The title of this post is also the title of a recent study published by the Board of Governors of the Federal Reserve System (often referred to as the “Fed”).

It took five researchers to come up with the following:

“The persistence of the large number of local bank branches across the country may be due to the fact that both depositors and small businesses continue to value local bank branches.”

Brilliant.

The report itself is an overblown contortion of statistical methods and techniques, including regression analyses, percentile computations, marginal effect calculations, and correlation estimations — that fundamentally found that:

1. Online banking users are less likely to visit branches. Using data from its Survey of Consumer Finances (SCF), the Fed discovered that 70% of US households currently use online banking. The Fed concluded “the persistence of bank branches does not appear to be simply explained by a low online banking take-up rate. In comparison, only 4% of households reported using online banking in 1995, suggesting that improvements in information technology have increased the availability and usage of online banking services.” But comparing the rate of online banking adoption (i.e., demand) in 2018 to 1995 is nonsense, as the number of banks offering online banking (i.e., supply) in 1995 is nowhere near what it is today.

2. Older, wealthier, and self-employed consumers use bank branches more than other consumers. The Fed ran a regression analysis to figure that out. Which is odd, since a regression analysis is supposed to find inter-dependencies between independent variables like “age” and “wealth” which are highly correlated. The Fed also calculated the “marginal effect” of the independent variables on branch usage. However, there’s an erroneous implicit assumption here, namely, that “as one gets older” or ” as one increases wealth” one will use bank branches more. That’s not true. The data is a snapshot in time, not a view of the same individual’s behavior over time.

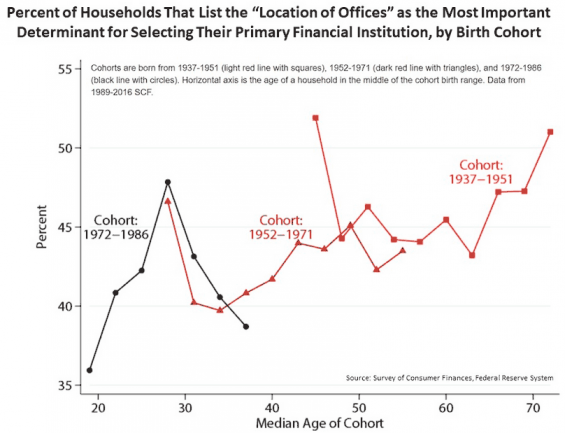

3. The subjective value of branches increases with age. The SCF asked respondents for the most important reason for choosing the financial institution for their main checking account. According to the study, older households are much more likely to value brick and mortar locations, with an upward trend in the reported value of location of offices starting at around age 31. I have no clue what the Fed chart means (see below). But here’s the thing to keep in mind: For every median age data point in the chart except for two (48 and 71), less than half of respondents cited “branch location” as the most important factor influencing their choice of bank. My own research shows that there are three segments of bank shopping consumers — those driven not by branch locations, but by value, features, and fees.

Regarding the “location of offices” as a influence on bank choice, the Fed makes the explicit assumption that “when currently young depositors transition into old age they will have a stronger preference for visiting their local branch, meaning that branches may remain important in the future.” But the Fed confused effects here. The question they based that conclusion on was “location of branches” as a determinant of selecting a bank, not a “preference for visiting” a branch.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Why Are There Still Bank Branches?

The question posed by the Fed study is, ultimately, left unanswered. The data the SCF provides shows branch usage and the contribution of branch locations to selecting a branch. But it doesn’t really answer the question.

Here’s a partial list of the reasons why bank branches still exist:

- Habit. After 30 or 40 years of going to branches, some people aren’t going to change their behavior.

- Comfort. Some people aren’t comfortable using technology for banking purposes.

- Utility. People can’t get everything done in non-branch channels.

- Perception. Some people (namely bank executives) think bank branches still drive retail-related business. I’d like to call this reason “delusion” but I won’t.

- Reality. Closing branches isn’t as easy as it seems. There are leases to deal with, regulatory implications… you know, “reality.”

I’m sure you can come up with other reasons.

The Better Question: Why Did We Build Bank Branches in the First Place?

To better understand why we still have branches, it would be helpful to remember why we have bank branches in the first place. It isn’t because of consumer preferences. When there were no branches, people simply could not have imagined a world with a bank branch on every corner.

The reason bank branches were built is simple: to house bank employees.

Someone, somewhere, at some time came up with a brilliant conclusion: It was more convenient for consumers for banks to decentralize employees into smaller physical locations than asking consumers to travel to a centralized location to do their banking.

This became especially true with the explosion of the suburbs in the 1950s and 1960s. I live 20 miles north of Boston. I can’t even fathom the inconvenience of having to go to downtown Boston to cash or deposit a check.

In other words, we have bank branches, because we had no alternative. The technology in place between 1940 and 1970 (even 1980) wasn’t there. So banks built bank branches in able to better facilitate the interaction between customers and employees.

But today’s technologies enable that interaction without requiring the two parties to be in the same physical location.

There’s no puzzle why there are still bank branches today. The only puzzle is why banks are still investing so much money in them.