Coined by Philip Kotler in 1967, the “Four Ps” breaks marketing down by Product, Price, Promotion and Place. Banks have based their approach to marketing on this model for decades.

It takes the form of a straightforward ‘product push’ marketing process:

• Produce the Product

• Decide on the Price

• Determine your target market and create the Promotional campaign

• Deploy it through the chosen channels (the right Place).

Although this approach is a tried and tested, it typically only yields a sales conversion rate of one- to three percent. Why? There are two main problems with the 4 Ps:

1.) The fundamental model. The 4 Ps were set up with product companies in mind, but financial institutions are service organizations. Each “product” a bank sells will be used many times over (for example, a credit card can be used hundreds of times every year). Every time a customer uses an institution’s “product,” it gives the bank yet another opportunity to distinguish itself with its service — that’s hundreds of opportunities stemming from a single “sale.”

2.) The timing. The methods used to determine a target market are typically statistical analysis tools (e.g., SAS) which might tell you that 87.2% of the target group will buy a new car in the next three years. This data can be amazingly accurate… and at the same time absolutely useless. Financial institutions need to know who wants to buy a car today! The essence of marketing is timing. The traditional 4 Ps approach is a bit like stabbing in the dark and hoping to hit your target.

Financial institutions differ from most other retail-based organizations. The more that they focus their marketing effort on trying to sell products, the more they miss the mark — while also handing a big opportunity to their competitors. Financial institutions need to change their marketing strategy away from the 4 Ps product-based approach and move to a strategy that is more in line with the marketing realities and priorities of a service-based company.

This has been underscored by research suggesting that of all of the customers that leave a bank, over 80% switch because they are dissatisfied with the service, compared with less than 10% who are dissatisfied with one or more of the bank’s products.

Service-based marketing is about determining the customer’s needs and addressing them. Unfortunately, financial institutions have always tended to develop their marketing strategy around simply selling products.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

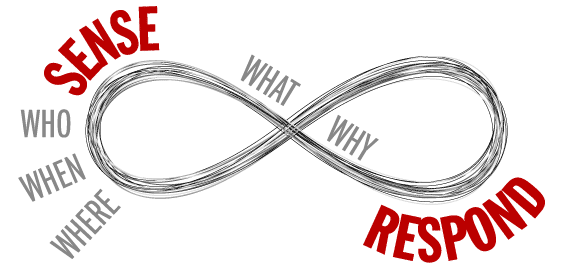

Sense and Respond Marketing

There’s another marketing model called “Sense and Respond.” The “Sense” element requires the answers to several questions before a reasonable “Response” can be formulated. These questions are: Who, What, Where, When and Why.

In sales situations, the Who, Where and When can usually be determined in the course of the interaction itself — e.g., a customer who is in the branch… now. At most financial institutions, this is as sophisticated as it gets. The sales and service protocol is simple and straightforward: “If Customer X is in Channel Y right now, what should we offer her?”

This system presents offers to consumers using either:

- a previously stored customer information to suggest the pre-calculated next best offer

- a crude rule, based on what the customer is doing (e.g. if they are looking for a mortgage, offer a mortgage!)

This is wrong!

If financial institutions don’t also correctly answer the questions ‘Why is the customer doing this?’ and ‘What is the need?’, they are simply swapping outbound product-push marketing for inbound product-push marketing. The difference is that with an outbound approach, consumers can set up filters or opt out of it. But with the more common inbound approach, consumers feel that they are being targeted whenever they contact the bank or credit union. That could even lead to them switching institutions.

Answering the Why and the What are the keys to highly effective marketing. If you know What a person wants and Why, the chance of being able to meet their need is immensely greater than playing the guessing game. Standard product-push, statistically-targeted marketing will generate average sales of 1% to 3%. Marketing when consumers’ needs are understood results in sales of 18% to 54%.

So why isn’t everyone doing it? The excuses include:

“My bank’s marketing is product-focused.”

“My bonus is based on product sales.”

“It’s what my supplier told me.”

“Isn’t this what everyone does?”

The Solution: Event-Driven Marketing

Financial institutions know the Who, What, Where and the Why but don’t really understand the When, which has resulted in consistently low response rates. However, with the advent of internet-based technologies and channels, it has become possible to identify the Who, When and Where in real time. You can now buy “real-time advisors” from most major CRM players. The problem is that none of them really get the “Sense and Respond” model, which means they can’t provide a proper analysis of the Why and What.

Depending upon which approach a financial institution has taken, they can either:

- know What to sell and Why, but not When

- or When to sell, but not What and Why

Financial institutions shouldn’t be forced to make a choice between these two unpalatable options. The complete customer-focused marketing approach is one that answers all five “Sense and Respond” questions: Who, What, When, Where and Why. These questions are all by Event-Driven Marketing (EDM). This involves determining the correct time to contact a person based on a significant change in their behavior (a ‘customer pull’ approach) instead of the typical direct marketing (product push) approach.

With EDM, commercial and communication activities are based upon relevant and identifiable changes in a customer’s individual needs. Events determine when a customer needs something — NOT when the financial institution wants to sell them something!

This clearly makes sense. If you want to sell a car to someone, you’re much more likely to have success if it’s at a time when they are actually looking for a car! With EDM, customers receive communications and service messages that are of interest to them at the right moment – and marketers avoid the ‘shotgun’ approach and cost that is typical of most targeted campaigns.

Financial institutions that have successfully deployed Event-Driven Marketing are reporting average sales of 12% to 54%, a churn reduction of 50%, and customer satisfaction scores that are 10-15% higher than competitors. That has also translated to conversion rates are roughly ten times higher than those achieved by antiquated marketing models like the 4 Ps.

Event-Driven Marketing addresses the limitations of Kotler’s 4 Ps, and determines the correct timing of any marketing activity — i.e., it identifies the Who, When and Where, but also focuses on answering the What and Why. It tells a bank or credit union who it should contact on any given day, and provides perfect opportunities for customer service.

Mark Holtom is the Managing Director of eventricity Ltd, a small UK based software house specialising in implementing Event Driven Marketing in financial institutions. Mark is also a guest lecturer on CRM at Oxford University.