At a time when most US consumers were looking for a fun summer diversion, along comes Pokémon GO. If you’re not already playing it yourself, your kids and many of your friends most likely are. The mobile and augmented reality (AR) game from Niantic Labs, a company founded by Google and Nintendo, is impacting consumer’s daily routines while providing somewhat unexpected benefits (physical and mental health, socialization, technological education).

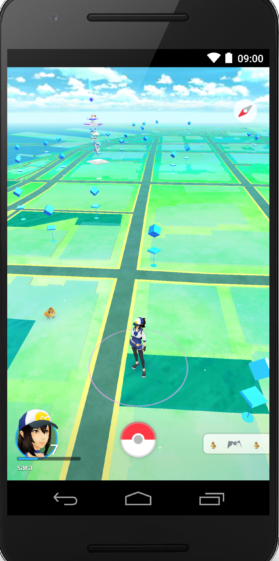

For those unfamiliar, Pokémon GO is a free mobile game that uses your phone’s GPS and camera to see tiny creatures called Pokémon (short for “pocket monster”) through the window of your phone, as if they exist in the real world. The object of the game is walk around your town, park, mall and business district catching these creatures along the way. Players can also visit Pokémon Gyms to train their creatures and PokéStops to collect items that help catch more Pokémon.

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind. Read More about The Financial Brand Forum Kicks Off May 20th Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers. Read More about Send the Right Offers to the Right Consumers

The Financial Brand Forum Kicks Off May 20th

Send the Right Offers to the Right Consumers

Popularity Explosion

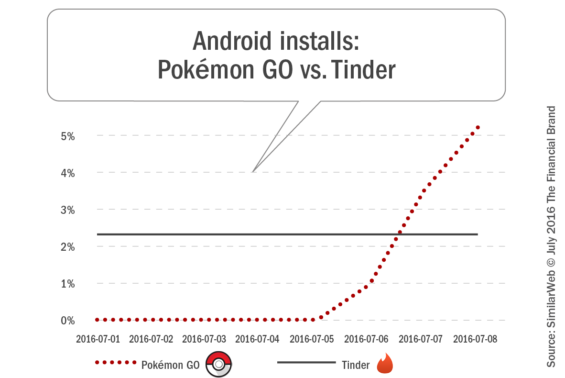

At this time, the app is only available in the US, Australia, and New Zealand. In these countries, the app is on top of all app download charts. According to Similar Web, the Android version of the app was installed on more than 5% of all Android devices in the U.S. within two days, giving it an install base larger than Tinder, the popular dating app.

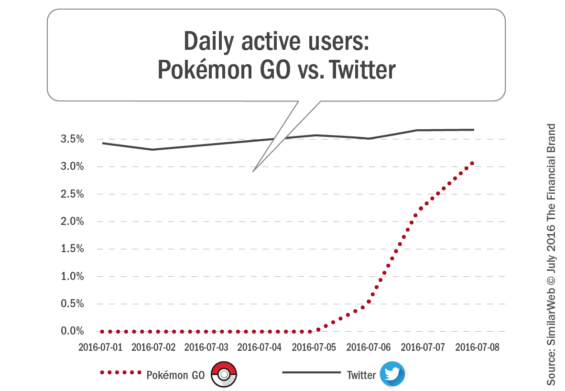

Not only are people installing the Pokémon GO app, they are also using it … a lot! According to SimilarWeb, over 60% of those who have downloaded the app in the US are using it daily, meaning around 3% of the entire US Android population are using the app. This puts the number of Pokémon GO Daily Active Users close to the level of use of Twitter, with SimilarWeb predicting Pokémon GO will overtake Twitter usage in the next couple days.

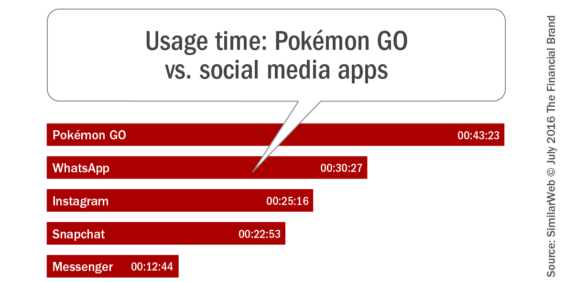

Finally, in terms of usage time, Pokémon GO is draining battery life like no other social application. In fact, by the third day after being introduced, the app was being used for an average of 43 minutes, 23 seconds a day, higher than Whatsapp, Instagram, Snapchat, and Messenger.

This unmatched popularity of Pokémon GO has caused Nintendo’s stock to rise nearly 25% since its release despite a revenue model that may not have a bottom line impact for a while.

While Nintendo might not not profit immediately, are there ways for the banking industry to learn from the Pokémon GO craze?

According to Brett King, CEO of Moven, host of Breaking Banks and author of the book, “Augmented: Life in the Smart Lane,” “Pokémon GO isn’t a banking app, but it does give us a glimpse into how very different the world of banking, investment and financial advice will be in 10 year’s time. The game also illustrates why banking is no longer a place you go, but something you do – on a phone, in AR and as a person lives their life. It also shows that mobile is far from being a mature platform, it still has plenty of surprises left.”

The Power of Augmented Reality

To date, banking has only modestly embraced augmented reality (AR), which fuses digital technology with the physical world. Some organizations have used mapping overlays for mobile branch and ATM finders. Some financial institutions have also used AR for sophisticated mortgage apps, where a consumer can see the location of houses for sale in a neighborhood and automatically get downloads of house details and financing options. The challenge in both of these use cases is awareness and usage.

According to the New York Times, Pokémon Go represents one of those moments when a new technology breaks through from a niche toy for early adopters to something much bigger. “This is the first time that there’s mass adoption of an AR application,” said Joost van Dreunen, who runs SuperData Research. While gaming applications don’t guarantee a broader appeal of banking AR applications, awareness of the technology and engagement potential should have a waterfall effect.

According to Bloomberg, the augmented reality technology used in Pokémon GO is fairly rudimentary. There have been server issues, instances where players have been lured into traps by hackers, and in some cases, privacy issues. As with any mobile application, increased adaptation and usage bring security requirements.

“With Pokémon GO’s massive popularity, it has begun to teach a wider range of consumers AR interactions,” states Fazir Jameer Ali, Mobile Strategy & Innovation Leader at KeyBank. “As these experiences become more popular in other apps, it could present significant mobile banking AR opportunities other than just finding the nearest branch or ATM.”

The Power of Gamification

Terri Schwartz from IGN Entertainment believes that Pokémon GO may be the greatest incognito exercise app ever developed, making people walk from location to location to play the game. The success is because the game follows one of the key tenets of applying game design to an every day activity – set a goal to pursue an end.

There is a powerful, psychological impact in taking something mundane or outside the realm of something one typically enjoys, (like walking with Pokémon GO), and turning it into something engaging. The app doesn’t say that a walk is necessary, but placing a goal on the activity makes it fun.

Pokémon GO also has a social component that positively impacts its success. Communities have already formed around the game, discussing and meeting at PokéStops, and collaborating or competing at Pokémon Gyms. Over the weekend, it was also easy to spot people playing the game just walking around.

While some of the dynamics are different, is there any reason this type of gaming strategy can’t be used by the banking industry to encourage other somewhat painful and mundane tasks – like saving or budgeting?

“For a long time, we’ve talked about incentivizing consumers to spend and save smarter through gamification, but seen little real world examples of this in action, says Chris Skinner, President of the Financial Services Club and Author of the book, “ValueWeb: How Fintech Firms are Using Bitcoin Blockchain and Mobile Technologies to Create the Internet of Value“. “Expect to see more gamification apps in the future and innovative bank marketers would be wise to sign partnership agreements with Nintendo and others fast. After all, when game companies make their in-app purchasing through a universal wallet, wouldn’t you want to be part of that wallet?”

Lisa Kuhn Phillips, Vice President at Allied Payment Network agrees, “The Pokémon GO strategy would be a great use-case to incentivize savings behavior and spending behaviors for the younger generations. Activity benefits, social media benefits, and ongoing engagement/interactive campaigns would all contribute. The data a banking organizations could glean from patterns of activity seekers vs sedentary users could be golden.”

The Power of Geolocation Data

While there has been some issues with the collection of more user information than players using Android devices were aware of, Pokémon GO uses a smartphone’s GPS information to track players’ locations – that’s how it can superimpose digital creatures into real-world environments. As a results, like other location-aware smartphone apps, Pokémon GO collects a great deal of geographic insight from game users. From where a player is at any moment, to where they came from and where they went next, the entire player physical journey can be stored. Even how long is spent at each location.

While there has been some issues with the collection of more user information than players using Android devices were aware of, Pokémon GO uses a smartphone’s GPS information to track players’ locations – that’s how it can superimpose digital creatures into real-world environments. As a results, like other location-aware smartphone apps, Pokémon GO collects a great deal of geographic insight from game users. From where a player is at any moment, to where they came from and where they went next, the entire player physical journey can be stored. Even how long is spent at each location.

The primary benefit of location-based offers in banking is that it allows financial institutions the ability to move beyond traditional, calendar-based promotions to provide more relevant content in real time. This includes the cross-selling of banking products based on need, the offering of outside merchant offers to increase loyalty of current customers and the recommendation of services that can alleviate a potential negative event (overdraft, fraudulent activity, etc.).

According to Cognizant, banking needs to follow the lead of retailers, turning to smart engagement techniques, including the collection of multiple sources of information, to create contextually meaningful offers to consumers. “Banking is well positioned to improve the relevance of offerings, since they possess detailed insight into customers’ transaction history and spending behavior,” says Cognizant. “Using this granular data – combined with geolocation insight – can allow for highly customized offers that steer customers to the right product or service at the right moment and at the right place.”

Ultimately, the application of insights for improved targeting and sales should become integrated into the daily lives of the consumer – moving banking from an outside influence to a desired partner. The collection and use of consumer data to deliver offers to consumers at the right time and place will be the key to success in a more digital world that expects nothing less.

This is already possible with merchant funded reward programs according to Scarlett Sieber, SVP of Global Business Development, New Digital Businesses at BBVA. “For loyalty programs, you can integrate AR as part of affiliate offers through the bank’s credit card relationship. For instance, I could walk past a shoe store that my bank has a relationship with, and from my browsing history, my bank knows a pair I was looking at online. Using machine learning, my phone vibrates with the pair of shoes levitating with a 10% off sign from my bank and the store.”

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The Power of Engagement

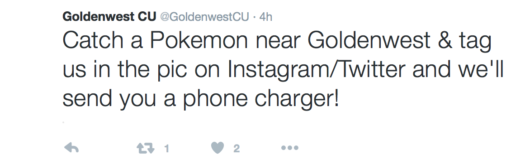

Possibly the biggest and most important lesson the Pokémon GO craze can teach the banking industry is the power of engagement. While local businesses can’t currently elect to become Pokémon Gyms and PokéStops, there are hints that this could become a sponsorship option in the future.

According to ClickZ, some fortunate businesses have found themselves integrated into the game and are embracing players, a strategy that could allow them to convert Pokémon GO players to paying customers. Local businesses that are home to a PokéStop can leverage an in-app purchasable Lure Module which “attracts Pokémon to a PokéStop for 30 minutes.” Combined with Pokémon GO-specific messaging and promotions, that could increase Pokémon GO foot traffic and result in revenues.

Avidia Bank has already embraced the excitement around Pokémon GO by encouraging customers to take pictures of creatures in the offices. And customers have responded, according to Katelin Cwieka, Marketing Specialist at the bank. “We asked our social media followers to share screen shots of where they found Pokemon in our branches. Several have shared pictures which we have posted on Instagram.

“When it comes to customer engagement, Pokémon GO shows that gamification, reward ‘currency’ and a splash of augmented reality go a long way to keep the digital consumer coming back for more – all things banks must design into their digital offerings,” mentioned Ghela Boskovich, Director of Global Strategic Business Development at Zafin.

But banking is not there yet as an industry. Bradley Leimer, Head of Fintech Strategy at Santander Innovation asks, “How are banks leveraging contextual awareness? We have so much data on our customers and yet we don’t leverage this to benefit or delight our customers today. I think our mobile developers need to think of additional types of value we could add to encourage positive behaviors (be that related to health, wealth, or tangential activities like education and travel that can have positive impact on wealth building behaviors).

Duena Blomstrom, FinTech Analyst and Digital Experience Strategy Designer, reinforces the importance of creating a memorable experience, “The concept of a ‘Delightful’ experience is not just a word the UX community choses to throw around for lack of a better term when they describe the essence of creating experiences. Instead, it’s a well thought out answer to what it is that makes lasting engagement. Silly or not, Pokémon GO is that to people. It answers primal emotional needs of play and discovery that delights them, which in turn is addictive.”

Bloomstrom adds, “Bankers should not take this as a signal to place Star Wars virtual reality (VR) stations in every branch, but as yet more evidence that if we want truly connected consumers we need to give them delightful experiences that make them fall in love.”

“Capturing the lightning in bottle that is Pokémon GO is hard – predicting it before the fact impossible,” states Dan Latimore, SVP of Celent. “Today’s sensation shows that people like to be engaged in what they’re doing, have challenging but achievable goals, and compete against others. Banks should be asking how they can leverage these characteristics to increase engagement with their customers.”

Leimer agrees, “We simply need to think outside of the existing bank application paradigm for building out applications – whether it’s rethinking personal financial behavior like buying homes or cars, or finding a better restaurant for dinner. There’s a lot more banks can do to engage their customers. That’s a game we should be playing.”