In the early ’90s, most people had never heard of the internet. Skip ahead to 2006 and four out of every five banking providers in the U.S. were offering online banking services. Shortly thereafter, the modern notion of mobile banking followed with the introduction of the first iPhone in June 2007.

Back in 2011, the Federal Reserve estimated that 43% of those in the U.S. with a smartphone were banking on their mobile devices — roughly 58 million people. By 2015, the percentage had crept up to 53%. A milestone was reached in 2018 when Juniper Research reported that the number of global mobile banking users had surpassed those using online banking.

Over the last few years, digital channels have skyrocketed in the banking sector. Now, 71% of all Americans look primarily to online and mobile channels for their banking needs, according to the American Bankers Association (ABA).

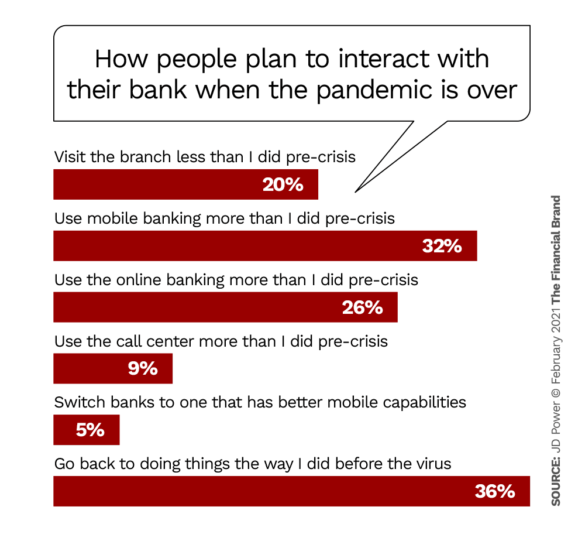

These days, news about how COVID-19 has spurred greater adoption of digital banking channels is everywhere. A study by Lightico found that 63% of U.S. consumers said they were more inclined to try a new digital app for banking than they were prior to the pandemic. A similar study by J.D. Power found that almost 60% of consumers planned to use both mobile and online banking options more than they had prior to the pandemic, even after the crisis is over.

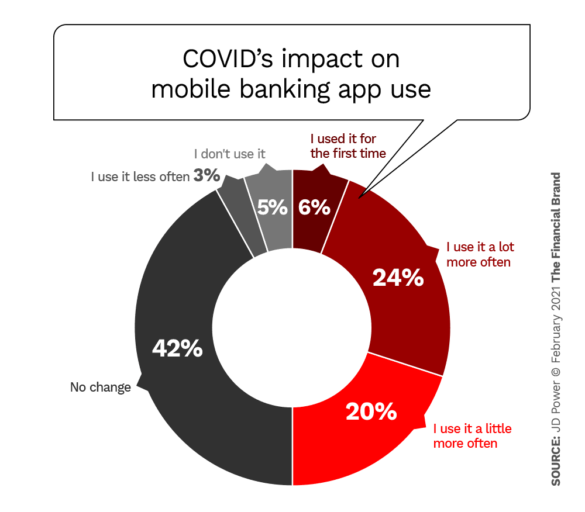

By the fall of 2020, eight months into the pandemic, 44% of retail banking consumers said they were using their primary institution’s mobile app more often, and three out of every four said they used it at least once a month.

Key Fact:

Today, only one in five consumers say they would rather visit brick-and-mortar branches than bank via digital channels.

Fractional Marketing for Financial Brands

Services that scale with you.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Other research from J.D. Power fielded in September 2020 found that 54% of respondents had used their banking provider’s mobile app within the last seven days, while a third had used online banking using a desktop PC or laptop. More than half had used an ATM or drive-thru at a branch in the past week, and only 15% had managed to conduct a teller transaction inside a branch.

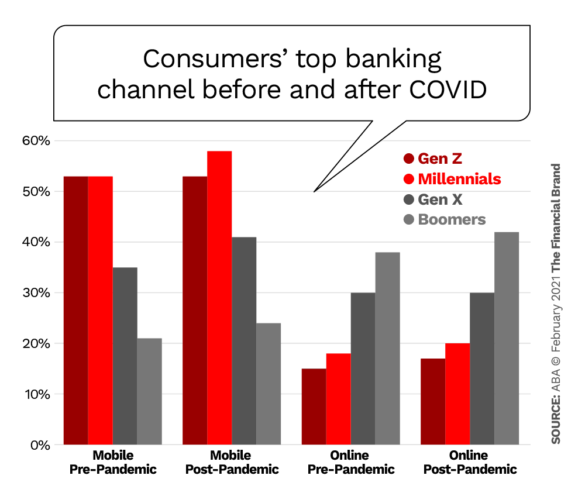

In a separate study from the ABA, 39% of consumers now report using mobile apps as the primary source for banking, a 3% increase from pre-COVID levels. Those who use desktop computers as the primary method to access their account bumped to 32% in 2020, up from 29% before the virus.

Read More:

- The Mobile Experience Now More Important Than In-Person Banking

- Taking Mobile Banking to the Next Level with Innovation & Design

- How to Build the Best Mobile Banking App

Ditching the Shackles of the Brick-and-Mortar Branch

When Credit Karma conducted a survey to gauge pre- and post-pandemic interest in branch utilization, they found that nearly one-third of respondents were regularly using their institution’s brick-and-mortar locations prior to the lockdowns. Now, more than half of these regular branch users say they have no intention of returning to in-person banking if they can avoid it.

Research from J.D. Power’s surveys yielded similar sentiment. More than a quarter of respondents in their survey said they would be going to their local bank branch less often than they were before the pandemic struck. Over one-third of the people surveyed said they were using the mobile and online tools to do more of their banking, and 28% even said they are utilizing mobile deposit check features more often.

Key Insight:

Juniper Research says traditional financial institutions must do a better job personalizing their mobile app experience and use AI‑based personal financial management tools to fight back against digital-only challenger banks.

While consumers may increasingly be turning to mobile channels, it’s critical to remember people still use online banking for certain needs. Many will frequently flip back and forth between the two channels. For instance, it’s usually quicker to check your account balance with a mobile device, but a desktop environment can make more sense when paying a batch of bills, planning out your budget, or updating important account details.

.

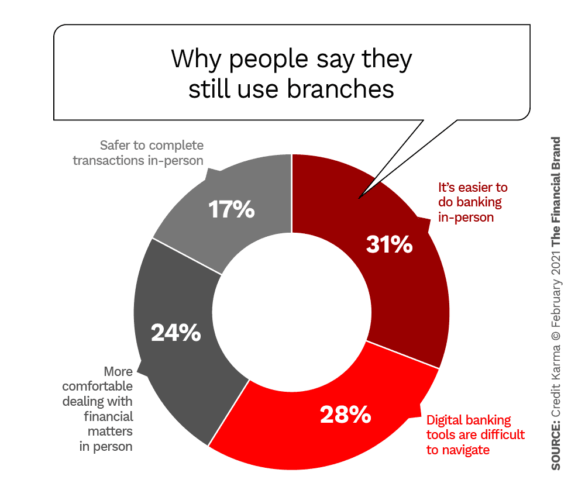

Nevertheless, despite the many innovative technologies blanketing the banking industry, some consumers continue clinging to the traditional in-branch experience they are familiar with. Roughly one in ten Americans still rely on their local branch as the primary channel for their banking needs, even if they supplement that with digital tools.

Why? Some say they think it’s easier to drive to the bank instead of utilizing digital banking alternatives. Others prefer the security and comfort of speaking to a real person about financial transactions.

To address consumer concerns floating around about the lack of security and ease of use of digital banking, analysts suggest integrating powerhouse tools that can reach every customer, regardless of their age and/or experiences. It can even be something as simple as an online teller — available 24/7 — who, at the opening of a bank’s website, pops up on the side of the screen.

While some people may feel at ease talking to a virtual assistant, like Bank of America’s Erica, it is crucial that financial institutions find a way to meet their customers at the digital door. Consistent with surveys and growing trends, people will acclimate to a mobile environment, but banks and credit unions can learn to make it even easier.