Opening an account is the customer’s first substantive introduction to a bank. When a new customer opens a checking account, for example, the process gives the bank a chance to set the tone for the ongoing relationship.

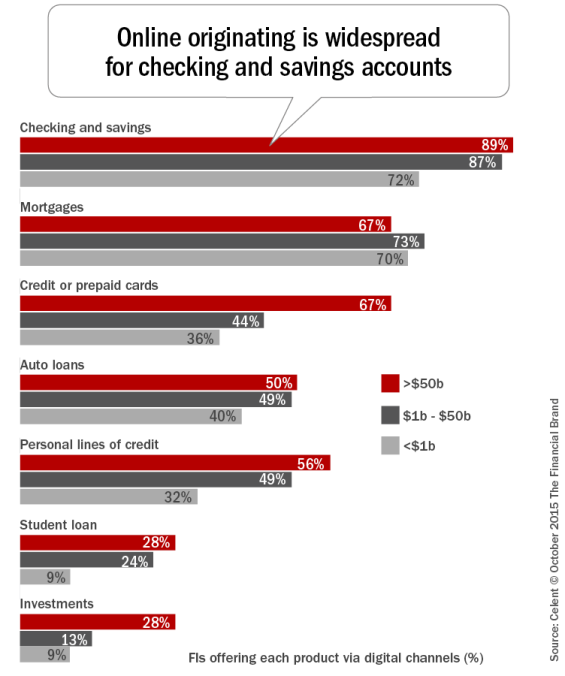

With fewer transactions occurring at the branch, and more accounts being opened online, it goes without saying that customer experience with digital channels has become increasingly important.

Since a banking customer’s first impression is being shaped by their experiences with these digital channels, customer-centricity (trite as the term is) must be the principle guiding banks as they refine their account opening processes.

As new competitors — from neobanks to prepaid cards — raise the customer experience bar, banks are under increasing pressure to put their best foot forward when courting new customers, more of whom are opening their accounts online rather than at the branch.

So the question becomes, how does a bank make a good impression?

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

The Experiment

Celent chose a cross-section of 26 banks and attempted to open accounts online during the spring and summer of 2015, evaluating the processes solely from the consumer’s perspective. We assumed that the customer has already decided he or she wants to open some type of checking account at a particular bank. Therefore we did not address marketing and other considerations (branch vicinity, recommendations, etc.).

We wanted to open the cheapest, most basic checking account possible, and looked for guidance from each bank’s home page and assessed its effectiveness. It is worth noting that the experiment was not an attempt to discover the “best” or most economical checking account, so things like fees did not deter us.

Once we selected the banks, we evaluated each one of them at every step in our seven-step account opening process:

- Provide access and guidance on account types

- Capture data

- Verify

- Decision and approve account

- Provide disclosures, obtain consent

- Fund account

- Fulfill

There are certain additional factors that don’t fit neatly into the seven steps, and we realize this. Most prominent are the ability to move between channels when opening an account (i.e., starting online and finishing in a branch) and the ability to save an in-process application and resume later. Therefore, we did not track these factors systematically.

Initial Findings

We found wide variability in each of the seven account opening stages. Some banks still take a bank-centric approach, while the best ones adopted a truly customer-centric perspective to make the exercise simple, seamless, and as painless as possible.

”We were surprised at the variability in the quality of the experience and believe that many banks should make improvements online even as they begin to make mobile account opening available.”

Of the 26 banks, we were unable to open an account at eight institutions. At some banks, we would have been able to open an account in person in another state (at least if Internet forums are to be believed), but that was not the purpose of this exercise.

Additionally, some banks had anomalous glitches or bugs. In keeping with the customer-centric focus of the experiment, our reaction was simply, tough. They had their one chance, and they failed to take advantage of it.

The quality of the experience varied widely, and even among leaders, there is an immense amount of room for improvement. Some prominent names still required wet signatures, or made applicants spend a lot of time on their sites before telling them that they couldn’t be served because they didn’t live in the right ZIP code. It seems as though they simply ported offline forms to the web and let compliance drive the process.

Others tried to implement technology that didn’t quite work (like capturing name, address, and the like by taking a picture of a driver’s license).

The banks that stood out as being the best, however, made the process as frictionless as possible with features such as quick entry, easy Know Your Customer (KYC) methodology, and a wide range of product choices appealingly presented.

Conclusions and Next Steps for Banks

”Too often banks seem to be designing their process to meet their own needs first, with customer experience being an afterthought.”

Banks face a host of constraints as they bring their account opening processes online. Customers, however, don’t care. Too often banks seem to be designing their process to meet their own needs first, with customer experience being an afterthought. Opening an account shouldn’t be a privilege that banks are deigning to bestow upon their customers. Rather, it should be a welcoming and inviting introduction to the bank.

Four key takeaways emerged from the experiment that banks need to consider when developing their own online account opening experience:

- Design the process from the applicant’s perspective, not the bank’s.

- Consider the capabilities offered by the new medium rather than simply transferring a paper- and branch-based process online.

- Avoid self-censorship: question why certain processes are used (e.g., wet signatures), and refine them when they don’t make sense.

- Develop a strategy to implement the next phase of account opening: mobile.

As we’ve all been told, you only have once chance to make a first impression, so make the most of it.