While using cryptocurrency to make everyday purchases seemed like a far-fetched idea just a few years ago, it’s now a reality and several steps closer to becoming routine.

Crypto-backed debit and credit cards connect a cryptocurrency exchange to a modern payment processing platform that enables consumers to transact as they would with any other card.

Until recently, consumers could only spend crypto at a handful of niche cafes or extract cash at ATMs. Yet the tremendous growth in crypto wallets and interest in cryptocurrencies in general has led many to look to plastic to open new doors and support transactions, says Jim McCarthy, President of i2c, in an interview with The Financial Brand.

“Crypto wallet players realized it’s difficult to build a global acceptance network where people can exchange bitcoin for goods and services, especially given the volatility of the currency. They all started moving to Visa and Mastercard as what I call the onramp and offramp,” McCarthy states. That development and the strong prospect of a central bank digital currency in the U.S. has raised interest in crypto payments significantly.

“I don’t think there is a bank that isn’t paying attention to the space,” says McCarthy.

Crypto Payments Growth Trend

While the first crypto-backed card was issued in 2015 by Coinbase and Visa, adoption hadn’t picked up until recently. PayPal started offering crypto to customers in October 2020, followed by Venmo in April 2021. But surging growth in crypto assets combined with interest from big players is leading many to look to Visa and Mastercard as the rails to finally make crypto practical as a transactable currency rather than just a store of value, says Zach Aron, Deloitte Consulting’s Banking and Capital Markets Payments Leader.

i2c, which is a global partner for issuing and processing crypto-backed cards, analyzed transactional data from more than 4,000 traditional and crypto-backed card programs with five million cards in 40 counties. It found crypto-backed card growth is outpacing that of conventional cards, with dollar spending rising eight times between 2020 and 2021 to more than $7.5 billion.

While that growth is impressive, the overall value is still miniscule compared with the $3.96 trillion spent on credit cards in the U.S. and the $3.03 trillion spent on debit cards in the U.S. in 2019, according to data reported by Statista.

Dig Deeper: Will 2022 Be the Year Crypto, Stablecoins and ‘CBDCs’ Take Off?

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

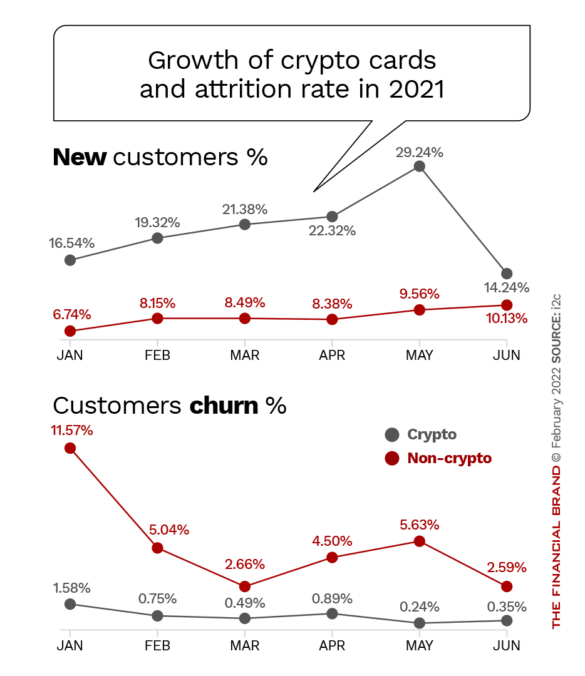

The charts below, from i2c’s research, shows that crypto-backed cards are growing at a much faster pace than traditional cards — even with some volatility — and exhibit less attrition as well.

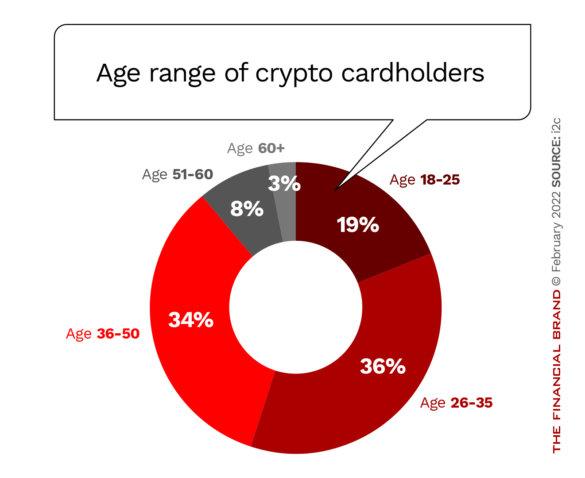

The analysis also revealed several other trends. One of the most notable was that crypto card adoption wasn’t just confined to younger users. Nearly half of the crypto-backed cardholders were over age 35, and 11% were in their 50s and 60s.

Crypto-backed card programs have a higher rate of cross-border transactions than traditional non-crypto programs, by a margin of 28% to 10%. A higher rate of card-not-present (CNP) transactions also indicates those with crypto cards more frequently purchase goods and services across borders.

“What we found is that people who have cards associated with these Bitcoin or crypto wallets are more trusting and more likely to buy over the internet across borders. It is almost acting as the international currency of the internet in some ways,” says McCarthy.

Big Players Eyeing Crypto-Backed Cards

Crypto-backed cards operate just like ordinary cards, except they are tied to a cryptocurrency, most commonly Bitcoin. Whereas crypto debit cards enable consumers to make purchases with the converted value of their holdings, crypto credit cards issue rewards in the form of crypto or offer consumers secured credit against the value of their crypto.

While these cards support crypto purchases in practice, they’re ultimately “regular card transactions” that convert crypto on the backend, explains Brent Johnson, Chief Information Security Officer of Bluefin, a payment and data security company.

“It’s doing the conversion for you, but it’s still just a regular Visa or Mastercard from the merchant’s point of view,” Johnson notes.

Two of the more popular crypto-backed cards on the market come from two cryptocurrency exchanges:

Coinbase’s debit card carries no annual fee, is compatible with up to nine different cryptocurrencies, and offers rewards in BTC and XLM. The card draws from the consumers’ Coinbase balance, enabling them to pay with a pin or withdraw from an ATM as they would with a regular card. While there are no card-specific fees, transactions include a cryptocurrency liquidation fee of 2.5% and a 2% international transaction fee.

The Crypto.com Visa debit card is one of the most flexible crypto cards, compatible with more than 90 different cryptocurrencies. It offers up to 8% cashback,10% back on Airbnb and Expedia and even 100% back on things like Amazon Prime, Netflix, and Spotify subscriptions. Cardholders with a higher monthly limit have no ATM fees and exclusive lower currency exchange rates. The catch is that it’s technically a prepaid card as cardholders first need to purchase Crypto.com’s CRO tokens. And to receive the top-tier benefits and cashback equivalents, cardholders need to have $400,000 in crypto.

Something's Changed:

Visa said customers made more than $2.5 billion in payments with crypto cards in fiscal Q1 of 2022, the equivalent of 70% of its crypto volume in all of 2021.

Commenting on surging use of crypto-backed cards, Visa CFO Vasant Prabhu told CNBC that “this signals consumers see utility in having a Visa card linked to an account at a crypto platform. There’s value in being able to access that liquidity, to fund purchases and manage expenses, and to do so instantly and seamlessly.”

Prabhu further said the company will “lean into the crypto space” with a strategy to be a key partner. Visa’s network of crypto wallet partners grew from 54 to more than 65, with the number of merchants accepting crypto now reaching 100 million.

Read More: 7 Major Payment Trends that Will Shake Up Banking in 2022

The Challenges of Fees and Volatility

Despite the growth and potential in the space, there remain challenges and complexities with crypto-backed cards, whether virtual or plastic.

First, cryptocurrencies are inherently volatile, with price fluctuations of up to 10% on a given day not uncommon. This may make consumers think twice about using crypto on everyday purchases, especially when a $5 coffee at Starbucks may trigger a loss or a capital gains tax. “I am not quite sure how it is going to be handled,” i2c’s McCarthy states. “If you are making everyday purchases with your crypto wallet, you eventually have to make sense of that from a capital gains point of view.”

Fly in the Ointment:

Crypto's notorious value fluctuations — often 10% daily — and tax rules on capital gains make small transactions problematic at present.

Fees are another thing to consider. While many of these debit cards don’t carry a fee, there are still fees related to liquidating the crypto and converting it to fiat currency.

Venmo and PayPal both announced in mid-February 2022 that they would soon charge customers a flat fee on crypto trades of up to $200. These fees include $.49 for trades up to $4.99, ranging up to $2.49 for transactions between $74 and $200. Trades over $200 will be charged a 1.8% fee, while transactions over $1,000 are subject to a fee of 1.5%.

McCarthy believes that over time competition will reduce or even eliminate these fees, much the way that happened with low-cost stock brokerage. Yet even as fees decline, they still make crypto-backed card transactions more expensive than traditional cards.

CBDCs: The ‘X’ Factor for Crypto Cards

Crypto-backed cards are likely to gain further adoption as governments and companies introduce central bank digital currencies (CBDCs) and stablecoins that eliminate the volatility risk, McCarthy predicts. He points to JPMorgan Chase’s introduction of the JPM Coin for B2B payments, as well as the fact that use of the China’s CBDC, the digital Yuan, outpaced expenditures on Visa cards at the Beijing Olympics.

“Stablecoins backed by central banks is where you will really see this take off,” says McCarthy, “and we’re not far away from that. It’s certainly on the way to becoming a mainstream way in which people buy, sell and hold these assets.”