Think about a day in the life of your average banking consumer. She wakes up and checks her phone. She browses her personalized news feed, which delivers stories that align with her interests and preferences. She checks Facebook, which recommends that she connect with an old friend from years ago. Later, she drives to work, with Google Maps advising her to take the back roads because of an accident on the highway.

After a long day at the office, she comes home to watch Netflix, which is recommending a great new movie she’ll almost certainly like. She starts watching the show while waiting for dinner to be delivered via DoorDash, which uses artificial intelligence to make sure routes are optimized, keeping delivery times down.

After she wraps up her Netflix movie, she does a little bit of banking online. What a drag… In comparison to all the other services and experiences in her life, online banking is disconnected, underwhelming, and not very streamlined. She shuts down her laptop just a few minutes into her session after doing the bare minimum — checking her balance and paying a couple of monthly bills.

In a typical day, consumers use and rely on services that consistently demonstrate how well they understand consumers at the individual level. But banks and credit unions today are falling way short and deliver an experience that can only be described as “inferior.”

Companies like Amazon, Facebook, Google and Apple have forever altered the company/consumer paradigm by putting CX at the center of everything they do. The most innovative companies in the world have fundamentally changed consumers’ expectations. People demand more than ever before, and banks and credit unions are struggling to keep pace.

NGDATA’s annual Consumer Banking Survey found that consumers have increasingly high expectations and demand exceptional customer service in exchange for their loyalty. This means that banks and credit unions must accelerate digital transformation across their organizations so that they have the tools to become fully customer centric. Consumers must be at the center of their entire architecture, and meet the raised expectations for service providers.

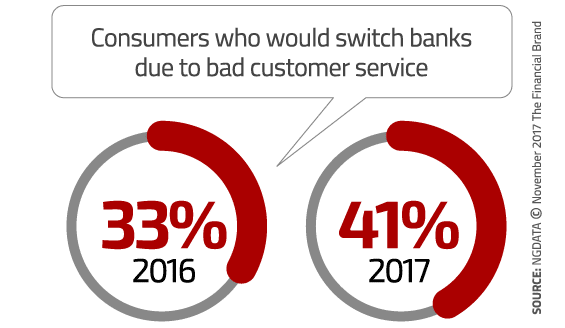

Customers want good service and a good customer experience, but banks aren’t delivering. 41% of consumers responded that bad customer service would be the primary reason they would switch to a new bank – that represents an eight percent jump over the past year.

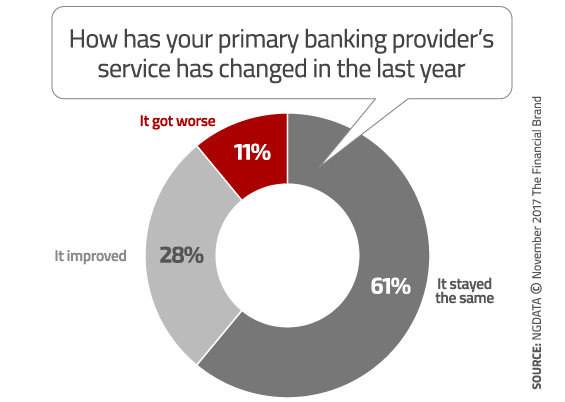

What was surprising is that 72% of respondents said that their banking provider’s customer service has not improved over the past year. This trend is even more pronounced with younger consumers, with respondents aged 25-34 citing cost as the least important factor for why they’d change banks. For Millennials, consumer sentiment goes far beyond how much is coming out of their wallet.

Unfortunately, many retail financial institutions are not taking the lessons to heart that other innovative service providers have learned to master. These data points paint a clear picture: expectations are growing while customer service is plateauing.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Banking’s Segmentation Models Are Not Good Enough

Looking even closer at the data and the reasons why consumers are disappointed with the banking experience, we see that 61% of respondents believe that the offers they receive from their bank are part of a campaign aimed at a broader market vs. offers based on their needs as individuals.

Think again about the contrast between tech giants and banking providers. On one hand, you have an organization that possesses all of your financial information — extremely personal data — and yet they are still segmenting audiences into massive buckets based on little more than a couple demographic parameters. On the other hand, these same consumers are getting detailed recommendations about what TV show they should watch from services like Netflix, or individually-targeted ads from Google in their search results. It’s no wonder people are frustrated with banks.

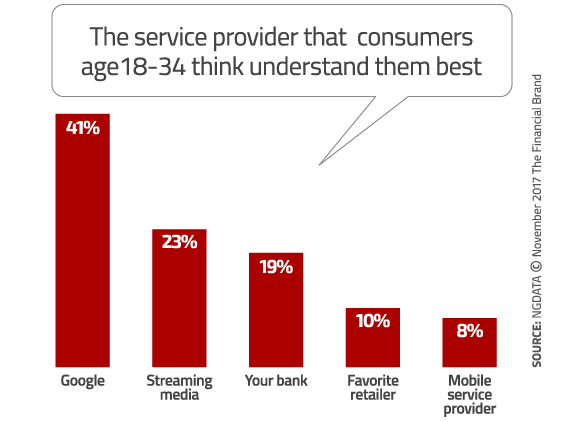

When asked to rate which service providers understand them best, banks and credit unions rank far behind Google. Alarmingly, this is playing out much more strongly among younger consumers. Compared to other service providers, only 19% of respondents aged 18-34 feel that their bank understands them best — by far the lowest of any age group. The younger generation is one that came of age during this era of hyper personalization and intense focus on individualized experiences. It is unlikely that they will be patient with any service provider that doesn’t understand them.

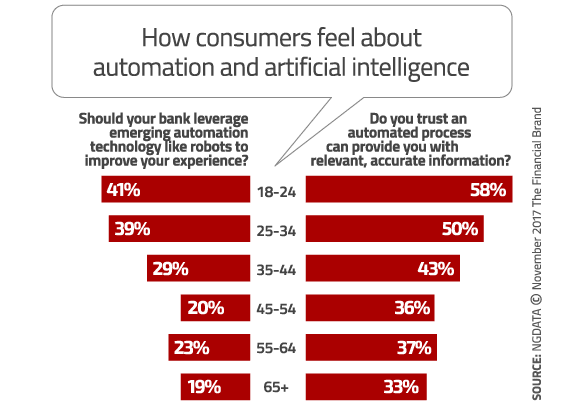

According to the data, Millennials also are far more receptive than their older counterparts to banking providers using technologies like artificial intelligence and automation to improve the customer experience. Nearly 40% of 18-34 year olds responded that banks should leverage emerging automation technology to improve their experience, and 53% in this age group trust that an automated process can provide them with relevant, accurate information in their banking experience.

The younger generation, accustomed to service providers anticipating their needs and customizing offers accordingly, presents an enormous challenge to the banking industry. The days of segmentation and marketing based on broad demographics have come to an end. Retail financial institutions that embrace the strategic importance of the customer experience are the ones that will benefit from the changing market dynamics and rising consumer expectations.

Banks and credit unions that are able to adopt a truly customer-centric approach will be in a better position to anticipate customer needs and demands, and to be prepared to deliver offers based on individual preferences — an experience that people have grow extremely accustomed to. Today’s consumer is asking for a better experience, but tomorrow’s consumer will demand it and won’t settle for anything less. Banks and credit unions that can’t deliver will be left behind.