With the cost of acquiring new retail, small business or commercial customers being five to ten times the cost of retaining an existing one, and with the average spend of a repeat customer being 50-100% more than a new one, bank marketers need to remember that the most efficient investment of marketing funds is to market to customers that already bank with you.

Here are 9 time-tested, common sense techniques that many bank marketers sometimes forget:

1. Ask questions: Consultative selling has been discussed the focus of the banking industry for decades. In a nutshell, the process begins by clearly analyzing a customer’s situation before presenting services or products. From the outset, a failure to cross-sell a brand new customer is a failure to develop a consultative relationship and a failure to ask the right questions.

Without these questions (which are close to impossible to ask later), the opportunity to open the right services initially or later in the relationship is made more difficult. In addition, as opposed to going through a long set of questions that make the banker (and customer) feel uncomfortable, the dialogue should be free flowing and natural.

Another option is to engage the customer with tools that can be used to complete the profile easily such as a tablet device.

2. Start with the lowest hanging fruit: The easiest sales that can be made to current customers are engagement services that help a customer use an account they already own. These ‘sticky services’ include a debit card, online banking, direct deposit, bill pay, automatic savings transfer, personal line of credit and security solutions such as privacy protection.

These services help to ensure the customer will use the products they own more frequently, will significantly improve retention and will help to improve the overall customer experience.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

3. Stay connected: I have opened a number of accounts over the past year (sometimes as a ‘secret shopper’) and am always very impressed with how much love the bank gives me when I opened my accounts. I am amazed, however, that I rarely heard from them again except to tell me about new fees or a regulatory change. This is despite the fact that each bank got my home address, my email address, my cell phone number and my home phone number. Nothing but crickets except for GoBank, that did a great job of informing me of next steps.

While some banks have very successful onboarding programs to help stay connected with new customers, a surprising number of banks still rely on the customer to onboard themselves. And unless the customer either opens a number of accounts initially or is successfully onboarded soon after they open a new account, their bank may never include them in a model-driven cross-sell program. This is because model-driven marketing programs usually focus on customers with broader relationships.

4. Continually evaluate upsell opportunities: Rather than using product-driven programs that are done seasonally, consider funding more customer-focused programs that evaluate each customer’s propensity to open one or more of the products and services you offer. With some of my clients, we evaluate each customer’s transactional, product ownership and even behavioral characteristics to determine what would be the most likely next purchase and whether the propensity to purchase is high enough to make an offer.

In some of most successful programs, this evaluation of opportunities is done monthly, with smaller mailing universes, but much higher response rates. As the ability to use ‘big data’ increases, the movement from sales ‘programs’ to sales ‘processes’ becomes a necessity.

The goal is to offer the right product, at the right time, to the right customer through the right channel. This takes customer data analytics.

5. Personalize your communications: A recent report from Gallup revealed that 66 percent of the most engaged customers at banks believed the marketing communication they are receiving was ‘general in nature’ and not at all personalized. Worse yet, 53 percent of the households surveyed said that the offer received was for a product they already owned.

With consumers becoming aware of the ability for all companies to micro target, they are expecting their financial institution to be one of the best due to the insight organizations have. Therefore, now more than ever, banks need to build segmentation programs that reflect customer needs as well as current product ownership and use this insight to drive communication.

6. Empower your customer contact teams: For most customer-facing employees of your bank, their primary responsibility revolves around efficient processing of transactions and/or customer service. To leverage the thousands of customer engagements these employees have each year, you need to provide easy ways for them to extend their conversations to include relationship expansion opportunities. Many banks provide prompts on their employee’s computer screen around recent sales communications received by the customer, most likely products that may interest the customer and even special offers that can be made as part of their transaction or service conversation.

The best programs don’t stop there, but include tools for the customer to take advantage of the offer. This may be an immediately generated custom printed sales document, a follow-up email or sales call or a referral form.

7. Ask for referrals: One of the easiest ways to generate new business and increase loyalty of current retail or business customers is to ask (and possibly incent) for referrals. If a customer is happy with the way they are treated at your organization, they usually want others to know. This is especially true with satisfied small businesses, private banking customers and with retail customers that are part of a bank-at-work program. And it doesn’t hurt if you provide an incentive to your current customer.

At a time when new customer acquisition offers often exceed $100 and when the overall cost of acquisition is more than $250, offering a ‘bounty’ of $50 would be less expensive and would most likely generate a more loyal customer.

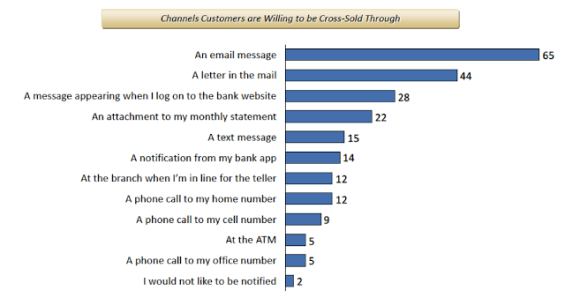

8. Leverage all channels: Never assume that customers understand all that your organization offers or absorb communication the same through all channels. Remind your customers continuously that you know who they are, understand their needs, are looking out for them and that you are willing to reward them for their loyalty.

And use as many direct channels as possible to reach out to your current customer base, including email, direct mail, statement inserts, banner ads on your website, ATM messaging, outbound calling efforts, etc. Digital retargeting of customers who visit your website or are part of your direct mail or email programs also is a highly effective and very efficient way to cross-sell customers.

Finally, it is time to start building cross-selling messages within your online and mobile bank applications and to not assume customers will not want or read an SMS message if it is well targeted.

Source: Novantas 2013 Multi-Channel Sales Survey (Total US Respondents = 4,813)

9. Measure and reward what you want done: By providing ongoing measurement of the cross-selling objectives you want to achieve and paying for the achievement of these objectives, you have a much better chance of reaching your goals. This continuous reinforcement of your cross-sell mission allows your team to be focused on what’s important.

You can also turbocharge your results by communicating how you are assisting in their efforts. Provide opportunity reports of the customers where they may have the greatest opportunity for success. As part of these reports, it is also helpful to provide background as to why the customer is being selected for a specific offer.

Finally, remember that current customers like to be rewarded for their loyalty. One of the best ways to do this is to remember to include an offer with any cross-sell or upsell message. Without an offer, you may be perceived as simply ‘pushing product’ without leveraging the relationship value already in place. A strong offer will not only generate a better response to your communication, but also remind the customer of the value of doing business with your organization.