At a time when consumers can order merchandise, apply for a mortgage and even buy a car online, many still cannot pay their rent digitally. By one estimate, more than 80% of tenants pay their rent by old-fashioned paper checks.

While several fintech companies offer digital payment solutions for landlords, no single solution has yet to check all the boxes for widespread adoption across the multifamily industry.

In what could be a game-changer for digital rent payments, Chase is using its scale and reputation to offer a new solution to tens of thousands of landlords and potentially revolutionize the rental space.

Payment Dinosaurs:

Nearly 80% of landlords still collect rent through non-digital payments like checks, money orders and cash.

“It’s a massive opportunity, and the renter market is growing,” Robert Le, Senior Analyst of Emerging Technology at PitchBook, told The Financial Brand. “A lot of fintechs are in the space, but Chase is going after it because there’s no market leader. I think they see an opportunity to build something bigger on the landlord side.”

Dig Deeper: Chase Reveals Its Strategy for Dominating Retail Banking

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Bringing Digital Payments to the Rental Space

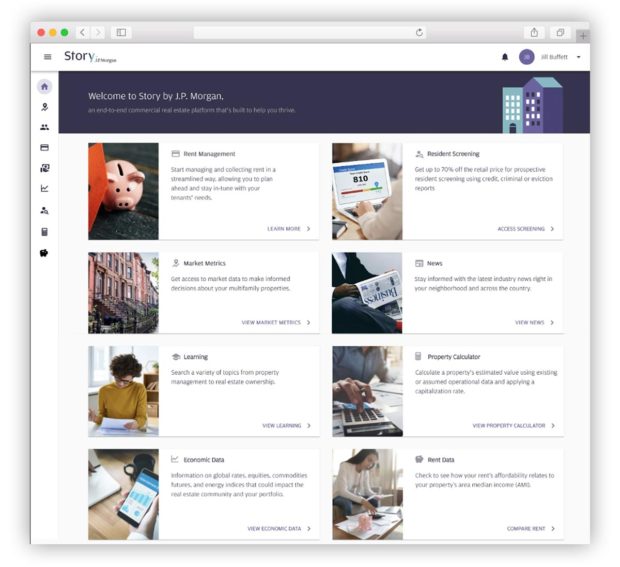

In October 2022, Chase released a beta version of “Story,” a digital real estate management platform for multifamily property owners. Aimed towards providing more value for its 33,000 multifamily clients with $95.2 billion in outstanding loans, Story offers an integrated suite of solutions to simplify and streamline portfolio management with access to a digital rent payment solution, along with data and market resources.

“We feel like we can offer a unique perspective in the development of a more integrated set of solutions for multifamily owners,” says Kurt Stuart, Managing Director of Commercial Team Lending in the Northeast, JPMorgan Chase, in an interview.

Potentially the greatest value of Story is that it supports digital payments between tenants and landlords. Chase believes there’s a big market for this. According to its analysis of data from HUD and other sources, more than 100 million Americans live in rental properties and pay rents totaling more than $500 billion annually.

Huge Market, Well Behind on the Technology Curve

Of the approximate 12 million rental property owners in the U.S., an estimated 10.6 million of them are privately held smaller businesses, according to Chase. Most of these owners and operators still use manual tools to run their businesses, with 78% still collecting rent through non-digital payments like checks, cash, and money orders.

Upgrade Needed:

Many independent landlords still use an assortment of disparate tools, such as Quicken and Excel, to manage their properties.

As more than half of payments in the mortgage market are digital, “the percentages of digital rent payments can evolve with the right tools,” Stuart maintains. Additionally, the Story platform will offer a range of digital tools for landlords to handle rent management, market analysis and renter screening.

“During periods of uncertainty, people want information. Within Story, we’re going to give them more information about their own portfolio, useful content and — through a partnership with Moody’s — more market insights,” says Stuart.

Chase believes multifamily housing is ripe for disruption because it remains one of the largest asset classes in the U.S. and is well behind the technology curve. Many of the solutions needed to run these businesses, including rent invoices, payments, banking, and accounting, are typically fragmented and difficult to use.

Story is currently in beta. Chase hopes to offer the platform for general availability in 2023, releasing continual updates and features.

No Clear Leader in a Crowded Market

While Chase is making a big splash in the market, several large multifamily companies offer their own payment solutions. Equity Residential, for example, which has more than 310 properties and 80,000 units across the country, has a platform to enable digital payments and invoicing. Houston-based Venterra Realty, managing 20,000 apartment units in 70 communities, also has a digital platform with an Autopay Discount of $20.

Many fintechs also operate in the space. Baselane is one, offering landlords banking, bookkeeping, rent collection and analytics in an all-in-one financial platform to save time and increase returns.

Bilt Rewards offers a program for renters to earn points on rent payments made with the Bilt Mastercard issued by Wells Fargo, with no transaction fees. Built recently raised $150 million in funding and now has a $1.5 billion valuation as it expanded its credit card offering for renters. Other players include Azibo, Moxo, and MYND.

Overall, Robert Le sees the market as really fragmented. “Outside of the large property managers, there are a lot of small landlords that have one or two buildings and aren’t using [any platform]. I think that’s the opportunity Chase is looking at,” the analyst states.

Read More:

- Community Banks Fatten Tech Budgets to Enhance CX

- The Shift to Cloud Technology in Banking Accelerates

- Four Essential Tech Trends Changing Banking in The Year Ahead

More Important Than Payment Transactions: the Data

Based on Chase’s announcement, Le believes the megabank will start on the landlord side and eventually expand solutions to the tenant side. Being one of the top banks in the country and one of the largest lenders for multifamily landlords, Chase may be perfectly positioned to capitalize on the market, he states.

“They’re probably seeing their landlords already bank at Chase, so it may be another added service to keep customers in the banking system,” says Le. “Chase has been doing this over the past five to ten years, building a bunch of new tech platforms to add value to their services.”

Chase CEO Jamie Dimon said in early 2022 the bank has committed to spending more than $12 billion on technology, per year. Dimon also said on the company’s Q4 2021 earnings call that the battle with fintechs is “a lot of competition, and we intend to win. And sometimes you need to spend a few bucks.”

Landlords don’t need to be JPMorgan customers to sign up for the platform when it is released to the public in 2023. While the bank has not yet released a fee structure, Le believes the real value for Chase will be in using data to build relationships with multifamily investors then offering additional services and loans.

“Story will enable Chase and landlords with more information about how they manage their properties,” says Le. “So if a landlord wants to buy another property, they’ll be able to use that for analysis and underwriting.”