Many community banks and credit unions are facing a daunting strategic dilemma: How to grow? Financial institutions in healthy markets grow organically. But a substantial percentage of institutions serve communities that are static, or shrinking, in population. Especially in rural areas, many serve towns that thrived in decades past but now face a downward spiral in growth.

This was happening even before the coronavirus pandemic began killing jobs and shuttering small businesses. Today, the decline is accelerating.

The Economic Dilemma Facing Local Banks and Credit Unions

Technology makes all of these institutions’ customers reachable by large banks and nonbanks that are nonlocal. These competitors increasingly can siphon business without incurring the cost of building and staffing branches. Meanwhile, the traditional customer base for financial institutions is aging. Millennials have surpassed Baby Boomers as the largest generation in the history of the world. And they are all digitally native. Many are attracted to the newest, most accessible high-tech offerings to manage financial tasks, instead of the traditional product suite at their local bank.

Furthermore, young people are leaving these communities. As job opportunities erode, they have been moving to cities where jobs had been plentiful, up until recently, or go off to college and never move back. As the remaining population skews older, community institutions suffer, as does the tax base. Local businesses lose foot traffic. Some fold up. Jobs decline even further. And now COVID-19 has dropped further malaise on all of that.

Community financial institutions have been the mainstays of these small towns. They extend mortgages and auto loans. They make the business and farm loans. They underpin the local economy, the charitable institutions and the social fabric itself. Now they are being squeezed from every side: by aggressive, lower cost competitors; by a disproportionate regulatory burden compared to both large banks and fintechs; by the daunting task of keeping up with the lightning pace of technology change; and by withering markets.

Institutions in this predicament have always had limited options. Some open a branch in a location beyond their home territory, tapping into a market that is growing. Some decide to take on a novel product niche that can supplement traditional revenue sources. All try to cut costs and to deploy new technologies. These strategies can succeed, but they come with substantial challenges and risk.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Could a Fresh Source of Decent Business Be Found Right at Home?

What if there was another option? What if there was a way that institutions like these could grow in place, by finding new markets vertically, inside their traditional footprints, right in the communities they have served so long and know so well?

That option is opening up today, thanks to new technology that can enable banks to underwrite loans using more fine-grained risk tools.

The key is to adopt underwriting methods that use non-traditional data.

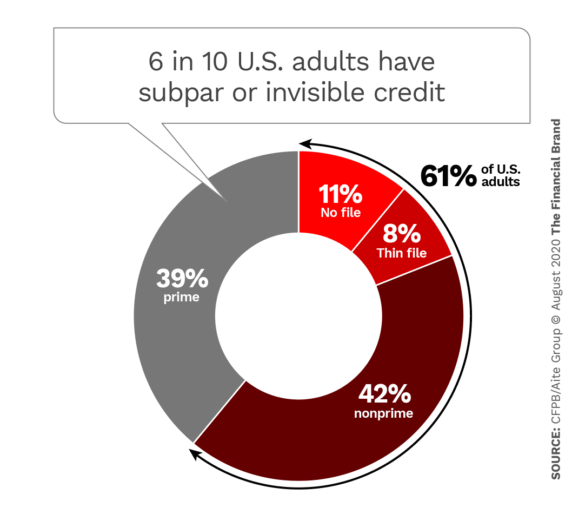

Traditional consumer credit underwriting relies heavily on evaluating applicants’ credit histories and credit scores. The credit scoring tools in widespread use today are generally high-value predictors of credit risk for people who have good scores. However, recognition is growing that these measures do a poor job of assessing risk of creditworthy people who have little or no credit history — the so-called “credit invisibles” — and also of people with complex histories that have nuances not fully captured by their scores.

Numerous studies suggest that the U.S. has millions of people who handle their financial lives responsibly and could reliably repay loans, but cannot get them, or are charged excessive rate premiums to cover “risk” that is not actual risk, but rather reflects the lender’s inability to know what the actual risk is.

The limitation of traditional scoring is also being exacerbated today by the COVID-19 pandemic, because scores reflect past credit behavior that may not be relevant to today’s suddenly volatile risk environment.

The good news is that new technology — specifically the explosion of accessible data and the advent of machine learning algorithms for risk analysis — offers an opportunity to solve these challenges by building more complete pictures of applicants who are disadvantaged in the current credit evaluation system.

Today, digitization is making it possible to use information that was completely inaccessible to lenders in the past, or that could only be accessed with cost-prohibitive manual effort. Estimates are that data volume today is doubling every 12 hours. It is coming from sources like the Internet of Things (IoT) that is embedding computers in devices from wearables to washing machines. It is coming from geolocation data such as in our cars and phones. It is coming from cameras and facial recognition technology. It is coming from the digital footprints in our phones and online activities — which are expanding due to the pandemic. It is coming from digitization of public records.

Digitization is making it possible to use information that was completely inaccessible to lenders in the past, or that could only be accessed with cost-prohibitive manual effort.

“Digitization is making it possible to use information completely inaccessible to lenders in the past, or that could only be accessed with cost-prohibitive manual effort.”

While there are critical societal and policy questions that need to be answered with respect to privacy, consent, and fairness, the proliferation of data has tremendous potential to make it easier to understand and evaluate customers — for credit, for identity verification, or for determining the best products to meet their near- and long-term financial needs. Online lenders like PayPal and Square, for example, gather automated information from small business customers to analyze factors like volatility and seasonality of their businesses, and then tailor repayment schedules to fit them. AI-based algorithms can find risk patterns that are not visible to reviewers using less information.

Research suggests that use of some of these kinds of alternative financial data can lead to markedly more inclusive lending, without compromising credit performance and even, in some cases, enhancing it, especially when traditional and nontraditional data are used together.

For example, research released last year by our organization, FinRegLab, assessed the value of cash-flow underwriting — evaluation of the customer’s bank account information to analyze things like whether income exceeds spending, whether bills are paid on time, and other markers of credit capacity. This study focused on lenders that use these cashflow data and metrics, while other new work is underway on the ability to use artificial intelligence tools like machine learning, to develop sophisticated risk analysis of the risk profiles of both consumers and small businesses, and the use of AI in financial services more generally.

These technologies have the potential to open up financial institution lending to consumers and small businesses that are today consigned to rely on high-cost funding strategies like seeking alternative providers whose business models assume high risk and price their credit accordingly. Sound use of these digital age technologies could open a new era of fair, inclusive and sound lending that could benefit millions of consumers, and their local financial providers as well.

Challenges Face New Methods, But They Aren’t Insurmountable

Until recently, these techniques did not exist. When they began to be adopted, primarily by fintech companies, most traditional institutions hesitated to try them out of concern about potential regulatory criticism, especially regarding fair lending. These newer models using nontraditional data have represented uncharted territory. They open questions about whether new data can introduce disparate impact risks, and also about how they should address adverse action notice requirements, when necessary. (As opposed to disparate treatment discrimination, disparate impact discrimination is based on the perception that sometimes identical treatment can nonetheless result in disparate results on specific groups.)

“The Consumer Financial Protection Bureau issued a no-action letter template to the Bank Policy Institute, recognizing terms for a standardized, small-dollar credit product.”

However, this is starting to change. Research like the FinRegLab empirical study is making a strong case that models built with cash-flow data — an alternative financial data type — are predictive and in some cases offer additional predictive value beyond traditional credit data. The research also found that combining both traditional data with cashflow data can perform better than either, alone.

Recognizing the potential value of new techniques to improve both sound lending and financial inclusion, regulators have been taking proactive steps to support uses of cash flow data in credit underwriting. The Consumer Financial Protection Bureau issued a no-action letter template to the Bank Policy Institute, recognizing terms for a standardized, small-dollar credit product. Underwriting based on the applicant’s cash-flow data is specified among the essential terms set forth for the standardized product. In addition, federal prudential regulators released small-dollar lending principles that specifically recognized the roles that innovative technologies and deposit account data can play in providing responsible small-dollar loans to consumers and small businesses who do not meet traditional underwriting standards.

Meanwhile, Acting Comptroller of the Currency Brian Brooks has communicated his intent to clarify regulatory expectations on these techniques. The OCC also included this question in a Advance Notice of Proposed Rulemaking on digital technology.

Importantly, these efforts are part of a larger trend toward enabling financial institutions to use both fintech and regtech tools that leverage new kinds of data and to deploy AI and its branches, such as machine learning (ML) and Natural Language Processing (NLP), for a wide range of purposes, including rooting out fraud and money laundering. This kind of regtech has huge potential to level the compliance burden playing field for community financial institutions versus large banks and fintechs. AI, combined with today’s unprecedented availability of data and computing power, can make tasks that were formerly difficult or impossible, easy and also more cost efficient.

Understanding Implications of Artificial Intelligence Is Critical

Use of AI for credit underwriting raises numerous policy questions. Here are some of them:

- Must the AI be “explainable,” and if so, what does that entail?

- Does higher explainability lead to lower predictiveness, given that the AI is able to take in massively more data than human brains can process?

- Do certain types of more sophisticated machine learning algorithms result in heightened predictability power yet also significantly diminished interpretability?

- How can we be sure that the “training data” used in developing machine learning algorithms does not transmit human-derived biases into the models?

- Do regulators need to exclude certain factors from consideration in AI models due to high correlation with protected classes, and if so, which ones?

- Can we develop AI algorithms that optimize for fair lending and combine their results with algorithms that optimize only for the likelihood of the loan being repaid?

- Let’s say AI models clearly enable lending to creditworthy people who would otherwise be excluded. But let’s further consider, what if at the same time they produce worsening overall statistics on disparate impact because more people are encouraged to apply for credit, and many of these are, of course, still turned down?

Other questions center on whether AI models should be allowed to consider behavioral characteristics that correlate with credit risk but that do not clearly cause it.

Action Steps for Community Financial Institutions

Regulators and researchers are actively working on evaluating and answering these questions. They are driven by the potential to create a lending marketplace that is more sound and more fair, by harnessing more data, and, especially in the pandemic, by harnessing data that is more up-to-date. If evidence continues to mount that these new digital strategies produce lending results that are both more fair and inclusive and more aligned with safe and sound credit performance, the system may even evolve to viewing them as a set of best practices.

In that event, failure to adopt them will be actively criticized by examiners. As the financial sector continues to digitize, this shift could happen sooner than might be expected.

Few community banks and credit unions will have the capacity to build these sophisticated lending models for themselves. But most can gain by being positioned to take advantage of them as regulatory clarity develops on when and how they can be safely used. To be ready, community institutions can take several steps:

• Assign a task force to learn this landscape. The groups should include people from the credit underwriting function, IT and the innovation team, if any. Include members with diverse backgrounds and experiences who can help evaluate and inform how the data and models are built and used to ensure that they are inclusive and fair.

• Assess offerings from vendors. Determine how they are addressing regulatory compliance questions.

• Study patterns of applicants who have been denied loans in recent years. Determine how many were declined mainly for having a thin- or no-file credit profile, or a score that was too low by a small margin.

• Analyze local economic trends and hold focus group discussions with customers and community leaders to identify where increased credit flows could help revitalize the local market.

The arrival of digital technology has created numerous challenges for community banks. Today, there is a good chance that these new technologies can be part of their salvation.

Authors Note:

Jo Ann Barefoot is CEO and Cofounder of the Alliance for Innovative Regulation. She is a former Deputy Comptroller of the Currency and chairs the board of directors of FinRegLab. She hosts the podcast Barefoot Innovation. Melissa Koide is CEO and Director of FinRegLab and a former Deputy Assistant Secretary of the Treasury.