Given the technological influence of younger generations and the economic power of their parents and grandparents, the financial services industry is at an interesting crossroads. Many banks and credit unions now find themselves struggling to retain their traditional in-person experiences for seniors while also trying to woo 22-year-olds who prefer mobile account openings and talking to customer service at 2 a.m.

A new survey from BAI found while all consumers are moving further to digital banking, there’s a growing generational variance in what they want and how they expect financial institutions to deliver.

Generational Differences Amplified by Pandemic

BAI surveyed consumers across four generations and found banking behaviors have changed significantly since the start of the pandemic. Many Boomers have taken a greater stab at technology, Millennials have rapidly expanded their expectations for the mobile experience, and Gen X has become increasingly concerned about fraud and trust.

“Ensuring a continued understanding of generational banking preferences will remain pivotal for financial services leaders as they build the appropriate strategies to prioritize products and services for their customers,” says Karl Dahlgren, Managing Director at BAI.

( Read More: Don’t Sweat Amazon and Other Big Techs: Steal Their Best Ideas Instead )

Gen Z: Ambitious and Mobile First

While it’s easy for older banking executives to write off Gen Z as spoiled kids that grew up with too much of the world at their fingertips, their growing importance demand that banks and credit unions pay close attention. Morgan Stanley notes that these kids will soon “reshape the financial industry in their tech-savvy, mobile-first image” as they enter the 25 to 40-year-old “sweet spot” for borrowing.

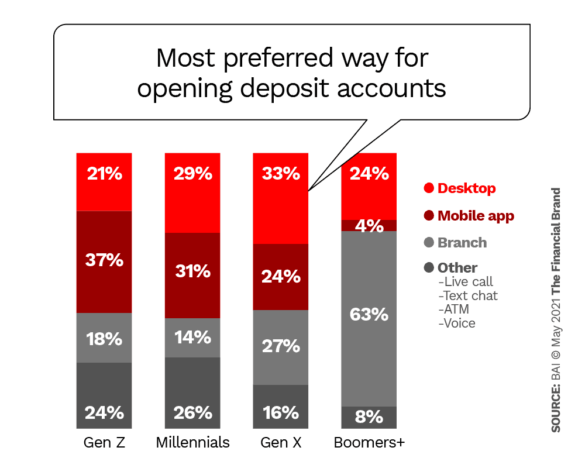

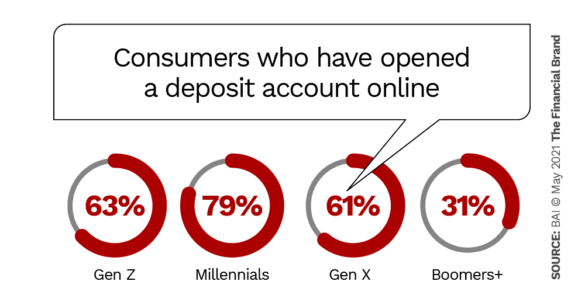

It shouldn’t be surprising that Gen Zers are mobile-centric. Many of them tinkered with smartphones before they could walk, and few of them have ever set foot in a bank branch. BAI found 37% prefer to use their phone to open a deposit account, a far higher portion than any other generation (31% of Millennials and 24% of Gen X, and 4% of Boomers).

Gen Z also has high expectations and big ambitions, even if they’re not entirely shrouded in reality. While most still live at home and rely on their parents for financial assistance, 59% told BAI they’re “financially independent,” and 75% plan to achieve a higher standard of living than their parents. And while 61% bank at the same institutions as their parents, they bring their own set of digital expectations.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Gen Z can sometimes seem like a tough nut to crack, but there is good news. Despite being mobile-first and constantly immersed in technology and social media, they prefer dealing with financial institutions over tech companies. That’s quite surprising and welcoming at a time when the tech Gods like Facebook, Amazon, and Google are increasingly trying to break into financial services.

“There is definitely a clear separation of church and state, and most of these kids want to get their banking services from a bank and not from big tech,” Warren Fisher, Founder and CIO of Manole Capital Management told The Financial Brand. While this could mean an up-and-coming generation of consumers willing to stick with traditional banks, it may not necessarily lead to unsecured lending profits.

Credit Wary:

Having learned from the mistakes of their parents who had too-easy access to credit in their 20s, Gen Z mostly avoids debt and prefers to pay by debit cards.

Only 17% say they prefer to pay by credit card, compared to 46% of Millennials, 35% of Gen X, and 47% of Boomers, according to BAI. As they mature financially, banks and credit unions can help attract Gen Z by serving as a trusted partner in their future with financial literacy lessons or education.

Read More: What Gen X Business Owners Want From Their Banking Providers

Millennials: Maturing Techies

As a population of 72 million people between their 20s and 40s, Millennials have the tech-savviness of Gen Z but with a greater sense of maturity and financial responsibility. More than 70% are employed full-time, and 85% consider themselves financially independent — the highest of any age group.

Raised on convenience, Millennials value speed and want faster payments with quicker transfers and a seamless omnichannel experience. This financial independence, growth, and connectivity lead them to interact with their financial institutions at a rate of 114 interactions per month, the BAI study found, nearly four times the rate of boomers and 50% more than Gen Z or Gen X.

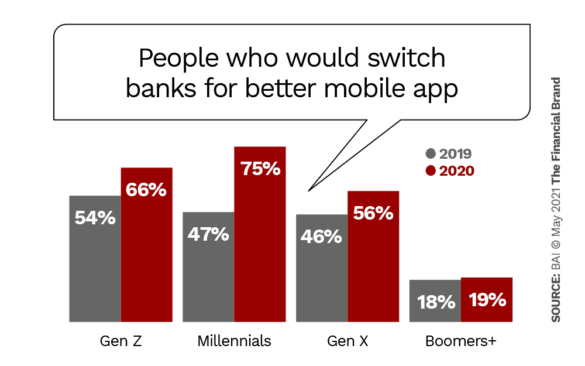

While they prefer mobile, they also have high expectations for what the mobile experience should be. In fact, 75% of Millennials say they would switch their primary financial services organization for a better mobile app, a whopping 28-point jump over the same number who said so last year.

One alarming discovery is that 85% of Millennials say they are willing to bank with non-traditional banks such as Amazon, Apple, or PayPal, the research found. That’s troubling given the growing size of the generation and the fact that these companies have a clear advantage in mobile app development. Yet, rather than worry about big techs, banks and credit unions should focus on using their ideas instead.

As they enter their peak earning years and start thinking more about retirement, their kids, and their financial future, Millennials are also eager for financial advice. However, 84% said they are comfortable with AI-driven financial advice, more than any other generation, according to BAI.

( Read More: Four Ways Banks Must Change Before Millennials & Gen Z Will Love You )

Gen X: Aging yet Agile

The MTV Generation of “slackers and disaffected youth” are now in the prime of middle age with greying hair and more concerns about retirement and their kid’s college tuition than about video games. While Gen Xers are comfortable with most digital services, they still share many traits with Boomers, including a preference for traditional banks and some face-to-face interaction. Most small business owners also fall into this generation.

BAI found Gen X generally has a high level of trust with their financial institutions. While only 39% of them have experienced some type of fraud or identity theft, 95% believe their banking provider “did enough to resolve fraudulent activity on my account quickly and efficiently.”

When it came to what they wanted in a financial institution, “best rates” were at the top of the list by a long shot compared to other generations, as shown below. And although they want online account opening for deposits and loans, nearly half said they prefer banks and credit unions with branches, even if they don’t use them.

Reasons consumers select a new primary financial institution

| Rank | Gen Z | Millennials | Gen X | Boomers + |

|---|---|---|---|---|

| 1 | Lowest Fees 33% |

Lowest Fees 28% |

Best Rates 39% |

Lowest Fees 33% |

| 2 | Best Rates 27% |

Positive Reputation 27% |

Lowest Fees 37% |

Best Rates 31% |

| 3 | Positive Reputation 25% |

Superior Customer Experience 24% |

Cash Incentives/Rewards 24% |

Cash Incentives/Rewards 31% |

| 4 | Large ATM Network 24% |

Best Products 23% |

Positive Reputation 22% |

Convenient Branch Network 23% |

Source: BAI

Boomers: Old School and Face-to-Face

With decades of work, experience, and savings under their belts, it’s not surprising that Boomers are more stable. The study found that 65% of them say they are either increasing their deposits or maintaining the status quo when it comes to savings, compared to 38% of Millennials.

Generational Myopia:

Financial institutions need to be careful not to alienate older consumers while obsessing over Millennials and other younger generations.

Boomers use more technology than many people give them credit for, and their pace of adoption has only increased since the pandemic. As digital aptitude can vary widely, banks and credit unions should seek consistent feedback on the user-friendliness of their digital services and offer assistance when needed.

Financial institutions will also need to consider how they’ll keep seniors using digital banking after the pandemic subsides. As a generation that still values physical branches and face-to-face interaction, it’s no surprise that only 35% are comfortable receiving financial advice via artificial intelligence, compared to more than 70% of the other generations.

While many Boomers are now more willing to bank through their phones than they were prior to the pandemic, they still prefer financial institutions with a branch or two nearby. BAI found nearly two-thirds prefer to open a deposit account in-person, more than twice the percentage of any other generation, and four times the number of Millennials. Most of these older consumers are loyal and content with their current banking situation, saying they are more likely to use the same institution in the next year.

One area where banks will need to pay particular attention to is trust. While 89% of Boomers say they trust their financial institution, the study found, only 63% feel it will protect them from fraud and identity theft, the lowest percentage of any generation.