Consumers say the overall digital experience their bank or credit union serves up is lacking. According to research by NTT DATA Services, consumers think banking providers struggle with anything beyond simple functional tasks like checking your account balances or looking up your transaction history. In the report, the study’s participants said their biggest beefs with their financial institution’s digital experience include:

- Not being able to accomplish what they want to

- Seeing options that aren’t relevant

- Wasting time with tasks that take too long

- Having to enter the same information over and over

- Having too many options that makes completing the task difficult

NTT DATA says one segment of consumers want simple and reliable Alexa-like interactions for routine interactions (e.g., making a balance inquiry, or checking on the status of a service inquiry). But that’s only half the story. There is another segment of consumers, however, who expect more than they are currently getting. In the study, researchers identified consumers’ top three hot buttons with respect to the digital experience they expected their financial institution to deliver:

- Easy to understand (68%)

- Minimal effort to use it (62%)

- Speed to complete transactions (49%)

“Banks and credit unions are handling the easy digital tasks well — checking balances, paying bills, monitoring savings and opening credit cards,” says Lisa Woodley, VP/Customer Experience at NTT DATA. But, she warns, if banks and credit unions want to satisfy consumers’ thirst for curated experiences that feel more personalized, they had better change their approach to data analytics.

When it comes to managing data, NTT DATA says banks and credit unions are halfway there. They may be doing a decent job using data to handle easy digital tasks, analyzing and using data within siloed business units. But most retail financial institutions fail at making data available throughout the enterprise in ways that will improve the organization’s digital customer experience. And consumers — especially younger ones — aren’t particularly thrilled about it.

“Tech-savvy consumers are demanding personalized customer service and guidance from intelligent machines,” adds Woodley.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Digital CX in Banking: Perception vs. Reality

If you ask banks and credit unions how they are doing in digital CX, they give themselves a passing grade. However, there’s a clear disconnect between how financial institutions think they are doing and how consumers think they are doing.

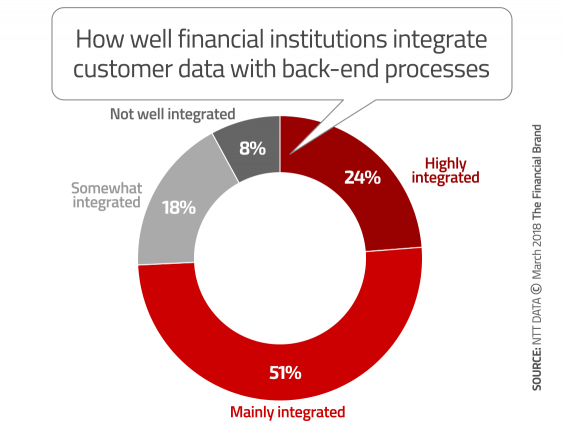

In NTT DATA’s study, only 16% of consumers said they are satisfied with their primary financial institution’s digital experience, yet 76% of banks and credit unions say their digital CX strategy is rock solid, and almost equal number give themselves kudos for integrating front-end customer data with the back-end processes driving the experience.

The reality is that data is still trapped inside silos within various business units and operational functions. Within each of these silos, things may seem fine; the folks who have access to data pertaining to their particular business unit could be using this data well. The problem is data sharing and integrated analytics across business units. In other words, the checking account folks are doing a bang-up job cross selling debit cards and other checking-related services like eStatements, but they aren’t sharing that data with the mortgage folks or the wealth management folks. Less than one quarter of banks and credit unions describe their approach to data analytics as “highly integrated.”

“Banks are putting their data in their mattress,” says Michael Goodman, Senior Director of Data and Analytics at NTT DATA.

Reality Check: Without data integration, your digital CX will suffer.

“No matter how much is invested in mobile applications, websites or social media, if all customer interaction data isn’t integrated enterprise-wide, financial institutions won’t deliver the personalization and financial guidance consumers are looking for, which is necessary simply to remain competitive,” says NTT DATA.

CX Is Sexy, But The Underlying Data Isn’t Very Seductive

What’s ironic is that banks and credit unions seem to appreciate the importance of digital CX, but they don’t yet know how to harness data. Two-thirds (67%) say that digital CX is critical to success, 56% say that it will be a differentiator, and 55% say digital CX is the most important part of the overall consumer experience.

Part of the problem is that data projects — those big, boring data architecture assessments and infrastructure projects — are not nearly as fun and sexy as the projects that everyone wants to work on, like mobile apps. And data projects tend to be expensive, and who wants to fund a big, boring project? Yawn.

That may help explain why overall spending on digital CX isn’t increasing as much as it should, says NTT DATA. Banks and credit unions are spending just enough to offer basic, table-stakes digital CX. Only 21% plan to increase spending on digital CX initiatives by 10% or more.

But NTT DATA contends that such data projects are the very foundation for all digital transformation and CX projects to come. The argument is pretty straightforward: if you can’t integrate things like checking account data with wealth management data, you’ll never deliver the type of CX that consumers demand.

Another challenge is that there simply isn’t enough data-savvy talent to go around. More than half (59%) of banks and credit unions say they have a data talent shortage.

“Banks and credit unions need talent with business, engineering and computer science skills — a rare hybrid that’s increasingly difficult to find,” says NTT DATA.

Read More: Banking’s Digital Talent Crisis – Who Will Fill the Tech Void?

Cracking the Code on Data

Bankers acknowledge that data available across the enterprise is critical to attracting and retaining consumers. Consider that 52% of consumers say they want banks and credit unions to connect the dots between income, expenses and savings and make suggestions with proactive financial advice. If you see a big deposit from a tax refund, show consumers how much that money would grow in a retirement account or their savings if they used the cash to pay off an outstanding credit card bill.

NTT DATA says that any bank or credit union looking to build a data-driven digital CX strategy needs to being with these four steps:

1. Get more data and know what you’ll do with it. Yes, when it comes to data, more is better. First, assess what you have and what you think you want and then do an analysis of the value of the data. What will you do with the data you have and acquire, and what is the reward? To know what data you really need, determine the economic value of that data.

2. Improve the data. If no one has confidence in the data, the best analytics and AI are a waste. Do an analytics-based data quality remediation and then develop an ongoing process for data quality.

3. Hyper-segment your audience to personalize the experience. It’s no longer enough to segment consumers by broad categories. Consumers are used to Amazon giving purchase suggestions based on the last items they bought. Banks and credit unions will need to apply deeper segmentation into behaviors, circumstances and products already owned and provide personalized offers and expert financial guidance.

4. Break down data silos. Sharing data across the enterprise is the only way to improve digital CX. Consider getting data out of legacy data warehouses and putting it in the cloud so everyone can access it. Stress to territorial data owners that the value of their data only increases the more people can use it.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Two Distinct Segments: ‘Explorers’ vs. ‘Settlers’

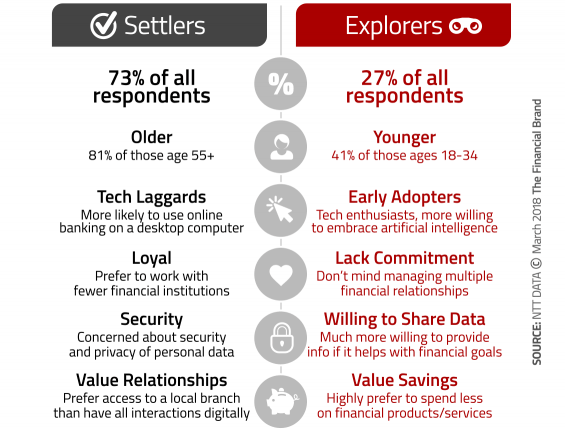

Not every consumer wants the same type of digital experience. Some want simple and fast, and are happy to let their digital transactions take a backseat to in-person interactions. Perhaps the banking industry’s current data strategies are adequate for this group of consumers. But there’s another group of consumers who expect more from their digital interactions. NTT DATA labels these two diverse groups “Settlers” and “Explorers.”

The differences between the two groups is dramatic. Both use mobile, although Explorers use mobile much more frequently. But 73% of Explorers say that their financial institution’s digital CX needs to improve, and an astonishing 86% say they would leave their current bank or credit union for a better digital experience. In stark contrast, only 18% of Settlers feel their banking provider’s digital CX is inadequate, and not a single one (0%) said they would switch to find a better digital experience.

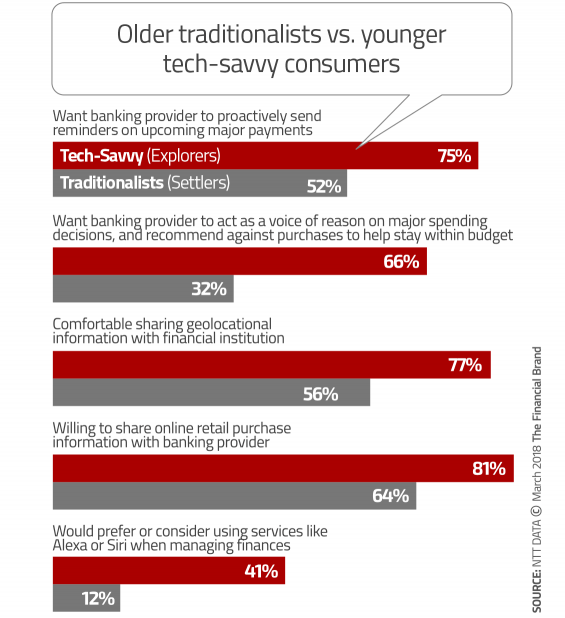

Explorers embrace AI and would love a Siri or Alexa experience with their bank or credit union. They aren’t as concerned about privacy (although they are still security aware) and in fact would trade personal data for a better experience. Explorers are practically begging for financial institutions to guide them in financial decision-making, even sending a “don’t buy that” text if a big-ticket item is going to throw their budget or their savings plan out of whack.

While only 27% of a respondents identified as Explorers, they are the future in the financial industry. Explorers make up 41% of consumers aged 18 to 34 years old — a critical demographic for banking providers’ long-term competitiveness.

Banks and credit unions that don’t invest in digital CX — and the underlying data infrastructure/systems required to fuel such a strategy — could see a mass exodus. Remember: the vast majority of Explorers say they will drop your financial institution if/when they find a better digital CX at a competitor. And when it comes time to open a new account, Settlers may very well look elsewhere, too.