If you like change, life as a financial marketer in the “new normal” is going to make you very happy. Here is just a sampling of what banks and credit unions must now watch out for now as coronavirus thinking becomes built into everything in the period here … and ahead.

1. How Consumers Are Coping with COVID Recession’s Impact and Stress

One of the key elements of the “American Dream” is homeownership, which typically means a mortgage. Over half of mortgage borrowers have had a drop in income, according to a July poll by LendingTree. One in five mortgage borrowers have missed a mortgage payment since March, the company also reported.

A TransUnion pulse research study found that by July consumers who say they have been impacted by the COVID recession estimate they have, on average, just short of six weeks before they can’t pay all of their bills. Multiple reports have noted that, increasingly, layoffs are becoming terminations and furloughs are going longer.

In late July Phoenix Synergistics reported that financial stress has started affecting more Americans’ jobs, their health or their personal relationships. The firm’s research found that 37% of all Americans surveyed feel at least one of those effects, a ten percentage point increase over levels before coronavirus arrived.

Faced with such hits, Americans have been taking steps for both the near-term and the longer-term to deal with COVID-19’s impact on their finances.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Fractional Marketing for Financial Brands

Services that scale with you.

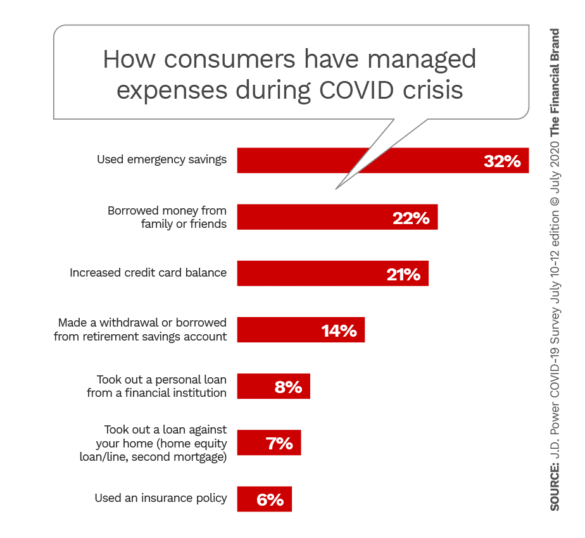

In the mid-July J.D. Power COVID-19 Survey the most common step was the tap emergency savings, with one out of three households doing so. (A bank’s financial blog recently offered the comfort that while it hurts to dig into emergency savings, that’s why it was there, and wasn’t it good it was.)

A bit more than one out of five has borrowed from family or friends and almost the same number has charged more on a credit card, increasing their balances. And 14% of consumers have withdrawn money from retirement savings or borrowed against those accounts. Few have taken out personal loans from banks or credit unions nor borrowed against their home equity.

Other research reports have added to the steps consumers have said they are taking. NerdWallet reports that one out of four consumers are looking for or have taken on additional work to supplement reduced salaries or trimmed hours.

A pair of sobering stats: One out of five people polled by NerdWallet have been selling personal items to raise cash. A small portion of respondents — 8% — are selling off non-retirement investments.

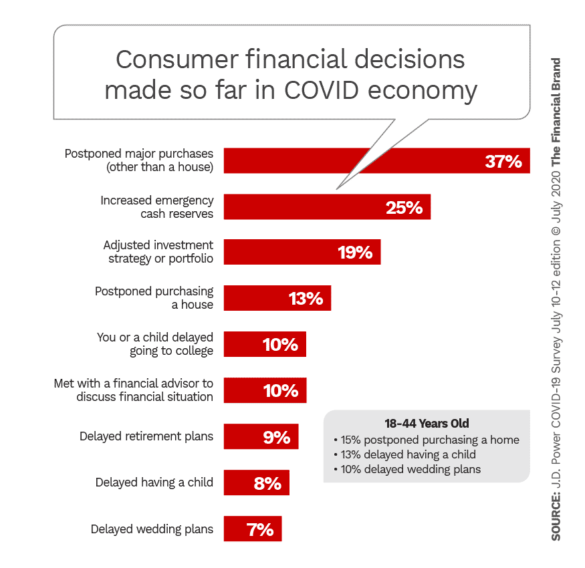

These actions can be considered somewhat “tactical” in nature, but consumers are also making decisions that are of more “strategic.” Nearly two out of five have put off a major purchase (not including homes). And one in ten people have delayed their retirement plans.

Over the horizon, when the nation puts COVID-19 behind it or finds a way to function effectively with it in the background, consumer behavior may change, indicates a poll by NerdWallet conducted roughly in the middle of the coronavirus lockdown period. The study found that three out of four Americans planned to change their financial behavior in some way. This includes:

- Save more in my emergency fund: 38%

- Spend less on nonessentials: 37%

- Create an emergency stockpile of necessary goods: 23%

- Aggressively pay off debt: 21%

- Look for a job/new job: 20%

- Increase/start retirement savings: 18%

Something your institution can try out. The Phoenix Synergistics research found a potential opportunity for banks and credit unions to be of more help to consumers. Many from all generations said they would go to their primary financial institution if they needed advice. But few have actually done so. Of the entire sample, only one out of five have asked their bank or credit union for financial counsel.

This is the time to promote your staff’s financial acumen.

“Financial stress is on the rise among consumers, and relevant financial advice can be a strong differentiator in a market characterized by products that tend to be quite similar,” says Bill McCracken, President at Phoenix Synergistics.

Read More: Why Now Is the Time for Banking to Champion Financial Wellness

2. When Americans Can Save Now, They Are Doing It With Zeal

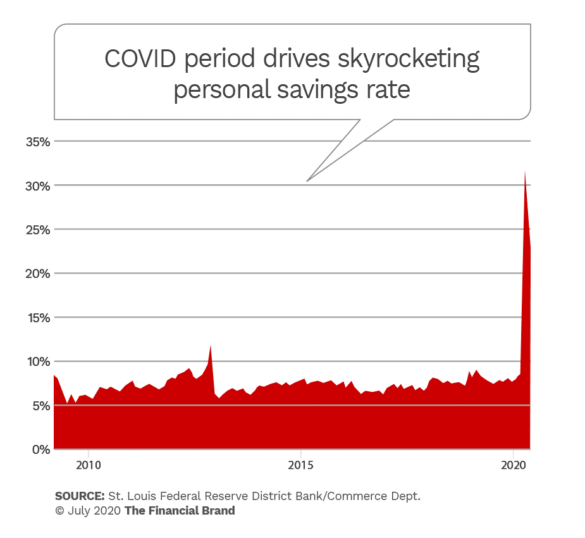

The flip side of many of the statistics about the pain of the coronavirus period is that many Americans have not yet suffered direct economic effects from the recession. They haven’t necessarily had to draw out emergency savings. Some, working from home at full salary and not having to pay commuting costs, may actually be coming out a bit ahead. Financial institutions, in the face of this and of a flight to safety, have seen deposits soar. FDIC noted in its June press conference concerning bank profits that the banking industry’s deposit surge was improving liquidity.

This is in spite of rates so low that it is almost humorous to read promotions for “high-yield” savings bearing APYs a bit over 1%.

But how low is low?

Articles have already begun appearing about the possibility of negative interest rates. It is a concept hard to get one’s mind around, especially if one is a financial institution marketer who has spent years promoting deposit rates.

In a blog intended to raise awareness of this potential issue, Comperemedia’s Anuj Shahani, Vice President, notes that while this may be new for America, it’s been the case in Japan for over two decades.

Shahani writes: “Personal savings rates in Japan still sit around 25%. Japan has always been a savings culture and negative rates haven’t impacted or stopped people from saving. New instruments have been created for people to continue to find ways to save.”

3. Have Some Financial Institutions Improved Their Image During COVID-19?

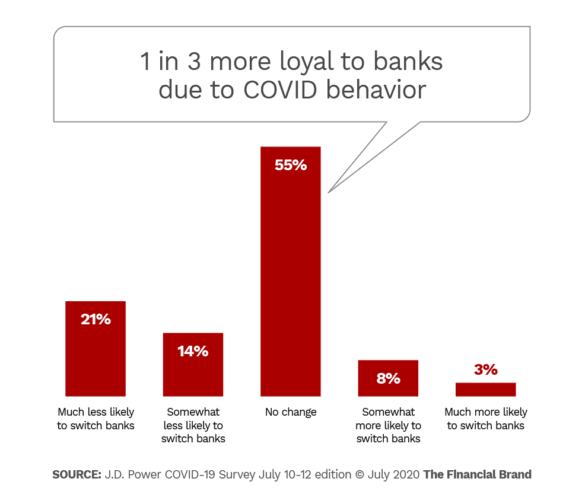

While there have been indications that a segment of younger consumers feel less loyalty to their current primary financial institutions, research by J.D. Power indicates that overall, the efforts made by many institutions’ to assist customers during the pandemic has been noticed.

The firm’s pulse survey indicates that while just over half of consumers haven’t changed how loyal they feel to their financial institutions, 35% indicate that they are at least somewhat less likely to switch to other providers.

This may in part be because the same research found that most consumers have found it very easy (38%) or somewhat easy (48%) to do business with their primary financial institution during the pandemic.

4. Health Concerns Cause More Consumers to Seek Personal Wheels

Before COVID a meme was developing that many Americans, especially Millennials, felt less and less need to actually own (and pay for) an automobile. Between ride-sharing services and various new twists on car rental, these consumers appeared to be giving up another part of the American profile — having your own vehicle for the open road.

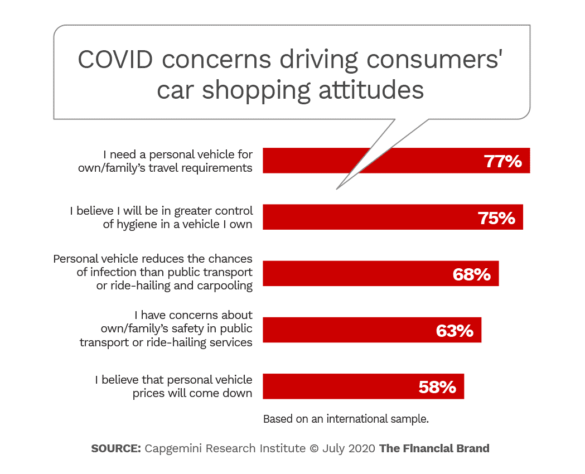

While things are still in flux, of course, banks and credit unions active in auto lending will want to take note that international research by Capgemini indicated in an April research note that consumers overall are leaning more towards buying their own cars. Health concerns play a big part in this thinking.

What’s interesting is the makeup of would-be car buyers in the Capgemini study: 29% are 25-35 years old, 22% are 36-45 and 15% are 18-24. While younger people typically would be in the market for cars, the numbers just cited indicate a good many Millennials will be searching for their own hygienic mobile bubble.

5. Deferrals Help So Far, But May Not Show the Ultimate Picture

One of the earliest measures taken by banks and credit unions to help consumers hit by the COVID-19 effect on the economy was a variety of debt-payment relief measures, including skip-a-pay programs.

“Analysts worry that deferrals and postponed recognition of troubled debt may be covering up indicators of a major credit debacle to come.”

Trends relating to the impact of these deferral programs have emerged from consumer surveys, industry studies and major banks’ second-quarter 2020 earnings reports. Overall performance has been positive, but some analysts worry that deferrals and postponed recognition of troubled debt may be covering up indicators of a major credit debacle to come.

“In the early months of the pandemic, unemployment benefits and relief from the CARES Act gave consumers a bit of a cushion, leaving the consumer fairly well-positioned from a cash-flow perspective,” says Matt Komos, Vice President Of Research and Consulting at TransUnion. “Lenders have been working with consumers during this time of uncertainty by extending financial hardship offerings that help them understand and manage their financial situation. These accommodations have been working as intended and have helped thwart a material breakdown in delinquency performance in the near-term.”

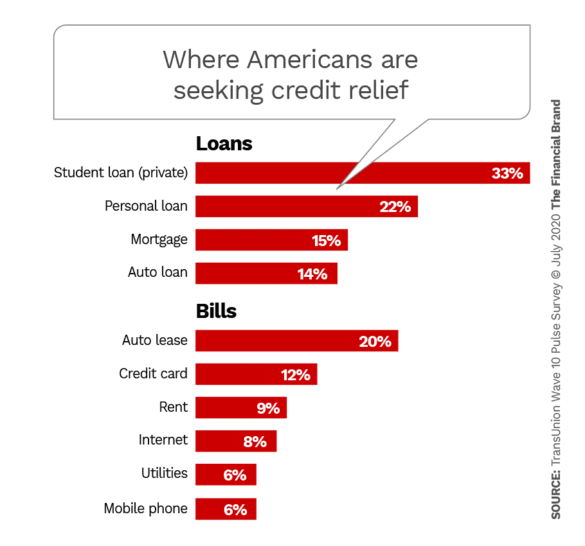

In mid-July the TransUnion financial hardship wave study indicated that private student loans were the consumer credit type most often seeing requests for relief, as shown in the chart below. This study indicated that 55% of Americans say they have been hurt financially by the coronavirus recession. Younger generations have been hit harder, with 68% of Millennials indicating the slump has hit them. Overall, while increases in unemployment had slowed at the time of the survey, consumers reported an increase in having paid work hours reduced. Subsequently, in late July filings for unemployment rose again, for the first time in four months, in the wake of states’ pausing or reversing reopening plans— although the Wall Street Journal noted that this uptick has been balanced to a degree by new hirings and some furloughed workers returning to their jobs.

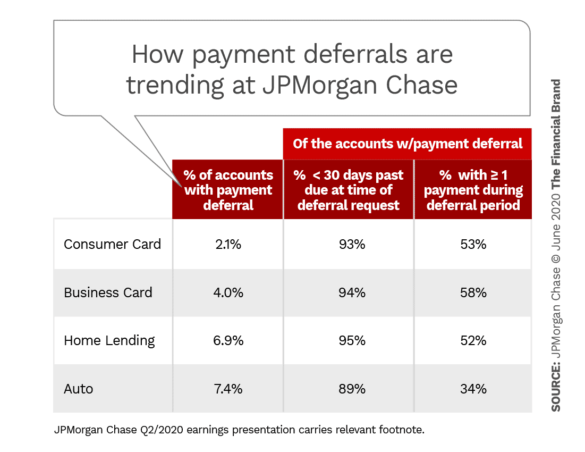

The nation’s five largest banks covered the issue of deferrals in their earnings calls.

Here’s what the top bank, JPMorgan Chase, has reported on deferrals. Jennifer Piepszak, CFO, told analysts that requests for relief peaked at the beginning of April. She added that they had declined significantly over the second quarter and noted that a large percentage of consumers in relief status had made at least one payment. Just over half of borrowers in the consumer credit card and mortgage portfolios had made at least one payment. Most credit card consumers who completed their deferral period had resumed payments, she added, with less than 20% of accounts asking for more relief. In the mortgage area, she said, most whose initial forbearance period expired in June had been re-enrolled.

“While we’re following this data closely,” Piepszak said, “it’s still too early to draw any conclusions.”

TransUnion research indicates somewhat similar findings across its credit database. June figures on financial hardship are shown below, with June 2019 figures in parentheses. (Hardship is defined as being in deferral, forbearance, frozen account or frozen past-due payment status.)

- Consumer Credit Cards: 3.57% (0.02%)

- Mortgage: 6.79% (0.47%)

- Auto loans: 7.21% (0.40%)

- Personal loans: 7.03% (0.26%)

The top five banks have processed literally millions of deferrals and other forms of relief for consumers, including international business. Highlights from remarks by other megabanks to analysts:

- Wells Fargo: CFO John Shrewsberry noted that in early April up to 70,000 consumer accounts per day were seeking relief and that by late June the rate had fallen to 4,000 daily.

- Bank of America: 95% of credit card accounts requesting help were current when aid was sought. One out of three have made every month’s payment since. Credit cards represented the credit category with the most requests for relief at the bank.

- Citigroup: An analyst asked CFO Mark Mason if the company could quantify the impact of federal enhanced unemployment payments. He said it wasn’t possible, but stated that the drastic declines in first-time enrollments for deferrals were probably the result of borrowers applying those benefits to their credit exposures.

Clearly consumers want to hang onto their credit cards should they need emergency spending power beyond their savings. TransUnion research indicates that 42% of all consumers surveyed are worried about being able to pay credit card bills. This concerned ranked highest for the firm’s overall sample and was highest among each of four demographic groups (Baby Boomers, Gen X, Millennials and Gen Z).

Wells Fargo’s investor presentation slides noted something significant for all lenders: “Customer forbearance and other deferral activities instituted in response to the COVID-19 pandemic could delay the recognition of net charge-offs, delinquencies, and nonaccrual status for those customers who would have otherwise moved into past due or nonaccrual status.”

Indeed, one of the benefits granted to lenders by the CARES Act was permission to not classify relief as “troubled debt restructurings.” These “TDRs” usually bear the requirement that the lender charge off a portion of the debt.

S&P Global Market Intelligence estimates that deferrals of all kinds, including business loans, impact just over 7% of the banking industry’s total loans as of the end of the first quarter 2020. The firm predicts that while these efforts have provided some short-term relief, that 30% of deferred loans will in time become nonperforming loans, leading to losses and erosion of capital. The company notes that community banks have made even more use of deferrals than large banks, on a percentage basis.

TransUnion’s Komos adds that all indications are that the country is in the early phases of the pandemic’s impact on the economy. “It will likely be months before the financial impacts of COVID-19 begin to materialize from a credit performance standpoint, and some of this will be dependent on any additional government actions,” says Komos.