Most banks and credit unions are struggling to acquire new customers using traditional methods. As consumers forgo visiting branches to open new accounts, the speed and simplicity of digital account opening becomes a top priority, followed closely by a reimagined digital customer acquisition strategy.

But even with these components in place, the potential to acquire new customers at scale is inhibited by increased competition from megabanks, digital-first neobanks, and fintech firms, especially as customer churn at the largest banks is lower than was previously the case.

The future of new customer acquisition in banking requires rethinking past paradigms. Instead of focusing on a single specific product such as checking, auto loan or credit card, banks and credit unions must focus on building holistic customer experiences. More importantly, traditional institutions must avoid the constraints of their branch footprints as they pivot to a digital-first growth strategy. To achieve new customer growth at scale, many financial institutions are now acquiring shopping, media or targeted product companies with national reach and high levels of digital engagement.

Below are four ways financial organizations are rethinking customer acquisition. Each provide a lesson on the future of building relationships focusing on data, digital channels and engagement.

1. PayPal’s Desire for a Shopping Platform Partner

At first glance, the news that PayPal was going to consider acquiring social media and shopping platform Pinterest may have raised eyebrows. Why would an established fintech player in the payments space want a company in such a different vertical? What is the strategy? Community banks and credit unions in particular may wonder, “Why should we care about a combination of a large payments firm and social media company?”

While the transaction looks like it may not happen now (possibly because of government scrutiny of all social media platforms), the underlying strategy reflects a broader trend in financial services with relevance to financial institutions of all sizes. Organizations need new ways to acquire customers – and the combination of a shopping and payments platform makes perfect sense.

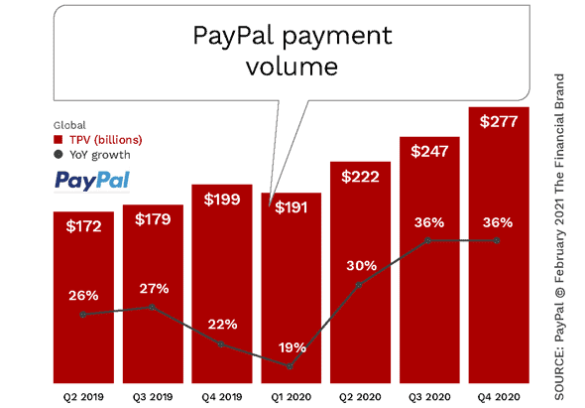

Similar to the majority of traditional banking providers, PayPal’s business model is under attack. ‘Buy Now, Pay Later’ (BNPL) apps from Affirm, Klarna and others are shaking up payments by providing consumers with short-term loans to make online purchases. Other players like Square Cash, Apple, Zelle and Google are also threatening PayPal’s dominance in payments. Traditional banks and credit unions are under attach by larger banks, fintech providers and big tech organizations.

PayPal’s response has been to focus on ways to increase engagement within their ‘super app‘, while also leveraging customer data to provide a greater value proposition for consumers and greater revenue opportunities for PayPal. The ability for consumers to instantly purchase something they see on a shopping platform like Pinterest using a PayPal button reduces friction between the shopping and payments phase of the customer journey.

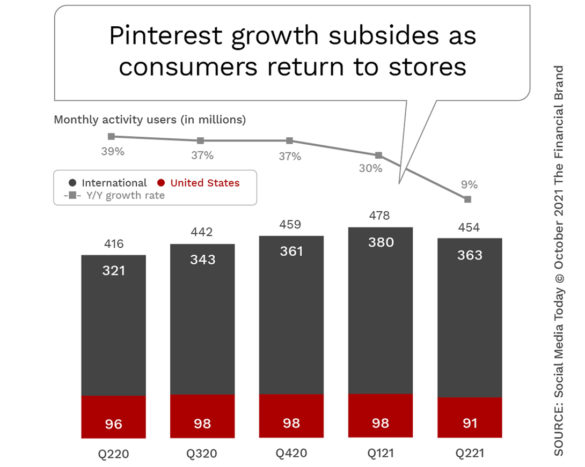

PayPal would have also gained access to shopping data from over 450 million active monthly Pinterest users, enabling expanded marketing of PayPal services and targeted offers. While this may have been a concern for those not wanting social media firms to become larger (and stronger), some form of this strategy is still valid.

PayPal + (insert shopping app name here) = Lower CPA and Higher LTV

The ability to purchase a desired item without leaving a shopping platform can increase engagement on the app while providing cross-sell opportunities for PayPal.

Integration of platforms similar to the proposed PayPal+Pinterest merger provides opportunities to engage and acquire customers at scale, and diversify new sources of revenue. Shopping platforms like Pinterest have users who interact with their app several times a day, whereas people interact with PayPal much less often. For PayPal (or any other financial player), elevating the level of engagement could become a centerpiece of a loyalty strategy: more engagement » greater brand awareness » increased utilization of PayPal’s services » more revenues.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

2. Marcus Acquires Digital Finance Platforms (and Their Digital Customers)

In the past, when a financial institution wanted to measurably increase its customer base — increasing market share in an existing market or expanding to new geographic regions — it was most often done by acquiring another bank or credit union. Eschewing this reflex, more and more institutions are starting to target institutions including fintech firms with strong digital finance functionality and an existing customer base.

For instance, Goldman Sachs has grown its consumer banking franchise with the launch of its digital bank, Marcus, which offers high-yield savings accounts, loans, credit cards and (eventually) checking accounts. Marcus has grown at scale by acquiring existing financial product platforms, which enables the acquisition of customers much more efficiently than traditional bank competitors.

As an example, Marcus snatched up B2B2C lender GreenSky to expand its loan product offerings, and acquire its user base. Before the acquisition, Marcus had about eight million customers. GreenSky provided Marcus with simple financial solutions for home improvement projects, a BNPL platform, and around four million customers with a network of over 10,000 merchants. The acquisition provides new, high margin customers that can immediately be cross-sold other Marcus products.

Other examples of firms acquiring digital lending specialty firms to expand product capabilities as well as to grow customer bases at scale include Square’s acquisition of Afterpay, PayPal’s acquisition of Paidy, and Amazon offering BNPL financing through Affirm.

3. JPMorgan Chase Pursues Multiple High-Impact Expansion Strategies

Last year, JPMorgan Chase CEO Jamie Dimon made it clear that the bank was going to aggressively seek the acquisition of financial services and technology firms as opposed to the old-school strategy of acquiring other deposit-taking organizations (limited by a national deposit share percentage cap).

JPMorgan Chase made more than 30 acquisitions in 2021, ranging from payments, to lending, to segment-focused financial services providers. This strategy allows them to grow their customer base well beyond their traditional branch-based model, with the added benefit of alternative revenue sources, customer insights and cross-sell potential.

For instance, JPMorgan Chase acquired college planning platform Frank to deepen relationships with students and their parents. The online portal gives students a simple application for financial aid, offers financial advice, and helps them find discounted online scholarships and classes. It has served more than five million students at 6,000 institutions since it was launched in 2017. Acquiring these borrowers provides an excellent platform for relationship expansion.

Gen Z Acquisition Strategy:

Chase acquired college planning platform Frank as an efficient way to get access to millions of younger consumers who will need a wide range of financial products in the future.

Other examples of acquisitions by Chase that expanded their consumer reach and revenue potential include buying a majority stake in Volkswagen’s payments business. Beyond car loan and leasing capabilities, this acquisition also includes digital payments for car fueling and charging, in-car subscription services and in-vehicle entertainment. In other words, Chase expands their technology platform and their customer base globally.

JPMorgan also acquired U.K. digital wealth manager Nutmeg (140,000 customers), and a significant stake in C6 Bank, one of the fastest growing full-service digital banks in Brazil, with more than seven million customers.

Read More: Why Square’s Expanding Ecosystem Threatens Banking’s Future

4. Media Companies Provide New Source of Engaged Consumers

A primary objective underpinning many recent acquisitions by financial services firms is to build higher levels of digital engagement on mobile platforms. As consumers have increasingly moved to mobile devices, they want seamless integration of tools that can save them time and money without requiring them to bounce from app to app.

JPMorgan Chase made a significant move to increase engagement with existing customers with the acquisition of the food and travel content-focused website, The Infatuation. This editorial platform helps 1.5 million to 2 million monthly visitors find the best places to eat globally, also managing the restaurant rating resource Zagat. With a high level of content, Chase can attract new customers at a lower cost, retain existing customers and increase credit card usage. Again, there is also the potential to expand existing relationships.

Power of Content:

The acquisition of media companies by financial firms provides immediate access to loyal subscribers and an authentic voice that can increase customer engagement.

This trend is not confined to traditional financial institutions. For instance, Robinhood acquired MarketSnacks in 2019, a top-rated daily financial news podcast and newsletter, that has since been rebranded as Robinhood Snacks. Even before this, Stripe acquired Indie Hackers, a website and community that focuses on helping entrepreneurs become profitable while remaining independent.

In each of these examples, the strategy is to build authenticity and greater engagement with an existing highly segmented audience, providing a lower cost of acquisition and a higher potential lifetime value. At a time when the cost of acquisition and ongoing engagement is both high and fleeting, these are significant differentiators in a marketplace of commonality.

Future of Customer Acquisition Beyond Branches and Footprints

Traditional customer acquisition in banking is highly inefficient. For those banks and credit unions that still rely on branches for the majority of new customer growth, the number of customers generated in this manner will continually diminish as more consumers open accounts and do their banking digitally.

Even if a bank or credit union’s digital customer acquisition engine is efficient, the power of checking accounts as the primary financial product is waning. The growth potential of alternative financial products like buy now, pay later, and other payment and lending services is far greater.

Finally, in order to reach the scale of growth desired (or required), financial institutions must look beyond traditional channels and existing branch footprints. With the power and modest cost of digital media, the incremental cost of acquisition falls significantly when the universe expands beyond local markets.

It is time for banks and credit unions of all sizes to follow the lead of PayPal, JPMorgan Chase, Marcus, Robinhood, Stripe and other traditional and non-traditional financial services firms finding partnerships to drive lower cost technology and customer acquisition.