In 1969, the number of federally insured credit unions in the U.S. peaked at 23,000. Today, there are just over 5,100, even as the total number of members and assets continues to grow.

What explains such a profound decline? One word: mergers.

Consolidation has been a dominant theme in banking for decades. Big banks acquire smaller and unhealthy ones. Smaller institutions bulk up for scale. In recent years, even well-funded fintechs are buying out rivals and other promising startups.

But the merger trend among credit unions is white hot, hitting big numbers most of the last 10 years.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

The Consolidation of Credit Unions Has Significant Impact

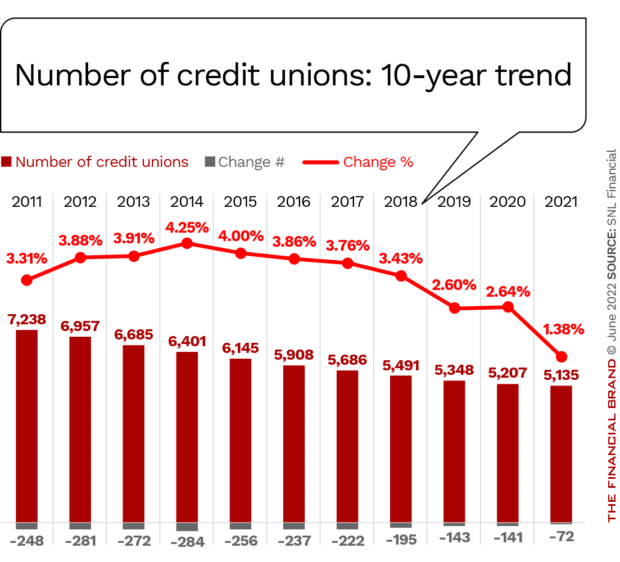

In 2021, there were 161 credit union mergers, up from 130 the year before. In the first quarter of 2022, the NCUA approved 41 mergers, setting a pace slightly above 2021 and exhibiting no signs that the trend will slow anytime soon. The impact of mergers — along with other factors — on the total number of credit unions is significant. The chart below shows the overall consolidation trend in the industry.

Looking at the total number of credit unions by asset size also underscores the merger trend. In 1979, there were over 10,000 credit unions with assets less than $1 million. As of Q4 2021, there were fewer than 1,050 credit unions with assets less than $10 million. By contrast, there were only three $1 billion credit unions in 1979, whereas over 350 exist today.

So there are fewer but larger credit unions today, but what does this mean for the industry?

Pros and Cons of Credit Union Mergers

It’s hard to argue against the benefits of operating at scale. In many ways, bigger is simply better.

Operationally, smaller credit unions that are acquired typically benefit from broader product and service offerings, and more innovative service delivery capabilities and investments in digital transformation by the acquiring credit union. Members of credit unions targeted for acquisition also often see benefits, generally in the form of better deposit and loan rates.

But the downside? One could argue that if credit unions continue to aggressively scale up through mergers, they may become big enough that state lawmakers and/or federal politicians could struggle to justify credit unions’ tax-exempt status.

“Some of these ‘not-for-profit, tax-exempt’ credit unions are now many times larger than thousands of banks,” bankers point out. Their argument gets more persuasive the bigger credit unions get.

The other question is : When credit unions merge, do they water down their value proposition — the distinctions that set them apart from banks?

However credit unions come down on those questions, the consolidation trend in the credit union industry is a major ongoing development. Here are three key trends impacting credit union mergers.

Trend #1: Merger Activity Will Remain Strong

Many experts in the credit union industry consider mergers mission-critical. With stiff competition from both traditional banking providers and digital-only neobanks, even larger credit unions’ path to survival may require gobbling up the assets, locations and members of smaller credit unions. Those smaller credit unions not acquired by bigger players are merging amongst themselves to build scale. (Another option for smaller credit unions is discussed in Trend 3.)

Key Fact:

Almost half of federally insured credit unions ended 2020 with fewer members than in 2019 — this was mainly small credit unions with less than $100 million in assets.

Jim Perry, senior strategist for Market Insights, believes smaller credit unions will have to seriously consider mergers and acquisitions to remain competitive, arguing that consumers in the post-pandemic world are increasingly demanding improvements relating to digital channels, personalization and security and efficiency — all areas where smaller credit unions struggle, and can only tackle incrementally.

Trend # 2: Credit Unions Will Buy More Banks

There were 13 bank acquisitions by credit unions in 2021, according to the NCUA, and some M&A experts predict between 15 and 20 more such deals in 2022.

Bankers’ hackles are rising over this feverish bank-buying activity, prompting them to fight back against what they view as an unfair competitive advantage, for example, by leveraging credit union tax-exempt status to outbid other banks. Some banks outright refuse to consider bids for sale to credit unions.

This trend risks additional challenges to credit unions’ not-for-profit tax-exempt status, threatening the primary mission of the credit union industry as a lower-cost alternative to for-profit institutions.

Given the risks, why is credit union interest in bank acquisition so hot right now? For some, it is simply a matter of seizing the opportunity to enter a previously unavailable market. Other factors: adding physical locations (banks typically have more branches), increasing the breadth and depth of products and services, and capitalizing on a quicker way to ramp up business lending

Between the Lines:

Every time a credit union buys a bank, bankers see red. Nothing infuriates bankers more than an untaxed credit union snatching up a bank.

Trend #3. Partnerships as an Alternative to Acquisitions

Small credit unions faced with higher expenses that chip away at member value may see acquisition by a large counterpart as a viable option. However, those hoping to avoid acquisition can achieve scale by participating in mutually beneficial partnerships.

Credit Union Service Organizations, or CUSOs, are not a new concept but, in the current environment, may offer a cost-effective way to expand a credit union’s footprint and help it benefit from increased efficiencies through economies of scale —allowing small credit unions to live to fight another day.

Shared branching, for example, offers a way to instantly increase each credit union’s footprint and up-level service to members. Sharing service delivery channels allows credit unions to spread the cost of technological innovation and meet increased member demands for convenience.

And shared back- and mid-office functions, including core systems, loan processing, call centers and even leadership, offer a way for smaller credit unions to quickly access the same level of operational speed and sophistication as their larger counterparts at a reasonable cost.

Still other credit unions have implemented unique, hybrid-model “mergers of equals.” These mergers are the same as any other on paper but are formed between credit unions of similar size, culture and financial health.