As part of a broader initiative to reach out to customers experiencing financial hardship, TD Canada Trust has created TD Helps, a subsite featuring 12 employee videos. The project was inspired by stories shared among employees on TD’s intranet.

Most of the videos — 10 of the 12 in fact — are firsthand testimonials, where an employee shares a story about how they were able to help a customer who has been severely effected by the economic downturn. There’s also one video with a step-by-step breakdown of TD’s loan consideration process, and another one from TD Canada Trust’s CEO introducing the subsite.

“Our employees were the driving force behind this website. We thought and hoped that a lot of our customers would identify with some of the situations our employees have helped with, and that their stories would encourage people to come and see us sooner,” says Tim Hockey, CEO/TD Canada Trust.

It does not appear that TD Canada Trust will be rotating any fresh videos into its TD Helps lineup. Maybe they will if the idea takes off, but don’t count on it.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

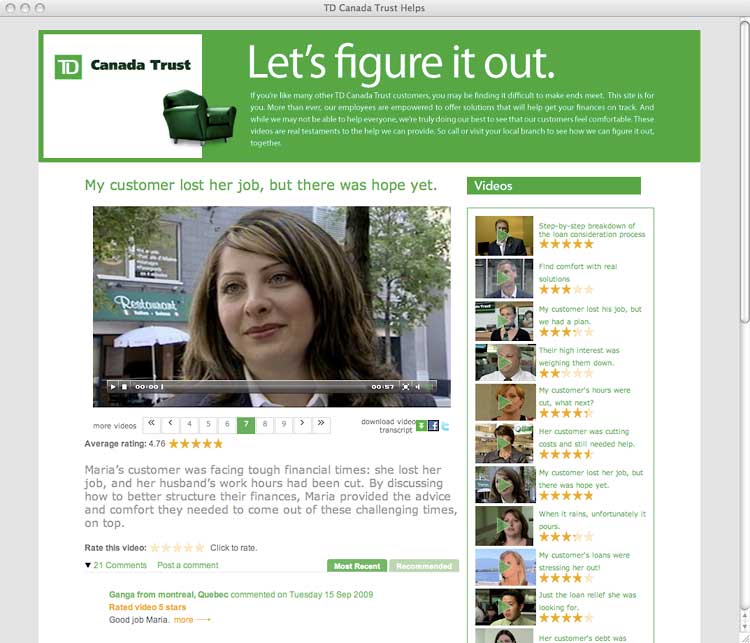

“Let’s figure it out.”

The subsite’s banner has an understated sense of design. A simple, overstuffed, green leather chair serves as a metaphor for the bank’s “sit-down-and-talk-to-us” message. It’s like an invitation from a financial psychologist, “Here, please, take a seat and get comfortable.”

The subsite’s banner contains is the only place you’ll find any copy from TD corporate:

“If you’re like many other TD Canada Trust customers, you may be finding it difficult to make ends meet. This site is for you. More than ever, our employees are empowered to offer solutions that will help get your finances on track. And while we may not be able to help everyone, we’re truly doing our best to see that our customers feel comfortable.”

The TD Helps subsite, hosted as a part of TD Canada’s main website and not as a stand-alone microsite, is fairly simple in its structure. There’s the welcome banner and 12 videos, and that’s it. But that doesn’t mean that TD didn’t put a lot of thought into it, because they clearly did, and there are lots of little details to prove it.

People can rate- and comment on the videos. You can even rate- and reply to other people’s comments.

The CEO’s welcome video has received the most comments so far, 63 in all. People are wondering, “Is this a genuine reflection of the bank’s beliefs? Or just a PR stunt?” The conversation is actually quite fascinating.

While customers have been able to comment on the TD Money Lounge on Facebook for a couple of years, this is the first time the bank has ever opened up its own site for comments.

A couple of the videos are rated five stars out of five. The lowest ranked video, “Their High Interest Was Weighing Them Down,” received only 2.17 stars, but unfortunately, the site doesn’t tell you how many people rated each video.

There are buttons that people can click to share the subsite with their Facebook fans and Twitter followers. Clicking on the buttons will auto-populate a somewhat presumptuous message from your account: “Wow, a story about a bank who’s actually helping people? http://www.tdcanadatrust.com/tdhelps”

The subsite has one other interesting feature. You can download a PDF transcript for any of the videos. But again, who’s going to do that?

Tasha’s Video

Tasha Serraro is a banking specialist at TD Canada Trust branch in Marathon, Ontario. The closure of the town’s local pulp and paper mill dealt a heavy economic blow to her customers. With her help, one of her customers secured lower monthly payments on his loan, and developed a plan to keep his family comfortable until he could find a new job.

“We were able to arrange lower monthly payments and offer a bit of a cushion in case times got worse and they did… he lost his job,” Tasha says in her video.

Her testimonial continues: “We don’t know if the mill’s going to reopen, but what we do know is that this couple is comfortable for the next few years. They have a plan in place and they’re going to be okay.”

TD Canada used Tasha’s testimonial as the showcase video for the launch of TD Helps. Her video travelled along with another video from the CEO in PR materials. It is the most professional of the 12 videos available on the site, with a higher production quality and good editing. Most of the other videos are shot in branch lobbies and typical office environments.

In case you were wondering… Yes, The Financial Brand was able to confirm that, similar to Delta’s Katherine Lee, Tasha is indeed a real employee at TD’s Marathon, Ontario branch, and not just an attractive paid actor or someone recruited from somewhere else at the bank.

“Project Umbrella”

Earlier this year, TD Canada Trust introduced an internal program to make sure that its employees knew what customers were dealing with. It was called “Project Umbrella,” an internal codename is meant to signify the bank’s willingness to shield customers from a rainy day.

Employees were trained accordingly, and given new tools, like the ability to defer mortgage payments.

“The result was that we were helping thousands of customers stay in their homes, get their debt under control and their lives back on track,” CEO Hockney says.

TD Bank says it has helped “nearly 20,000 clients facing severe financial hardship” from February to July under Project Umbrella.

According to TD, employees started asking “How do we reach more people? How do we get the word out to more people that we can help them?”

The Toronto Star reports that TD “executives weren’t convinced at first that going public was the right approach,” and that Project Umbrella is expected to have “no material impact” on TD’s earnings or loan loss provisioning.

That’s an interesting thing to admit to.