The ongoing revolution in mobile computing and the rise of big data should be transforming the banking landscape. But technology moves fast, and banks tend to be slow. Most of the mobile solutions out there today are piecemeal solutions to larger problems.

Frequently, mobile banking apps are cobbled together out of software built for other purposes, adapted and translated for new platforms. They’re good at fixing short-term needs, but they’re not as good at providing holistic experiences.

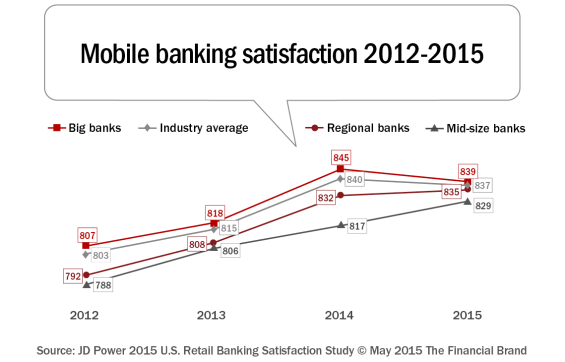

This kind of ad-hoc design doesn’t always inspire a lot of trust or love from users. This year, for the first time, user satisfaction with mobile banking has fallen when measured against the year before. The 2015 U.S. Retail Banking Satisfaction Study from J.D. Power shows that, while overall satisfaction with retail banks has improved to from 2014, satisfaction with mobile banking actually dropped over the past year.

More specifically, mobile satisfaction, which has increased each year since the sub-factor was included in the study in 2012, declined by 3 points in 2015 to 837 from 840 in 2014. For big banks, this decline is largely due to a 6-point drop in mobile scores year over year (845 vs. 839, respectively), based on lower customer ratings in clarity of information and ease of navigating.

As can be seen, the big banks’ lead in mobile-banking satisfaction is narrowing, as features like mobile check deposit become common across the industry. But levels of satisfaction are lower for younger consumers, especially among Generation Z customers – those born in 1995 or later. Consumers younger than millennials, who range from 21 to 38 under J.D. Power’s definition – prefer both the online and in-branch experience at the biggest banks, the study found.

This represents a challenge for regional and community banks, which have traditionally been better at in-person customer service, said Jim Miller, J.D. Power’s senior director of banking. “The challenge for the midsize banks is as all these customers age, can they hold on to their advantage in customer service?”

Customers expect their applications to gain more and more functionality while also becoming easier to us. At present they feel left behind by banking apps. But a quick look at some of the reviews of popular banking applications shows that banks also fail to meet user expectations in providing even basic services.

On iTunes, many customers complain that they can’t get bill pay to work, view credit card statements, search their transactions, or get their application to run on an iPad. Others find themselves frustrated by malfunctioning Touch ID, frequent updates and crashes. Many find themselves drowning in too much information – or not getting a detailed-enough picture of their finances.

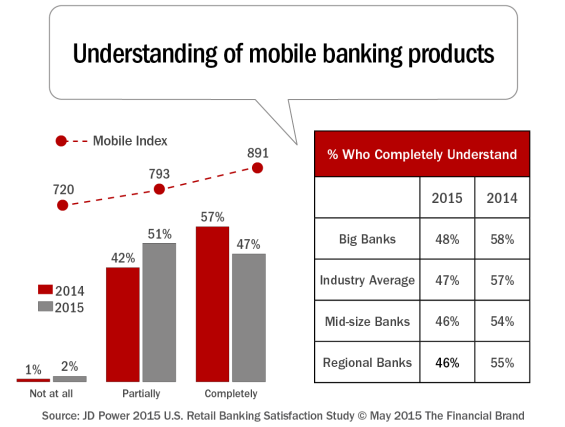

This was found in the J.D. Power study, where despite increased app functionality, satisfaction has dropped as fewer customers indicate that they completely understand mobile (47% vs. 57% in 2014). And these findings were consistent regardless of size of financial institution.

“Satisfaction with mobile banking is dropping as customer expectations are outpacing technology improvements,” said Jim Miller, senior director of banking at J.D. Power. “Customers expect to be able to perform more functions on the same device this year than they did last year and that it will be easier to use. Success will not be driven by just adding more bells and whistles, but by balancing functionality with ease of use and then clearly communicating features and benefits to customers.”

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Learning Mobile Banking From The Start-Ups

So what’s the solution? On one hand, banks need to get better at the basics of mobile banking, like account overviews and bill pay, by making them easier to access and use. But banks also need to start envisioning a new future for mobile banking. Crucially, they need to decide how to best use the immense amount of data users generate every day and package it into something genuinely useful without feeling overwhelming.

“What mobile customers need isn’t a bunch of patches – it’s a brand new boat.”

Too often, the way mobile banking applications are built resembles someone plugging up holes in a leaky ship. But what mobile customers need isn’t a bunch of patches – it’s a brand new boat. That is, a banking solution that leverages the enormous new power offered by mobile devices and integrated databases to give users a comprehensive platform to address all their financial questions and needs.

The keys to this will be personalization and integration: personalization, to get the right information into the right hands at the right moment, and integration, so that systems work seamlessly across platforms and databases.

On both of these fronts, guidance for the future can come from world of financial tech startups and innovators. The Spring 2015 Finovate Conference, featured a treasure trove of companies working on the frontiers of financial innovation. Most of the new products and features presented focused, in some way, on either streamlining the delivery of financial services, or leveraging consumer data into real-time recommendations and offers.

A few of the startups at Finovate focused on security. Trulioo demonstrated how they enable instant identity verification in more than 40 countries. SayPay Technologies demonstrated a new voice biometric payment solution that lets users authorize transactions by speaking into their phone. Kofax demonstrated the use of smartphone cameras, instead of voice, to capture customer IDs and handle authentication in the account-opening process.

A larger number of the products presented at Finovate concentrated on integrating multiple financial services into a single package. For instance, Avoka demonstrated a “frictionless customer experience” for applying to a range of financial benefits, from credit offers to government services. And, Lendkey introduced a process that helps consumers complete the online loan process from start to finish, letting them browse and compare loan offers, and then customize and complete their loan, all through a single interface.

The most exciting presentations at Finovate, however, centered on providing customers with information about their spending habits, obligations and credit status. Moven showed off a mobile app that provides instant feedback on transactions and spending patterns. Yodlee demonstrated the use of behavioral psychology and data clustering to automate chores, make personalized recommendations and provide financial advice. Finally, CreditSesame created an app that monitors customers’ key financial indicators and alters them when there is a change in their credit score or home value.

The Future of Mobile Banking

Of course, not all financial innovation in the mobile sector comes from startups. Established banks have been doing their part as well. Some use phones’ GPS to provide location-based offers and recommendations. Others allow customers to pay bills by using photos or include photographs and videos to their transactions, adding an extra layer of customization and personalization. The most exciting new application, though, might be a virtual assistant that lets customers conduct all their transactions through voice command, which has the potential to turn any space with a phone into a full-service bank branch.

“At some point, banking apps need to become all-purpose financial platforms.”

So what does this landscape of innovation add up to? Right now, it isn’t quite clear. Startups and individual banks are introducing lots of promising concepts, but few comprehensive solutions. But some of these do point the way to the future of advanced mobile.

It is clear that the future is going to involve a ton of streamlining and integration. At some point, banking apps need to become all-purpose financial platforms – digital hubs where customers can investigate, solve and manage all of their financial needs, from loans to investments, mortgages to retirement accounts.

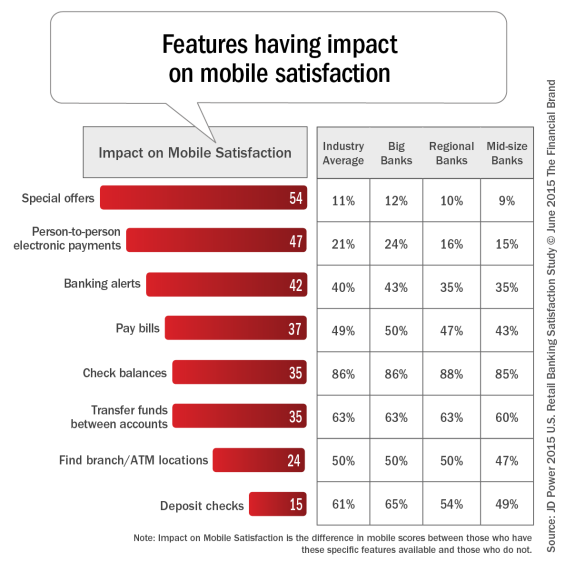

That’s going to involve bringing a huge range of different functions under one roof, while providing an experience that’s fluid, simple and easy to use. That isn’t going to be easy – but it will happen. The key will be prioritizing based on the potential impact on consumer satisfaction and the ease of implementation remembering that ‘more’ doesn’t always mean ‘better’.

The other direction for mobile banking is going to involve much finer-grained use of customer data. Every mobile banking customer generates an incredible wealth of data – and right now, much of this insight is untapped. But the time will soon come when that’s no longer true.

Advanced contextual targeting is still in its infancy, but in a few years we can expect it to become an industry standard. In the not too distant future, mobile banking apps will start acting as personalized financial concierges. Already some are offering discounts and rebates at the point of sale, and giving instant warning about overspending or unusual charges. Still others use augmented reality to map nearby bank branches and ATMs and GPS coordinates to provide location-dependent alerts about offers and sales.

In the near future it will be easy to obtain real-time account assistance tailored to tagged content, either through Instant Messaging or over the phone. Based on a user’s demographics and history, apps will give targeted recommendations for loans, home-refinancing opportunities and debt restructuring. At the same time, they will act as a tool for financial education, keeping customers up-to-date on their investments and outlays, while also modeling their financial future through vivid, easy-to-understand mobile graphics.

“Banks must develop elegant and easy-to-understand technology even as the products become more complex, J.D. Power’s Miller said. “Certainly, banks need to pay attention to digital and make sure that they continue to add features that customers really want but make sure the device is easy to use.”

The pieces of the mobile financial future are out there already. Now it’s just a matter of putting them all together.

Sandeep Sood is the CEO of Monsoon, a firm that designs, develops and markets mobile and web applications that help business thrive in a connected world. His firm has worked with companies such as Wells Fargo, Capital One, Guardian Life, and Citigroup to help them get their ideas off the whiteboard and onto people’s devices. He has spoken at SxSW, TED and TiE. Sood is also the founder of RainFactory, a technical marketing agency that has launched a few of the largest crowdfunding campaigns to date. You can connect with Sandeep on LinkedIn or Twitter.

is the CEO of Monsoon, a firm that designs, develops and markets mobile and web applications that help business thrive in a connected world. His firm has worked with companies such as Wells Fargo, Capital One, Guardian Life, and Citigroup to help them get their ideas off the whiteboard and onto people’s devices. He has spoken at SxSW, TED and TiE. Sood is also the founder of RainFactory, a technical marketing agency that has launched a few of the largest crowdfunding campaigns to date. You can connect with Sandeep on LinkedIn or Twitter.