Some may question Sir Richard Branson’s timing. Why would he launch a bank now?

Well, for starters, Branson is exceptionally good with money. Who better to run a bank than a guy who makes money almost faster than it can be printed?

But there’s a more serious and strategic reason Branson is launching a new financial brand right now: Every financial institution established prior to the credit crisis has, in the consumer’s eyes, a somewhat tarnished brand. People are apt to lump most pre-2009 financial brands into the same category, at least to some degree, making them share equal bits of blame. Guilt through complicit complacency, if nothing else.

Why do you think consumers have responded so enthusiastically to Ally Bank? Folks don’t really know/care that Ally is simply a reskinned GMAC. People love the fact that the bank is fresh and funny. It’s a new brand, so it’s new to them.

Reality Check: The financial industry is ripe for new “challenger brands” to come in and rock the status quo.

Branson’s announcement that he is expanding Virgin Money to become a full-fledged bank — with branches! — undoubtedly shocked those in the financial industry. If you’re like any of those Branson has challenged before, you’re probably reacting with a mix of anxious excitement and fearful nausea.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

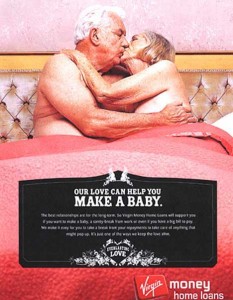

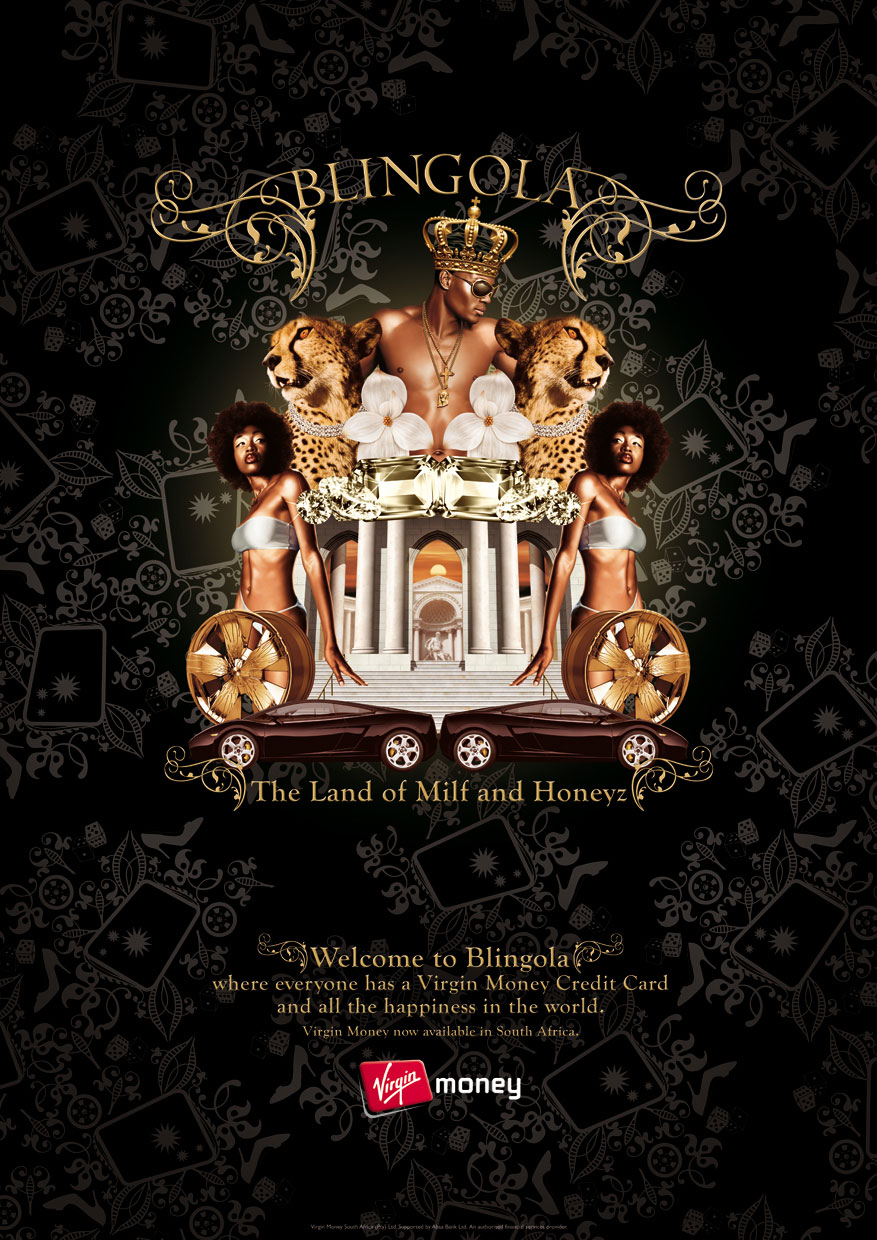

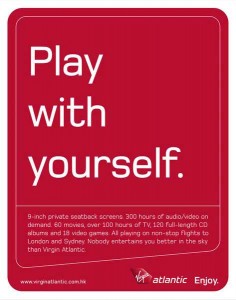

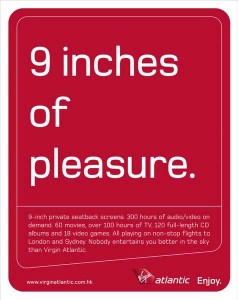

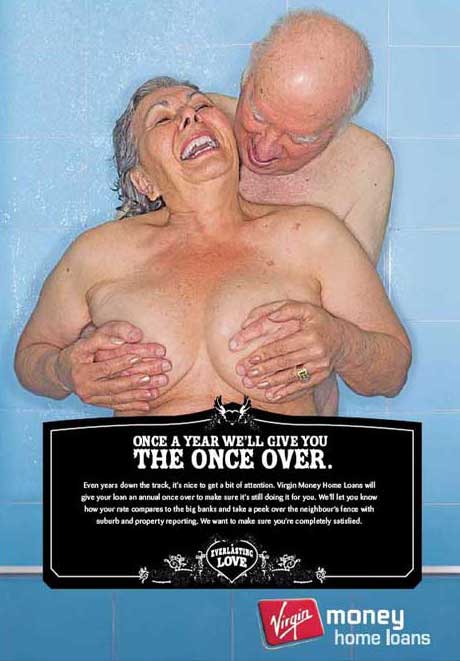

The Virgin brand — in any industry — is known for shaking things up. Branson loves doing things that everyone else says shouldn’t- or couldn’t be done. He takes chances. But when it’s all done (usually with great success), everyone looks back and admires Virgin’s unique flair. It’s a stylish and sexy combination of courage and cunning that reflects the cavalier playboy behind the brand.

And the same thing is bound to happen in the financial industry. But don’t despair; there is a silver lining. A few years from now, everyone will be thanking Virgin for coming along and loosening up banking. Branson will burn banking’s figurative (yet ever so restrictive and uncomfortable) bra, and liberated financial marketers will owe Virgin their gratitude for defining the new extremes of “what’s acceptable.” Financial marketers will be able to rationalize their crazy new ideas by pointing to Virgin and saying, “See! At least we’re not that far out there!”

If you doubt Virgin’s powers of disruption, all you have to do is look at what the brand has already done in other industries. These guys are smart marketers, crazy innovators, and they know how to execute. They are creative, provocative and obsess over details. Just look. These guys bring their A-game every day, something that should scare everyone in retail banking. Their sometimes lewd nature may not appeal to everyone, but then again, the best brands never do.

Much like this year’s Nobel Peace Prize, The Financial Brand could bestow a “Breakthrough Brand Award” for what the Virgin Bank brand will likely achieve. But that feels a tad premature, so we’ll wait and see what comes next.

Much like this year’s Nobel Peace Prize, The Financial Brand could bestow a “Breakthrough Brand Award” for what the Virgin Bank brand will likely achieve. But that feels a tad premature, so we’ll wait and see what comes next.