Most digital and in-person account openings follow the same basic steps: The bank or credit union collects the applicant’s data, verifies his or her identity, approves the application, collects a signature and allows the new customer to fund the account.

The difference between fully digital account opening and what has been done by banks in the past is not just handling all the steps digitally, but completely reimagining the process for a digital world. This includes, but is not limited to, user experience driven responsive design, the need for simplified staging, and mobile identification verification.

Done well, digital account opening eliminates a massive amount of keystrokes by pre-filling parts of the process from insights already available through primary or secondary sources. Most importantly, a digital account opening process should be capable of completion entirely on a mobile device in less than five minutes.

Using mobile devices for account opening calls for the addition of new, mobile specific features such as data capture and document upload via the device camera, touch signatures, and location tracking for reporting and potentially other functions, like fraud prevention.

Digital account opening, at the basic level, would have the ability to perform the following:

- Capture and/or auto-fill basic personal identity information.

- Qualify applicants from a risk/fraud perspective.

- Verify applicant identity (usually through third-party data sources).

- Fund digitally in real-time (usually with either a debit/credit card or with mobile deposit capture).

- Integrate with the core banking system.

Beyond the five core features, several additional features should be included in any best-of-class digital account opening process:

- Contextual pre-qualification for, and cross-sell of, additional products and services using collected internal and external insight.

- Online and mobile banking single sign-on (bypassing data entry and identity verification steps).

- Ability to save and resume digital account opening at any point in the process (supporting multichannel integration).

- Electronic signatures (replacing signature cards).

- Ability to upload photos of supporting identification documents for digital storage (business agreements, etc.).

As we look at the future of digital account opening, the building of a mobile account opening process at speed and scale should drive the processes required for online account opening and even branch openings.

Read More: Digital Account Opening: Hot Trend, But Kinks Hinder Speed

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Digital Account Opening Trends

Most top banks and credit unions offer online account opening, yet mobile-optimized account opening capabilities, where a branch engagement is not required and where an account can be opened seamlessly within three-to-five minutes, is still not commonplace.

As mobile banking functionality and customer acceptance of mobile banking has continued to increase, not being able to open a new account quickly and easily on a mobile device has had a dramatic negative impact on account opening success.

Digital account openings (DAO) are done by both traditional banks (some of which have digital-only components), digital challenger banks (neobanks), and big tech firms who are increasingly entering the banking battlefield. Traditional banks are increasingly being held to the standards that neobanks and big tech firms have set. These firms have eliminated friction from the process and simplified onboarding using digital channels.

The streamlining of processes has yielded significant results. According to a 2020 study from Lightico, only 8% of consumers who use digital-only banks said they had trouble opening a new account online, outperforming major traditional banks, such as Bank of America, where 30% reported difficulties. While local banks (16%) and credit unions (21%) performed better, much of this was attributed to greater human involvement.

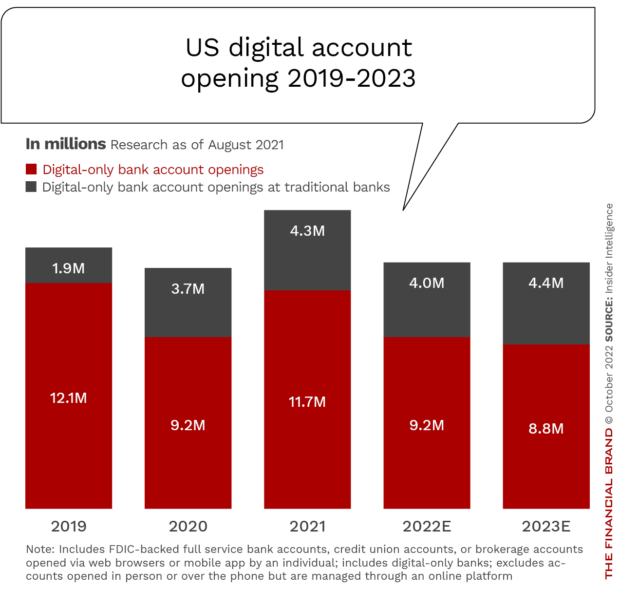

According to eMarketer, digital account openings overall fell drastically in 2020 due to the pandemic but have recovered to more incremental growth in 2022 and beyond. The biggest drop during the pandemic was seen by digital-only players (primarily fintech firms) that saw account openings drop. Traditional financial institutions now must respond to the demand for seamless digital account opening or face significant abandonment of new account openings to more efficient players.

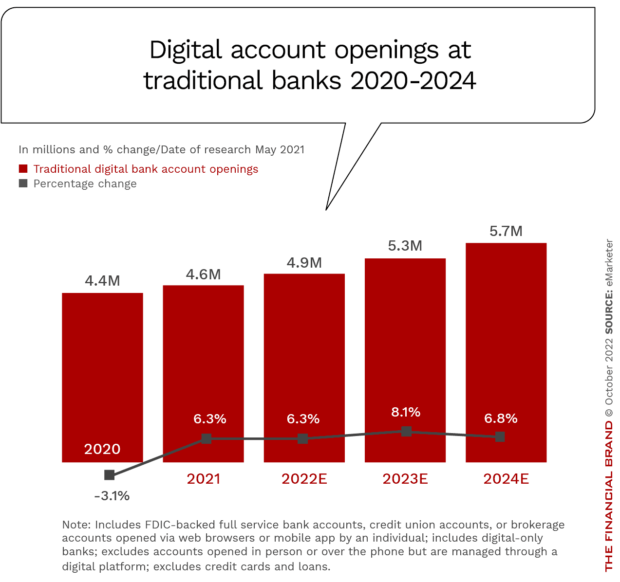

Total digital-only neobank account opens plummeted 48.2% year over year (YoY) in 2020 but have since recovered. Traditional banks, on the other hand, took much less of a digital account opening hit in 2020 (a 3.1% YoY shrinkage). They have since experienced a modest rebound that is expected to continue in the future.

Applying for an account with a neobank often takes about two-to-five minutes — a fraction of the time of most incumbents (over 10, and often 15 minutes). One step that eliminates customer frustration is that many digital challengers quickly divert digital applicants to a call center when a prospect experiences challenges or abandons the digital account opening process.

According to eMarketer, “Granting customers access to their accounts as soon as their applications have been approved, and cutting the jargon from their aesthetically designed communications, are some of the other ways that digital challengers are disrupting the incumbent players.”

The advantage of traditional banking organizations is the combination of brand recognition, trust, breadth of account offerings, the availability of legacy account opening channels, and cross-selling opportunities. Alternatively, traditional banking organizations have the burden of legacy core technology, higher costs to serve customers due to branch networks, greater regulatory scrutiny, and (in most cases) the dependence on third-party solution providers. At neobanks, the decrease in outside funding and concern around trust of lesser known brands negatively impacted digital account opening growth.

Read More: Back-Office Overhaul Critical to Digital Banking Transformation

Use of Third-Party Solution Providers

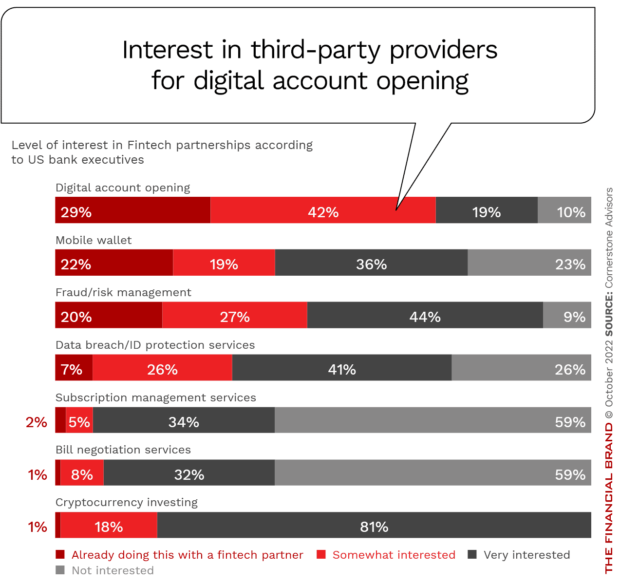

Traditional banking organizations can either choose to build an internal solution, or they can leverage third-party solution providers to provide some or all of the components of the process. The use of outside solutions can be a major advantage due to the speed of implementation and scalability of solutions.

When Cornerstone Advisors asked about the level of interest in using third-party solution providers, 29% of organizations noted an interest in using outside partners to assist in building a better digital account opening process.

New Account Abandonment Rates

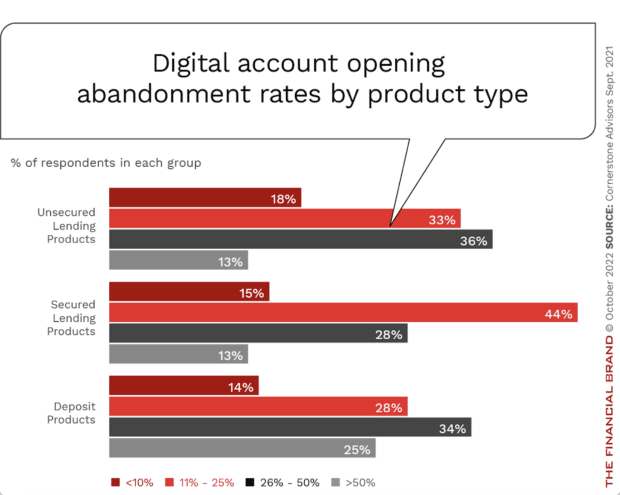

The biggest negative impact of a poor digital account opening process is the abandonment rate of people trying to open a new account. According to Q3 2020 data from Cornerstone, only 14% of banks and credit unions in the U.S. said that their abandonment rate for digital applications for deposit products was less than 10%. A quarter of the same firms said they were seeing rates higher than 50%.

The challenge was even more acute for larger financial institutions (those with more than $10 billion in assets). Approximately a third of larger institutions saw 75% or more of their digital deposit applications abandoned. Reasons for this level of abandonment included a lengthy application process, complex forms, the requirement to come to a physical facility for one or more steps of the process, and requests for too much information.

Research by the Digital Banking Report found similar abandonment rates, especially with organizations where digital account opening processes exceeded 10 minutes in length or where the consumer needed to provide insight that was not readily available.

What Customers Want With Digital Account Opening

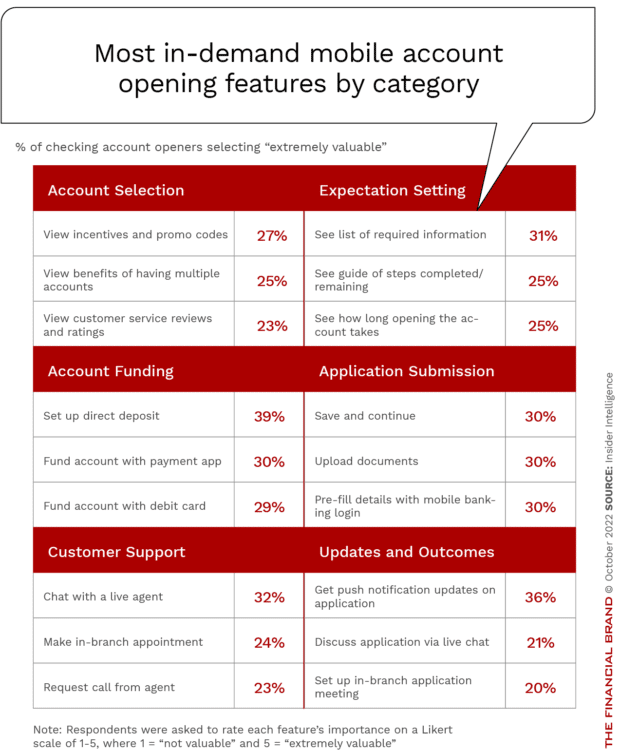

More consumers than ever are opening checking accounts online, raising the pressure on traditional financial institutions to create improved digital account opening experiences. Insider Intelligence used a scorecard of 35 emerging mobile bank account-opening features to determine which ones consumers find most valuable.

According to the research, the most desired digital account opening features were:

- Ability to easily set up direct deposit.

- Push notification updates on progress with the application process.

- The ability to chat with a live agent if needed.

- Providing a list of information needed at the beginning of the process.

- Simplicity of digital account funding.

The biggest performance gap between what is desired and what is being delivered by legacy financial institutions was seen in the areas of direct deposit setup and the ability to fund the account with a digital payment app. Meeting these digital account opening expectations is imperative since most account openings will likely be via mobile in the future. According to Insider Intelligence, 57% of U.S. adults who had opened a checking account in the past 12 months did so on mobile devices.

Crucial to Build on Digital Account Opening Progress

Legacy financial institutions are focusing efforts on improving the digital new account opening process. While progress has been made, there is still much to be done, especially in updating back-office processes to enable fast and seamless ‘top of glass’ experiences.

It is expected that the combination of decreased digital account openings by fintech firms and improved opening experiences by traditional banks and credit unions will result in more digital account openings being done at legacy banks than fintech firms within the next two years. According to Insider Intelligence, it is also expected that for both digital-only and incumbent providers, priorities will shift from “user growth at all costs” to metrics that tie back to the bottom line – such as primary bank status, average deposits, and potential for relationship growth.