Most banks and credit unions are having an easier time growing loans than they are growing low-cost deposits. That makes checking account growth a top priority for most financial marketers. This trend applies to institutions large and small, resulting in head-to-head competition, often with aggressive marketing — $300 cash incentives are not uncommon. Before paying up, however, it’s wise for marketers to gain insight into how consumers are actually making the checking purchase decision. Focusing on the right benefits and messages can go a long way toward countering that stiff competition.

A study completed in October 2019 by Market Street Research for the New England Financial Marketing Association reports on how many people are choosing new financial institutions and what is driving their selection. The study looked at differences by age as well as what drives satisfaction once the consumer has become a customer. Several of the findings are consistent with prevalent thinking, while two insights may upset many retail bankers’ assumptions.

The Primary Reasons People Switch Banking Providers

Just over a fifth (21%) of all consumers have been with their primary financial institution for five years or less. This rate nearly doubles to 41% among consumers under age 40, and increases to 57% for residents who have moved into the area. About 5% of consumers switch primary banks annually. Of the survey respondents, two of three use a large bank as their primary institution.

Overall, a considerable degree of inertia remains in banking. The survey report notes that the average tenure with their current primary bank is 12 years, and that during that time consumers bought two cars, changed jobs three times and replaced their cell phone five times. In fact 24% would rather work on their taxes and 13% would rather have a colonoscopy than change their main banking relationship.

Because of that inertia, financial marketers need to make the most of their opportunities to grab the “switchers” when they do decide to change institutions. People open up a checking account for three primary reasons, according to Market Street, each representing about a third of respondents:

- It’s the first checking account the person has opened. While this is typically a high school or college student, it can also be someone new to the banking system or the country.

- A significant life event has occurred, with the dominant one being a move into the area.

- A service or fee issue made the consumer unhappy with its previous institution, or they wanted something they believed only a new bank or credit union could offer.

These findings are not unexpecded, but have implications for targeting. It’s clear that younger consumers are more likely to open up a checking account as a lead product, as are new movers. With regard to messaging, a service-based or fee-friendly value proposition could sway an unhappy consumer your way, as could emphasizing features or value-added services that are unique to your institution.

Read More:

- Big Chance to Grab (or Lose) Consumers Primed to Switch

- Don’t Abandon Branches to Favor Digital Banking Channels

- Just Because Banking Customers Don’t ‘Switch’ Doesn’t Mean They Love You

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Top Factors in Choosing a New Financial Institution

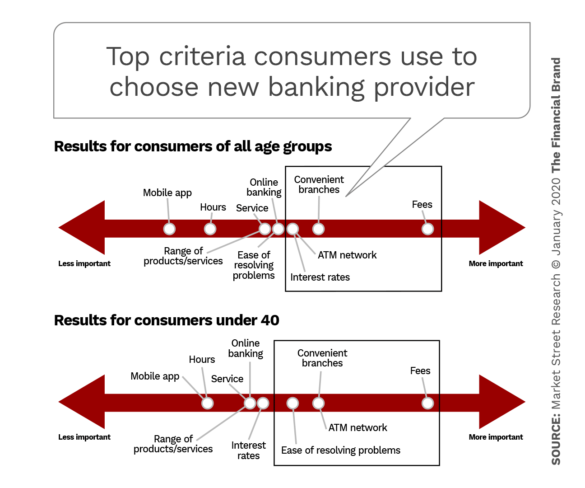

The study performed a trade-off analysis of ten criteria to determine which were the most important when a consumer evaluated a new institution. Four things rose to the top — but two of them were different for consumers under 40, and not the ones you might think.

Among consumers of all ages, fees were by far the most important criteria. This is a combination of most consumers being sensitive to paying fees, along with the fact that many switchers were doing so because they were unhappy with fees at their previous institution.

The second most important attribute was “Convenient branches.” Even though most consumers use digital channels and don’t have to visit branches frequently, this attribute continues to come out near the top in study after study. It makes sense. 90% of the time, the consumer opens up the account in the branch. And after that, a branch is kind of like an insurance policy — “It’s there if I ever need it.”

“The truth is, bankers think about rates a lot more than most consumers do.”

Tied for third among reasons consumers choose a new primary financial institution was “ATM network” and “Deposit interest rates.” Many institutions think that deposit rates are more important than they actually are. Yes, some large balance or retired consumers are counting the pennies, but deposit rates are not driving bank selection for most consumers shopping for a checking account.

How do these selection criteria differ for younger consumers? Quite a bit, actually. Fees are still number one by a long shot, but that’s where similarities end. ‘ATM network’ and ‘Convenient branches’ are tied for second place. How can it be that consumers under 40 care more about physical locations than their parents?

There are two possible reasons. First, younger consumers are often less knowledgeable about finance, and want more hand-holding, both on-line and in person. Second, a $3 ATM fee is a big deal to someone just starting out in their career, so they search for an institution that either has a large ATM network, or doesn’t charge ATM fees.

The final criterion — and difference from the larger group — is that younger consumers prioritize perceived “Ease of resolving problems” above deposit rates. Makes sense. Typically, their balance is lower, so a few basis points aren’t going to make a difference. But younger consumers have no patience waiting an hour on the phone, or having to reach out several times to get a problem resolved.

Why Branches Edge Mobile in the Digital Age

So, what isn’t in the Top Four criteria? Two real surprises: “Online/mobile banking” and “Service.” You could argue that “Ease of resolving problems” is a type of service, but the survey found that the broader definition of “high quality personal service” was not an important driver of selection, but was a critical driver of satisfaction, once you have become a customer. This also makes sense. It’s pretty hard to determine if a new bank or credit union’s service is good until you become a customer and experience it. There are exceptions, of course, like if a friend or colleague raves about a bank’s service, or an institution receives some kind of service accolade.

How do we square the fact that “Mobile App” is dead last for both groups? While there is the possibility that consumers were confused by the term, we think in fact it’s that consumers see more differences between banks’ ATM and branch networks than between their mobile applications. Put another way, while any mobile app may more or less meet their needs as long as the bank has one, the ATM or branch network could range from ideal to nonexistent in their area.

Read More:

- Surprising Reasons Why Consumers Would Switch Banking Providers

- How to Grow Deposits in a Weird Rate Environment

- Massive Forces Impacting the Future of Bank & Credit Union Branches

- Digital Banks Forcing Financial Marketers to Revise Checking Strategies

4 Key Takeaways for Financial Marketers

We believe the survey data contain some important lessons for bank and credit union marketing teams:

1. Don’t Give Up on Branches. While some banks have performed the swan song for their branch networks, this study suggests the funeral is premature.

2. Consumers hate fees, especially for ATMs. Consumers of all ages and incomes choose their new institution based on the level and fairness of fees. For instance, ATM fees are irritating to many consumers because it doesn’t seem fair to pay money to access their own money. Spending time understanding what consumers are willing — and not willing — to pay to receive value can go the extra mile to winning more than your fair share of the checking market.

3. Don’t oversell deposit rate. The truth is, bankers think about rates a lot more than most consumers do. Pay a fair rate, and put some of the savings toward reducing fees.

4. Make it easy to solve problems. Consumers are harried today, running from family to work to errands and trying to fit in some fitness or relaxation as well. Take a hard look at your policies, procedures and processes to make it fast and easy to resolve problems. Give your customers the “gift of time” and they will return the favor by staying with you and telling their friends.