A straight smile without ever visiting an orthodontist? Sounds like financial services without ever visiting a branch, doesn’t it? Yet in both cases, in-person interaction has been and will continue to be critical to building much needed advisory trust.

Every retail banking executive and marketer should be a student of the SmileDirectClub story. It carries revealing insights relating to customer experience, engagement, and service delivery.

Until a short while ago, orthodontics required repeated, in-person visits over the course of 18 months or more. Anyone familiar with traditional metal braces would probably concede that while the outcome may be satisfying, virtually everything else about the experience is terrible. Moreover, because care delivery has been labor-intensive, braces typically cost an arm and a leg — excluding millions of people who could not justify the cost of a new smile. Like financial services, there is a sizable market of underserved adults who would otherwise benefit from orthodontia.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

CX Game Changer For The Smile Business

The first disruption of this very hands-on business came in 2000 when Align Technologies introduced Invisalign — clear, nearly invisible aligners. Rather than periodically adjusting metal braces, patients receive a series of new aligners each sized differently. The product has been highly successful, but its patent has now expired. Enter SmileDirectClub.

Fitting clear aligners requires a 3D model of each patient’s smile, traditionally done in-person. SmileDirectClub changed all that in 2015 by creating a remote process utilizing what it calls a direct-to-consumer impression kit. The firm creates a 3D-printed model remotely from the mailed-in impressions and renders digital image results to the customer via an online patient portal.

Most patients can immediately see what their smile will look like during and after treatment on the secure patient portal. This alone is a customer experience (CX) game-changer. I put four children through braces and never once was shown the outcome in advance!

In a short while, customers receive a SmileKit by mail, which includes all the required clear aligners and instructions. Throughout the treatment, which takes an average of five to six months, patients capture selfies and post them to their patient portal for SmileDirectClub’s digital network of dentists and orthodontists to review.

Read More: Top Branch Trends For Banks And Credit Unions

Why Add Brick And Mortar When Digital Was a Success?

SmileDirectClub has already served a half million customers. After three years of operating a fully digital business model it opened its first store in 2017. Since then it has opened 245 additional stores. These stores play no role in service delivery beyond capturing a 3D image of each candidate’s smile as an alternative to the direct-to-consumer impressions kit.

SmileDirectClub’s flagship store in California. Most of its 246 locations are small and not intended to be “billboards.”

Why in the world did a successful digital start-up invest in brick and mortar? For the same reason most banks will choose to continue to operate retail branches. In a word: trust. Advisory trust to be specific.

Even with SmileDirectClub’s big cost savings, orthodontics is still both expensive and deeply personal — it’s rarely an impulse purchase. Neither is a mortgage. Regardless of the business model chosen, providers of orthodontia and financial services both need high levels of advisory trust to be successful.

Physical stores accomplish two things for SmileDirectClub:

1. Create core credibility for the brand. Trained dental assistants called SmileGuides help calm nerves and address potential objections. In short, stores help develop a personal connection to the brand. Advisory trust builds quickly.

2. Function as a learning lab. Prior to opening physical locations, SmileDirectClub had little direct customer engagement. Now, its SmileGuides develop customer empathy and insight the firm uses to perfect its brand positioning, sales approach, and in-store choreography.

Read More: The Branch Puzzle: Why Are There Still Bank Branches?

Trust Builds Engagement For Financial Providers

A minority of banks seem to get the importance of advisory trust. I see banks falling over themselves to invest in the digital channels while neglecting the in-person CX. Make no mistake, digital investment is an imperative, but most digital banking platforms are purely transactional. They merely provide convenient, low friction transactional capability. Such things are table stakes.

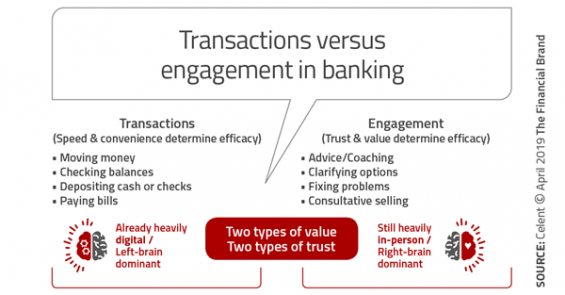

Wise banks know the difference between transactions and engagement and invest in the latter while not neglecting the former. Speed and convenience determine transaction efficacy. Engagement is different. Convenience plays a role in engagement efficacy but is secondary to advisory trust, which is most effectively built through a personal connection.

Celent consumer research examined the trust issue in retail banking. Our surveys indicated that while the significant majority (86%) of US adults trusted that their money was safe at their bank, considerably fewer consumers felt their bank had their back. Just 44% of those same adults felt their bank knows them, and 39% would go to their bank for financial advice if they were facing a major life crisis.

Said simply, banks have done a good job safeguarding money and facilitating transactions but have failed to convince most customers they can improve their financial lives. There is a big trust gap in retail banking. Advisory trust is demonstrably lacking.

Read More: New Study Shatters Myth That Digital Channels Are Killing Branches

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

How a Physical Presence Enhances Credibility

As in any human relationship, trust is built or lost through our experience of each other. Closing the trust gap in retail banking therefore involves a paradigm shift in how many banks view customer experience.

Embracing this new paradigm will necessitate a culture change in many banks to demonstrate they are acting in their customer’s best interest — precisely what SmileDirectClub is doing. This needs to happen in both the digital and in-person realms because most banks serve broad markets with sizable segments that value in-person interactions. For many people, including many in younger generations, trust can be built much more rapidly through in-person engagement.

What did SmileDirectClub’s investment in physical stores produce? Most new customers are now captured in SmileShops, and customers with SmileShop experience report higher levels of satisfaction. Said another way, SmileDirectClub massively accelerated its revenue growth through strategic investment in omnichannel retail delivery, skillfully orchestrating a physical-plus-digital customer experience. Much of SmileDirectClub’s recent revenue growth is directly tied to its expanded physical presence.

What Bank Marketers Can Learn from SmileDirectClub

“The physical versus digital debate is a distraction. Banks and credit unions must deliver an excellent CX across all points of customer interaction.”

Above all, the SmileDirectClub story demonstrates what Celent has been advocating all along. That is, the physical versus digital debate is a distraction. Banks and credit unions must deliver an excellent CX across all points of customer interaction.

Here are three recommendations that follow from my own SmileDirectClub experience:

1. Be proactive. Banks and credit unions are reasonably good at being reactive but not very good at being proactive. SmileDirectClub’s advertising invites a call to action, either ordering an in-home impression kit or visiting a SmileShop. Within moments of my registering interest to one of its digital ads, I received an email offering me a free teeth whitening kit if I visited a nearby store in the next week. This provided both an incentive to act and a sense of urgency to do so. This incentive prompted me to schedule an appointment.

Reminders flowed periodically, including a short video preview of the in-store experience, and precise directions to the nearby store complete with a street view of the property. Most of the foot traffic in SmileShops are booked appointments, not walk-ins — just the opposite of retail banking in the US.

2. Be personal. In his popular book, H2H, Bryan Kramer reminds us that business is personal. All else being equal, most of us tend to do business with people we like, and we like people with whom we’ve made a personal connection. At SmileDirectClub, most customers remember the name of their SmileGuide. Mine was Brianna. A percentage of customers buy on the spot. Most do not. Rest assured, SmileShop visitors meet with diligent and highly personal follow-up. Can that be said of your banking experience?

3. Be digital. Before, during, and following my SmileShop experience, every interaction was digital. My CX was seamless and efficient, yet personal — and highly measurable and cost-effective for SmileDirectClub. Most banks aren’t even close.