A decade ago, community banks and credit unions regarded themselves as masters of customer service. Today new research indicates they’re getting lapped by the biggest players.

35% of major banks’ customers who considered the institutions their primary financial institution felt that service had improved during the coronavirus pandemic.

No other category of institution covered in a Raddon study came close to this approval, with most people saying that the level of service had remained the same at their primary institutions — multistate banks, community banks and credit unions.

Under the circumstances of the pandemic, maintaining services levels would seem an accomplishment by itself. However, this comes on the heels of other research by the firm that indicates that major banks’ share among consumers continues to grow. And researchers say the reason has been improved service.

In fact, in the firm’s report, major banks score highest among their primary customers in three key areas that hinge not on tech prowess, but on staff excellence:

- Employee skill handling my financial needs: Major banks (43%), community banks (34%), multistate (32%) and credit unions (22%).

- Employees are polite and friendly: Major banks (53%), multistate (48%), community banks (47%) and credit unions (41%).

- Employees demonstrate good communications skills: Major banks (51%), multistate (45%), community banks (40%) and credit unions (35%).

In one measure, credit unions scored highest, at 50%, versus major banks at 47%. This was in “ease of receiving assistance from an employee.”

But overall, the trend surprised Caroline Vahrenkamp, Senior Research Analyst and Program Manager at Raddon. She says large banks would be expected to excel with tech, but on the three people factors mentioned above, “I would have thought there would have been a more even performance. That leads me to wonder how much that is contributing to major banks’ growth in primary customers.”

Most of Raddon’s report, “Delivery Insights: Changing Demands in a Contactless World,” deals with the channels and products that financial institutions use. Yet it is impossible to separate these from the human element because nearly every financial interaction may still involve contacting bank or credit union staff.

Many of the suggestions in the report and in an interview with The Financial Brand — from both Vahrenkamp and Lynne Cornelison, Research Analyst, and the report’s author — concern the points where delivery, consumers and staff intersect.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

People Still Want To Talk To People. (But Differently)

In some ways during the pandemic, in spite of the acceleration of digital banking, being able to communicate with a human being was not only still wanted, but as the months ground on, sometimes acquired a premium.

“So many people have needed service more this period than they have in the past, asking questions about unemployment checks and stimulus payments and more,” says Vahrenkamp.

This need fed into the continued demand for branch service, often delivered via drive-through, where it was available. She sees this as a temporary condition, though.

Signs of the Times:

No one is building new drive-throughs because of COVID. Similarly, investment in new ATMs will fall.

The role of technology and human contact is at a strange crossroads. In some cases, tech wins out. For example, consumers overall were more likely to make a phone call to their financial institution than to use live chat via computer or mobile device. However, those consumers who have frequent contact with their providers — five or more times monthly — use live chat almost twice as much as calling humans.

It’s possible that frequent users grow more comfortable live chatting with a human over time.

But then there is video, so common now that business people speak of “Zoom fatigue.”

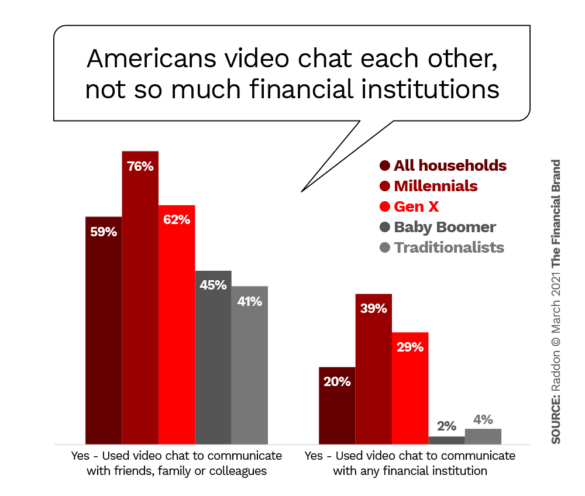

As the chart above shows, there is huge gap between how people communicated with friends, family and colleagues and their financial institutions. For personal and business talks, six out of ten respondents used video chat in some fashion during 2020, and three-quarters of Millennials did so. Even two out of five of the oldest Americans used video chat this way.

However, as the chart also shows, use of video chat was dramatically lower overall and among every generational group when it came to talking to banks or credit unions. While many institutions have not invested in proprietary video systems, the likes of Zoom, FaceTime and similar apps are widely available. So lack of tools may not be an issue.

“Everyone’s used video chat personally, but not for talking to financial institutions. I was surprised, because I thought that using video to talk to family members would have normalized the channel.”

— Caroline Vahrenkamp, Raddon

Overall, only 9% of respondents used video (specifically through a mobile app) to talk to their institutions in 2020. However, 23% said that they were “extremely or very likely” to do so in the future.

Read More:

- Why This Mobile Bank Prefers Live Chat With Humans Over Chatbots

- How Personalized Video Boosts Engagement and ROI in Banking

Fresh Thinking Will Improve The Omnichannel Service Proposition

Both researchers had ideas on how to expand the use of video and chat technologies as the industry moves forward.

For live chat, Cornelison believes simplicity is the key to making it more popular. In addition, she says financial institutions must commit to an omnichannel structure that enables consumers to pick up where they left off if they change from one channel to another.

Vahrenkamp boldly suggests that the ability to unite all ways of seeking help so every banker could be reached by text, phone, video and more would have broad consumer appeal. She admits that it would take time and training to get used to being reached by multiple channels, but consumers would appreciate the flexibility. Taking the multi-track approach would mean consolidating channels. In some institutions live chat is currently outsourced, she points out.

“Taking this step could be a real positive for account holders because they can get a sense of continuity, of customer experience, that they don’t necessarily have now. You don’t want to let that opportunity slide these days,” Vahrenkamp says.

Looking Forward:

Expanded use of video may simply be a matter of time, as people get more used to the idea of dealing with financial providers that way.

It took some time for mobile banking to gain broad acceptance, points out Vahrenkamp. With video chat, consumers will need to get used to chatting with a different representative each time they call — this would not be like having a personal banker — and they would have to get used to potentially having a “stranger” looking into their home via video.

That said, over time Vahrenkamp believes some consumers will prefer this to dealing with artificial intelligence that may not really be ready for prime time or with other tech that leaves them stuck in loops.

Looking Forward:

Post-COVID will be the time to reconsider many institutions’ approaches to staffing contact centers.

Vahrenkamp says that contact centers are often not pleasant to work in — “You’re usually in a dungeon with no windows” — and they are often where newbies in financial institutions start. As soon as they show some initiative, they are moved elsewhere. And yet contact center staff often field a greater variety of queries than do people in branches.

“It’s an area where financial institutions should be investing more,” says Vahrenkamp, “building expertise and bandwidth.” She thinks the COVID experience, where many financial contact centers had trials by fire, should drive some permanent change.

Cornelison suggests that simply letting more contact center people work from home could be a cheerful improvement.

The Channel Few Saw Urgency For. Then Came COVID-19

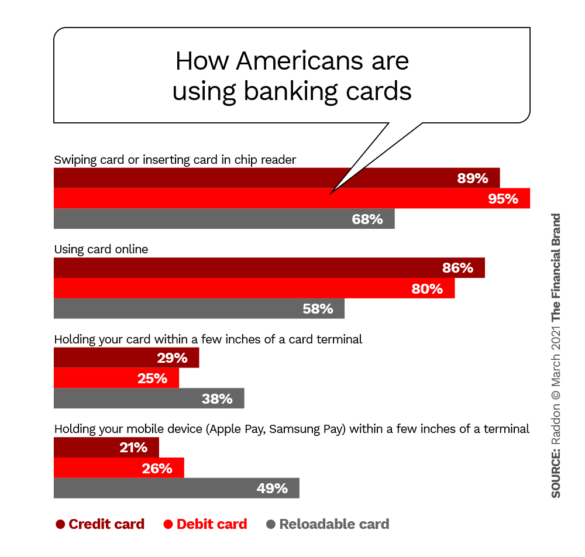

Contactless cards were a product that was in the right place at the right time.

Vahrenkamp was a credit union executive before joining Raddon and she says the head of IT insisted on introducing contactless technology for credit and debit cards. Vahrenkamp thought the tech exec was nuts.

“A year ago, before COVID, contactless didn’t have any reason to exist a year ago, it was a solution without a problem,” says Vahrenkamp. “But we found the problem.”

For an increasing number of Americans, contactless cards have become part of their COVID kit and the habit will remain ingrained. At midyear 2020, the report notes based on Federal Reserve data, six out of ten consumers still carried cards that didn’t have contactless features. Vahrenkamp believes that institutions have stepped up issuance of these since. So usage will likely continue to build, though some institutions haven’t replaced cards issued before COVID hit.

There’s also the question of ability to use contactless. Locally institutions may need to work on merchants to get the holdouts to switch to point-of-sale equipment that will read contactless cards and digital wallets.

“My supermarket still doesn’t accept contactless payment,” says Vahrenkamp.

Use of digital wallets is evolving, independent of pandemic issues, as well. In its a 2016 study Raddon found that 60% of the cards loaded into wallets were reward cards, such as Starbucks’, and store cards.

“As comfort and familiarity with making payments from a mobile device has increased, we see the rewards or store cards have been replaced by the consumer’s primary credit or debit card,” the latest report states.

Cornelison suggests that institutions devote more time to educating consumers on how to use contactless methods. The interest is there.

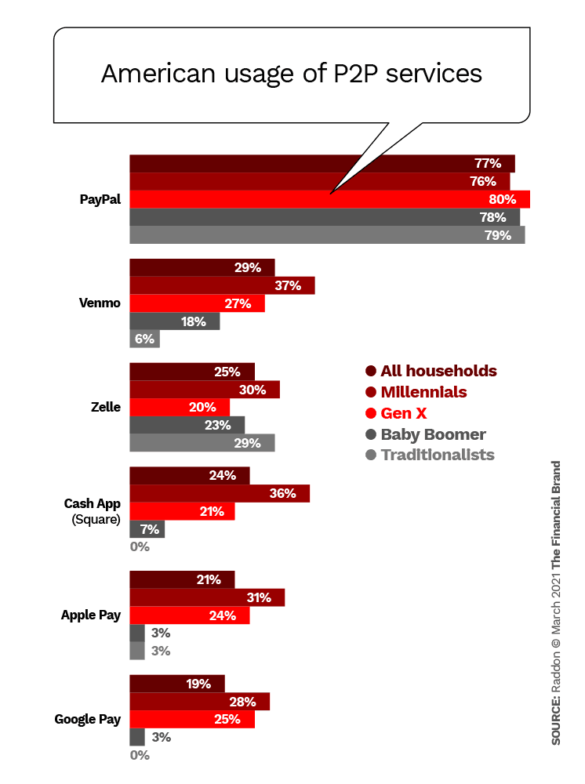

The study also found stronger interest in another contactless channel: P2P payments. 67% of the sample have sent or received funds using P2P, or done both, versus 42% in the 2018 study.

In addition, interest in using virtual assistants like Amazon’s Alexa, Google Assistant and Apple’s Siri for banking has been growing. Among the sample 48% said they currently use the tech in some way for their finances. That’s a bit more than double the rate of interest seen in the 2018 report.