There is a lot of discussion in the banking industry regarding the potential and possible impact of Amazon’s entrance into banking. To recap some of the prevailing perspectives:

“Amazon is under pressure to keep increasing revenue, and financial services is a large pool they can go after.”

— Asheet Mehta, McKinsey

“Amazon may acquire a small or mid-size bank in 2018 to test the regulatory waters and gain a footing in the industry. This may either be a tactical move or a broad strategic jump into banking, as Amazon seeks more stickiness with consumers and small businesses in consumer lending such as auto loans, credit cards and home mortgages.”

— Ken Leon, CFRA

“By no means will the Bank of Amazon or Bank of Google be taking direct deposits to finance the apartment complex next door anytime soon. While Amazon [brings] capital to an underserved market, their business strategies are still a far cry from an existing industry being crushed by a tech giant.”

— Eric Byunn, Centana

What Do Consumers Think?

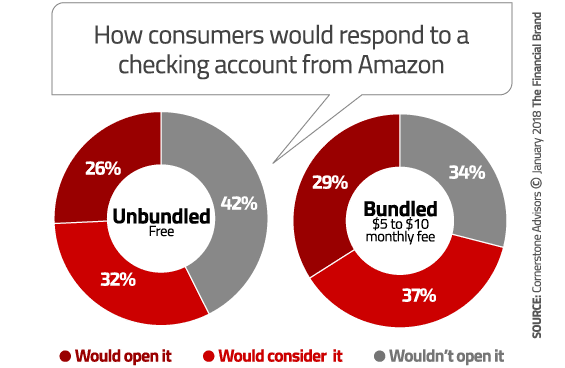

Cornerstone Advisors conducted a survey of 2,015 U.S. consumers between the ages of 21 and 72 who own a smartphone and have a bank account, and asked respondents what they would do if Amazon did two things: 1) Offered a free checking account, and 2) Offered a checking account bundled with other services like cell phone damage protection, ID theft protection, and roadside assistance, for a fee of $5 to $10 a month.

For each account option, survey participants were given six responses to choose from, but for ease of analysis, I’ve aggregated the answers into three: Would open it, would consider it, and wouldn’t open it.

Overall, about a quarter of consumers would open the free account and a third would consider opening it. What’s interesting, though — and perhaps surprising — is that a slightly larger percentage of consumers would open or consider the bundled, not-free account.

The overall results belie the generational differences. I can’t imagine that it would surprise you to find out that younger consumers are more interested than older consumers in either type of account from Amazon. But I split Millennials into two sub-segments — Young Millennials in their 20s, and Old Millennials in their 30s — and found that more 30-somethings express interest in an Amazon checking account than the 20-somethings.

| Young Millennial (1988-1996) |

Old Millennial (1980-1987) |

Generation X (1964-1979) |

Baby Boomer (1945-1963) |

|

|---|---|---|---|---|

| Unbundled (Free) | ||||

| Would open it | 27% | 43% | 24% | 11% |

| Would consider it | 38% | 33% | 32% | 29% |

| Wouldn’t open it | 35% | 24% | 44% | 60% |

| Bundled ($5 to $10 Monthly Fee) | ||||

| Would open it | 37% | 46% | 26% | 12% |

| Would consider it | 39% | 34% | 38% | 38% |

| Wouldn’t open it | 25% | 19% | 36% | 50% |

Source: Cornerstone Advisors survey of 2,015 US consumers, Q3 2017

Nearly half of older Millennials, and more than a third of younger Millennials would open a bundled checking account from Amazon and pay a monthly fee to do so.

Even though the percentages of Gen Xers and Boomers who are interested in an Amazon is much lower than among Millennials, what’s noteworthy is that for both of those generational segments, there’s virtually no difference in interest between the free account the fee-based account.

Read More: Amazon Bank: Will Banking’s Worst Nightmare Come True in 2018?

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The Impact on Banks and Credit Unions

In one respect, the potential emergence of Amazon into banking won’t impact all financial institutions equally. Because of the underlying age differences in the customer/member bases of different types of FIs, an Amazon checking account would disproportionately impact megabanks.

| Megabank | Large Regional Bank |

Community Bank |

Credit Union |

|

|---|---|---|---|---|

| Unbundled (Free) | ||||

| Would open it | 35% | 22% | 12% | 15% |

| Would consider it | 34% | 32% | 33% | 30% |

| Wouldn’t open it | 31% | 46% | 55% | 55% |

| Bundled ($5 to $10 Monthly Fee) | ||||

| Would open it | 40% | 25% | 12% | 14% |

| Would consider it | 37% | 35% | 39% | 41% |

| Wouldn’t open it | 23% | 39% | 49% | 45% |

Source: Cornerstone Advisors survey of 2,015 US consumers, Q3 2017

Among consumers who consider one of the megabanks their primary financial institution, 40% would open a bundled, fee-based checking account from Amazon. That percentage drops to less than 15% among consumers who call a community bank or credit union their primary FI.

So only the megabanks have to worry about Amazon? Hardly. The smaller financial institutions are already challenged in attracting younger consumers to their institutions. An Amazon entrance into banking will only make it harder for them.

Bottom Line: The real lesson from this data isn’t simply consumers’ interest in getting a bank account from a non-bank. It’s their willingness to pay a fee for a checking account when there are value-added services bundled with the account.

Remember the scene in Monty Python and the Holy Grail when the Dead Collector is walking through the town, yelling “bring out yer dead!”? It’s time to throw free checking on the cart. Oh sure, free checking will say “I’m not dead yet.” Maybe not… but it’ll be stone dead soon.

For more insights into this research, download the white paper Reinventing Checking Accounts here.