Data from a new survey shines a bright light on the rapidly developing trend of consumers using technology to manage their finances . “The Fintech Effect,” the second annual report by that name from Plaid, in conjunction with The Harris Poll, highlights the impact the pandemic had on the significant growth in adoption of digital financial solutions. It illustrates digital’s increasing integration within traditional bank offerings, the impact on the access to financial services, and the speed of innovation within banking.

According to Plaid, “This mass adoption moment signals that fintech is no longer separate from the traditional financial system. It is simply becoming the way we do finance, digitally.”

As consumers were forced to use digital services with the closing of physical banking offices, their expectations changed in an instant, fueling innovation and enhancements to the way people transacted and interacted with their financial institution. The following changes in expectations are not temporary, but part of the foundation of what will be expected by every age segment in the future:

- Ease and Simplicity – Consumers want their financial apps to be fast and easy to use, with customization to the way they want to bank.

- Interoperability – Consumers want to use multiple apps, from multiple providers, that provide seamless, connected experiences.

- Value – Consumers want a greater value exchange for their business, including the ability to achieve better financial outcomes through the use of data, insights and new technologies.

- Scalability – As use of digital financial services increase, consumers expect the benefits and trust in the technology to increase. This increased engagement will drive future value transfer.

An underlying theme that continues to occur is the embedded nature of digital finance beyond banking apps. From the ordering of products on Amazon, the delivery of groceries through Instacart, the ride-sharing with Uber, and the buying of coffee at Starbucks, finance is becoming increasingly ubiquitous within our daily lives.

Challenge for Banking:

With consumers becoming more comfortable with financial technology, there is added pressure on legacy banks and credit unions to leverage new technologies and innovation to provide more than just rudimentary digital solutions.

Read More:

- Executing What’s Possible With Digital Banking Transformation

- Digital Banking Innovation Becomes Mandatory, Not an Advantage

- Increased Digital Banking Interactions Require Greater Personalization

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Digital Technology Powers the Future of Banking

The research by Plaid defines fintech, not as a category of competitor, but as a way consumers transact their banking. According to Plaid, “Fintech is the intersection of financial services and technology. It refers to any digital service that a consumer engages with in order to manage their money, including online banking, payments, investing, savings, budgeting, borrowing, and goal-setting.”

In the survey, conducted in July of 2021, 69% of respondents said they use technology as much as possible to manage their money due to the pandemic. Even when the pandemic becomes less of an issue, consumers don’t expect to revert to previous ways of doing banking. In fact, between 80% and 90% of those who used digital banking in the past year plan to use it the same amount or more going forward. Even without the pandemic forcing the use of digital banks, 58% of consumers said they can’t live without using technology to manage their finances.

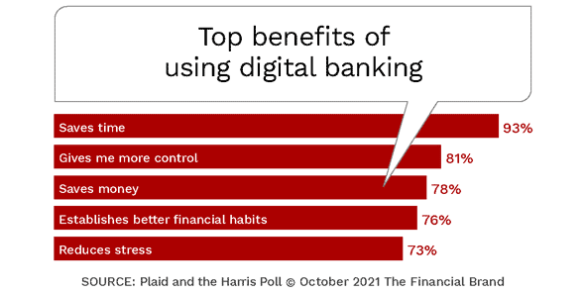

Users of digital banking services stated that use had a positive impact on understanding finance (44%), progressing to a financial goal (34%), and improving the management of their finances (29%). The top benefits mentioned by digital banking users were saving time (93%), more control (81%), more choice (79%), saved money (78%), better habits (76%) and reducing stress (73%).

The ability to use financial technology to help reach financial goals is an important benefit. This includes both saving money for the future and decreasing the cost of banking. According to the Plaid research, the adoption of digital savings tools increased 11% over the past year to 57% of all Americans and digital investing increased 8% to 51%. At the same time, 39% of Americans said they use apps and other digital services because it saves them money on fees including overdrafts and account minimums.

This is an area of vulnerability for traditional financial institutions. Where consumers want apps that help them reach their financial goals, many traditional banks and credit unions have only made legacy products digital. It is a matter of rethinking banking beyond just checking, savings and lending, to include the integration of these services to help consumers achieve a better financial future.

Key Insight:

As digital finance reaches mass adoption, traditional providers must do more to help consumers reach financial goals as consumers increasingly using fintech firms to reach these goals.

Despite the growth in the use of digital banking tools, there is still room for growth. For instance, just 28% of consumers who say they’re not saving enough for retirement use investing tools to reach their goals, with only 33% of those who cite keeping a budget as a challenge using digital budgeting applications. Obviously, it will be incumbent on both traditional and non-traditional financial organizations to encourage the increased use of these types of tools for future growth to reach full potential.

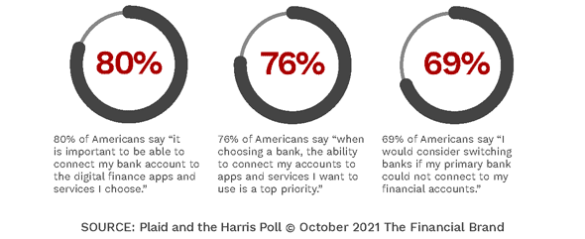

The ability to connect accounts and services together has also become a requirement for an increasing percentage of consumers. The research found that 76% of consumers said the ability to connect their accounts was an expectation when choosing their bank, with 69% of consumers saying they would consider switching banks if this capability was not available.

According to Plaid, “The youngest generations of consumers lead the way on wanting interoperability – 77% of Gen Z and 80% of millennials say the ability to connect their bank accounts is a top priority. But across every generation, at least seven in ten said it’s important to connect their financial accounts together.”

Digital Technology Positively Impacts Financial Inclusion

While 95% of Americans have bank accounts, use of traditional banking drops within minority groups, with only 87.8% of Hispanic people being banked, and 86% of Black households being banked. According to the Plaid research, Black, Indigenous and People of Color (BIPOC) use digital banking more than the white population, with the desire to avoid banking fees and getting employment payments faster being primary drivers. Keeping track of account balances and credit scores are also important benefits for these populations.

According to Plaid, “With minority groups growing as a proportion of the population – and the economy – it’s critical that our financial system represents all demographics. It starts with establishing a new foundation that goes beyond expanding yesterday’s solutions to new populations, but designing new solutions with those specific groups in mind.”

Traditional banking must follow the lead of fintech firms that have shown how to embrace financial inclusion with highly targeted digital banking solutions. Few traditional banks and credit unions have made the strides needed in the creation of low cost services or by providing the financial education sought by minority segments.

Key Insight:

Underbanked consumers use digital banking to address financial challenges including fees, budgeting, and staying on top of finances.

Digital banking has also made the discussion of finances more social, with 71% saying banking technology has made finances easier to discuss. Interestingly, people of color are even more inclined to engage socially around finances with 76% of this segment saying financial technology makes discussion of finance with friends and family more likely.

The increasingly social nature of digital finance increases the use of banking services across all demographic segments and results in higher dependence on advice and guidance from others. According to the research, more than half of people (57%) use financial technology because of a friend or family member recommendation.

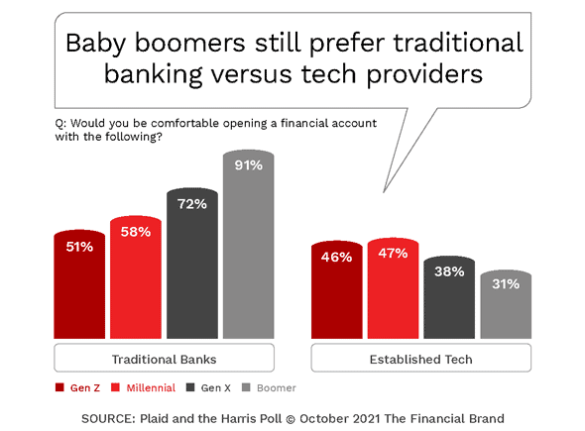

While digital finance is still more prevalent among the youngest age segments, Baby Boomers saw the largest leap in overall adoption among all demographic groups, doubling year-over-year from 39% to 79%. The main driver of increased usage of digital finance among Baby Boomers was convenience, with 64% saying they’d use a digital financial tool if it was easier or faster than what they currently did. In fact, as Baby Boomer usage of financial technology increases, the usage patterns are beginning to mirror other generations.

The acceptance of digital finance by Baby Boomers still hasn’t had a dramatic impact on where this segment desires to open a new account however. The research found that 91% of Boomers say they’re comfortable opening a financial account with a traditional bank, compared to only 31% wanting to open an account with a tech company.

The Growth of Embedded Banking

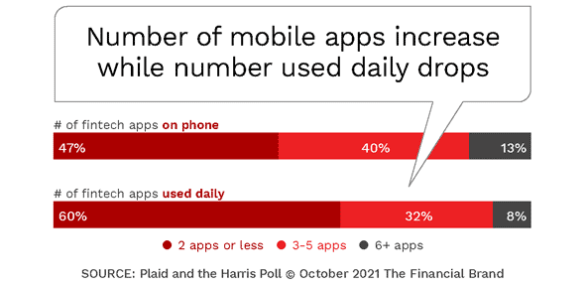

The increase in the use of digital banking applications on a daily basis increased from 37% in 2020 to 48% in 2021. Daily use by Gen Z (49%) and Millennials (55%) exceeds the norm, while use by Baby Boomers is less. That said, the research found that the average number of financial apps people have on their phones decreased from 4 to 3.7 over the past year. This decline was most likely the result of new users, who probably initiated digital banking at a lower level than established users.

A growing trend is that consumers are also decreasing their need for continuous ‘check-ins’ while looking for more embedded engagement that helps them solve more complex financial needs (movement of money for greater return, increased use of budgeting tools, etc.). This can place traditional banking in an advantageous position competitively. According to Plaid, “While people see technology providers leading the pack on innovation and ease of use, banks still lead on trust – a fundamental requirement for people to take actions with their finances.”

The desire by consumers to integrate financial solutions from various providers is increasing as is the desire for banking services to be embedded within a person’s daily life. Over the past year, this type of digital banking experience has become a reality for more consumers. What this means for traditional banking organizations is that the definition of ‘loyalty’ may have shifted from accounts, balances and transactions to engagement and interactions. “People want fintech to balance automation and control to benefit their financial lives”, states the report.

Key Insight:

While a traditional bank may still have the account and balances of a customer, the relationship may be at risk as the customer fragments their relationship across many providers.

But, as consumers are increasingly combining the use of financial solutions from both traditional and non-traditional providers, the level of trust with non-traditional providers continues to increase … including the consideration of ‘primary account’ status. While trust numbers still favor traditional banks and credit unions (77% of the overall population trust financial institutions with their financial information, as compared to 69% tech companies, 69% retailers, and 63% financial technology companies), the variances are lower for younger age categories and for consumers who have used digital banking apps from alternative providers the longest.

The Need for Increased Innovation

The findings of the Plaid survey show the major shift to digital banking solutions and the increased expectations across all demographic segments for simplified and seamless management of finances. As this trend continues, more consumers will embrace solutions that are customized to their specific needs and delivered seamlessly across channels. The desire for embedded finance will only increase as will the use of non-traditional providers.

To respond to these increased expectations, traditional financial institutions need to leverage emerging technologies for the delivery of traditional and emerging solutions. Banks and credit unions will also need to focus on incremental innovation to deliver new solutions in ways that are still taking shape. The sharing of data with both third party organizations and the ability for the consumer to control access to data must be made more transparent.

Finally, traditional financial organizations need to create solutions that are inclusive to all demographic segments. This should not be limited to socioeconomic groups, but also to consumers with disabilities and consumers in higher age categories.

As stated in the report, “The mass adoption of financial technology represents a significant shift in consumer behavior – changing how, when and where people interact with their financial information and their money. It also represents a permanent change in consumer expectations as people want to do everything digitally.”