Not long after the first iPhones debuted, fintech apps began giving bankers fits. Now these consumer-oriented fintech banking apps have become the standard for more and more people.

“Between 2020 and 2021, the proportion of U.S. consumers using fintech grew from 58% to 88% — a 52% year-over-year increase,” according to a study by Plaid. “Similar adoption leaps took the refrigerator 20 years, the computer ten and the smartphone five.”

89% of Americans use mobile banking in some form, according to a study by Insider Intelligence — with even 79% of Baby Boomers using it.

What do banks and credit unions have to offer in their own mobile apps to appeal to consumers these days, to be competitive?

The Financial Brand selected a dozen fintech apps and inventoried their features and approaches. Some aim to serve consumers in general, while others aim for specific groups. For most, traditional banks serve as the old school that they market against. Every one of the fintechs examined is able to offer banking services, including deposits and credit and debit cards, because of the participation of a chartered institution as a banking as a service provider.

The fintechs reviewed include: Albert, Bridge, Cheese, Chime, Dave, Digit, Douugh, Finch, Greenwood, HMBradley, Marygold & Co. and MoneyLion.

We focused not so much on technology — use of biometrics and such within bank apps — but on the services delivered through the apps. The following stand out on the list of “must haves” to compare favorably to fintechs, and one of them is very physical. Bank names in parentheses are the BaaS providers that facilitate the fintechs’ banking services.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Fintech Feature #1: Early Wage Access

Nearly every fintech app we reviewed includes this feature, promising early access to payroll funds and other regularly scheduled payments up to two days early. It’s table stakes today, apparently for every demographic.

“No waiting for your money, and no paper check to get lost in the mail,” promises Chime. “You’ll get paid as soon as the money is available — which is often up to two days before traditional banks.” (The Bancorp Bank and Stride Bank are behind Chime.)

Says Greenwood, an app created for Black and Latino consumers: “You work hard for your money. With direct deposit, you receive your payroll and other ACH deposits as soon as they’re available — often as much as two days before other banks.” (Coastal Community Bank.)

Marygold, which is in beta, presents itself as being “like having a private banker on your phone.” It will also offer early access. (LendingClub Bank.)

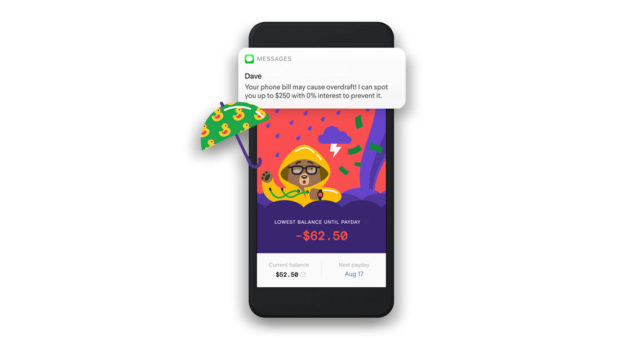

Fintech Feature #2: Temporary Advances and Liberal Overdraft Policies

Who hasn’t felt the need for a small sum to tide them over a few days until payday? Most of the apps accommodate this in some way, many at no cost beyond repayment.

Albert will provide an advance of up to $250 on the consumer’s next paycheck, with no late fees, no interest, no credit check and no mandatory repayment timeframe. “Repay us when you get paid or when you can afford it,” the fintech states. Small charges apply if the accountholder does not use direct deposit. (Sutton Bank.)

MoneyLion calls its service “Instacash” and ties it to direct deposit into the consumer’s “RoarMoney” account in the app. “Your available Instacash limit can be up to 30% of your repeating direct deposit with a max limit of $1,000…,” MoneyLion states. “That’s how you borrow from yourself, not a bank.” (MetaBank.)

Tips Are Appreciated:

Several fintech brands don't charge for temporary advances, but suggest that a 'tip' can be in order. Chime promotes the idea that tipping pays things forward, to help it offer advances to others.

A natural question is, do people tip a financial provider when they don’t have to? In an investor presentation Dave included tips in an explanation of its revenue sources. The company shares its tips with a charitable nonprofit.

Read More:

- Is PayPal Now a Bigger Threat to Banks than BofA or Chase?

- After 10 Years, Digital Transformation Still Eludes Most Banks

- Chase Bank’s CEO Jamie Dimon: Brace for Competitive Carnage in Banking

- The Most Popular Digital-Only Banks in the World

Fintech Feature #3: Multiple Means of Building Better Credit

Clearly, many consumers tapping these apps want to be able to build their credit records to be able to obtain mainstream credit. Various paths are offered.

Dave provides the services of LevelCredit, a firm that works with credit bureaus to reflect consumers’ rent and bill payments in credit scoring. The service normally costs $100 annually, but Dave grants free access for a year for people who set up direct deposits into their Dave spending accounts. (Evolve Bank & Trust.)

Chime offers its Credit Builder secured card, which requires a deposit but doesn’t charge fees or interest. Payment records are reported to credit bureaus, to establish credit history.

Cheese, a fintech founded to serve Asian Americans, has a waiting list set up for its own credit building card, which will not require a securing deposit. (Coastal Community Bank.)

The fintechs typically spell out how they will work, or not work, with credit bureaus in multiple aspects of their offerings. Many consumers appear to have concerns about what is relayed to the bureaus.

Fintech Feature #4: Providing Places for App Customers to Deposit Cash

Pretty typically the apps provide some means of withdrawing cash, generally at a nationwide network of ATMs through use of the app on a phone or via an associated debit card. Typically no fee applies, though not always. Chime brags of having “more fee-free ATMs than the top three national banks combined.”

Why invest in branches when all you need to do is “rent” a nationwide pharmacy’s locations to accept cash deposits, as Chime does.

On the flip side — and this is unusual because we’re talking about digital apps — most of the apps don’t provide for a way to deposit cash into the accounts.

Chime's Deposit Workaround:

Chime accepts free cash deposits through over 8,500 Walgreens pharmacies in the U.S. Other retailers also accept cash for Chime, sometimes charging a fee to the consumer.

Clearly there’s still a “phygital” trend going on, in spite of Covid’s impact on the industry. Chime promotes that the Walgreens deal means “more walk-in locations than you’d have using any bank in the U.S.”

This is a plus that traditional banks can exploit, most having branch networks. Green Dot, a bank-fintech hybrid, has an extensive network of Walmarts and other retail locations, totaling over 90,000 locations that it boasts about all the time. This serves multiple customer bases for Green Dot, including customers for its own GO2Bank accounts and partners.

Read More: Inside Green Dot: The Bank Behind Walmart, Apple, Amazon & Intuit

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

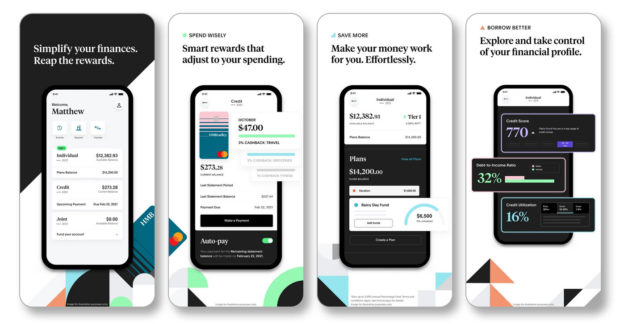

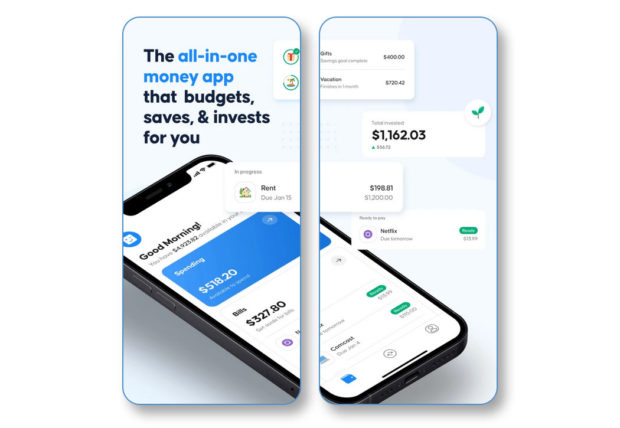

Fintech Feature #5: Helping Consumers Hold to Budgets and Improve Their Finances

70% of consumers surveyed expect their financial services providers to give them personalized notifications and insights and 63% want those firms to give them proactive help to better manage their money, according to the “Consumer Trends in Digital and Mobile Banking” report from MX.

The apps we looked at serve different customer segments — some clearly aim for upper middle-class consumers while others present banking tailored for people of modest means. Just as clearly, income bracket doesn’t necessarily indicate how well you can stick to a budget or build up savings.

Most have some type of budgeting tools within the app based on tech, some drawing on artificial intelligence. Albert stands out because it provides human experts available through a texting-style interface “here to answer everything, from the toughest to the simplest to the most embarrassing questions. That means budgeting, credit cards, student loans — even buying a home.”

Douugh (Choice Financial) features a selection of “jars” that money can be placed in, toward bills, other spending, savings and wealth accumulation. The consumer can choose “Autopilot” to automate much of the jars approach to budgeting. Douugh also provides a weekly wrap up of budget insights and a monthly “deep dive.”

Digit analyzes the user’s spending, decides what should be sequestered for expenses and goals and moves the appropriate amounts into categories. “What’s available in Spending is good to use on everyday items or a spontaneous splurge,” the company states. A feature of Digit is the ability to save towards specific monthly payments as income is earned, to avoid having something like the rent hitting the account with one big wallop. (Metabank.)

The Finch (Evolve Bank & Trust) app features a 5% cashback level, which is automatically directed into the app’s investment portfolio.

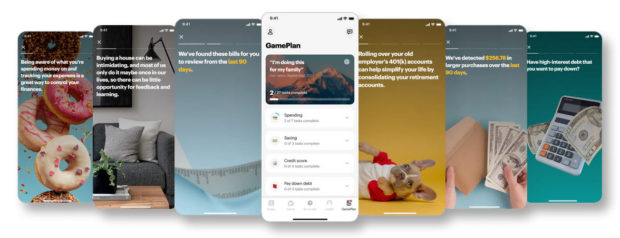

MoneyLion offers spending tracker tools and related services, but also offers the more sophisticated GamePlan level. This service performs analysis and then presents specific financial tasks the user is advised to take to address the software’s analysis.

Marygold, in beta, promises a function called “Money Pools,” which will be individual savings plans for specific goals. The user can set up plans for automatic deposits towards these goals, including visible timelines to illustrate progress toward them. In the app’s design, each can be represented by a photo of what’s at stake, and a master screen shows all goals, each with a progress bar underneath.

HMBradley offers detailed information and analysis, but goes another step and ties into specific options. For example, it “curates” credit choices for someone who needs to borrow for a specific purpose. It also prepopulates credit requests with information it already has about the user. (Hatch Bank.)

Read More: MoneyLion Brings Platform Banking to Life with a Financial Marketplace

Bonus Fintech Feature: Apps that Help Customers Make Money

Some of the fintech apps have an element we haven’t seen in traditional institutions’ apps. That is information on how to get additional income through gigs or side hustles. This seems to acknowledge that sometimes financial improvement simply means bringing in more bucks.

Dave maintains a marketplace for gig work for its users within the app. “Unexpected expenses can make your money life unpredictable, but Dave’s got you covered,” the company promises. “Dave’s network of partners help you discover and apply for work right from your phone. Apply. Hustle. Collect your cash. Repeat.”

Bridge actually promotes itself as “the only debit card that helps you earn money.” Users can earn tokens for fulfilling aspects of handling their accounts. The tokens can offset fees or be cashed in. The fledgling app (working with BaaS provider Blue Ridge Bank) is developing additional earnings opportunities.