Today, most retail checking portfolios are tiered based on the value of the relationship. For example, premium checking accounts provide more features (e.g., ATM fee rebates) than entry-level products and are free for those who maintain high balances. Low-balance shoppers are steered into basic checking products that provide fewer bells and whistles.

Now this framework functions well when consumers choose their new bank or credit union first, and then determine which checking account at their new institution will fit them best; back in the old days, before the internet, that’s how most people used to make their decision: institution first, then checking account. But today, online shoppers are more product-focused (e.g., “I need a checking account”) than institution-focused. They are looking for a specific suite of product features, and it’s much easier for online consumers to do research about their options.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

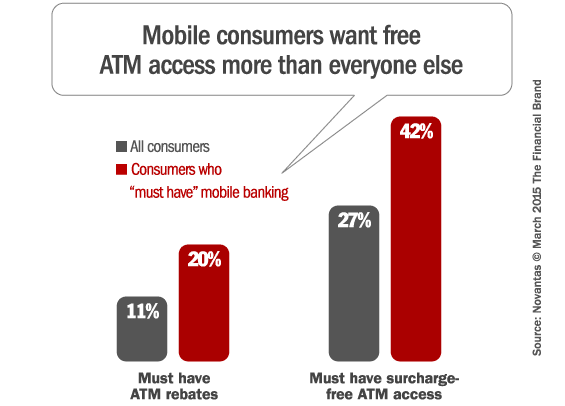

Many institutions’ current checking portfolios don’t match consumers’ demand for mobile banking features and functionality. Many mobile-centric shoppers also want access to surcharge-free ATMs and/or ATM fee rebates. Why? Because what they really want is mobility. After all, they want to bank on their phone. Why would they want to be tethered to a limited ATM network? On FindABetterBank, many of the larger institutions don’t offer ATM benefits beyond their own networks. This isn’t an issue in markets where they are ubiquitous, but they miss the mark with mobile-centric shoppers in places where they have thin ATM networks, or with consumers that travel outside of their ATM reach.

Many smaller banks and credit unions offer mobile banking apps and ATM fee rebates or access to surcharge-free ATM networks with all their checking accounts. But unfortunately, many don’t have brands that resonate with mobile-centric consumers or enough online visibility in their own markets for online shoppers to be aware of them.

For product teams, what would checking propositions look like if they were aligned to cohorts that aren’t defined by balances? For marketing teams, how and where can you be visible to online shoppers with brand messages that resonate with the cohorts you want to win?