The megabanks might be the first to get hit by new climate reporting expectations, but smaller banks and credit unions should start evaluating their carbon footprint. Conversations during and after the COP26 conference in Glasgow could soon set the stage for new financial reporting requirements.

“It’s highly likely that the SEC is going to come out with some minimal reporting guidelines,” says Executive Director of the Center for Climate-Aligned Finance Brian O’Hanlon. “Particularly for smaller firms who are working with smaller companies.”

Yet, it’s not easy for even the largest financial institutions to learn where the lines are drawn in the sand, especially since there aren’t yet concrete regulations in place. What makes it worse is that there are a lot of acronyms and a sea of complicated information about sustainability, climate change and the future of reporting standards in the U.S. Here’s what every bank and credit union should know to feel prepared, including links to useful resources.

Read More: Green Banking: Brand Differentiator, Regulatory Requirement or Both?

Regulations On The Horizon

As noted, there aren’t any hard-set regulations requiring sustainability reporting by U.S. financial institutions. Yet financial regulators appear determined to act. And it will likely stem from a Financial Stability Oversight Council (FSOC) report. The report, released just prior to the COP26 summit, details 30 disclosures and regulations the council recommends government agencies should implement for the banking industry.

The OCC already looks like it’s ready to make a move. Acting Comptroller Michael Hsu announced that the agency, which regulates national banks, plans to soon implement some of the regulations outlined in the FSOC report.

“In almost every case, [climate regulation] is going to be a net benefit in a huge way. There will be some back-end costs, but we’re just seeing a massive upside opportunity.”

— Brian O’Hanlon, RMI

“We need to get the ball rolling,” Hsu said in a November press conference. “Folks need to know where the guardrails are. But there’s a lot of devilish details.”

Federal Reserve Board Governor Lael Brainard said that the Fed is looking to roll out what she calls a “scenario analysis,” which is an economic model that can predict financial risks in the banking industry that correlate with climate change. Individual banks and credit unions would be analyzed using this model to determine what further steps need to be taken. Brainard notes that these analyses will be very different from the stress tests implemented following the 2008 financial crisis.

“Current voluntary climate-related disclosures are an important first step in closing data gaps, but they are prone to inconsistent quality and incompleteness,” Brainard said in a statement.

Read More: Big Techs in Finance Will Test Regulation and Policy Levers

Sustainability may be new to the financial sector, but there are organizations ready to step in and sort out the “devilish details” that Hsu referred to. The Rocky Mountain Institute (RMI) is one example. The Colorado-based non-profit has for decades been helping to raise awareness among financial institutions about the carbon footprint of their portfolios. O’Hanlon, in addition to his role as Executive Director of the Center for Climate-Aligned Finance, is also the Senior Principal for RMI.

“RMI was founded by a gentleman named Amory Levins, who was a senior advisor to the Carter administration,” O’Hanlon explains, adding that the non-profit’s objective since then has been to evaluate different sectors, specifically oil and gas, which is heavily financed by local institutions.

“If you’re looking at how oil and gas is banked, I’d say it’s a lot of local firms,” he states. “It is coming to small-town America in a faster way.”

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Fractional Marketing for Financial Brands

Services that scale with you.

What Is GFANZ? And NZBA?

Your executive teams might have heard the acronymns GFANZ and NZBA thrown around in the news. They refer to two organizations. Before diving into what your bank or credit union needs to do next, it’s crucial to understand the roles these two groups play in the sustainable finance movement and what “net zero” really looks like in banking.

Net-zero. Net-zero can mean many things, but when it comes to climate science, net-zero refers to the balance between carbon emissions released into the atmosphere and the amount of carbon emissions removed from the atmosphere. For banks and credit unions, this plays out in two ways: operationally and in their loan portfolios.

Often Overlooked:

Most companies can get away with operating at net-zero emissions. Banks and credit unions, on the other hand, must achieve net-zero in their operations and their loan portfolios.

Evaluating an institution’s operational carbon emissions is much easier than dealing with lending. A bank or credit union’s operational carbon footprint can be assessed by evaluating energy usage across branches and offices and either transitioning to renewable energies or buying carbon offsets. On the other hand, making a loan portfolio “net-zero” is much more difficult, but we’ll get into that more below.

GFANZ — Glasgow Financial Alliance for Net Zero.

GFANZ was founded in April 2021. It is a group of over 450 global financial companies pledging to invest over $100 trillion in net-zero investments. Vivid Economics says that these pledges alone will account for 70% of all total investments needed to meet global net-zero goals.

NZBA — Net Zero Banking Alliance. This alliance — a branch of GFANZ —is made up of almost 100 financial institutions worldwide, which together account for 43% of the world’s banking assets (approximately $66 trillion). Yet, to date, only seven of these institutions are from the United States: Amalgamated Bank, Bank of America, Citi, JPMorgan Chase, Morgan Stanley, Goldman Sachs and Wells Fargo. The Financial Brand reached out to all seven, and spoke with Amalgamated and Wells Fargo. Others did not respond in time for comment.

Listen In: The Business Case for Sustainability and Doing Good

Amalgamated Bank helped spearhead the launch of the NZBA. Senior Vice President and Chief Sustainability Officer Ivan Frishberg says he hopes to see more financial institutions join the pact. He points out that there are many baseline requirements and various types of targets that institutions must hit, as determined by the 12-member committee that oversees the NZBA. But, he adds, they are very doable.

“From a regulatory standpoint, it’s going to happen. All of this is going to happen pretty quickly,” Frishberg explains. “One of the challenges for banks is they don’t move quickly. They kind of make a commitment, but the world has already moved two steps forward because the science gets worse, then the scenarios. I don’t think you can be too aggressive in this space right now.”

While the alliance is helping make headway in holding institutions accountable in their efforts to reach net-zero targets, it does currently ignore off-balance sheet activity, S&P Global points out.

“Banks that do not make efforts to reduce their exposure through the underwriting part of their portfolio will be particularly vulnerable to potential government legislation impacting fossil fuel supply and demand,” Jeanne Martin, a senior campaign manager in nonprofit ShareAction’s banking standards team, told S&P. Martin says that Barclays and JPMorgan are the only megabanks to have included climate-orientated underwriting initiatives.

One of the challenges for banks is they don’t move quickly. They kind of make a commitment, but the world has already moved two steps forward… I don’t think you can be too aggressive in this space right now.”

— Ivan Frishberg, Amalgamated Bank

Learning the Metrics

Wells Fargo’s Vice President of Corporate Responsibility Communications EJ Bernacki says that one of the toughest parts for banks right now is the ambiguous reporting expectations and “just trying to figure out how to accurately measure our carbon emissions.”

Frishberg says that the Science Based Targets Initiative (SBTi) very well could be the best method to date for banking providers to determine if they are keeping up with the expectations from scientists. He compares the SBTi certification to a Certified B Corp stamp. “Everybody will have a climate target and everybody will care about the climate. But what you really want to look for is, do they have a target?”

The Task Force on Climate-Related Financial Disclosures (TCFD) is also consulting with financial institutions to help them measure their climate risk and learn more about measures they should be taking. Additionally, PwC designed its Pathways to Paris initiative, which is a collaborative effort between financial services providers to brainstorm various net zero pathways.

“Net zero is a significant topic for banks,” PwC’s EMEA Banking and Capital Markets Leader Burkhard Eckes tells The Financial Brand. “Our Climate Excellence methodology contributes sound guidance, data and a means for better understanding an individual counterparty’s or asset’s role in the net zero transition of the banking industry.”

Policing Half-Planned Promises

The other problem Frishberg finds is that many banks and credit unions are so absorbed by the idea of sustainability that they will end up making promises and pledges they don’t have plans in place to fill.

“What most banks will try to say is they’re going to engage with their clients, and they’re going to help them transition,” Frishberg says. “I’ve come to believe that’s pretty dangerous terminology. ‘We’re going to talk to our clients, see if they have any plans and we’re going to agree to check in next year.’ That’s not really going to bring about change.”

O’Hanlon expands on this, adding banks and credit unions need to be much less passive about environmental, sustainable and governance (ESG) initiatives “and far more engaged with understanding where that sector is going to be moving and what are the least cost, lowest admissions to decarbonize.”

Walk the Talk:

When it comes to climate reporting it isn’t going to be enough simply to make a promise without following up. Making the lending portfolio sustainable requires diligence.

“The measuring stick has moved, so it’s no longer enough to make a claim that we’re going to put trillions of dollars into clean energy,” O’Hanlon says.

One further spur to action: the insights and analytics firm Coalition Greenwich reports that “companies are expected to start taking ESG performance into account soon, if they are not already doing so, when allocating their banking business.”

Read More: Is Eco-Friendly ‘Green Banking’ a Sustainable Strategy?

What Financial Institutions (of All Sizes) Can Do Now

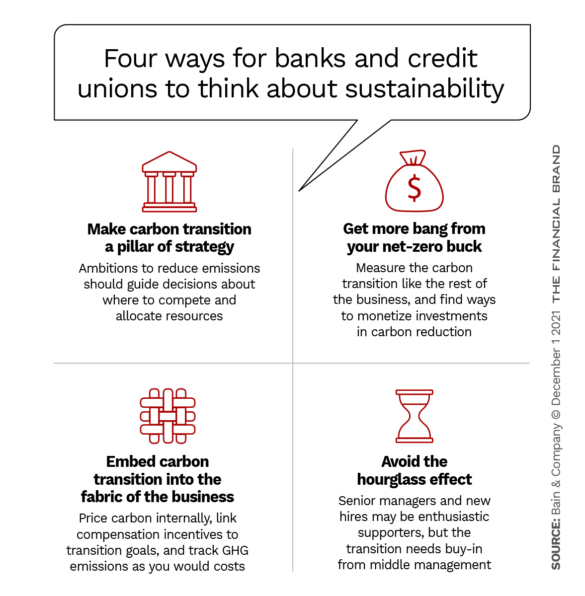

There are steps that banks and credit unions can start to think about. Bain & Company has four key recommendations for any corporation, shown in the graphic below.

For community banks and credit unions, taking a page out of the playbooks of other banks who have already started implementing climate-focused strategies isn’t a bad strategy. Amalgamated’s experience provides several places to start. For instance, Frishberg says one of the biggest steps the bank has taken is to purchase renewable energy for its backend operations.

“Most of our emissions come through our utility bill, so we switched to clean energy providers wherever we could,” Frishberg explains. “There are some places where we couldn’t do that. Then there are some emissions — like when we’re traveling on train and or a plane — where there are no practical zero-carbon alternatives. So that’s where we do use offsets in our operational emissions, but we don’t use them in our portfolio emissions.”

Amalgamated Bank is already operating at net-zero in its own branch and office networks and looks to achieve complete net-zero emissions by 2045. The lending portfolio is where the second half of this comes into play, Frishberg says. He estimates that — while only 13% of the bank’s portfolio was dedicated to climate solutions in 2019 — almost a quarter (23%) is now designated to climate-conscious lending.

Banks and credit unions can look to other Net Zero Banking Alliance members for additional concrete examples.

O’Hanlon explains there is a misconception in the industry that it is going to cost an institution big time to absorb these new regulations. Outside of certain sectors, however, such as retrofits, banks and credit unions could ultimately see a quick ROI on green investments.

“That’s the biggest narrative missing at this point. In almost every case, it is going to be a net benefit in a huge way,” O’Hanlon says. “I’m not just saying that because that’s what I am focused on. There will be some back-end costs, but we’re just seeing a massive upside opportunity.”

Frishberg confirms that Amalgamated’s shift to renewable energies didn’t end up costing that much more.