In today’s digital age, data privacy has become a significant concern for consumers and financial institutions alike. On one hand, consumers want to protect their personal data and maintain control over what their bank or credit union can access. On the other, they will often willingly share personal information in exchange for personalized experiences and services. This is known as the “data privacy paradox” – personalization and data privacy have become two central, yet conflicting, themes.

The Power of Personalization:

2021 Capco research indicated 72% of consumers found it 'highly important' to have a personalized banking experience.

As emphasized often by The Financial Brand and Digital Banking Report research, delivering personalization at scale is imperative for banks and credit unions. As customers and members increasingly interact with their financial institutions across multiple channels, they expect an individualized approach across every brand touchpoint.

This level of personalization requires data. It also ensures that the consumer feels recognized as an individual rather than being clustered into a group by generation, age group or gender.

Banks are at the forefront of personalization because of the depth and breadth of data they possess on customers. This data can be used to tailor products, services and communication to individual customers. For example, using predictive analytics, an institution can anticipate a customer’s need for a specific financial product, such as a car loan, credit card or new savings plan even before the customer realizes this need themselves.

Dig Deeper: How Data and AI are Transforming the Future of Banking

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Striking a Balance Between Financial Privacy and Banking Personalization

While consumers state that personalized experiences are extremely important, data privacy is becoming increasingly more of a concern for people and organizations alike. To better understand attitudes around online privacy, interactive marketing and technology firm Razorfish partnered with research firm GWI. The research found that, when it comes to data privacy, purpose, trust and transparency rule the day.

Interestingly, the study found that 76% of consumers are aware of data privacy risks, but 56% still share personal information to receive personalized experiences. Furthermore, 45% of consumers are willing to share personal information if they believe it will result in better services or products. This suggests that while consumers are aware of the risks associated with data sharing, they are willing to take the risk if they believe there is a benefit to doing so.

The study also found that 75% of consumers value personalized experiences, but 68% also want more control over their personal information. Also, 70% of consumers believe they should be able to delete their personal information from a company’s database at any time. This suggests that consumers are willing to share personal information, but they want to be able to control how that information is used and who has access to it.

Read More: How Data, AI & Machine Learning Supercharge Personalization for Banks

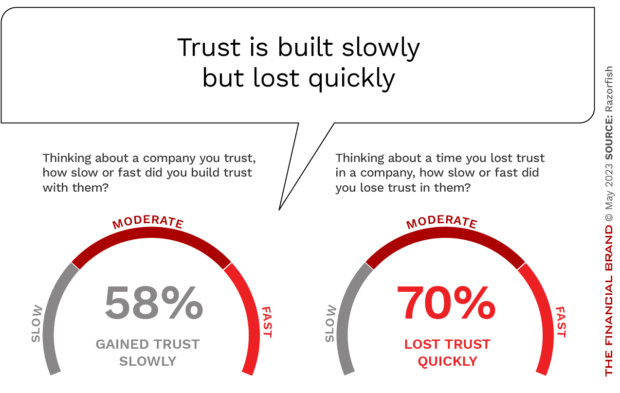

Trust Gained Over Time But Can be Lost in an Instant

The Razorfish study found that consumers have varying levels of trust in different types of companies. For example, 70% of consumers trust banks to protect their personal information, while only 33% trust social media companies. This suggests that banking may benefit from its position in the marketplace, but that there is more pressure to maintain this trust. Given the sensitivity of financial data, any breach could have severe consequences for consumers, leading to a loss of trust in a specific bank or credit union.

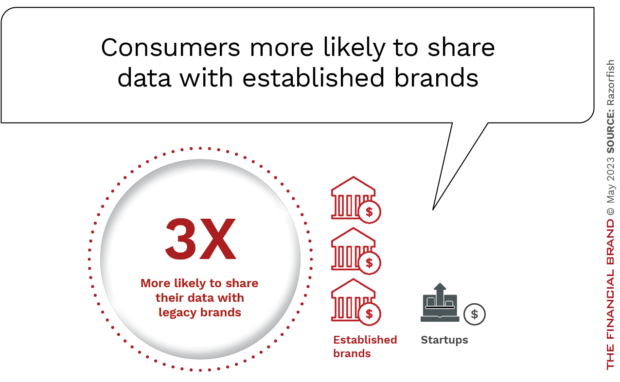

While there are disadvantages to being a legacy bank or credit union, a financial institution’s legacy correlates directly with consumer trust. People trust companies that have been around 50+ years three times more than startups when it comes to data protection, according to Razorfish. At a time when digital start-ups are creating “silent attrition,” traditional banks and credit unions may want to lean into their heritage.

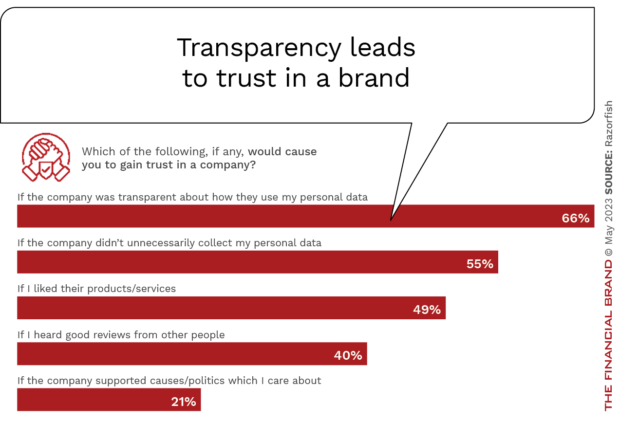

To increase trust, organizations must also go the extra mile to be open and transparent. The majority of respondents said that a brand’s honesty around how data is being used engenders trust. They said this actually ranks higher in importance than great products or positive reviews.

Interestingly, some banking institutions are taking initiatives beyond what is required by compliance, seeking to leverage the data privacy paradox as a competitive advantage. By being transparent about how an organization uses data, giving customers control over their data, and demonstrating that they can protect data, these banks and credit unions aim to build trust with their customers. Trust, in this context, becomes a crucial factor for customer retention and acquisition.

While the data privacy paradox presents challenges for the banking industry, it also offers opportunities. By navigating this paradox effectively, banks can deliver the personalized experiences that customers desire while also respecting and protecting their privacy. This not only complies with regulations but also helps build trust, which is key to maintaining a competitive edge in the digital age.

Learn More: 3 Keys to Better Personalization of Banking Services

Navigating a Privacy-First World

McKinsey suggests organizations of all sizes focus on a customer-centric approach including understanding customers’ needs, preferences and behaviors. They encourage marketers to collect first-party data directly from customers with their consent and to use it to create meaningful and personalized experiences. This shift towards customer-centricity supports building trust, enhancing transparency, and providing value to customers throughout their journey.

McKinsey identifies three key strategies for marketers to adopt in a privacy-first world:

- Building trust and transparency: Marketers should be transparent about data collection practices and ensure customer consent. Communicating the value exchange and clearly articulating data usage policies can help build trust and strengthen customer relationships. Create a self-service portal consumers can use to access and delete data, or offer contact information for customer support.

- Leveraging first-party data: Data must be collected at any point of interaction a customer may have with your brand, such as email, social media, website, mobile app and in-store. This provides a more comprehensive view of the customer. This data can be obtained through opt-ins, registrations, loyalty programs or customer interactions.

- Creating value for customers: Marketers must prioritize delivering personalized experiences that provide genuine value to customers. By understanding customers’ needs, preferences, and journey stages, marketers can tailor messages, offers and content to meet their specific requirements, fostering long-term loyalty and satisfaction.

Most importantly, there must be collaboration across marketing, technology and product functions within organizations, with up-front participation of the compliance area of the bank. This requires investing in technology infrastructure, talent, and capabilities to effectively manage and utilize customer data while ensuring compliance with privacy regulations. Many organizations have successfully collaborated with third-party solution providers to deliver results at speed and scale.