Features to make digital credit card applications shorter, speedier and less confusing for consumers are becoming more common.

Keynova Group has found that top credit card issuers are increasingly taking steps to address abandonment of online applications, including streamlining forms to reduce the amount of information requested and pre-filling forms by pulling consumer’s personal information from third-party databases.

The research firm’s report focuses on website applications from bank card issuers, with a future report planned on mobile applications. Though similarities exist between the two, the approaches used for online and mobile applications increasingly capitalize on the strengths that each digital platform offers — warranting separate analysis — says Beth Robertson, managing director at Keynova.

Mobile devices allow for easy use of scanning, while efforts to make website applications more user-friendly typically focus on minimizing the time and hassle involved by reducing the amount of data entry they require, according to Robertson.

“The whole idea is encouraging people not to abandon a form when they’re applying for a new card,” Robertson says.

Just Minutes Until Abandonment Happens:

Research from the Digital Banking Report indicates a customer abandonment rate in excess of 50% if opening a new account digitally takes more than three to five minutes.

Friction encountered in digital account opening can have a major impact on a company’s net promoter score, meaning the likelihood that a user would recommend a company, according to 2023 research from Bain & Co.

Here’s an overview of how online credit card applications have been changing.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

They’re Shorter: Credit Card Applications Shrink to a Single Page

As banks work to make credit card applications go faster and more smoothly, they’ve adopted different approaches, Robertson says.

One trend is a growing reliance on abbreviated application forms.

“This approach requests only the core information that is really necessary to making a credit decision, instead of a lot of additional details that aren’t core, especially if they can access third-party data during the underwriting process,” says Robertson.

Keynova’s review of 10 top credit card issuers found that six of them have moved to single-page online application forms. An inspection of a handful of other sites by The Financial Brand found that others still require data entry followed by a “next” or “continue” button, with more data fields to follow. But even in those cases the intent seemed to be to make the process appear more manageable and user-friendly, by dividing it into digestible bits.

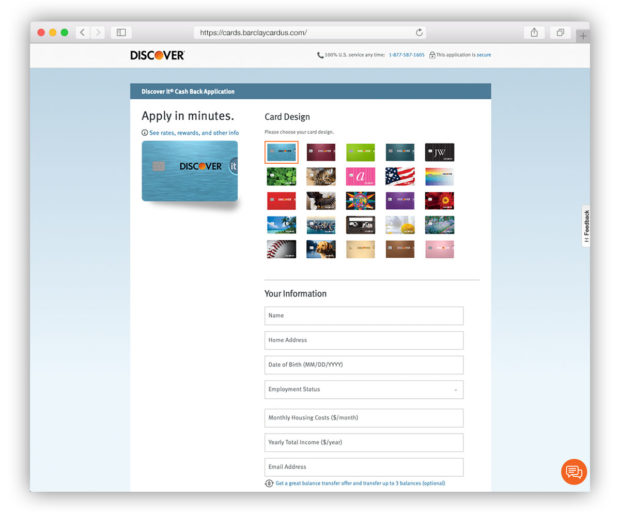

The Discover Card online application form below is one of the tautest ones out there.

It is a single page that opens in a visually engaging way, giving applicants their choice of how they want their card to look. It then requests a minimum amount of data, covering just the bare essentials.

Discover’s quick form also provides terms and conditions and fulfills key compliance requirements. (The illustration above shows the top part of the one-page form.)

Read More:

- Improved Digital Account Opening Must Be a Top Priority for 2023

- BMO’s Digital Banking Goals: Solve Customer Problems and Generate Revenue

- A Bright Future for BNPL Is in the (Bank) Cards

They’re Speedier: Pre-Filled Applications Use Tech to Grab Data

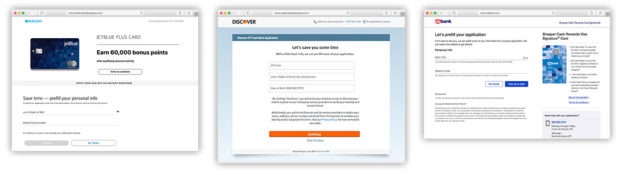

Sites like Barclays US and Discover also set up “pre-fill” options to shorten the application process even more, Keynova found. U.S. Bank also offers the capability of activating a pre-filled form. Consumers can opt out of that choice if they prefer to manually enter their information.

These options generally request bare-bones data, such as the last four digits of a social security number and a mobile phone number or a birth date to activate the pre-fill process.

Applicants can ditch the signup process at any point, so the shorter, the better, Robertson says.

Instant approval, after the consumer applies for a credit card, is another feature many of the sites offer, Keynova found. This helps cement the deal and, in a time when the Apple Card can be approved and activated in minutes through an iPhone, seems like it is becoming table stakes.

Read More:

- Digital Marketing Is Falling Short, But How to Improve Is Clear

- How to Ensure Your Digital Loan Applications Don’t Alienate Borrowers

- 5 Payment Trends to Watch

They’re Less Confusing: Assistance for BofA Credit Card Applicants Is One Click Away

Robertson speaks highly of Bank of America’s live chat-assisted application process. The live chat option helps by reassuring applicants that they can instantly ask questions if they get stuck during the process.

“This feature is available both when you are shopping for a card and when you are in the application,” Robertson says. “It’s a very proactive feature and nobody else is really doing it.”

BofA also includes prompts during the application process with links to relevant terms and questions. She says this helps avoid abandonment due to confusion.