For the fifth consecutive year, we have surveyed a panel of close to 100 global financial services leaders for their thoughts around upcoming retail banking and credit union trends and predictions. The crowdsource panel including bankers, credit union executives, industry analysts, advisors, authors and fintech followers from Asia, Africa, North America, South America, Europe, and Australia.

These exclusive interviews are one of the components of the expansive Digital Banking Report, ‘2016 Retail Banking Trends and Predictions‘, sponsored by Kony, Inc. In addition to interviews, the report includes in-depth analysis, charts and case studies around each trend.

Last year’s report proved to be highly accurate, with significant advancements in digital delivery, mobile design, the use of analytics, innovation and customer experience. Our expert panel was a bit too optimistic with their projections regarding mobile payments, industry consolidation and contextual engagement, however.

This year’s projections include a ‘doubling down’ on some of the major trends from last year, with new projected trends in the areas of digital and mobile delivery, customer experience, digital payments, alternative products, innovation, authentication and advisory services.

— Top 10 Retail Banking Trends and Predictions for 2016 —

- The ‘Platformification’ of Banking

- Removing Friction from the Customer Journey

- Making Big Data Actionable

- Introduction of ‘Optichannel™’ Delivery

- Expansion of Digital Payments

- Executing on Innovation

- Exploring Advanced Technologies

- Emergence of a New Breeds of Banks

- Mining New Talent

- Responding to Regulatory and Rate Changes

The first four of the trends above were omnipresent trends that were referenced by the majority of our panel. For the first time, panelists also believed banking would be testing of blockchain opportunities and responses to rising interest rates. While the impact of any of these trends will differ by region or institution, the panel believes each will have the potential to be game changers in 2016.

Overall, it was universally believed that the banking industry would still be playing ‘catch-up,’ and that the potential to be left behind or consolidated would increase as consumer expectations escalate and margins remain thin. James Haycock, managing director of Adaptive Lab and co-author of the book, Bye, Bye Banks, said, “It’s plain to see that a perfect storm of competition, technology, shifts in customer behavior and regulation will wreak havoc on the businesses we trust with our money. It’s a matter of when, not if, banking is reinvented. A new generation of companies and leaders are tearing the rulebook to pieces, adopting new technology, using new working practices, and serving customers whose lives are increasingly orientated around their mobile phones better than traditional banks can currently.”

Overall, it was universally believed that the banking industry would still be playing ‘catch-up,’ and that the potential to be left behind or consolidated would increase as consumer expectations escalate and margins remain thin. James Haycock, managing director of Adaptive Lab and co-author of the book, Bye, Bye Banks, said, “It’s plain to see that a perfect storm of competition, technology, shifts in customer behavior and regulation will wreak havoc on the businesses we trust with our money. It’s a matter of when, not if, banking is reinvented. A new generation of companies and leaders are tearing the rulebook to pieces, adopting new technology, using new working practices, and serving customers whose lives are increasingly orientated around their mobile phones better than traditional banks can currently.”

Dan Latimore, SVP of banking for Celent, was a bit more optimistic, saying, “2016 will be the year that the gap between fintech hype and actual production-level implementation begins to significantly narrow. From biometrics to big data and analytics, from mobile payments to real-time, momentum will build as banks begin to implement at scale, and consumers begin to adopt in meaningful numbers. It won’t be a flood – changing the consumer takes time and requires overcoming inertia – but there will be significant progress.”

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

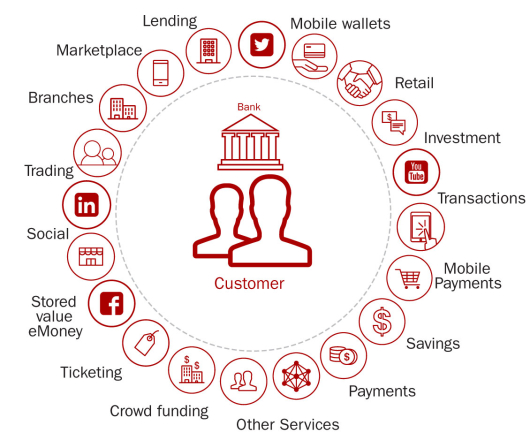

1. The ‘Platformification’ of Banking

In a report published by the Economist Intelligence Unit titled, ‘The Disruption of Banking,’ senior bankers and fintech executives were interviewed to ascertain the likely landscape for the retail banking industry over the next five years. While the degree of anticipated impact differed, both groups believed fintech firms will have a significant impact on the future landscape of banking. When the EIU asked bankers and fintech executives to assess their own strengths and weaknesses as part of the study, there was a strong correlation between the strengths of banks and the weaknesses of fintech, and, conversely, the strengths of fintech and the weaknesses of banks.

The most obvious complementary factor is that fintech firms need the scale of customers that the banking industry already possesses. With a much longer tenure and scale, banking firms also had the advantages of stability, trust, experience navigating regulations and compliance requirements and the access to significant capital.

When the weaknesses of banking were analyzed, it was determined that banks were more constrained by legacy systems than fintech firms, stifling innovation and the ability to be agile. Banking was also hampered by the inability to recruit the level of technological expertise needed to improve products compared to fintech firms.

Because of these complementary needs, the number one prediction for 2016 (by far) was the realization that fintech firms may be better partners than competitors in the future … a ‘platformification’ of banking.

“The most significant trend of 2016 will be the ‘platformification’ of banking, where both existing banks and startups begin a strategic shift towards becoming banking platforms, much like how Amazon is a platform in retail.”

Ron Shevlin, Director of Research for Cornerstone Advisors and author of the book Smarter Bank

“The trend of building integrated solutions will remind industry old-timers of the ‘financial supermarket’ trend from the 80s, but platformification is different because banks and fintech startups can’t just sell (or re-sell) individual services from multiple providers. Instead, they will integrate services and provide quantifiably superior solutions (superior in terms of cost, performance, speed, convenience),”says Shevlin.

Financial industry consultant and fintech advisor, David Gerbino, referenced that fintech partnerships are not necessarily new. “While fintech firms and banks will continue to be pitted against each other in the media, by Congress, in banking c-suites and by regulators in 2016, the smart banks will partner with fintech solution providers as they have for the last few decades.”

Matthew Wilcox, SVP of the Digital Banking Group at Fiserv agrees, “I believe you will see advancements in partnerships with fintech companies who have created specific use case solutions that will drive enhanced results for retail, small business, and corporate banking customers.”

“I think the issue of rebuilding of organizations around APIs, will come to the fore. For the incumbents, it is far from clear that adding an API layer will be sufficient to deliver the flexibility and creativity that interconnecting challengers can bring to the space. Therefore, I suspect, that as APIs become the focus of competition in services, we will see considerable activity in acquisitions and partnerships.”

– Dave Birch, Director of Innovation at Consult Hyperion

“By leveraging the gain they made in building trust and differentiated experience, the winners of the first wave of financial services startups will aim to provide a more complete financial services experience to their users.”

– Yann Ranchere, Partner at Athemis Group

“We will finally see a marriage happening between fintech and banks, with the latter integrating talent from the former, somehow looking for help to become faster in delivery, more accurate in their value propositions, and extremely attractive in UX and design of experiences.”

Maria Jose Jorda Garcia, Head of Customer Experience Transformation, BBVA

“I think that 2016 will see more banks partnering with startups in a quest to get to market faster than their legacy systems currently allow – both under their own brand and white labeled.”

– Louise M. Long, Head of Human-Centered Design at NAB Labs

“Next year, we will also not speak about banks vs start-ups but the collaboration between banks and startups. Within 2-3 years, the rise of the API economy will also arrive in banking.”

– Claire Calmejane, Director of Innovation at Lloyds Banking Group

“Banks will continue to invest in fintech, with more banks having an increasing focus on ROI. A significant number of banks will also open up their APIs to the fintech community in 2016.”

– Danny Tang, Channel Transformation Leader, Global Banking at IBM

“JP Morgan Chase’s partnership with OnDeck will inspire more partnerships with fintech firms to accelerate change. But laggards are going to lag, and we’ll see them fade into irrelevance faster than last month’s internet memes.”

JP Nicols, President and COO of Innosect

“It becomes increasingly apparent that some banks do not have the scale to compete as retail innovators or efficient payment processors. These firms will need to reinvent themselves or sell the resulting run rate to their boards, shareholders and commentators.”

– Daryl Wilkinson, Managing Partner of Lab12 Innovation

“Fintech will partner with incumbents or be bought by them as fintech accelerate their growth and banks will try to close their innovation gap. The fintech revolution has only scratched the surface of its potential and that is just great news for customers.”

– Spiros Margaris, Founder of Margaris Advisory

“We will see more acquisitions of fintech companies in 2016, and it will be interesting to see if start-ups are left as standalone entities or folded into the legacy organizations. Open APIs will help integration attempts and the smarter banks will leverage this advantage.”

– Aden Davies, previously Social Technologies Specialist at HSBC

“I wouldn’t be shocked if a firm like Visa or Goldman Sachs look to open-source more of their internal projects as a way to attract participation from Silicon Valley – this will hint at banks becoming ‘platforms’.”

Ian Kar, Future of Finance Reporter at Quartz

“Fintech firms will mature, with investment in the fintech industry further increasing. The majority of banks will pick up the digital banking theme and create fintech partnerships.”

– Frank Schwab, Co-Founder of the FinTech Forum

“Traditional financial groups will start to integrate new services originated by startups, in the same way that Goldman Sachs is developing online lending or ING is partnering with Kabbage. At the same time, there will be more rationalization and consolidation in the fintech space, with the large players continuing to grow – and potentially acquiring smaller startups.”

– Huy Nguyen Trieu, author of the blog, Disruptive Finance

“The attention paid by the financial sector to fintech is due to several factors: start-ups gaining traction around the world, some large digital players launching financial products which gained scale and visibility quickly, and the emergence of new technologies, such as blockchain, which could change a number of things for the sector.”

– Christophe Chazot, Group Head of Innovation at HSBC

“Similar to the stage theatre competing with broadcast TV, can banking build a new business with new media and a new team? Will banks wake up and give up some of the ownership of governance within their organization and put it in the hands of the fintech expert?”

– Barbara Biro, Director, Channel Migration/Digital Transformation at Mashreq Bank

“The recent partnerships between banks and fintech firms show that banks value the platforms these start-ups have built, which will foster more collaborations in the future. We should expect more alliances built around APIs and white-label solutions in the future, allowing any entity with strong ties to the consumer or small businesses to offer solutions to those markets.”

– Stephen Sheinbaum, Founder of Bizfi

2. Removing Friction from the Customer Journey

The digital revolution is impacting all industries, including banking. It is impacting the way consumers research their choices, access their products, how products and services are delivered and purchased, and the underpinnings of the entire financial marketplace.

It is no longer adequate to wait until the customer or member walks into a branch or decides to purchase a new product online or via a smartphone. Instead, banks and credit unions must engage customers at every stage of their purchase journey – not just because of the immediate opportunities to convert interest to sales, but because two-thirds of the decisions customers make are informed by the quality of their experiences all along their journey.

According to a research article from McKinsey entitled, ‘Digitizing The Consumer Decision Journey’, digital channels are at the center of this transformation. “Under this scenario, digital channels no longer just represent ‘a cheaper way’ to interact with customers; they are critical for executing promotions, stimulating sales, and increasing market share.”

Gemma Godfrey, Founder and CEO of the soon-to-be launched digital wealth management firm, Moo.la, agrees, “The most significant trend for 2016 will be the increased focus on delivering a digital service and experience built around customer needs. The pressure is on for incumbents to evolve or collaborate. Likewise, the doors are opening for greater innovation, as disruptors or enablers.”

Steven Ramirez, President of customer experience consultancy, Beyond the Arc, asks the question, “Has your company ever mapped out the process of opening a new account and trying to expand a relationship? Do your customers have to fill out a lot of paperwork to get started? You may be shocked at how many steps new customers need to take, and how much time the process consumes. We must make it easier for companies to welcome, onboard and sell to customers.”

“In 2016, and over the years to come, retail banking will lean on UX (user experience) to design more than a ‘mobile first’ experience. Experience architects will rethink what a bank is and what it means to digital-first and mobile-only customers, designing an entirely new set of products that will lead to new types of relationships. It’s innovation and disruption over iteration. The ‘uber of banking’ is imminent.”

Brian Solis, Principal Analyst for the Altimeter Group and author of the bestselling book, X: The Experience When Business Meets Design

“Banks who don’t have a strategy to build authentic relationships with digitally native customers will continue to feel pressure as their customers leave their branches and head online.”

– Josh Reich, CEO and Co-Founder of Simple

“Less is more in the customer experience. Some banks will realize they can’t hit mobile users who log in 30 times a month with the same 5 product pitches and will offer a choice of music, news, entertainment (assuming a difference) or content like The Onion, letting customers design their experience and perhaps share it with friends.”

– Tom Groenfeldt, writer for Forbes

“To defend their position against new players and enhance the overall experience, banks must drive towards a cohesive, integrated ‘Digital Banking Ecosystem’ — embedded in the organization’s culture, serving customers and empowering staff.”

– William Sullivan, Head of Global Financial Services Market Intelligence for Capgemini

“Digital marketing strategy must be planned around consumer buying journeys as consumer shopping behavior for financial services continues to evolve. Financial institutions have the opportunity to utilize marketing automation to capture a consumer’s basic information early in their buying journey and then use contextual marketing to guide the consumer towards purchase, adoption, and ultimately advocacy.”

James Robert Lay, CEO of CU Grow

“Delivering an exceptional mobile user experience will continue to grow in importance. In addition to innovations in the areas of new account opening, mobile payments and contextual offers, mobile use cases will expand beyond just banking features and be limited only by consumer creativity.”

– Steve Luong, Director, Product Marketing at Kony, Inc.

“With more touchpoints, mapping the customer journey becomes critical to an enhanced customer experience. Understanding where consumers start, how they use channels in tandem, and where they stop along the way will be essential to managing relationships in the future.”

– David Kerstein, Founder of Peak Performance Consulting Group

“We will see smaller financial institutions (especially those in communities with populations greater than 100K) begin to realize they can’t just talk about the future of banking as consultative, without taking real steps to be more than an outlet for transactions.”

– Jim Perry, Senior Strategist at Market Insights

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

“Designing brand new experiences for consumers will be imperative as separate digital and branch channels no longer exist. Personal interactions enabled and supported by digital capabilities will create the experiences consumers want from their banks.”

– Jim Cross, VP, Retail Product Development at Fifth Third Bank

“Consumers are craving for a unique, customizable financial experience with an institution that’s fiscally and socially responsible. This lends itself to the community banking model. Despite mounting regulatory challenges and competition, community banks can remain competitive because of nimbleness in making decisions. If a $250-million-asset institution in a heavily banked marketplace can achieve these results, then any community bank can!”

Jill Castilla, President and CEO, Citizens Bank of Edmond

“Customers of banks will become users of banks. Banks will become slaves of those who own the customer experience (Samsung, Apple, Google and Alibaba).”

– Peter Vaner Auwera, Co-Founder of Innotribe

“Design will become more important in the online and mobile environments. It’s time to make your digital platforms stand out by using small design elements that delight customers and put a smile on their faces.”

– Ross Methven, Director of Client Services of Mapa Research

“There will be investment in niche areas like gamification that will help improve customer experience and increase customer retention quickly – as the larger banks begin to compete with smaller banks as well as consumer fintech firms.”

– Devie Mohan, Fintech Strategist, Researcher and Speaker from Thomson Reuters

And last, but certainly not least regarding the improvement of the customer journey …

“Finally, can we stop hyperventilating over technology and double-down on delivering personal customer experiences? That’s what this is all about, right?”

– Neff Hudson, Emerging Channels Executive at USAA

3. Making Big Data Actionable

Capturing and using consumer insight can be an important differentiator for organizations hoping to build new relationships and solidify those relationships already in place. In fact, CapGemini found that over 60% of financial services institutions in North America considered data analytics to be a source of a significant competitive advantage. In addition, over 90% believed that “successful data initiatives will determine the winners of the future.”

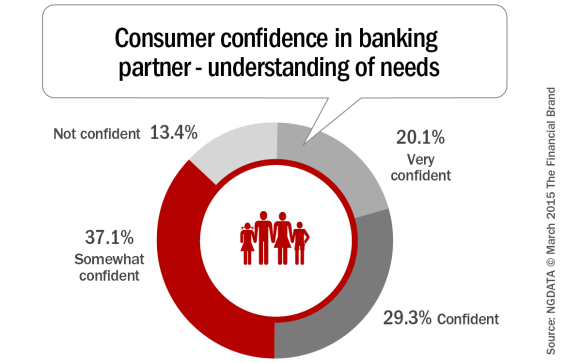

Despite this potential to leverage data to understand and serve consumers, only one-fifth of respondents to a survey from NGDATA felt very confident that their financial institution understood them. More than 50% of those surveyed were only somewhat confident or not confident at all that their bank or credit union understood their needs.

There is technology available today that provides the flexibility and scalability required to support a much more effective approach to data storage, data analytics and data utilization. New approaches to data storage allow for easier collection and a greatly expanded capacity for storage and analysis at a lower cost. Visualization and reporting platforms also offer a view into data only dreamed of just a few short years ago. In other words, what was once the domain of only the ‘big boys’ is now accessible to banks and credit unions of all sizes.

But, having access to data and the ability to process this insight is not enough. Consumers expect their financial institution partners to be able to provide real-time recommendations based on changes in their financial profile. According to Mary Beth Sullivan, Managing Partner, Capital Performance Group, “Banks of all sizes will leverage data and technologies to help customers make better financial decisions – improving the ability to save money, achieve specific financial goals, increase financial knowledge, better budget spending, etc. For many banks, this will entail partnering with technology partners rather than building in-house.”

“Financial institutions will heighten their focus on deepening engagement with both their customers and employees through real-time access to actionable intelligence and tools designed to make their lives (and jobs) easier”

Jenni Palocsik, Director, Solutions Marketing, Verint

“Contextual data analytics will introduce more intelligence into each customer contact, laying the groundwork for augmented intelligence towards the end of the decade.”

– Chris Skinner, best-selling author and President, Financial Services Club

“Banks will stop talking about gathering big data and starting using big data to make a difference for the consumer. We will see the integration and synchronization of data sources, enabling real-time determination of relevant data points for 1) analysis, 2) communication and 3) decision making – the ‘trifecta’ of big data.”

– Beth Merle, VP, Enterprise Solutions at Epsilon

“Pressure from millennials and Gen X will force banks to utilize data analytics much more effectively to anticipate customer needs and deliver a value enhancing experience similar to what they receive from their most used non-financial applications.”

– Luveen Sidhu, Chief Strategy and Marketing Officer at Bankmobile

“Advanced analytics will allow data to take on ‘human-like’ characteristics, being real time, forward looking, and becoming a powerful currency in the race for fintech supremacy.

– Rob Findlay, SVP, Experience Design for DBS and Founder of Next Bank

“2016 will mark the year fintech and martech begin to converge. Organizations will better understand each of their opportunities (from the device ID to end of life of the accountholder), creating ever-evolving user profiles of consumers and automating actions across every point of interaction regardless of channel!”

John Waupsh, Chief Innovation Officer, Kasasa by BancVue

“Banking will use data initially for improved targeting of specific user segments for marketing, and eventually to provide advice and drive engagement. Banks that move first will see the greatest advantage – but, soon this level of targeting will simply be table stakes.”

– Matt West, Global Strategic Account Executive, MX

“For many organizations, digital experiences have been designed like billboards and offered up bland experiences. Going forward, technology will pay off on the promise of personalization and enable in-house teams to become savvier.”

– Craig McLaughlin, CEO of Extractable

4. Introduction of ‘Optichannel™’ Delivery

Digital technology is evolving rapidly … and consumers are adopting to new technology at record levels. The industry has experienced double- to triple-digit growth in mobile banking users over the last several years. The result is explosive growth of a hyper-connected customer base, connecting to their financial institutions through multiple channels and devices.

These consumers demand financial services to be available and delivered to them as seamlessly and ubiquitously as any transaction they complete with Amazon or other non-financial partner. And it’s not just about improving customer service … it’s about delivering both service and sales through the channel the consumer chooses to use.

Beyond multichannel (delivery on multiple platforms), or omnichannel (delivery through all channels similarly), an ‘optichannel™’ experience delivers solutions using the best (optimum) channel based on the customer’s need and preferred channel. In other words, rather than offering all channels for a specific solution, big data will enable an organization to point the consumer to the channel that will provide the best, personalized, experience.

‘Optichannel delivery’ may eliminate channels and products as we know them today altogether according to Brett King, best-selling author and CEO of Moven.

“2016 will be the year we start to say goodbye to traditional bank products like the credit card, and fixed deposit, in favor of embedded banking experiences. You’ll get emergency cash at the groceries, in-store financing for that new iPhone or VR Goggles, and savings triggered via wearables, with interest rates determined by social media and behavior. None of these will ever have a paper application, need a signature or be based on a card.”

Brett King, best-selling author and CEO of Moven

Get the 2016 Retail Banking Trends Report

The integration of processes from the consumer’s perspective is foundational to the optichannel theme. “Rather than looking at channels independently, banking needs to develop and provide financial tools that are integrated in daily life,” states Nicole Sturgill, Principal Executive Advisor for CEB TowerGroup.

Digital teams will shift emphasis away from a narrow focus on online account opening towards a more omni-channel view – how digital can work seamlessly with the branch through the purchase funnel, to drive higher awareness, consideration, and purchase, wherever the actual final purchase occurs. ‘Bricks and clicks’ anyone?

– Sherief Meleis, Managing Director at Novantas

“After several years of reviewing channel options, many financial institutions are moving from an ideal to a reality in rolling out omnichannel banking, which together with digital banking and analytics initiatives serve as a springboard for deeper customer engagement and delivery of an outstanding customer experience.”

– Ed O’Brien, Director, Banking Channels at Mercator Advisory Group

“In the upcoming election year, customers will vote for their preferred bank based on the quality of mobile offering. Organizations that invest more in this technology will see loyalty and revenues grow.”

– Deva Annamalai, Director, Innovation and Insights at Fiserv

“The proliferation of channels will begin to consolidate and improve in efficiencies. Account-as-a-Service platforms are a great example of how organizations of all sizes can offer customers a single, optimum channel account experience.”

– Stacey Zengel, President of Jack Henry Banking

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers. Read More about Send the Right Offers to the Right Consumers Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand. Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Send the Right Offers to the Right Consumers

Navigating Credit Card Issuing in an Uncertain Economic Environment

“The digitization of banking will continue to have far reaching implications, as financial institutions work to encourage adoption of self-service options and adapt branch networks to suit the changing ways people access financial services.”

– Kevin Tweddle, President, Bank Intelligence Solutions at Fiserv

“We are at an inflection point where account openings and advisory services will be delivered remotely. This will represent a fundamental shift, where the physical branch will support the digital channels, rather than the reverse.”

– David Kerstein, Founder of Peak Performance Consulting Group

“The future retail banking and wealth management ecosystems will include simplifying the research content, delivering contextual alerts and designing channels to convey the feeling of thoughtfulness, intelligence and other values that your brand stands for.”

Jin Kang (Zwicky), VP, Experience Design at OCBC Bank

“Banks will continue to consolidate branches, increase self-serve/automation, reduce tellers and add universal bankers to capitalize on relationship building opportunities while dealing with shrinking branch traffic.”

– Alpine Jennings, Partner at StratAgree

“Community banks will continue to struggle to find the right balance between mobile and the physical branch. Their challenge is to promote digital convenience without creating a sense of moving away from offering a less personal banking experience.”

– Lori Philo-Cook, Owner of Innovo Marketing

“The biggest story in banking is still capital controls and the need to transform cost. We’ll see a continued focus on reducing footprint and increasing automation.”

– Simon Taylor, VP, Entrepreneurial Partnerships at Barclays

“Designing a ‘digital personality’ is one of the most significant components to building a competitive advantage in the financial services industry”

– Jin Kang (Zwicky), VP, Experience Design at OCBC Bank

“While innovation and digital channels are important, consumers still love the humans in their branch. Branch evolution will continue where routine transactions move to digital channels, and delivery becomes even more advice-centered.”

– Dominic Venturo, Chief Innovation Officer at U.S. Bank

“Many banks will finally realize that their website, if done right, can generate multiple times more leads than their best branch.”

– Chris Nichols, Chief Strategy Officer at CenterState Bank

5. Expansion of Digital Payments

The ‘2015 North America Consumer Digital Payments Survey‘ found that while the number of North American consumers who know they can use their phones as a payment device jumped nearly 10 percentage points since last year, to 52%, actual mobile-payment usage remained flat. The percentage of consumers who used their mobile phones to make at least one payment a week grew only 1 percent, from 17% in 2014 to only 18% this year.

“Though it’s clear that consumers are aware that they can make payments through their phones, continued use of existing payment methods — such as credit cards and cash — and slow retail adoption of modern card readers has caused usage levels to remain stagnant over the last year,” said Robert Flynn, managing director for Accenture Payment Services in North America.

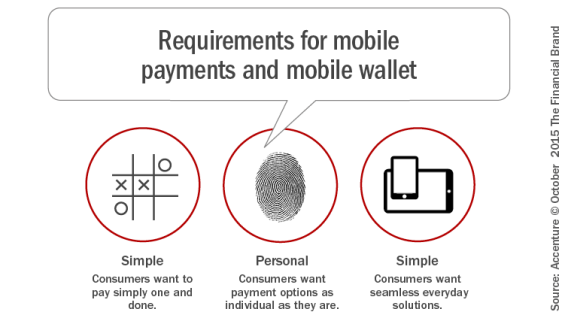

Accenture came to three conclusions around the types of digital payments solutions consumers are seeking.

- Simple: Consumers want to pay simply – one and done

- Personal: Consumers want payment options that are as individual as they are

- Everyday: Consumers want seamless, everyday solutions

Part of the problem may be confusion, according to Bradley Leimer, Head of Innovation, Santander Bank, NA. “Everyone seems to be building a wallet, a loyalty app, and value added services around payment data. And to consumers and merchants, it’s a complete mess.” These same concerns prompt Alex Jimenez, Digital Banking and Payments Strategist, to state, “Mobile payments will continue to increase in adoption, but it won’t set the payments industry on fire – we are still a while before a tipping point in mobile payments.”

“For the past few years, a number of technologies have been rising in a perfect storm: cloud, Big Data, mobile apps and more. In 2016, the eye of the storm will hit as we see a massive focus upon mobile wallet development to increase usage from Chase, Samsung, Apple and Google wallets.”

Chris Skinner, best-selling author and President of the Financial Services Club

“As the digital payments trend continues, security remains a top concern to consumers. This year’s EMV compliance deadline in the U.S., combined with the launch of several new mobile wallets including Chase Pay, Samsung Pay and Android Pay, means it is essential to continue developing new strategies for fraud detection and prevention.”

– Chuck Fagan, CEO of PSCU

“The continued growth of digital payments and the change in ACH processing, specifically real time capabilities, will result in financial institutions coming to terms that they must evolve. I predict the potential for more standardization in how payments are processed as well.”

– Howie Wu, Vice President of Digital at BECU

“Payments getting shoved into everyday things like wearables disguises the more important effort of representing a beachhead in establishing trust between devices, by using tokenization as the vehicle to store items of value in untrusted devices.”

Cherian Abraham, Director, Mobile Commerce and Payments at Experian Decision Analytics

“In Africa and Asia, we will see digital/mobile money systems inter-connecting, using the network effect to seek volumes and scale. These systems will extend to merchants. Some of these systems will form regional multi-currency hubs. East Africa will be the hotbed for such innovations, probably laying the ground for a new digital economy in the years ahead.”

– Kosta Peric, Deputy Director, Financial Services at Bill & Melinda Gates Foundation

“The uncertainty of whether to swipe or dip, and the additional time it takes to process the transaction will push many to give their mobile pay app a try. I would not be surprised to see a doubling in the use of mobile payments.”

– James Anthos, Senior Vice President at BB&T

“2016 will see demonstrably higher payment volume from Apple Pay and others – more so through when bill payment providers are integrated in-app, as compared to P2P or retail”

– Cherian Abraham, Director, Mobile Commerce and Payments at Experian Decision Analytics

“More payments will move to wearable devices as manufacturers incorporate token payment support. Mobile overall grows, as more retailers will adopt contactless payment support.”

– Dominic Venturo, Chief Innovation Officer at U.S. Bank

“By the end of 2016, I predict that 8 of the top 11 retailers will announce a mobile wallet, while less than 5 of the remaining top 100 retailers will do the same. In addition, 6 of the top 10 U.S. card issuers will announce a mobile wallet, with at least one of the credit union associations announcing a mobile wallet that can be leveraged by any of their members. Finally, I think Microsoft will announce a wallet along with at least 1 Telco.”

– Peter Olynick, Card and Payments Practice Lead at Carlisle & Gallagher

6. Executing on Innovation

Increasing consumer expectations, the influx of fintech competitors and the reduction in margins are forcing banks to rethink their current business models and sources of revenue. Although innovation is a proven path to differentiation and competitiveness, the banking industry’s short-term focus, siloed approach to operations and risk-averse culture work against the potential for meaningful advancements.

Start-ups embody the core principles of innovation to drive commercial success. They embrace risk-taking and failure, while rewarding success. They are agile and can pivot immediately to meet market demand. Because they are usually small, they can think big. But because they are small, scalability can be a challenge.

The question is whether banking can replicate the best of fintech start-ups, while leveraging their customer base scale advantage to respond to a changing marketplace? Or, will the majority of the industry need to be a fast-follower or laggard … with the inherent risks?

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

According to James Haycock, managing director of Adaptive Lab and co-author of the book, Bye, Bye Banks, “There’s been a lot of hype about innovation and the banks are investing heavily, but the consumer has yet to see much of the outcomes. The struggle is access to customer data through bank’s legacy technology, the comfort with being more experimental due to the risk of brand damage, escalating research and development costs, and the underlying conservative culture of banking.”

Maria Jose Jorda Garcia, from BBVA believes the tide is turning, “I believe that after this tactical and in some cases uncontrolled year of investments trying to be part of the innovation game (fintech investments, open competitions for banking challenges, creation of innovation boards, structures and tools to generate ideas, and in some cases, partnerships or acquisitions), 2016 will be the year we see banks trying to get value out of those investments.”

“2016 will see the construction of larger sandboxes by the banks. The current legacy infrastructure doesn’t allow for enough play with fintech partners. No play, and no room for real experimentation, results in no real change.”

– Sam Maule, Emerging Payments Practice Lead at Carlisle & Gallagher

“Decentralized IT and blockchain fintech startups will be a focus area for VCs, and in general, VC focus will change from B2C to B2B. Security, analytics and artificial intelligence are areas of special interest.”

– Frank Schwab

“We’ll see more large financial firms investing in internal business incubators and innovation labs and pursuing research and development between their own walls. This will include bringing more design capabilities in-house. These trends will require a culture shift and more courageous enterprise risk management policies”

Tim McAlpine, President & Creative Director, Currency Marketing

“More banks will open up their APIs, and there will be more innovation labs operating within financial organizations, which will enable experimentation with startups and new innovation technologies.”

– Elizabeth Lumley from London MD Startupbootcamp Fintech

“Innovation programs and incubators at large banking organizations will increasingly start paying off, with a number of banks launching homegrown offerings that get serious traction.”

– Nick Bilodeau, Head of Insurance for Canada at American Express

7. Exploring Advanced Technologies

There is no question that technology is changing banking. From online, to mobile to wearables, the advancements in digital technology are moving faster than most banking organizations can handle. This wasn’t lost on our panel of experts, as they looked into their crystal balls to make educated guesses as to what we could expect in 2016.

While there will be a great deal of debate as to the likelihood of any of these trends gaining traction in the next 12 months, most panelists believe the debate can only be around timing.

— Blockchain —

According to an excellent overview done by Simon Taylor from Barclays, blockchain technology presents both opportunities and obstacles. “While it’s clear that the security and controls associated with blockchain technology will need development before many of these applications can become mainstream, the opportunities are so significant that it’s a question of when, not if, these applications will emerge,” said Taylor. “The technologies around bitcoin have the potential to transform many different processes, and companies should be discussing these developments at the board level and asking how this technology could help them and whether they should be investing in it.”

“Blockchain for shared ledger structures will be a hot topic for 2016, as it enables any financial counterparties to exchange value with trust in real-time for almost free, stated Chris Skinner, best-selling author and President of the Financial Services Club. “This has been discussed in 2015, but will make an even more dramatic impact in 2016.”

Chris Fleischer, Market Research Manager for D+H, has a more pragmatic perspective, “While the industry is exploring the innovative potential of blockchain technology, the great majority of banking firms are focused on ‘blocking and tackling’ trends that might not be as sexy, but impact the operations daily and for the foreseeable future.”

“Blockchain technology will move into the correspondent banking business, with a community-lead approach.

- financial inclusion in developed markets, focusing on under banked and millennials. Financial Inclusion for underbanked will have an unprecedented focus.

- crowd funded micro insurance in emerging markets”

– Matteo Rizzi, Co-Founder of FinTechStage Limited

“I see the progress in blockchain and distributed ledger technology in 2016 … with 2016 potentially being the first year of ‘blockchain banking’.”

– Roberto Ferrari, General Manager at CheBanca!

“The distributed ledger architecture will see the first real world applications with instant settlements between financial providers along some high-volume cross-border routes. Another application will be notarization of physical or digital assets. Finally, I predict the availability of digital lockers accessible through biometric authentication, and again they may come first in Asia or Africa.”

Kosta Peric, Bill & Melinda Gates Foundation

“The race to establish open standards tech stacks in the blockchain space will accelerate and leave casualties in its wake. The casualties will be those that want to own the entire stack and intend on having banks and markets captive to their solutions.”

– Pascal Bouvier CFA, Venture Partner at Santander InnoVentures

— Robots and AI —

The primary opportunity for robots and AI tools in the banking industry at this time is that they can extend the creative problem-solving capabilities and productivity of human beings and deliver superior business results, states Cognizant in a report on the use of this new digital technology. Their research shows that through these technologies, humans have the potential of attaining new levels of process efficiency, such as improved operational cost, speed, accuracy and throughput volume.

The opportunity for cost savings is the first place where AI and process automation will impact banking. In the Cognizant study, 26% of banking respondents stated they have enjoyed 15%-plus cost savings from automation in their front office and customer-facing functions compared with one year ago, and 55% expect those same levels of savings (15% or more savings) within the next three to five years.

According to Cognizant, the top drivers for automation beyond cost savings include:

- Reduced error rates (21%)

- Better management of repeatable tasks (21%)

- Improved standardization of process workflow (19%)

- Reduce reliance on multiple systems/screens to complete a process (14%)

- Reducing friction (11%)

“Less than a month after Google introduced public APIs for its AI engine, Facebook followed suit and Elon Musk led the the $1B founding of OpenAI. Together, they accelerated and democratized the development of AI by a decade, with finance most likely going early.”

– Neff Hudson, Emerging Channels Executive at USAA

Advances in machine learning and AI’s will start infiltration of financial processes. They will asses risk and reward. AI’s will not only provide solutions for customers, they will also integrate with processes such as compliance, information security and more.”

– Mike D. King, Owner of Bankwide

“While AI won’t get quite to the levels of hype that blockchain is receiving, AI has the potential to really move the dial on operating costs and bring the power of digital servicing to the masses through natural language processing and interactions.”

David Brear, Chief Thinker at Think Different Group

“Robotics will be used more in banking services – physical robots in the branch environment and software robots in customer advice and back office processing will become more the norm.”

– Makoto Shibata, Head of Global Innovation at Bank of Tokyo-Mitsubishi UFJ

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

— Internet of Things —

The Internet of Things is defined as a way for devices that are connected to the Internet to communicate and share information with other ‘smart’ devices in real time. In context, these sensors would leverage the capabilities of big data, analytics and even artificial intelligence to anticipate needs, solve problems and improve efficiency.

“By enabling the collection and exchange of information from objects, the IoT has the potential to be as broadly transformational to the financial services industry as the Internet itself,” states Jim Eckenrode, executive director of the Deloitte Center for Financial Services and the author of the Deloitte report, How Financial Services Can Make IoT Technology Pay Off.

With the deployment of as many as 25 billion new endpoints, there will be opportunities for all industries, including banking. The Deloitte analysis suggests that as many as one-quarter of sensors deployed in 2013 could be of use to FSIs, rising to one-third in 2015 and then to about 50% by 2020.

“It seems to me that there are probably three main ways that banking will intersect with the Internet of Things in the foreseeable future, says Dave Birch, from Consult Hyperion. “The first, and to me most interesting, is the issue of identification and authentication. This is an area where banks ought to be able to deliver interesting new services to customers, building them around the idea of safekeeping and privacy. The second is in terms of instrumentation for risk management. The third may be in the area of payments.”

“The impact a connected world will have on our daily habits is as large as the Internet itself. As mobile connectivity brought the world of information and context to our daily life, autonomous devices will start driving new value into our life to save the most precious commodity of all – time.”

Bradley Leimer, Head of Innovation at Santander Bank, NA

“The Internet of Things” (Iot) will slowly come of age and offer opportunity to innovators in fintech and financial services. Much of this will be driven by mobile and our on-demand economy, which will result in the ‘uberfication’ of everything.”

– Bryan Clagett, CMO of Geezeo

— Authentication —

As knowing your customer (KYC), privacy and identity protection becomes more important, we are constantly seeing new approaches to how consumers’ identifications are managed and delivered as parts of key economic activities – account opening, check-out, payments, critical services, immigration/border control etc. As various countries from the UK, New Zealand to Italy and Nigeria work to create their own national identification schemes, consumers are challenged by questions such as, “Which document do I carry?”, “Which document will be most broadly accepted?”, and “Which authentication process is the most secure?”

The greatest challenge facing all of these proposed solutions is uniform acceptability. In any counterparty relationship, there are two parties who must work with each other to agree a common standard or protocol. For identification, one party (usually the customer) must possess a current and valid form of the required information, and then must provide it to the other counterparty (the vendor) who must equally accept and recognize it as a sufficient form and type of verification.

“The trend that stands out for me in 2016 is the renewed focus and interest around authentication and digital identity. Apple led the way in showing how device-based biometric authentication can be used in payments. We will see increasingly more banks exploring how similar approaches can be used to authenticate customers for a broad range of activities.”

Zilvinas Bareisis, Senior Analyst for Celent

Andra Sonea, Lead Solutions Architect at Lloyds Banking Group agrees, “A true banking ‘customer view’/identity does not exist in a way that it should in a digital business – authenticated, rich, accessible in real-time for making real-time decisions. I can just hope that we will see some focused work in this respect as the current technology allows us to do things we didn’t even dream of in banking.”

“Both the complexity and tediousness of such a task for the service provider implies that we will see a ‘Stripe for KYC’ very soon, who will wrap ‘Know Your Customer’ (KYC) processes to perform the function in the most clean, and scalable manner,” added Cherian Abraham from Experian Decision Analytics.

8. Emergence of a New Breed of Banks

As legacy banks deal with outdated core systems and processes steeped in tradition, more and more challengers are entering the competitive fray, willing to fill the gap in digital expectations of an increasingly mobile consumer. Not totally unlike the ‘free banking’ era in the U.S. during the mid-1800’s, there is a growing energy in the U.S., U.K., and globally around the establishment of new banking organizations to better serve the changing needs of today’s consumer.

The term ‘challenger bank’ is widely used as a description of a banking organization, started from the ground up, and built without relying on another banking firm for back office support. These are found less in the US, but are gaining steam in the UK, where regulations have made getting a banking license less cumbersome.

Most challenger banks focus on underserved markets, products or channels, and are not really challenging larger, established banks for market share at this time. However, challenger banks provide two important economic functions according to a KPMG report. “Firstly, they are in themselves picking up the white space left behind post-financial crisis. But perhaps more importantly, they are starting to drive incremental innovation in the wider market.”

“Challenger banks, while still in their infancy, are set up with the customer at their heart and technology at their brains. They have no legacy, no wrongs to right, but equally no customers yet. They are not to be underestimated, but 2016 will determine how much of a success they are.”

David Brear, Chief Thinker at Think Different Group

Get the 2016 Retail Banking Trends Report

Chris Gledhill, CEO and co-founder of the UK challenger bank-to-be, Secco Bank, says, “In 2016, we will see legacy banks pairing off with challenger banks like the investment by BBVA into Atom. Similar to many fintech firms, challenger banks have vision, innovation and talent but lack money, customers and a license. Big banks have these advantages. It’s a perfect match. Just don’t be a Big Bank left partnerless when the music stops!”

According to our crowdsource panel, these smaller challenger banks may not be the only breed of competitor to deal with.

“2016 could be the year that one of the tech giants show their hand in financial services. If this occurs, this will mean profound cultural change that will make legacy firms consider new data and relationship driven business models, leveraging exciting new technologies, AI, advanced analytics and more.”

Duena Blomstrom, Fintech & Digital Experience Specialist, owner of Duena Blomstrom Consulting

“Most of what we learned from fintech disruption in the past will become irrelevant if pure tech players, such as Google, Facebook or Apple venture into financial services with their economies of scope and ability to make platform plays at unimaginable speeds and scale.”

– Peter Vaner Auwera, Co-Founder of Innotribe

“A concern for legacy banks is the potential arrival of big ecosystems that the tech and telco companies possess. These firms are very customer-focused, with the ability to push financial services to their own customer bases.”

– Alessandro Hatami, Founder of The Pacemakers

9. Mining New Talent

A major barrier facing the banking industry in their quest to modernize their technology is the need to hire the right talent. As banking organizations compete with all industries for many of the same types of skills, banking is not viewed as the most exciting career opportunity, especially by millennials.

‘Being digital’ requires rethinking all aspects of how we conduct banking in the eyes of our employees and in the yes of the increasingly digital consumer. Changing internal processes, moving to contextual engagement and operating in real-time are all foreign concepts for most financial institutions. A major internal change will also include the increased use of data and analytics to initiate and support decision making, product development and distribution.

Attracting and retaining top digital talent that can support this internal culture shift will become a priority in 2016. According to Accenture, “Sixty-one percent of digital organizations see shortages of digital skills as a top challenge in digital transformation, and are concerned about how they can attract and retain top digital talent.”

“Currently, having somebody whose job is digital, in a bank, says a lot about the organizations in that it is something bolted on, rather than something that is fundamental, says Anne Boden, CEO of Starling Bank in the UK, ” The people who are really creating waves in data and technology are not sitting in banks. They’re sitting elsewhere.”

“It is imperative that we find experienced talent to develop disciplines like Design Thinking, Lean Start Up and proper Open Innovation, says Maria Jose Jorda Garcia, from BBVA. “These three capabilities allow a banking organization to design for the customer, to speed up value delivery, and to create those customer experiences that we are all aiming for.”

“The most impactful changes will be inside the banks and probably invisible outside for a while longer. These will be within the Executive Leadership teams and the board of directors.”

– Daryl Wilkinson, Managing Partner of Lab12 Innovation

“The vast majority of the leadership of banks don’t understand exactly how digital works and are very worried about the concept of becoming a ‘digital bank’. They have a subset of a subset of a subset of their employee base running large percentages of their business without the leadership knowing exactly what’s going on inside.”

– Alessandro Hatami, Founder of The Pacemakers

Beyond technical talent, it is believed that a diversity of talent is needed to reflect the diverse marketplace:

“Reflecting the growing prominence of women in key positions in other industries, 2016 will be the year of diversity, with women in fintech (‘see this excellent website curated by Sam Maule, from Carlisle & Gallagher on FemTech leaders) arising and taking leadership positions across start-ups and legacy organizations.”

– Claire Calmejane, Director of Innovation at Lloyds Banking Group

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

“Numerous studies across industries illustrate that more diverse companies outperform their counterparts. In 2016, conscious inclusion will occur at all levels and will be part of board room discussions and executive plans.”

– Lisa Kuhn Phillips, Founder of inaVision, LLC

10. Responding to Regulatory and Rate Changes

New European regulations requiring banks to offer APIs to the open market is set to have enormous impact. This is both a threat and an opportunity, with many banks not having worked out a response yet. Delivering on the opportunity will be a significant challenge, since legacy technology makes it difficult to keep pace. While there is no comparable regulation in the US, loosening the requirements for challenger banks, it will continue to be important to move in lock step with future changes.

“Regulation has the potential to create an industry dynamic that changes banking forever, states Jake Chambers, co-founder of Lab12 Innovation. “By deciding the basis of competition, from PSD2 and beyond, regulation could fuel competition, change and innovation or it could protect the stays quo. Which way it goes will be the biggest single determinant of the future of the industry in the UK.”

“Regulators are increasingly focused on fintech upstarts. 2016 will be the year it is decided where and how to tighten oversight vs. create a sandbox to protect innovation. They will do both – the question is, who will get which treatment?

– Jennifer Tescher, President and CEO of The Center for Financial Services Innovation

“In the US (where checks are still widely used), regulation around overdrafts is expected mid-year. If regulators do move forward with the kinds of limits floated recently, banks will be busy adding fees, which could be an avenue for non-traditional banks to stand out.”

– Alex Jimenez, Digital Banking and Payments Strategist

“Rising interest rates, which might not become significant until 2017 or later, will challenge young bankers who have never even heard of passbooks. How do you market and compete on interest rates? And how will the digital banks put pressure on banks with expensive legacy technology and legacy branches?”

– Tom Groenfeldt, writer at Forbes

“With the Fed increasing its base interest rate, the rest of the world is on notice that all our costs will soon go up. We have had it so good for so long, but change is imminent and that will affect our behavior more than any other industry trend in 2016.”

– Alex Jimenez, Digital Banking and Payments Strategist

“As rates rise, deposit teams will realize that broad brush ‘front book/back book’ promotional pricing techniques are too blunt an instrument, and will increasingly test market, segment and customer-level targeting of promotional pricing. This will allow banks to be competitive with higher rate competitors and selectively grow deposits from rate sensitive customers without re-pricing the entire portfolio, keeping interest rate ‘betas’ reasonable as rates rise.”

Sherief Meleis, Managing Director at Novantas

Summary

“2016 will more dramatically underscore the difference between the winners and the losers, as the ebbing tide of interest rates and the economy will expose those who are not investing in new ideas and new technology to improve efficiencies and customer experiences, states JP Nicols, President and COO of Innosect.

Jim Bruene, Editor and Founder of Finovate, added, “2016 will be a year of execution, as a number of big trends begun in the 2008 recession move mainstream (mobile, P2P lending, robo-advising, biometrics, etc.). I also expect the large financial brands to roll-out formidable solutions, often powered by the very upstarts bent on disrupting them.”

Finally, Penny Crosman, Editor in Chief for Bank Technology News may sum up the upcoming year the best, “Banks will step up their game technology-wise; they’ll continue to partner with fintech startups and they’ll begin rolling out useful mobile wallet apps that compete with Apple Pay, Samsung Pay and Android Pay. They will also start to pilot and deploy blockchain-style software for payments, trade finance and securities settlement. Finally, they will also find a mutually agreeable way of sharing customer data with data aggregators and personal financial management providers, to deliver a better customer experience.”

A Note of Thanks

We would like to take this opportunity to thank the close to 100 member crowdsource panel that assisted in the development of this expansive annual report. The insight shared was extraordinary and the continued support of this effort is greatly appreciated. There is no place that we know where more diverse and in-depth insight is available. In combination with the research done by the team at the Digital Banking Report, we believe we have the best source for what will most likely happen in banking in 2016.

We would also welcome any comments or discussion around 2016 trends believed to be missed or shortchanged. Nobody’s perfect, and it would be great to receive even more insights for the readers of this article.

Finally, we would like to thank the sponsors of this year’s research. Kony, Inc.