The customer experiences major banks offer on websites and mobile banking apps are converging, not only in look, feel and function, but also via omnichannel approaches to customer support and improvements to dashboards.

According to the Online Banker Scorecard for Q2 2024 by Keynova, the consistency between online and mobile banking is increasing among the 18 major banking brands. Susan Foulds, managing director at Keynova, says the trend toward uniformity improves familiarity across digital channels and can help improve customer satisfaction. (The 18 brands in the semiannual study are listed at the end of this article.)

“Banks are closer to achieving parity in functionality between their desktop online banking and mobile app offerings — and some are in synch with the mobile web platform as well,” the study report says. (“Mobile web” refers to an iteration of the bank’s website designed to accommodate typical interaction on a mobile phone or tablet using such features as touch screens, versus mouse and cursor movement from a physical keyboard.)

Register for Discovery2024 Conference

Join us August 8th for Discovery2024, your gateway to the strategic insights and human connections you may need to navigate the evolving financial landscape.

Increase loan volume through embedded financing

Discover the strategies behind Silver State Schools Credit Union’s transformative journey in today’s competitive lending marketplace — enabling sustainable growth and connecting with 500+ new members.

Read More about Increase loan volume through embedded financing

One Screen Size Doesn’t Fit All

Foulds says that many institutions say that their customers use a blend of desktop and mobile, while the customers of others lean one way or the other. She says institutions have indicated that there are more logins on the mobile channel now.

Consumers surveyed by the American Bankers Association in a late 2023 study reported managing their accounts most often on mobile apps via smartphone or tablet (48%), followed by online (23%) and branches (9%.) The 2023 study marked the fourth year in a row that consumers expressed a preference for mobile.

More specifically, the preference for mobile was over 50% for all age groups except baby boomers. For that demographic the preference flips — 39% prefer online banking while 31% prefer mobile.

The highest preference for mobile was seen among millennials — 60% favor mobile.

Foulds believes the mix won’t remain static, because as some consumers grow older their digital preferences may change — tipping the scales even more towards mobile.

Just as digital channels haven’t replaced branches, mobile may not supplant online banking for some time. “‘One size does not fit all’ applies to digital banking,” says Foulds. “I know people who only use tablets and phones because they don’t really need a computer anymore.” Others may still have a preference for computers.

A recent analysis in the Wall Street Journal found that while more digital purchasing was moving towards mobile apps, many consumers still prefer to use laptops or desktop computers for major purchases, comparative shopping involving multiple windows, and other transactions when they want the assurance of a keyboard or simply more screen space.

This observation for purchasing may have applicability to digital banking. In its presentation for Q1 2024 earnings, Bank of America noted that digital adoption among clients for its global wealth and investment management services broke out this way: 80% online and 62% mobile.

The long-term potential for blended experiences between computer and phone remains to be seen. Many computer logins now feature transmission of codes that are sent to the user’s phone, for human input. Apple’s upcoming iOS 18 will include a feature enabling consumers to access Apple Pay on non-Apple equipment using browsers other than Apple’s Safari. The computer will display a graphic that, shot with the user’s iPhone, will invoke the iPhone’s security features.

Read more: Two Screens, One Goal: Where Mobile and Online Banking Meet Local Growth

Aligning the Look and Feel of Online and Mobile Banking

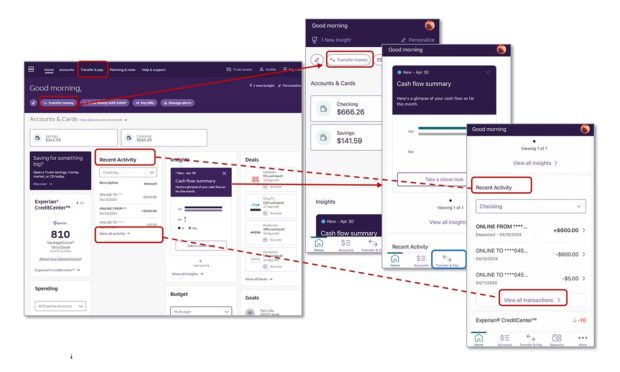

The screen captures below from Keynova’s report compare Truist’s online appearance to its mobile appearance. The study cites this as one of the best blendings of online and mobile functionality. (Click on the image for a larger view.)

Truist offers a full desktop view online, Foulds points out. “When you go to their mobile app, there’s a lot of downward scrolling,” she says, “But you’re getting the same information and much the same customer experience. It’s just a vertical view versus a broader view. We’re starting to see more of this.”

Other brands haven’t merged things quite as far, according to Foulds. U.S. Bank, for example, “has aligned their mobile web banking fully with their online banking, but they still keep their mobile banking app a little different,” says Foulds.

Part of what is helping align online and mobile experiences is responsive design, an approach to coding that adapts sites and apps to present their best appearance tailored to the user’s device.

This technology has improved tremendously, according to Foulds.

“In the early days I could tell when a bank was using responsive design because the site was slow — I used to call it ‘unresponsive design’,” she says. “But it’s improved.”

Read more: How American Express Keeps Gen Z and Millennials’ App Preferences in Focus

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

Register for Discovery2024 Conference

Join us August 8th for Discovery2024, your gateway to the strategic insights and human connections you may need to navigate the evolving financial landscape.

Making Good Use of Online Banking’s ‘Real Estate’

A key point for online banking users is the opportunity to pull everything about their relationship with their bank onto one screen. These dashboards generally come right after login.

Keynova’s analysis identified six best practices, some of which are only provided by a few leaders:

- Present a list of recent transactions right on the dashboard. Only 28% of the banks do this.

- Provide a link to formal statements. Nine out of ten banks do this.

- Enable personalization of the dashboard by the user, including the ability to change quick links that are provided (i.e., like having “factory settings” that can be changed). 28% of the banks allow this.

- Display both credit card balance and available balance, with link for making payments. Four out of five institutions provide that.

- Enable customers to set up meetings. In-branch meeting could be arranged from the dashboard at 83% of the banks. Video meeting appointments were offered by only 17% of the institutions.

- Display the customer’s free credit score. Three out of five banks provide that.

Read more: Offer ‘Test Drives’ of Mobile Banking Apps for a Marketing Advantage

Blending Digital and Live Support for Customer Queries

Consumers have come to expect online self-service, Keynova observes, but they still want to be able to access a human when they want a live contact. Banks are responding in a variety of ways.

Most of the banks display a customer service number within the authenticated part of the website, to at least give customers assurance that the number is legitimate.

Among best practices in customer service:

- Offer a human “lifeline” to backstop AI chatbots. Seven out of ten of the banks offer chatbots for customer queries. Of those banks, 67% offer support via live chat if the chatbot has failed to answer the consumer’s question after two tries.

- Consider instant access to live chat. Of institutions that offer live chat off the bat (67%), half post estimated wait times.

- Offer two-way messaging. Essentially like a secured text channel, this enables customers to post a query and come back later for the answer. One in five banks offer this.

A rough spot identified by the study: The way non-customers are handled when they visit the public side of bank websites. Only two out of five banks offer live chat assistance to prospects who are opening an account or shopping for one. In addition, two-thirds of the institutions offer a number for assistance on the public side that leads not to a person but to “IVR” — interactive voice response, also known as “pushbutton hell.”

Read more: How Bank of America Unified Five Apps Into One Experience

Increase loan volume through embedded financing

Discover the strategies behind Silver State Schools Credit Union’s transformative journey in today’s competitive lending marketplace — enabling sustainable growth and connecting with 500+ new members.

Read More about Increase loan volume through embedded financing

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

When Studying Sites for Ideas, ‘Trust But Verify’

Foulds studies numerous mobile apps and websites of the largest institutions. Bankers and credit union executives looking at big players for ideas on new features should try things out, not just take features at face value, her experience suggest.

Foulds was recently testing a large bank’s digital account opening routine — an institution reputed to be really good with that feature. Foulds went through the process until she received the message that the transaction couldn’t be completed. She would have to go to a branch.

“And I’m sitting there thinking, ‘I wonder how often this happens?’,” says Foulds.

Editor’s note: Keynova’s study universe included these institutions: Bank of America, BMO, Capital One, Chase, Citibank, Citizens Bank, Fifth Third Bank, Huntington Bank, KeyBank, M&T Bank, PNC, Regions Bank, Santander, TD Bank, Truist, USAA, U.S. Bank and Wells Fargo.