central America, Europe, the Middle East and Australia.

For the first time, we also surveyed the industry, including banks, credit unions and solution providers (suppliers) worldwide to allow us to prioritize the trends identified. Our global market survey of over 900 organizations also provided an opportunity to review 2016’s projections to determine importance. Finally, the global survey collected insight into strategic priorities for 2017 and the fintech players that the industry believed would have the greatest impact in the upcoming year.

By collecting insights from leading influencers, ranking the trends using an industry survey, and including extensive analysis around each trend, we have created the most comprehensive annual trend report in the banking industry. For the second consecutive year, the research, analysis and Digital Banking Report entitled, “2017 Retail Banking Trends and Predictions,” were sponsored by Kony, Inc.

Top 10 Retail Banking Trends for 2017

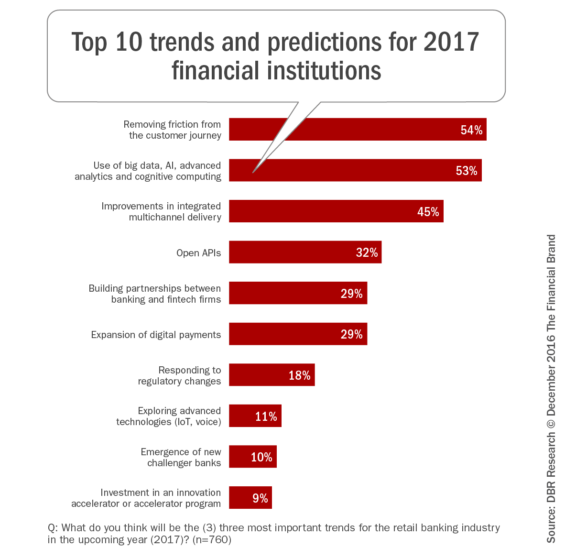

The ranking of the top 10 trends and predictions was done by providing a list of possible trends and asking banks and credit unions globally to provided their top 3 predictions. We asked some of the same questions of industry suppliers and vendors for a total of over 900 responses. Of the 760 financial institutions that provided their top 3 trends, the highest ranking prediction was that the industry was going to remove friction from the customer journey (54%). The next two most mentioned trends were the improved use of data and advanced analytics and improvements in multichannel delivery (mentioned by 54% and 45% respectively).

Most surprising was the emergence and importance given to the opportunity of open banking APIs (mentioned by 32% of FIs). This trend was only mentioned by a few industry leaders last year. Rounding out the top 10 for 2017 were; partnering with fintech firms (29%), expansion of digital payments (29%), responding to regulations (18%), exploring advanced technologies (11%), emergence of challenger banks (10%) and investment in innovation (9%).

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Here is what some of our crowdsource panel had to say about 2017.

“The relentless speed of digitization and automation, the rise of fintech and regulatory initiatives will encourage all financial institutions to become more transparent and nurture richer ecosystems of data and partners. It will also force them to better foster internal and external collaboration, accelerate culture change and truly empower their workforce. It will urge them to balance tech investments for customers and employees and furthermore, create a need for open, cognitive systems which not only understand, reason and learn, but also interact with people, entities and other systems.”

– Christophe Langlois, Executive Consultant at IBM

“Looking at last year’s predictions it seems we are all the eternal optimists in the financial services industry. New competition is still developing, big data is still underutilized and banking experiences haven’t improved. In 2017, we will start evaluating our collective ‘innovation efforts’ – the labs, the funds, the departments and people – and start seeing some of the transformation the industry needs.”

– Duena Blomstrom, Fintech and Digital Experience Consultant at DB Consulting

“Consumers will take more control of their financial relationships and will look for digital tools for advice and insight. Banks will come to realize that fintech is not a threat, but rather an opportunity, and while a focus has been on millennials, Gen X and Boomer segments will become increasingly important to financial institutions.”

– Bryan Clagett, CMO at Geezeo

“Consumers will be increasingly exposed to financial shocks in 2017. Uncertainties around health care insurance, government funding of social services, and possible loosening of government regulations will expose more people to income and expense volatility. Banking will need to respond to these consumer needs.”

– Jennifer Tescher, President and CEO of CFSI

“Hold on tight because 2017 promises to be an uncertain one. With loosening regulatory controls, a crackdown on big banks, and tightened controls on fintech, it will be a year filled with ups and downs. Expect banks and fintech firms to batten down the hatches. Instead of developing new products and services, firms will focus on perfecting the products and services that they’ve created over the last 3 years.”

– Nicole Sturgill, Principal Executive Advisor at CEB

“Fintech has quickly become one of the biggest sectors in technology. 2017 is looking like this may be the year when blockchain races into production at the largest firms, PSD2 and other global regulatory changes associated with APIs take center stage, increased cybersecurity threats are omnipresent, and artificial intelligence transitions from sci-fi high concept to an everyday reality.”

– Oliver Bussmann, Founder and Managing Partner at Bussmann Advisory

“2017 will be the year of ‘convergence’ in financial services. There will be more cooperation between financial services and startups, blurring lines between traditional products (retail, payments & insurance in particular), and the acceleration of the convergence of technologies including mobile, distributed ledgers, IoT and cognitive computing.”

– Sebastien Meunier, Senior Manager at Cappuis Halder & Co.

“Share price rebound and interest rate increases, driven by the American election, will create more budget flexibility and space for innovation. For many organizations, it could allow firms to double down on old business models and infrastructure. This could mean that new fintech competitors have a lazy incumbent base to attack.”

– Simon Taylor, Co-Founder of 11:FS

“In 2017, we will see the scaling of fintech and the beginning of the post app world.”

– Alex Sion, Executive Director, Mobile Platforms at JPMorgan Chase

“Because of rising interest rates and inflation, new opportunities for profitability in deposit, lending and wealth accounts will emerge. Agile organizations that can rapidly drive customer acquisition, and quickly launch new products to attract new customer segments, will be in best position to generate higher revenue and profit from this new environment.”

– Don Bergal, CMO at Avoka

1. Removing Friction from the Customer Journey

An optimal customer journey makes every step and touchpoint in the buying cycle streamlined, efficient, consistent and personalized from the consumer perspective. Financial institutions need to re-imagine their core journeys from front to back by addressing key customer pain points, identifying new opportunities to delight customers in differentiated ways.

The relatively poor performance by a majority of traditional financial services organizations in delivering a customer-focused digital account opening, onboarding and cross-selling process is an opportunity for those institutions that want to embrace the potential of becoming a “Digital Bank”.

The 75-page Digital Banking Report, ‘State of the Digital Customer Journey,’ provided evidence that banks and credit unions of all sizes are not prepared to combat the increasing encroachment by fintech start-ups that focus on making every stage of the customer journey easy, seamless and contextual. In fact, there are some segments of the industry that are falling significantly behind consumer expectations.

The key takeaways from the previously published report, which surveyed banks and credit unions about digital new account opening, onboarding and cross-selling include:

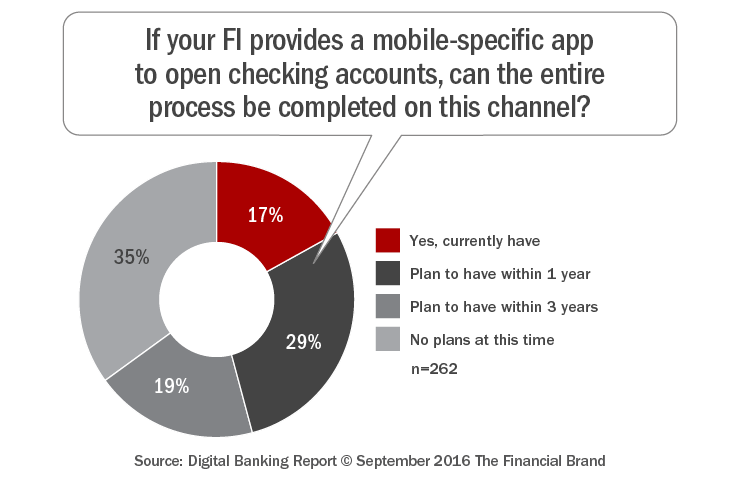

- Most financial institutions can’t open a new account entirely online or on a mobile device.

- Only 16% of financial organizations provide a tablet assist account opening option in a branch.

- Branch based ID verification and/or signatures/supporting documentation are required at the majority of organizations.

- Multichannel digital account opening (save and resume) is not supported at most financial institutions.

- New account opening abandonment rates are high for institutions that offer online or mobile account opening.

- Only 55% of banks and credit unions have a “structured” onboarding process.

- Only 22% of financial institutions onboard new customers with the “optimal” amount of communication.

- Only 30% of banks and credit unions market products within the mobile banking app.

- Community banks are falling behind both larger banks and credit unions in digitizing the customer journey.

The consumer expects a simple and seamless digital experience. If this can be achieved, it will be reflected in improved satisfaction, loyalty and referral scores. If the digital consumer does not experience a positive end-to-end digital process, new account opening abandonment or existing relationship attrition is likely.

“The upshot of the Wells Fargo scandal will be that banks will seek to prove that they have their customers’ best interests in mind when marketing and cross-selling to them. The result will be a focus on “we’re here to help you improve your financial health,” and a positioning of PFM-related tools and apps as ways to measure and improve financial health.”

– Ron Shevlin, Director of Research at Cornerstone Advisers

“In 2017, limited resources and cultures of ‘legacy thinking’ will cause the gap to widen between customer expectations and digital customer experience at many smaller institutions (under $1B in assets). Thankfully, the year ahead will also see new resources emerge – as well as new examples of organizational agility and operational structuring – that will finally prompt some small institutions to reshape cultures and become digitally proficient and customer-centric.”

– Jim Perry, Consultant and Strategist at Market Insights

“A customer-centric approach will be a ‘must have’ instead of a ‘nice to have’ for financial institutions, with the need to increase engagement or risk getting relegated to being a dumb pipe. Expect more personalized offerings and business models that adapt to lifestyle and the impact of an aging population (most notably enormous healthcare and caregiving costs).”

– Theodora Lau, Director of Market Innovation, AARP

“Everyone’s talking about customer experience and design, but to produce better ROI it’s time to turn to the data. Design is as much science as it is art, and the moment the Dow starts to pause, expect to see more focus on results-driven design (rather than the faddish approach often dominating the headlines today).”

– Jim Van Dyke, Founder and CEO of Futurion.Digital

Fractional Marketing for Financial Brands

Services that scale with you.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

“We are going to see more emphasis and execution of empathy-led marketing. Social conversion strategy is going to become more prominent, with content marketing strategy being focused on unique high quality and interactive content. Smart businesses will take a much more strategic, thoughtful approach to engage in meaningful ways with their customers and prospects.”

– Danielle Guzman, Global Solutions Marketing Leader at Mercer

“Mobile banking will transform in 2017, with a focus on making mobile banking apps different by executing on great designs emulating best-in-class consumer vendors such as Facebook and Amazon. There will be an expanded feature set with photo bill pay and debit card controls as well as stand-alone mobile banking apps for debit card controls and alerts.”

– Tom Shen, CEO of Malauzai Software

“The most important trend will be incumbent retail banks implementing on last year’s promise of a smoother customer experience, beginning with onboarding. Challenger banks and technology firms have put a spotlight on the onboarding process, making this almost frictionless with biometric layers and digitized KYC/AML checks. Challenger banks also set the standard for personalized and contextual experiences. It’s time for all of the fintech/bank partnerships, innovation lab experiments and design studios of incumbent banks to deliver.”

– Daryl Wilkinson, Managing Director of DWC Strategy and Innovation

“The banking relationship continues to move from the branch to digital to mobile as technology matures. Despite the advances, the basics of banking still apply: Banks win because of strong relationships driven by consistently reliable and rewarding customer experiences. To build these kinds of interactions, banks will need to evolve from the traditional user experience design process to a design thinking approach supported by a service design methodology.”

– Craig McLaughlin, President of Extractable

“More than ever, the mobile apps that become the ‘Uber of banking’ are becoming the minimum ante to compete in a connected economy. Technology aside, I believe that 2017 is a year that calls for transparency in banking, operations and customer engagement. The prophecy is coming true; we do in fact live in interesting times. Customers and employees are evolving – and how they think about banking, money and success is deviating from the old normal. It’s time for leaders to disrupt themselves before the gift of disruption is given to them by someone else.”

– Brian Solis, Principal Analyst for the Altimeter Group and author of the bestselling book: The Experience When Business Meets Design

“Personalized service will further evolve beyond communications and interactions, toward the personalization of products (like mortgage, savings deposits and checking accounts with rates and terms that better match client profiles and needs).”

– Nick Bilodeau, Head of Insurance (Canada) for American Express

“The focus for 2017 will be on enhancing the customer experience through proactive customer experience design. Removing the friction from the banking relationship and making banking more intuitive and useful. There will also be a strengthening of brands to enhance appeal and trust in a fragmented and crowded marketplace. This is becoming even more important as fintechs, telcos and start-ups eat our market shares away.”

– Vikram Krishna, EVP and Head of Group Marketing at Emirates NBD

“In 2017, banks need to test their assumptions about what ‘banking’ is – it’s not about opening a checking account or completing transactions. It’s about creating products that assist with all of the steps customers must complete in order to achieve their financial goals.”

– John Fishback, Principal Executive Advisor at CEB

“The banking industry needs to remember that the consumer’s mobile phone is part of their life. Well, at least it is for people who don’t live in woodsy Wisconsin, where reception at home doesn’t work…”

– Tom Groenfeldt, writer for Forbes

“With the globalization of finance, a dwindling profitable middle class and an ever-growing regulatory overhead, it’s all about creating an engaging and personalized experience, and more importantly, being helpful to customers and users. Soon, customers will demand hyper-personalized conversations with their banks, via an IoT device and with artificial intelligence … will banks be ready?”

– Mike King, Founder and President of Bankwide

“There is a tremendous digital knowledge and talent gap holding traditional banks and credit unions back from responding to the needs of the digital consumer. There are four options; Train, fire, hire, or outsource. Outsourcing is only a short-term solution. And hiring still has challenges due to the nuances of financial services. Therefore, ramping up and investing in delivering the best possible experience will be an important trend for financial institutions as they seek to guide consumers through the digital buying journey.”

– James Robert Lay, CEO of CU Grow

“In the coming year, financial institutions will put a high priority on upgrading digital channels as a key to future successes. As more consumers prioritize their experience on digital channels, FIs will conclude that offering an innovative and modern set of digital offerings is key to survival and customer retention.”

– Jeff Weikert, President of Payveris

“2017 will be the year of the digital-direct effort by banks. In typical form, 7-8 years after Simple and Moven were founded, banks have finally figured out that customers aren’t visiting branches to open accounts anymore and digital acquisition is a thing.”

– Brett King, best-selling author and CEO/Founder of Moven

“Banks will be willing to partner with Fintech startups that offer delightful digital experiences that has resulted in a loyal fan base.”

– Deva Annamalai, Director of Innovation and Insights at Fiserv

“Beyond the retail consumer, there will be momentum around building a better experience for SME banking (especially micro businesses). This is important since most banks and credit unions do not offer this valuable segment any value-added services despite a proven record of being willing to pay for value.”

– Mike Carter, CMO of D3 Banking

2. Use of Data, AI and Advanced Analytics

Data is the fuel of the digital economy and the foundation for all the trends and predictions in 2017. Unfortunately, while the consumer has indicated a willingness to share information about themselves with banks and credit unions, the ability for financial institutions to leverage this insight has been far short of optimal.

The Digital Banking Report found that many customers will share their data with bank brands if they get something valuable in return. The desired reward? Offers customized to their individual wants and needs.

Unfortunately, the clear majority of organizations are collecting customer data and not doing anything with it that benefits the customer. Beyond neglect, this practice could also be killing an organization’s future and ensuring greater share of wallet go to your competitors.

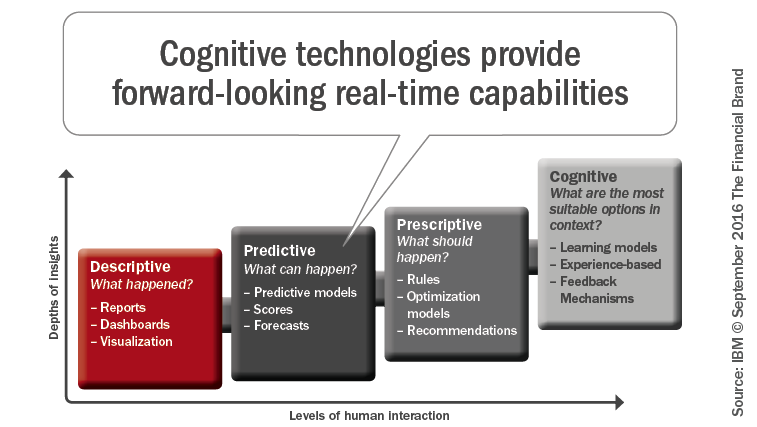

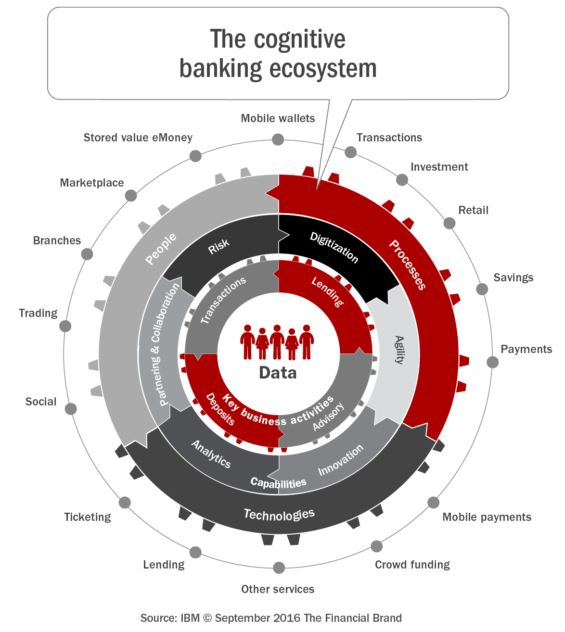

In the IBM report, “The Cognitive Bank“, it is emphasized that tapping into huge quantities of dormant, bank-owned data is essential to offering the individualized engagement that customers demand. It is also proposed that cognitive systems can continually build knowledge and learning, providing the insight needed to increase efficiency and effectiveness throughout the organization. In other words, the one to one future on steroids.

Ultimately, cognitive computing enables banks to exploit the benefits of available data by:

- Providing deeper and more personalized customer insight

- Supporting more-informed decisions across the whole bank

- Accelerating operational and organizational efficiency

By combining internal and external data (both structured and unstructured), banks and credit unions can position their organizations at the center of rapidly evolving banking ecosystems. Because legacy banking organizations have such a wealth of knowledge, cognitive banking organizations can provide ‘doorways’ for existing fintech firms to build relationships with households they could not reach or serve before.

The promises and hype around big data, advanced analytics and AI have yet to be realized for many financial institutions, states Ron Shevlin. “It’s not because of a lack of statistical and analytical tools and techniques. It’s not necessarily because of the lack of access to the data available. And it’s not necessarily because of data “cleanliness” issues. It has a lot to do with the fact that the data that is available isn’t predictive or descriptive. It’s the wrong data.”

While financial institutions make a big deal about having payment data available, Shevlin asks the simple question, “What does payment data do? It certainly helps retailers and merchants (and Apple) pitch offers. But, that’s not what customers want from their banks.”

The term gentrification typically refers to the renovation and improvement of rundown properties. Shevlin argues that banks’ data warehouses are similar … rundown properties in need of gentrification.

“Over the next few years, banks will embark on data gentrification efforts – not just cleaning up the data they have, but collecting and using BETTER data. Data that better predicts and explains consumers’ financial health, directions and trends in their financial health, and actions needed to better improve financial lives.”

– Ron Shevlin, Director of Research at Cornerstone Advisers

“The use of data really is now becoming a mandatory tool to assist the customer, employee and the CEO. Going forward, data will be embedded and detected on a real-time basis, driving decisions on efficiency, experience improvement, and margin gains. Banks and credit unions will look to large technology companies as the standard in data-responsive design and development, and will seek to automate not just measurement, but also improvement and process.”

– Rob Findlay, Founder of Next Money

“2017 is the year to marry Tech + Touch. Find a balance between accelerated digital adoption and the human touch. It’s time that banks start using data to digitally personalize customer interactions.”

– Vikram Krishna, EVP and Head of Group Marketing at Emirates NBD

“Retail banking should have been transformed by data analytics late last century but it was not. The rise of fintech and the 2008 financial crisis have ushered in a new focus on data (cognitive computing, AI, predictive analytics, etc.) throughout the entire organization, with operational excellence and digital transformation being key. 2017 will be the year when financial service providers who have embraced these tenants will begin to separate from those who have not.”

– David Gerbino, Fintech and Marketing Adviser at DMG Consulting

“Banks and credit unions will be challenged to deliver digital experiences that mimic the human assistance that consumers get in other channels – such as the branch and call center. Through artificial intelligence, banks and credit unions can breathe life into consumer interactions. With artificial intelligence as the face of the digital interaction, other technologies such as natural language processing, predictive analytics, biometrics, among many other technologies, become the guts that stitch together an experience that drive interactions through every stage of the consumer lifecycle.”

– Tiffani Montez, Senior Analyst at Aite Group

2017 will herald in the 5th age of banking – the analytics age. Financial Institutions will face an unprecedented opportunity to be true advocates for consumers by utilizing data to the same level as other disrupted industries (think Amazon or Netflix). Consumers enjoy unprecedented choice and virtually no friction to change. FI’s who do not embrace data will find themselves beautifully equipped for a world that no longer exists.”

– Don MacDonald, CMO at MX

“Machine Learning and Artificial Intelligence will begin to be applied beyond robo-advisors and activity to leverage these technologies will begin to take hold. 2017 is likely to be a transitional year where pilots inform longer term product development.”

– Dominic Venturo, EVP and Chief Innovation Officer at U.S. Bank

“2017 will be the year that predictive analytics will hit the big time in retail bank marketing. Banks will boost their top line with ‘next best product’, social media, and customer retention analyses.”

– Steven Ramirez, CEO of Beyond the Arc

“Machine learning and artificial intelligence are transforming other industries. Banking is just getting started building out greater efficiencies using these tools and leveraging the data we’ve neglected for decades. Banking apps will deliver personalized financial advice by leveraging aggregated financial data across a consumer’s providers in the future. Forget robo-advisors for investments only … our entire financial life will have a robo-component. And we will be better off for it.”

– Bradley Leimer, Head of Fintech Strategy at Santander, US

“Smart use of data can enable us to reestablish personalized services and bring back customized one-to-one relationships between the bank and the customer. The upcoming PSD2 (and US equivalent) will alter how the data is stored and used, with bots, machine learning, and adaptive technologies all playing a role. Nailing this (data) step is essential to progress towards the banking-as-a-platform model, which is the future of finance.

– Alex Nechoroskovas, Founder of Fintech Summary

“Predictive analytics move from theory and early beginnings to broader and more prevalent application. Recurring transactions become easier to undertake and product recommendations become more pro-active and relevant.”

– Nick Bilodeau, Head of Insurance (Canada) for American Express

“All of the business models we have seen created and funded in fintech over the past 8 years will be revisited with an AI component – be it machine learning, deep learning or other. This is bound to happen as AI is sweeping the business world. If mobile is eating the world, AI is the chef that is orchestrating the menu.”

– Pascal Bouvier, Venture Partner at Santander Innoventures

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

3. Supporting Integrated Multichannel Delivery

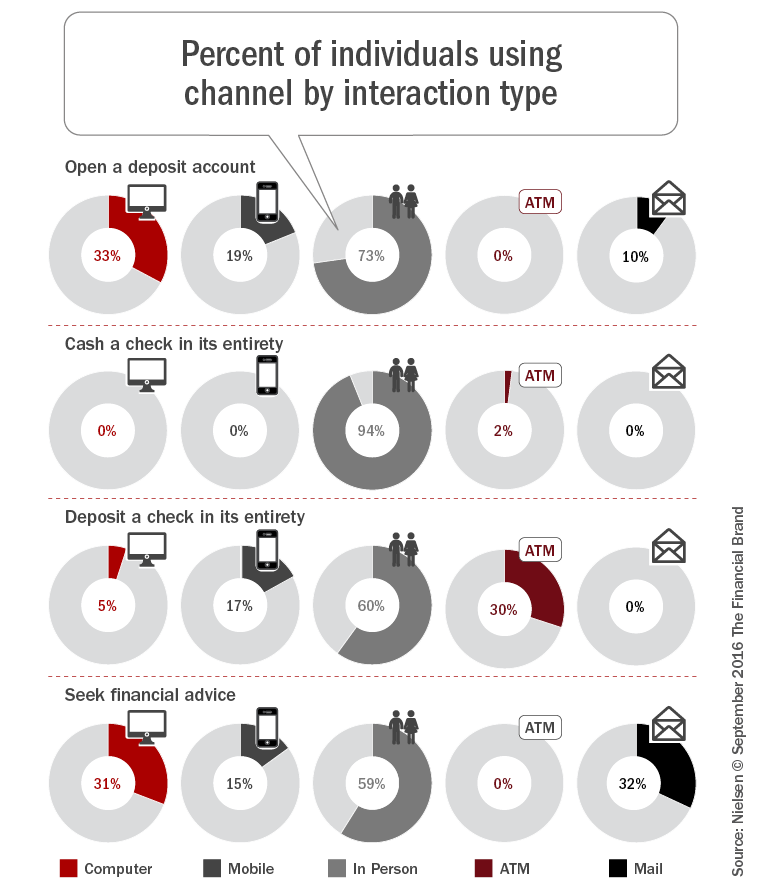

Most consumers continue to use multiple channels to conduct their banking based on transaction type and individual behavior patterns. To migrate more transactions to digital channels, financial institutions must move their sole focus away from cost reduction, and instead focus on improving the integrated multichannel experience.

Part of the reason physical branches remain open is because of the preference of consumers to continue to use branches for activities such as opening an account, cashing or depositing checks and seeking financial advice. As has been noted in previous reports, the reliance on branches should be taken with a grain of salt since many institutions have made the process of opening accounts digitally exceedingly difficult, and/or have not done an adequate job of educating consumers on services such as mobile deposit capture.

As mentioned above, these numbers can be a bit misleading, however. In the 75-page Digital Banking Report, there is strong evidence that banks and credit unions of all sizes are not making every stage of the customer journey easy, seamless and contextual. This includes the entire account opening process, early new account onboarding and even subsequent engagement around the building of a stronger digital relationship once an account is opened (cross-selling).

For any organization, the priorities should be to improve the digital deliverables that include making basic transactions (balance inquiry, funds transfer and bill payments) more simple and intuitive, while also making the next stages of engagement (account opening and check deposit) more easy to complete with an online and mobile device.

“We’ll find a lot of banks revisiting their branch portfolio and there will definitely be some consolidations and closures. The trend will be towards greater self-service cash transaction and digital integration in physical units. Research data and market analytics will also enable data-driven decision making, with branch design based on the type of distribution model appropriate for each market area.”

– Mark Charette, CEO of Solidus, Inc.

“The banking business is going liquid, expanding the relationship towards the digital places where customers fulfill their everyday needs. Purchasing any kind of financial product will be built within a highly-contextualized proposition … remember when insurance was sold at ATMs in the US airports in the 50’s? Now imagine a world where open APIs bring banking everywhere.”

– Ambrogio Terrizzano, Interactive Financial Services Lead for Europe at Accenture

“Some institutions will get serious about experiential design and build internal teams staffed with senior designers from out of category (e.g. Retail) to build elegant and integrated omnichannel experiences. They will be the winners in the future.”

– Tom Wennerberg, EVP Marketing Director at Key Bank

“Leading banks will start converging mobile and online banking into new digital banking applications composed of widgets built on an agile microservices architecture. The new digital banking applications will offer many cross-channel services, such as text with contact center, video with relationship banker, cardless withdrawal at ATMs, appointment making, and transaction pre-staging prior to a branch visit.”

– Danny Tang, Worldwide Channel Transformation Leader at IBM

“There will be continued digitization of banking and the redefinition of ‘place’. This should, hopefully, prompt more financial institutions to invest more aggressively in digital channels, rethink their strategic planning processes, and consider ‘place’ as a customer mindset more than a geographic location.”– Joe Sullivan, CEO of Market Insights

“In 2017, AI will help retail banks profile the collective financial lives of their customers. This will aid in multichannel distribution, by identifying the real-time what, where and when and how opportunities to deliver complimentary products and services.”

– April Rudin, Founder and CEO of The Rudin Group

“The Chinese are ‘Always on’! It’s much more than just O2O (online-to-offline and offline-to-online). Today, the Chinese people are ‘always online’, creating a need for banks to understand how to communicate and when to interrupt and influence. In China, social and ecommerce platforms are driving connections with retail brands, purchases and relationships with money.”

– Matt Dooley, Director of Next Money Hong Kong

4. Testing Open Banking APIs

APIs were not even listed as a 2016 trend, but was #4 in 2017. The use of open APIs provides the opportunity for combinations of products and services beyond traditional banking. As mentioned by Ron Shevlin in last year’s trends report, traditional financial services firms can leverage their existing customer relationships to create the foundation of platformification with traditional organizations at the center of the relationship

According to Ron van Wezel, Senior Analyst, Retail Banking and Payments at Aite Group, “Technology is a strong driving force in the trend to open banking. APIs enable banks to redesign their IT architecture and work with fintech start-ups to develop innovative solutions for their clients.” Competition from peers and new entrants urges incumbent banks to develop a digital strategy. In Europe, regulations have accelerated the trend to open banking and enforces an end date for banks to provide open APIs.

Many US banks have limited or even shut off access to financial data rather than exploring ways to make sure that such access, once granted, is safe and secure. The largest banks, in particular, appear to want to control what outside organizations can use their data for the benefit of the consumer.

This has not gone over well with the US Consumer Financial Protection Bureau (CFPB). The CFPB recently issued a veiled warning to banks suggesting they may soon be forced to give up their troves of customer data if they don’t do it voluntarily. The CFPB believes consumers should have control over their own data and the ability to instruct banks to share it with third parties if they wish.

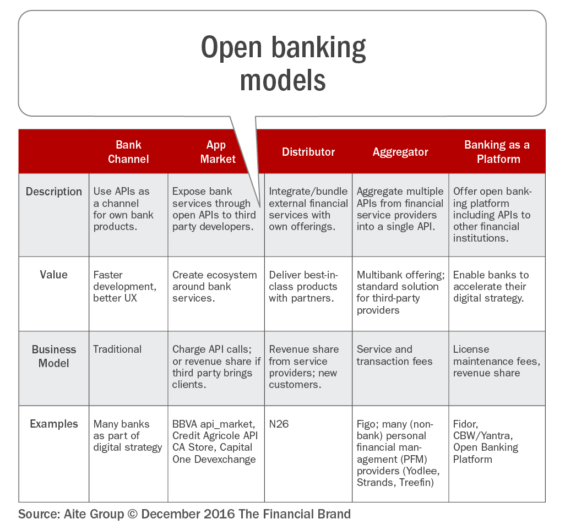

There are many open banking models as shown by the chart from Aite below.

Bottom line, open banking APIs enable incumbent banks to build and launch products more quickly, and probably more easily, than they historically could. Banks will also likely find it attractive that open APIs require minimal connection effort on their part and offer access to multiple third parties. Fintechs, on the other hand, will benefit by gaining access to incumbent institutions’ large customer bases.

“The enablement of customers to share their data stored in bank systems with any 3rd party accredited organization, will foster the emergence of data-driven business models and new commercial exploitation, providing new services and experiences for customers.”

– Claire Calmejane, Director of Innovation at Lloyds Banking Group

“The maturation of APIs will accelerate the open banking movement. Banks and other ecosystem participants will get used to working with APIs and more will become available, propagating a virtuous cycle.”

– Dan Latimore, SVP of Banking at Celent

“Players have to prepare for the implementation of PSD2 in the UK and similar regulation potential in the US. With the creation of open banking platforms, there will be opportunities for fintech firms to partner with banks, creating more exciting customer experiences.”

– Oliver Bussmann, Founder and Managing Partner at Bussmann Advisory

“2015 was all about blockchain. 2016 saw an explosion of interest in machine learning and artificial intelligence. 2017 will be the year of open marketplaces and platforms. Platforms support the rapid cycle deployment of microservices into a financial marketplace. Those microservices are apps, APIs and analytics that transform the back, middle and front office respectively. As the financial world is rapidly moving to open, loosely coupled marketplaces, any bank with old legacy technology will start to look like a dinosaur.”

– Chris Skinner, Author and CEO of The Finanser Ltd

“As banks become more comfortable with APIs, partnering with fintech start-ups, and coming to the realization that not all products need to be created internally, we will see more Banking-as-a-Service (BaaS) or Banking-as-a-Platform infrastructures being created.”

– Bryan Yurcan, Senior Writer for the American Banker

“APIs and Open Banking will start to shift the banking landscape with more traction in Europe and Asia, but we’re likely to start seeing the gap between leaders and laggards widen.”

– William Sullivan, Head of Global Financial Services Intelligence for CapGemini

“Frequency and depth of bank integration into the digital platforms most entrenched in our customers’ lives (e.g., Google Now, Facebook, Alexa) will increase – reinforcing the long-term value of an open API architecture. On the flip side, banks will work to take advantage of the open API model to seamlessly integrate “best of breed” partners into their experience – beginning the ‘platformification’ of banking.”

– Niti Badarinath, Head of NA Channels for BMO Financial Group

“We will begin to see a variety of API business models emerge, but 2017 will be too soon to tell which will succeed and which will falter in this new API economy.”

– Paul Loberman, Global Head of Retail Business Banking Digital at HSBC

“The most significant change in financial services next year will be open banking APIs, as banks will start focusing on how to expand their reach and shift from the brand to the back end. Bank APIs allows businesses to build and scale more quickly, opening opportunities to bring services to market faster. For this to be successful at scale in the US, the core banking vendors and the government needs to get involved.”

– Scarlett Sieber, SVP for New Digital Businesses at BBVA

“Platforms and ecosystems will continue to take shape as various banks further build their API strategies, their marketplace strategies, or even their Bank-as-a-Service strategies. I expect the beginning of standardization in a similar vein to the movement we have seen in the DLT/blockchain space.”

– Pascal Bouvier, Venture Partner at Santander Innoventures

“The hype around banking APIs will increase, even overtaking cryptocurrencies. Major banks will launch public API platforms. In Europe, a fight will break out between proponents of OAuth and ISO 20022 as the technical standard for PSD2 APIs.”

– Shamir Karkal, Head of Open APIs at BBVA

“2017 could be a year where we see several countries follow the UK lead regarding API regulations. Fintech capabilities and partnerships at challenger banks will grow as big, legacy banks put their integration skills on display.”

– Aden Davies, Director of Portfolio Management at 11:FS

“APIs are arguably one of the biggest topics in the industry. In Europe, they’re now a regulation discussion that’s becoming real. The business model for profiting as a platform is key here, and many are still struggling with it.”

– Simon Taylor, Co-Founder of 11:FS

5. Partnerships Between Banking and Fintech

The rise of interest in the fintech sector has been caused by increasing unmet consumer demands for digital banking solutions fueled by digital advances in many other sectors (retail, hospitality, travel, etc.). These consumer demands, combined with reduced barriers to entry in some markets, have improved the availability of funding for the sector and have increased the interest in potential partnerships.

The future of collaboration and competition between legacy financial organizations and new fintech providers remains somewhat uncertain. Banks and credit unions must continue to explore strategic options, however, as technology changes and regulations evolve.

According to the World Fintech Report 2017, by Capgemini and LinkedIn, in collaboration with Efma, 50.2% of banking customers across the globe are using the products or services of at least one fintech provider. In addition, it was found that tech-savvy consumers are supplementing traditional banking services with fintech solutions at twice the pace as less tech-savvy consumers (67.3% vs. 33.6%).

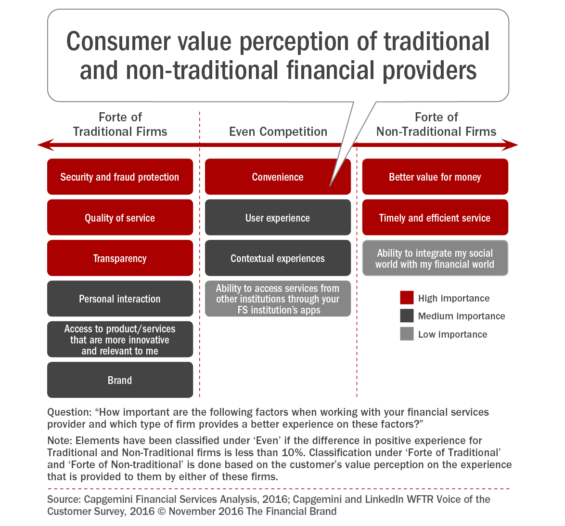

While fintech firms usually have the “first mover’ advantage, delivering customer-centric solutions at a low cost, without the burden of legacy infrastructure, they still lack scale in most cases. This is because traditional financial organizations continue to be viewed positively by consumers in the some of the most important foundational areas such as trust.

It should be noted that both traditional and non-traditional financial service providers are struggling to keep up with the demands of the increasingly digital consumer. It is thought that using advanced analytics to better understand the consumer and deliver personalized solutions will ultimately determine the winners and the losers.

Fintech is Simple, but Still Awareness Lags

There is nothing simple about opening a checking or current account, adding a savings plan, taking out a loan or establishing an investment or insurance relationship at a traditional bank. At most institutions, the paperwork is intimidating and the consumer is usually relegated to visiting a branch office.

That may be why the simplicity of setting up an account was the overwhelming reason for using a fintech provider according to EY’s first Fintech Adoption Index. More attractive rates, access to different products and services and a better online experience were also popular responses, but these were dwarfed by the impact of making the process simpler for the consumer to engage.

The response to the fintech movement will differ for each organization, with the options of building internally, buying, partnering or playing “wait and see” all being options. But with the penetration of smartphones and wearables increasing and the expectations being set outside the financial services industry, there is the need for a logical approach for transformation and differentiation.

“In 2017, there will be a widening of the gulf between banks that are building meaningful partnerships with fintech firms and those that think that they are because they have a couple of tech vendors and a procurement department. There will also be an explosion of fintech offerings for small to medium enterprises (SMEs).”

– JP Nicols, Managing Director of Fintech Forge and Chairman of Next Money US

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

“2017 will be the year of Fintech rethinking its role. FinTech will not disrupt banking, but will deeply renovate it. Rethinking the expected speed of change, which is slower than start-ups want but faster than what bankers hoped. And, rethinking the fintech business model, looking for more revenues and less dreams.”

– Roberto Ferrari, General Manager of Chebanca!

“I see collaboration between fintech and traditional financial services firms still being the big story for 2017. Many startups need additional investment and will require a longer runway to achieve scale and profitability. The environment will become even tougher as rates rise. We might also see the first mega-mergers and acquisitions between fintech unicorns and banks as the market begins its inevitable shake up.”

– Bradley Leimer, Head of Fintech Strategy at Santander, US

“The lines between banking and fintech companies will blur, driven by open APIs, actionable data, and consumer demand. Traditional banking — fixated on paper, tellers, and mass marketing — will be crippled by competition from savvy tech partnerships and forward-thinking institutions.”

– Jon Ogden, Director of Content at MX

“The Fintech debate shifts from Tech to Trust. Incumbent financial brands have formidable brand bulwarks, but they must resist being unbundled at key journey moments. At the same time, fintech challengers need to focus beyond cold lead gen to richer nurture and consideration campaigns.”

– Jennifer Grazel, Director of Global Vertical Marketing at LinkedIn

“The FinTech hype is at its peak. At the same time, many early fintech firms are out of money, and either need to shut down operations or merge with traditional banks. 2017 will become the year of symbiosis of fintech and banking.”

– Frank Schwab, Member of Technology Advisory Board at Sberbank

“With rates rising and venture funding tapering off, the fintech sector will need to show how they can grow the bottom line more than ever and the only way to do that is with a large client base for distribution. Only the banks have that today.”

– James Anthos, Director of Strategic Planning at BB&T

“Fintech startups will come together in 2017 to create solutions that solve fundamental business problems, old or new. There will be more regional hub and ecosystem bridges, and collaboration to emerge, ensuring there is a global view of all innovation coming up, regardless of where it originates from. Globalized efficiency will the outlook for fintech in 2017.”

– Devie Mohan, Co-Founder and CEO of Burnmark

“Banks struggle to deliver innovation will lead to more Beta Banks launching and a maturing of how banks partner with early stage fintech firms. It will move from innovation theatre/stuff to excite the exec. to serious programs supported by a full launch to customers, capital injection etc.”

– James Haycock, Managing Director of Adaptive Lab

“Banking has finally realized that they are falling short when it comes to innovation and are beginning to acquire and invest in small fintech startups Not surprising that 25% of global banks would buy a fintech company or that 60% would partner with one.”

– Sophie Guibaud, Vice President of European Expansion at Fidor

“Fintech will manifest itself as a techno fantasy, drawing attention away from the real problems to be tackled: cybersecurity, trust and identity, which only can be solved through laser-focused industry and government efforts.”

– Peter Vander Auwera, Founder of Petervan Productions

“With the uncertainty of an election year in our rearview mirror, 2017 will finally be the year that banks and lending fintech firms have to compete against each other in a rising rate environment … and the fintech firms that have forged relationships with banks will likely live to see 2020.”

– Chris Fleischer, Market Research Guru

“Just as repartitioning of the world is happening through political forces, the repartitioning of the global digital banking space is going to happen by the most powerful digital ecosystems. The digital noise will fade away.”

– Barbara Biro, Manager of Digital Transformation at Citi

“We are witnessing the beginning of an important restructuring of the retail financial services, moving from a vertical, integrated, fully owned model to horizontals of functionalities where new type of agents will compete against each other but together, in various configurations they will be able to deliver diversified services at much lower costs.”

– Andra Sonea, Fellow at Athemis

6. Expansion of Digital Payments

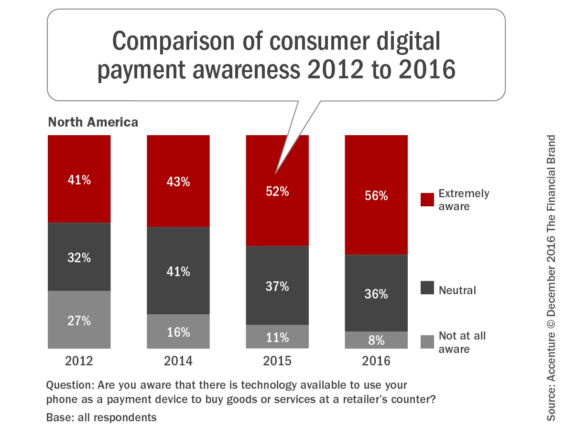

Despite an increase in awareness of mobile payments, usage continues to remain flat, illustrating the challenges in changing consumer behavior when merchants and issuers can’t deliver a strong value proposition. Will 2017 be the ‘tipping point’ for digital payments?

According the 2016 North America Consumer Digital Payments Survey from Accenture, 56% of North American consumers are now aware of mobile payment services — a 4% increase from 2015. However, the regular use of mobile payments remains flat at 19%, with 60% of consumers using cash at least weekly to make purchases at a merchant location (a drop of 7% from last year).

Consumers are expressing optimism about mobile wallet adoption in the future. anticipating a nearly 60% increase in the use of mobile wallets from card networks (from 14% in 2016 to 22% in 2020) and from technology companies (from 13% in 2016 to 21% in 2020). The usage of bank-branded mobile wallets is also expected to increase from 14% to 19%. While digital payments options are expected to increase, traditional payment alternatives are in the decline.

For financial institutions to achieve a first-mover advantage, barriers to consumer adoption of mobile payments must be addressed. Of the nearly two-thirds (64%) of consumers who have never used their mobile phone for in-store payments at a merchant location:

- 37 % said they have not done so because they believe cash and plastic are fine for their payments needs

- 21% prefer not to register payments credentials into their mobile phone

- 19% are concerned that unauthorized transactions may occur

To be a market maker in the payments marketplace, providers will need to commit to increasing the level of personalization, leveraging insight not commonly used today. This includes not only payment data, but locational, behavioral and even social insights.

“Faster payments will start to become the standard in the US. Faster payments will start with simpler payment types, but will evolve during 2017. Acceleration of payment speed can help financial institutions regain control of their customer’s payment relationship and help drive towards their goal of increasing digital engagement.”

– Matthew Wilcox, Senior Vice President of Marketing Strategy and Innovation at Fiserv

“A few banks will seize on real-time payments to cut out credit card companies, rebuild direct payment relationships with customers, and use technology to offer quick, cheaper, short-term personal loans as an alternative to cards.”

– Tom Groenfeldt, writer for Forbes

“Retail banks will continue to lag the likes of Venmo, PayPal and more seamless digital mechanisms that continue to increase usage.”

– Bailey Reutzel, self-employed reporter for Moneytripping

“Large commerce and payments platforms (such as Facebook, Amazon and PayPal) will get more aggressive with their financial services offerings, leading with more customer-centric innovation. We will also see massive disruption by outsiders in China with Ant Financial, Tencent, etc.”

– Gaurav Sharma, Executive Director of Atlantis Capital

“2017 will be the year when bank-based real time P2P will gain mainstream adoption with Zelle. The fact that banks are not planning on charging for this service will be a key driver to adoption. This may finally be a nail in the coffin for checks.”

– Deva Annamalai, Director of Innovation and Insights at Fiserv

“2017 will see the rise of the super commerce platforms, with many of these originating in China. Names like Ant Financial, Tencent, Uber-beater Didi Chuxing, Weibo and Taobao, will join more commonly known platforms like Facebook, Apple and WeChat as social merges with payments globally.”

– Matt Dooley, Director of Next Money Hong Kong

“Product innovation in prepaid will continue to boost financial inclusion around the world. Safer than cash, prepaid will continue to help consumers budget better and lay the groundwork for financial stability.”

– Bob Legters, Senior Vice President at FIS

7. Responding to Regulatory Changes

As competition increases along with digital technologies and the way consumers do their banking, regulations are being challenged from both legacy players and start-up fintech firms. Fintech firms have not been very successful in forcing changes in regulations to date, mainly because most of the regulations are not in place to stymie competition, but to protect consumers.

There is no arguing that regulation increases the cost of entry, and provides some protection to incumbents. But most of the regulations that protected legacy banking organizations in the US were swept away as a part of deregulation in the late 1980s and 1990s.

Most of what remains exists primarily to serve other purposes such as consumer protection or anti-money laundering (related to KYC due diligence). Thus, even if consumers would prefer regulations to change, most are in force to protect them.

Regulators have a variety of reasons to want to facilitate fintech growth that are not inconsistent with their overall regulatory goals. One reason for optimism is that most regulations are not principally about limiting competition.

There is continued discussion globally to allow for fintech entry while still achieving the goals of regulations. It is believed, in some cases, fintech could help existing financial services firms provide better services at lower cost. The hope is that lower-cost services will not only benefit existing financial services consumers but also help in reaching consumers who are currently unbanked or underbanked.

It is still unclear how regulators will balance the need for limiting risks with the desire to encourage innovation. It is clear, however, that the role of government regulations will increase in the foreseeable future, impacting partnerships, investments and innovation in the banking industry regionally and worldwide.

The very concept of what comprises fintech will shift. This new fintech era is being shaped by changes in market conditions, new regulations, and shifts in consumer demands and behaviors. Thus, the industry is becoming more cautious, even as it becomes more diverse across technologies and products.

“2017 will be the year of ‘Regtech’. Regulators are beginning to create environments where innovators and incumbents can find common ground before scaling their product or solution. Cross-pollination, and a more coordinated approach among regulators across geographies, will help fintech startups while facilitating a better collaboration with legacy financial institutions.”

– Matteo Rizzi, Advisor for the Omidyar Network and Co-Founder of the FinTechStage

“The new decision from the OCC in the US to grant Fintech firms limited bank charters should make things interesting as more firms will be able to connect and offer payments without going through banks.”

– John Owens, Global Senior Advisor for Digital Financial Services for Development

“Partially due to the US elections, expect changes to current regulatory constraints, with decision-makers willing to take more calculated risks to increase profitability, decrease human costs and invest in tech transformation.”

– Lisa Kuhn Phillips, VP of the Allied Payment Network

“We will see a war on cash as governments around the world appear to be suspiciously enthusiastic about moving their citizens to cashless. The loss of anonymous transactions will have a huge impact of civil liberties, with governments possibly not having our best interests at heart.”

– Chris Gledhill, CEO and Co-Founder of Secco

“With the announcement by the OCC that fintech companies can apply for national bank charters, I expect to see many try to go that route in 2017 – in particular online lenders.”

– Mary Beth Sullivan, Managing Partner of Capital Performance Group

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

“With a new administration governing in the US, all regulations will be on the table for review. And with the US having multiple regulatory bodies, plus a patchwork of state agencies covering financial services, we could see a complete rethinking of the overall US financial services regulatory approach.”

– Jim Van Dyke, CEO and Founder of Futurian.Digital

“Ideas of ‘partnerships’ between fintech start-ups and financial institutions could fly out the window as a new ‘lighter’ charter landscape is created. While new charters may allow fintech companies to buy money as cheaply as banks, increased regulatory scrutiny on non-bank fintech companies may also slow growth for those unable to adapt.”

– John Waupsh, Chief Innovation Officer at Kasasa and Author of Bankruption

“The potential of fewer regulatory and compliance requirements will save banks both staff time and money, that can be better spent improving digital channels for individuals and small businesses.”

– Lori Philo-Cook, Marketing and Communications Consultant at InnovoMarketing

“Under a Trump administration, it’s likely that regulations introduced since 2009 will be significantly rolled back, with Dodd-Frank repealed in part, which could boost investment and lending.”

– Don Peppers, Futurist and Co-Founder of CXSpeakers

“US regulators will encourage innovation in the financial service industry, as they ease off new regulation. Sandbox schemes, controlled tests, and encouragement of standards will be the specific activities that we will see in 2017.”

– Alex Jimenez, Digital Banking and Payments Specialist

“PSD2 will put massive pressure on the UK incumbents … global regulators will embrace fintech competition and regulatory concessions … Africa will embrace APIs … financial inclusion will become a mainstream and actionable topic … and the US will embrace change in the regulatory and political system.”

– David Brear, CEO and Founder of 11:FS

8. Exploring Advanced Technologies

Banking is becoming less a place you go, and more something that is hidden from view behind digital banking and commerce apps. Technologies like Apple’s Siri, Amazon’s Alexa or Samsung’s Viv will enable an even greater shift in banking. Instead of being hidden within apps, banking will become completely invisible to consumers.

Fueled by improvements in advanced data analytics, AI, voice-controlled devices, API’s, cloud technology and the Internet of Things (IoT), banking will be able to be integrated seamlessly within a consumer’s everyday life. Ultimately being available ‘beyond the device,’ these technologies will allow banking, commerce, daily intelligence and decision making to be available to consumers 24/7/365 as a virtual, e-personal digital concierge.

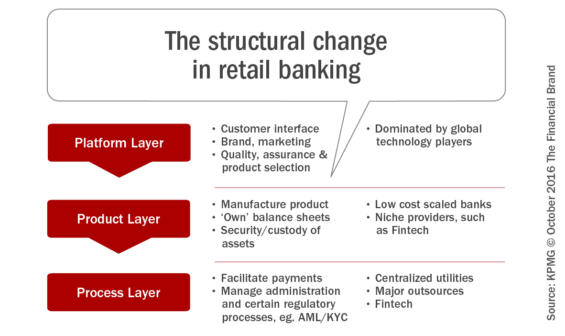

In a vision presented by KPMG in their report, “Meet Eva – Your Enlightened Virtual Assistant and the Future Face of the Invisible Bank”,

Banking will become a disaggregated industry – with three distinct components.

- The first layeris the platform, leveraging a Siri-like device that combines the many services provided by smart tech with banking

- The second layer is the product, which becomes more flexible and customer-centric

- The third layer is the process layer that brings a new wave of utilities to operate the transactional infrastructure of banking

The technology required to build the Invisible Bank already exists today. Components such as APIs, cloud-based services, artificial intelligence and mass personalization are already becoming the foundation for the future at many financial institutions. But, in most cases, these technologies are being used in the peripheral systems rather than the core.

According to Brett King, founder and CEO of Moven and author of the book Augmented: Life in the Smart Lane, “Banking is becoming embedded in our life through a set of distinct experiences, whether that be access to credit in a store, a voice agent that can act as a money coach and tell us if we can afford to go out for dinner and then can reserve and pay for a restaurant booking, or an algorithm that will manage our portfolio. As banking becomes a set of embedded technology-based experiences, the artifacts associated with the bank disappear.”

A real shift in banking would require building out core platforms from scratch – and few banking CEOs have the risk appetite for that. The winners will be those that can utilize their data, drive down costs, build effective partnerships with a broad range of third parties, and provide robust cyber security.

“The most significant change in 2017 will be voice-mediated AI. This innovation will drive a deeper relationship that is more like a private banking relationship. AI and machine learning, with a Voice interface, will become a powerful way for banks to become more relevant with their customers, proactively recommending new products, on-demand finance and credit.”

– Brian Roemmele, Founder of Payfinders.com

“Chatbots (supported by robust AI and NLP) will start to go ‘mainstream’ – drawing into question the long-term future of apps in a ‘post-app’ world.”

– Niti Badarinath, Head of NA Channels at BMO

“In 2017, hype will move away from fintech, with the new hype on robotics, AI, deep machine learning and its potential impact eliminating the relationship manager.”

– Alain Enault, General Manager and Program Director at Efma

“Customers will want and expect to access their bank via a chatbot on Facebook Messenger, or via a voice interface, such as Apple’s Siri and Amazon’s Alexa. This will start with basic information, customer servicing, and ‘simple’ transactions, and will get more sophisticated over time.”

– Zilvinas Bareisis, Senior Analyst at Celent

“Banks will join Capital One in working with Amazon’s Alexa, while others will work with Apple’s Siri. Still others will build their own virtual assistants, as USAA and Standard Chartered are doing. Banks and nonbanks alike will be forced to provide intuitive, conversational interactions for customers banking over digital devices.”

– Penny Crosman, Editor at SourceMedia

“In the next year, machine learning and AI will be used to anticipate banking customer needs and proactively provide advice so they can make better financial decisions on a moment to moment basis. This will expand to biometrics, robotics, sensors, and the Internet of everything.”

– Luvleen Sidhu, Co-Founder and Chief Strategy Officer at BankMobile

“Supported by the opening of regulation, there will be new products, service offerings and an abundance of non-bank players with new approaches to old problems. Technologies like Blockchain, AI, Natural Language Interfaces (Alexa, Siri, Google Assistant), and Cloud will underpin almost every advancement.”

– Scott Bales, Managing Director at Innovation Labs Asia

“Interactions with banks will be nothing different than a small talk with a friend. Conversational interfaces, in the form of AI-powered bots and Alexa-like devices, are going to remove any kind of friction, thus boosting digital adoption more than ever.”

– Ambrogio Terrizzano, Financial Services Lead for Accenture

“In 2017, more and more banks will embrace Robotic Process Automation (RPA) to help improve productivity and quality, while also offloading manual processing from employees. The result will include improved customer experience, as well as reduced cost of operations.”

– Jenni Palocsik, Director of Solutions Marketing at Verint

“Cloud hosted applications will make greater inroads in the financial services industry, with next year being an inflexion point as banks fast track this transformational initiative.”

– Arjun Ray Chaudhuri, Senior Project Manager at Oracle

“A hot trend for 2017 will be ‘Botification™’, as banks look to ‘botify’ their mobile banking-related service, marketing, and advice offerings with chatbots and AI technology.”

– Ron Shevlin, Director of Research at Cornerstone Advisers

“Retail customers will start to feel the effects of API banking as their data is transformed into true capital. They’ll also realize that the more data is exposed/exchanged, the less capital value it has on the market. This may result in a lesson in capital assets, not necessarily in smoother transactions.”

– Ghela Boskovich, Director of Global Business Development at Zafin

“Evidence-based identity management will be the one technology to ensure systematic competitive advantage in the future.”

– Andreas Staub, Managing Partner at FehrAdvice

9. Emergence of Challenger Banks

If Challenger Banks are going to drive significant numbers of customers to change financial relationships, they must not only offer powerfully attractive alternatives and improvements, they must also convince consumers they can be trusted — to deliver on their promises and for security and privacy. 2017 will be a year the industry finds out about the long-term strength of this segment.

Challenger brands may be offering far better interest rates and lower bank charges, or easy to use digital services, or better design, or improved service, but the reality is that very few consumers switch providers despite widespread and often deep dissatisfaction and distrust with the financial industry’s established players.

Even though these new innovative providers have been “challenging the status quo” for a few years, the net number of those switching accounts has barely changed. In the UK, for instance, one million people switched their primary financial institution last year — 11% less than the previous year, even though several banks have been offering generous cash incentives to encourage switching.

The same is true in the US, where new challenger organizations have many of the ‘bells and whistles’, but not the scale that one would expect from a better offering. The challenge is a combination of consumer lethargy, difficulty in switching accounts (more so in the US) and a lack of trust in many of the lesser known start-ups.

Despite these challenges, these organizations are proliferating in the UK in numbers unseen elsewhere around the globe, according to data from Burnmark. For instance, there are 40 challenger banks identified in the UK, compared to only 5 in the US. Despite the advantages offered by the UK market, it still seems likely that some challenger banks will fail. That’s because the market is becoming increasingly crowded, making customer acquisition an uphill challenge.

“2017 is the year challenger banks will need to prove they can actually win customers, and traditional banks need to prove they can truly make digital the center of their strategy.”

– Jelmer de Jong, VP of Product Management at Backbase

“There are many new digital challengers in the UK gearing up for their full launch and the lifting of their banking restrictions. When this happens, it will herald a huge shift for the fintech sector, with real competition finally being possible. Customers will have real choice.”

– Anne Boden, CEO of Starling Bank

“Online lenders will make a comeback by more deeply partnering with banks, or by becoming banks.”

– Teppo Paavola, Chief Development Officer at BBVA

“In 2017, we will begin to see the era of insurtech (insurance technology). The integration of advanced analytics, digital delivery and devices will herald in new challengers that will be watched closely by start-up banks and legacy organizations.”

– Spiros Margaris, Founder of Margaris Advisory

“Being truly digital will come of age, as organizations like N26 and Monzo (who now have banking licenses) look to expand. Both have a digital core … It will be interesting to see how they differentiate, grow and what sort of ROE they can deliver.”

– Simon Taylor, Co-Founder of 11:FS

“Unlike single-product fintech solutions, challenger banks are rethinking comprehensive banking services from the perspective of the ideal customer experience. They are ‘new hope’ for the financial services industry. Their models and experience could turn into a key factor for the whole industry transformation over the next 10 years.”

– Alex Kreger, Founder and CEO of UX Design Agency

“It’s going to be the year where 30 new banks come to the market in Europe and we start to see whether or not they will make dents in the retail, commercial and wealth spaces.”

– David Brear, Founder and CEO of 11:FS

10. Investment in Innovation

The innovation agenda has become intertwined with the digitalization agenda, with both requiring changes in culture and back office operating systems. While increases in innovation investment have slowed, the focus is still on reducing costs, improving engagement and making banking easier.

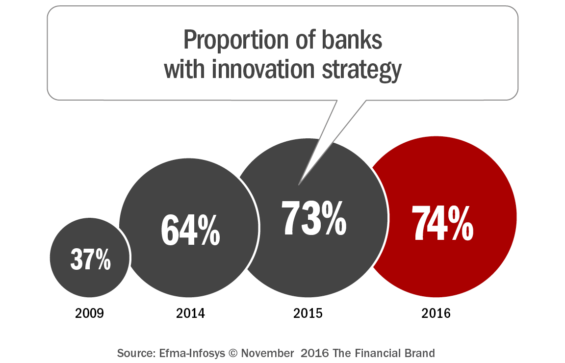

According to the Efma/Infosys Finacle Innovation in Retail Banking study, the proportion of banks with an innovation strategy has increased marginally in 2016 to 74%. This is only a one percentage point rise from last year, yet significantly than the level in 2009. The slowdown in innovation spending is also reflected in the proportion of banking organizations that have increased spending YOY, where we see a drop from 84% increasing their innovation investment in 2015 to 78% in 2016.

The areas where most banks are increasing innovation investment are customer service/experience (84%) and channels (82%), followed by processes (67%), products (63%) and sales and marketing (56%). Interestingly, 50% of banks regard their innovation performance in channels as high (scoring 6 or 7 on a scale of 1 to 7). In all other areas (customer experience, processes, products and marketing/sales), less than one third of banks feel that their innovation performance is high.

Small and medium sized banks might be at a disadvantage to larger banks when it comes to innovation investment. However, there are steps they can take to ensure they are keeping up:

- Monitor Trends and Other Organizations. Make sure your bank is aware of all the critical innovations taking place around the world and understand how these are impacting the business model of banking.

- Build an Innovation Culture. Smaller banks will have an advantage over larger banks when it comes to developing an innovation culture so this is an area on which to focus attention.

- Prioritize. With limited resources, smaller banks need to be very selective and disciplined in choosing where to invest.

- Leverage Vendor Relationships. Make use of relationships to access innovation at lower cost, done by vendors, other organizations or even trade groups.

“I think that over the next twelve months we will see the comeback of the innovation edge from those few traditional banks that have thoroughly embraced digital. Insight + digital infrastructure + customer experience design will produce a new, powerful competitor to fintech start-ups.”

– Marco Brandirali, Executive Director at EY

“The biggest news will be material or mission-critical financial services technologies moving to cloud-first architectures, opening the door for innovation at the core of a bank.”

– Scott Bales, Managing Director at Innovation Labs Asia

“Due to economic and bottom-line pressures, banks will witness massive lay-offs and disinvestments in innovation labs and initiatives. These initiatives will be re-branded as research efforts, focused solely on incremental improvements in the core business lines.”

– Peter Vander Auwera, Founder of Petervan Productions

“2017 will be the year of accessible integration…finally! Look for trade groups, cores and community bankers to unite in the effort to make community bank tech relevant and open to innovation.”

– Jill Castilla, President and CEO of Citizens Bank of Edmond

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Some Closing Thoughts

“Long time stable financial institutions will no longer be the safe bet for many. Waves of hidden entrepreneurial minds are about to leave their comfort zone to look for ‘new income models’ or to create/strengthen start-up ventures. It’s time to refresh talent in banks, as many ‘legacy’ employees become obsolete.”

– Maria Jose Jorda Garcia, Head of Customer Experience Transformation at BBVA

“There will be a continued power shift to the East. The emergence of Asia, led by China, as the leader in fintech investment and innovation of financial services products will occur due partially to the uncertainty in Europe thanks to Brexit and the new administration in the US.”

– Sam Maule, Director and Senior Practice Lead at NTT Data

“2017 will see an increase competition for talent with the rise of the Asian hub. This has been set by the success of several very large fintech events that have produced fintech unicorns with key figures like Jack Ma, CEO of AliPay, with the intention of tuening Fintech into TechFins.”

– Claire Calmejane, Director of Innovation at Lloyds Banking Group

“Social media has given rise to a new class of online influencers in financial services, comprised of experts and analysts, competitors and collaborators, journalists and bloggers. Whether you’re a disruptive start-up or an incumbent brand, you need to identify relevant influencers and start building relationships with them. You can buy followers, but you can’t buy influence.”

– Jay Palter, President and Founder of Jay Palter Social Advisory

Thanks

I would like to thank the more than 100 members of this year’s crowdsourced panel who accepted my invitation to be interviewed for this expansive annual report. The insight shared was extraordinary, and the continued support of this effort is greatly appreciated.

I would also like to thank the more than 900 banks, credit unions, suppliers and vendors who took the time to help us prioritize the trends from both 2016 and 2017. I know you’re busy, so some special thanks.

I would also like to thank Carol Ryan, Jim Booth, Jeffry Pilcher, Ron Shevlin, Brett King and the rest of the Fintech Mafia for the daily support, inspiration, insights and laughs. My wife, Linda and son, Cameron also get a huge thanks for putting with me daily (it’s not easy).

Finally, and most importantly, I would like to thank the sponsor of this year’s research, Kony, Inc. Without your support, this research would not be possible.