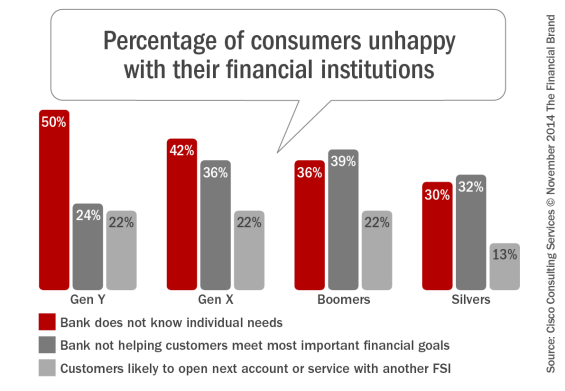

According to a study from Cisco entitled “Reimagining the Digital Bank,” 43% of consumers believe their bank does not know them, and consequently cannot deliver personalized service. In addition, 31% believe that their bank is not helping them reach their primary financial goals and 1 in 5 respondents said they will switch financial institutions for personalized Internet of Everything (IoE) enabled services.

Broken down by demographic segments, younger consumers are more likely to believe their financial institutions doesn’t know their needs, while older demographic segments are more likely to feel their bank is not helping them meet their financial goals. The result a belief that an alternative provider may serve them better across all demographic segments.

On a more positive note, the research found that financial institutions have an enormous opportunity for growth if they can become just as digitized as their customers … in the branch and through online and mobile channels. The research findings indicate that it isn’t only Millennials and Generation Y that respond positively to technology innovations, but that consumers from all age groups have a desire for technology that opens the opportunity for personalized anytime, anywhere service in their banking relationships.

More specifically, the study shows that there is a significant opportunity for retail financial institutions to evolve to a digital business model to reduce attrition and increase customer wallet-share by utilizing IoE enabled technologies to:

- Deliver more personalized and convenient services, with 53% of respondents looking for remote advice delivery outside of the branch

- Apply analytics to better understand consumer behavior, with 73% of respondents interested in one or more analytics-based banking tools and apps

- Provide integration of physical and virtual channels to deliver services on-demand, with 24% of respondents stating they would invest more of their assets and 26% stating they would buy additional products

While all age groups desire greater digital engagement, the main difference between them lies in their acceptance of risk. “All consumers are interested in being assured the security is there,” said Paul Jameson, managing director of global industries at Cisco. “But, millennials are much more risk-oriented than their older counterparts. Acceptance [of risk] is getting pretty high. They’re waiting for the banks to start.”

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

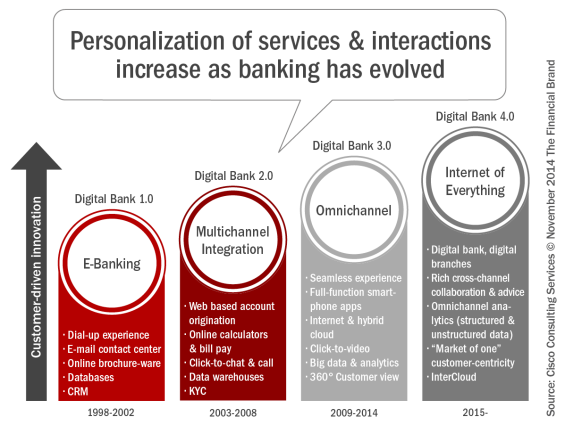

Digital Bank 4.0

The transition of the banking industry over the past two decades has been historical, following the path from online enabled capabilities, to multichannel integration, to more seamless full-function solutions that leverage mobile devices and big data analytics. According to the Cisco research, the next stage of banking evolution will make transactions so convenient and automated that they will appear virtually invisible to the consumer, but will deliver value added benefits beyond the transaction.

“A simple payment with a mobile phone will be transformed into a service that helps the customer receive, organize, and redeem offers from his or her favorite retailer. A visit to a ‘typical branch’ or the online banking site will be transformed into a meeting with a highly qualified financial planner about the consumer’s retirement strategy. Online and mobile services will provide tailored advice, even without an advisor, through analytics.”

In this emerging stage in banking, IoE enabled solutions can help financial firms deliver the type of multichannel, personalized experiences that other innovative industries are beginning to offer.

Demand for IoE-Enabled Services

With digital technology already permeating consumer’s lives, the expectations from financial institutions are increasing. These include advancements in video delivery, mobile payments, wearables, augmented reality and digital advisory services.

Some of the findings in the Cisco study include:

Video: A wide range of customers are interested in a “remote advisor” service that connects financial experts to customers via high quality video from the branch or a mobile device.

- Regardless of the mode of delivery, customers want the ability to chat with a trusted adviser, but the experience and relationship must feel like an in-person interaction

- 54% of U.S. respondents seek remote-advice delivery outside the branch

- Top preferences for video advice, in order, include: financial planning, problem resolution, stock and funding picks, selecting bank products and insurance policy advice

- More than a quarter of those interested would move their money for video advice

Mobile Payments: Consumers are becoming accustomed to using mobility to place orders in advance, avoid lines, and pay — all with a few swipes on their mobile device. This capability is expected from banking relationships as well.

- 72% of respondents would use a mobile payment system if it had the capabilities they most want

- 15% would definitely start an account to get it

- The top factors that would increase a consumer’s willingness to use a mobile payment system include:

- Greater security

- Ease of use

- Universal acceptance

Wearables: Nearly half of all respondents (47%), regardless of age, are interested in banking with a smart watch application to:

- Check account balances (28%)

- Receive alerts to avoid overdraft fees, for example (24%)

- Transfer funds between accounts (23%)

- Pay for an item in a store or physical location (22%)

- Receive and redeem special offers or promotions (22%)

Augmented Reality: A surprising 76% of consumers are interested in augmented reality experiences that, when viewed through a smartphone, superimpose discount offers from local retailers. Other uses of augmented reality by financial institutions include:

- Reward redemption: Real-time display of merchants in an area where a user can redeem coupons

- Virtual locators: Location of bank, ATM, as seen through the camera of a mobile device

- Real estate: View property details, mortgage calculator and other tools by pointing a mobile device at a property

Digital Money Management: There is the capability of helping consumers manage their money more intelligently, either through enhanced budgeting programs of personalized investment recommendations. According to the Cisco research, 48% of U.S. respondents are interested in receiving automated financial advice, with the percentage even higher in younger demographics.

- Among those interested, 77% would move at least some assets to use an automated adviser

- 73% of respondents were interested in analytics-based banking tools, such as retirement calculators (22%), automatic savings tools (20%), and automated budgeting (20%).

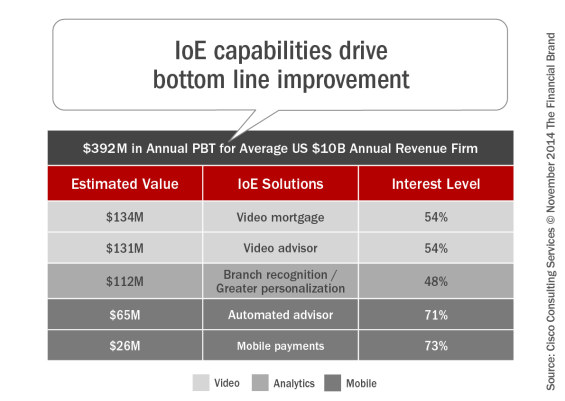

The Financial Potential of IoE Capabilities

Economic analysis from Cisco projects that changing the customer-relationship model in the branch and through digital channels could result in a bottom-line improvement of 5.6 percent for a typical financial services firm. For a financial institution with $10B in annual revenue, this represents a $392M annual profit increase opportunity.

More specifically, specific IoE-enabled solutions would have the following revenue impact for a typical bank that generates $10B in annual revenue.

A Digital Bank Case Study: mBank

In a Breaking Banks interview I did with Michal Panowicz of mBank in Poland (a recipient of the BAI-Finacle Global Innovation Award for Channel Innovation and several other awards globally), he described how digital capabilities underly all components of a customer relationship at mBank. For instance, mBank introduced an online and mobile banking platform featuring more than 200 innovative features such as advanced integrated money management, real-time customer relationship management, merchant-funded rewards, and Facebook integration that is available through both digital and physical channels.

By building digital capabilities underlying all processes, mBank is able to provide an advanced digital experience regardless of the channel(s) used by the customer. This includes, but is not limited to digital account opening, mobile cross-selling and the implementation of unique product enhancements such as their 30-second loan product, that currently represents over 20% of mBank’s loan volume in just over 6 months.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Implications for Banking Organizations

“The Internet of Everything (IoE) is rapidly changing the expectations of today’s consumers, and banking is not immune to those shifting preferences,” said Jameson from Cisco. “While the demands of Generation X have influenced banking practices in recent years, this study shows that every age group is clamoring for the personalized, convenient and secure services that IoE-enabled banking affords. Retail banks have a great opportunity to shift their business models and deploy solutions that deliver these services to increase customer satisfaction across all age demographics as well as increase their wallet-share.”

With one in five telling Cisco they would turn to a competitor if they don’t get the service they want, organizations slow to adopt should be concerned since switching financial institutions is getting easier on a global basis. In many cases, a relationship can be closed and another one opened with a couple touches on a mobile device.