Ask Devon Kinkead, founder and CEO of Cambridge, Massachusetts-based Micronotes, how he feels about marketing in the financial industry and he won’t pull any punches.

“There are 14,000 or so financial institutions in the U.S. right now, and only a handful of them do cross-selling well,” he says. “And yet cross-selling is mentioned in the strategic plans of pretty much every one of those banks and credit unions.”

One of the reasons so many banks and credit unions suck at cross-selling, Kinkead says is that “you have to get your staff to become salespeople… which is really difficult.”

Compounding the challenge, cross-selling has historically been a branch-based activity, and people just aren’t going into financial institution branches anymore.

“The question a lot of bank and credit union executives are asking themselves these days is: how are we going to do this — cross-sell to our customers — online?”

Kinkead’s been riddling that same question himself for some time. After experimenting with a number of different strategies, Kinkead realized that the answer is not banner ads. In part that’s because more and more of today’s consumers suffer from so-called “banner blindness.” Consumers simply tune the ads out largely because such ads are annoying… or worse: irrelevant.

“I hate it when I’m online and someone throws an ad in front of me that has nothing to do with my life.”

— Devon Kinkead, Micronotes

“I don’t know about you, but I hate it when I’m online and someone throws an ad in front of me that has nothing to do with my life,” Kinkead gripes. “I always think, ‘If you asked me what I’m looking for, I’d tell you.’”

Micronotes “is my response to that annoyance,” he adds. “Which is to say, with our technology, we ask people want they want and need — and we listen to what they have to say, too.”

Kinkead says he’s been offering Micronotes’ “targeted interview technology” to financial institutions for the last couple years, which allows them to conduct succinct, real-time interviews with consumers through their websites. This has given Kinkead a front row seat with an unfettered perspective on today’s banking consumers.

Read More: The Future of Online Banking: Know Thy Visitor

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

The Right Kind of Q&A

Micronotes technology inserts unobtrusive dialogue boxes onto bank and credit union websites, posing targeted questions about consumers’ financial needs. The questions appear in the website’s sidebar as customers review their accounts. There’s also the option to query users in a similar fashion by presenting a series of simple questions as they’re about to log out of the site.

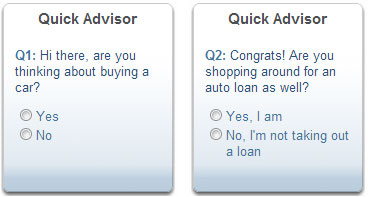

An example of the kind of product questionnaire that can be posed as online banking users log out of a session.

Micronotes doesn’t engage customers at log-in, because, as Kinkead explains, “we’ve done a lot of user studies and that taught us that the best way to get someone angry is to get in the way of them getting their bank business done.”

Here’s an example for how Micronotes technology might work. Let’s say you’re a customer of ABC Bank and you’ve been incurring a bunch of auto-repair or rental-car expenses over a period of a few months. When you go online to do your banking at abcbank.com, ABC Bank might present you with a dialog box that asks, “Are you thinking about buying a new car?” After answering yes or no, a few more follow up questions push the conversation further, ultimately leading to a personalized offer. The process takes an average of about 18 seconds.

“What we do is interview consumers and then, based on their responses, give them exactly what they need in terms of products,” Kinkead explains. “It’s all driven by what the customer says during that 18-second interaction we have with them.”

“If you tell us you aren’t planning to buy a car anytime soon, why bother splashing an ad for car loans in front of you?” Kinkead asks incredulously. “Instead, we’re going to say, ‘okay, we understand.’ Then we ask you different questions. ‘Are you making a payment on an existing auto loan at another financial institution? You are? Well, we may be able to save you some money.’”

The ultimate objective, Kinkead says, is to turn these two- and three question interviews into “conversations that are relevant to consumers, that have something to do with their needs and their lives.”

And, as a bonus, people will learn more about the range of services and solutions offered by their financial provider.

The conversation doesn’t end with the online Q&A, by the way. Once someone accepts a lead or offer, Micronotes automatically routes it to a product expert within the financial institution for more direct and personal follow-up. Leads also are cataloged in an archive that can be accessed and examined later. A campaign summary provides an overall view of a particular campaign’s performance to date.

Read More: 10 Tips To Drive More Online Applications

Deepen Relationships and Drive Down Attrition Rates

Micronotes co-founder and COO Christian Klacko says engagement rates with the surveys average between 8% and 10%. 50% of those opt to proceed with an offer, with 15% to 20% eventually converting into actual sales.

Kinkead points out that although the average consumer has seven financial products in their portfolios, most banks and credit unions own only 2.1 of them. Kinkead believes Micronotes can help them boost that number to 2.4 products per customer.

It may sound like a modest gain, but Kinkead says there are incremental gains with respect to loyalty and attrition.

“Once you deepen the relationship with a consumer, the probability of him or her leaving your financial institution for a competitor diminishes,” he says. “It’s a return that compounds with each successive product you own.”

Read More: Consumer Loyalty in Banking Pays Big Dividends on Sales Growth

Kinkead describes the implementation of Micronotes Q&A cross-selling solution as “really easy.”

“You don’t need to worry about core integration, and you won’t need to contact your online banking provider,” he says. “We basically insert just our interview widget where the financial institution normally would put an ad — right in their online banking platform.”

Kinkead says Micronotes will soon be expanding its technology into the ATM and mobile spaces as well, which should yield some more interesting opportunities to cross-sell banking services to consumers.