Net Promoter Score, though popular, is a fatally flawed metric, and banks and credit unions that use it are lying to themselves. The same is true for most employee engagement assessments. The bar set in both methodologies is simply too low — nowhere near where customers and employees demand it to be. As a result, financial institutions don’t have nearly as many “promoters” or engaged employees as they think they do.

Reality Check: NPS makes institutions think they’re winning with customers and employees when they’re actually losing.

A Crash Course in NPS and eNPS Concepts

Net Promoter Score was introduced in 2003 as “The One Number You Need to Grow.” Just one question could cut through the noise, determine customers’ perceptions and predict business growth. By simply asking, “On a scale of 0 to 10, how likely is it that you would recommend our company/product/service to a friend or colleague?” companies could easily segment their customer base into Promoters, Passives and Detractors.

“NPS seemed like a silver bullet. … Leaders were incentivized, promoted and fired based on results.”

“Promoters” represent those customers who give a 9 or 10 rating. They say they’ll refer friends and family and fuel business growth, and they are the holy grail for NPS practitioners. “Passives” are those consumers who give a 7 or 8 rating. They’’re deemed satisfied with the brand — but they are essentially indifferent and therefore vulnerable to competitors’ offers. “Detractors’ are those customers who give a 0 to 6 rating. These customers are in the danger zone. Not only are they at elevated risk of leaving — they will likely damage your brand.

Subtracting the percentage of Detractors from Promoters yields the Net Promoter Score, which can range from -100 (if all customers are Detractors) to 100 (if all customers are Promoters).

The great promise of this concept was that a simple metric could demystify customer behavior and foretell organic growth. NPS seemed like a silver bullet. Companies, including financial institutions, began tracking it in droves. They changed their business models, management systems and customer delivery practices to drive up the score. Many companies even began reporting their NPS results and trends on quarterly earnings calls. Leaders were incentivized, promoted and fired based on results.

The NPS boom also spread to employee measurement through eNPS — Employee Net Promoter Score — said to determine how likely employees are to recommend their company as a place to work.

One simple metric … but one big lie.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

It’s Time to Get Real About Promoters

The fatal flaw of NPS is very simple: 9 doesn’t equal 10.

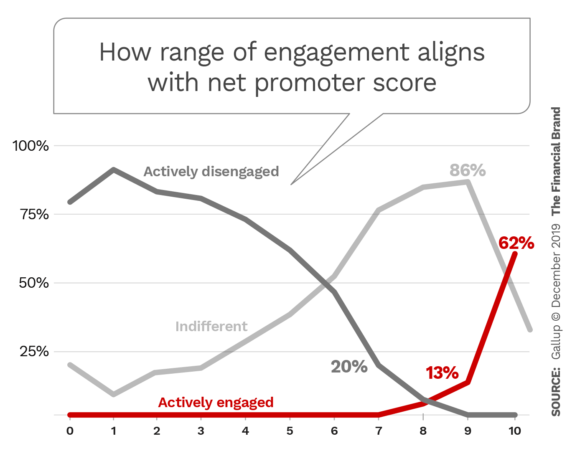

The reality is that almost 90% of consumers who rate their bank a 9 on NPS are indifferent to their financial institution. This has massive implications for share of wallet, referrals and retention.

Gallup has found that in order to impact business outcomes, the bar must be set higher — because consumers demand it.

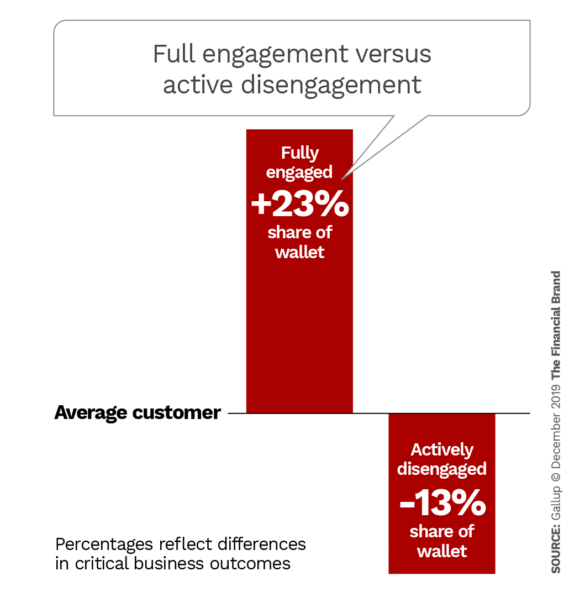

Gallup’s Customer Engagement metric classifies people as Fully Engaged, Indifferent or Actively Disengaged — and the bar is higher than set for NPS. Customer engagement captures the psychological and emotional connection to the brand and thus better predicts behavior. Gallup Analytics show that Fully Engaged customers deliver a 23% premium in terms of share of wallet, profitability, revenue and relationship growth over the average Indifferent customer. In stark contrast, Actively Disengaged customers represent a 13% discount on the same measures.

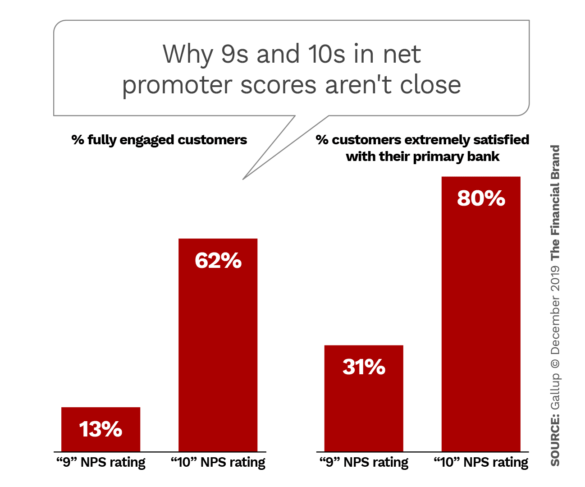

In a Gallup retail banking industry study — covering over 24,000 respondents across 2,734 institutions — we gauged NPS and a number of other metrics, including overall satisfaction with customers’ primary bank and Gallup’s Customer Engagement metric. We compared customers who gave NPS scores of 9 to those who gave scores of 10 and found differences that bank and credit union leaders need to know:

• Those who issue a 10 score on the NPS “recommend” item are nearly five times more likely to be Fully Engaged with their primary bank than those who score a 9: 62% of customers who score a 10 on NPS are Fully Engaged compared with only 13% of customers who score a 9.

• Those who score a 10 are also over 2.5 times more likely to be extremely satisfied with their primary bank: Only 31% of customers who score a 9 on NPS are extremely satisfied with their primary bank, compared with 80% of customers who score a 10 — a 49-point difference.

• In addition to inflating the percentage of Promoters, NPS also underrepresents Detractors —20% of customers who score a 7 are Actively Disengaged with their primary bank.

The net difference between traditional NPS and how it should be calculated is substantial. In Gallup’s banking study, traditional NPS is 11 (42% Promoters and 31% Detractors). This score isn’t that strong to begin with. However, when we significantly raise the bar and move those who scored 9 to Passives and those who scored 7 to Detractors, the new NPS is far worse, at -14 (29% Promoters and 43% Detractors).

The Wakeup Call: That’s a 25-point swing. Any company that mistakes 25% of its customers’ sentiment is at grave risk.

Imagine Bank A has 100,000 customers and they all score a 9 on NPS. Bank B has 100,000 customers who all score 10 on NPS. The two banks effectively have the same Net Promoter Score, so NPS posits that their results should be similar.

But that couldn’t be further from the truth. In actuality, Bank B would have 49,000 more Fully Engaged customers, who are generating a 23% premium. If that premium is worth just $500 a year per person, Bank B would generate an additional $24.5 million a year.

Gallup research finds a similar misconception regarding employee satisfaction measurement — whether via eNPS or five-point employee engagement surveys — exists to equally damaging effect. When Gallup studied hundreds of organizations, we found that gains in the percentage of people rating a 5 (on a five-point scale) resulted in nearly double the improvement in business outcomes compared with the same improvement in people rating a 4.

9 is not 10, and 4 is not 5. It feels good to combine 9s with 10s, or 4s with 5s, but it won’t get financial institutions what they want: customer loyalty, employee engagement, profit and growth.

Read More:

- Consumers Demanding Improved Digital Banking Customer Engagement

- Financial Services Entering New Era of Customer Engagement

- Data and AI Power the Future of Customer Engagement in Financial Services

- Digitizing Banking is All About Engagement and CX, Not ‘Tech’

Financial Marketers Must Get Brutally Honest with Themselves

Plainly, a score of 9 from consumers or 4 from employees is just a polite “no.”

If you treat such scores as a “yes,” you’re staking your organization’s future on a false premise. Financial services leaders have to do the tougher, but smarter, thing and practice brutal honesty in their metrics. Financial institutions will never create exceptional engagement — and superior results — unless leaders are willing to hold themselves accountable to the extremely high standards employees and customers have already set for them.

Gallup Analytics has found the greatest lever of organic revenue growth is engaged consumers. The greatest driver of engaged customers is engaged employees. And the most important factor in engaging employees is the manager. Managers are responsible for over 70% of the variance in engagement among teams. Nothing improves until managers do.

Leadership must be brutally honest about the state of the organization’s managers and leaders, starting with who gets to sit in those seats. Gallup Analytics finds that over 60% of people hired or promoted into these roles have very little innate leadership talent. Most “earned” the role through tenure or success in an individual contributor role — neither of which have anything to do with leadership strength. Financial institutions must utilize predictive and validated talent analytics to scientifically identify, hire and promote top talent into these roles.

Next, banks and credit unions must address their broken performance management systems, including faulty metrics like NPS and eNPS, as well as developmental approaches that perpetuate ineffective coaching.

For instance, Gallup Analytics finds that only 50% of employees clearly know what is expected of them at work, and only 26% of employees strongly agree that the feedback they receive helps them perform better. This means that three in four employees essentially operate on their own.

The greatest workplace shift is that employees want coaches, not bosses. They expect development and a purpose in their work. They want their strengths acknowledged and improved. If you don’t do this for them, they will leave — Gallup also finds 91% of employees who changed jobs left their company to do so.

Read More:

- Digital Redefines Customer Engagement Playbook for Financial Institutions

- 4 Indisputable Steps To Optimize Customer Engagement in Banking

- How Financial Marketers Can Lift Engagement with Experiential Content

- Banks Losing Customers Who Want Seamless Digital Experiences

Finding Your Institution’s Best Path to Growth

It is clear what bank and credit union leaders need to do to truly engage customers and employees and thereby accelerate organic growth:

- Fix your employee and customer measurement instrumentation. Stop lying to yourself and raise the bar to where employees and customers have already set it.

- Use predictive talent analytics for hiring and promoting. Stop hiring managers and leaders without any talent to lead others.

- Focus all your developmental efforts on evolving your culture from “boss” to “coach.” Stop wasting time, effort and money with ineffective coaching.

- Revamp your performance management system to ensure it drives business outcomes. Stop chasing (faulty) scores.

Profit derives from engagement, not promotion.

Financial institution leaders would do well to get a clear understanding of customers’ and employees’ psychological and emotional connections to the brand, select managers for innate talent and develop them, and create a culture of engagement and coaching. It takes far more time and effort than obtaining a good NPS.

Jennifer Robison and Julie Griffiths contributed to this article.