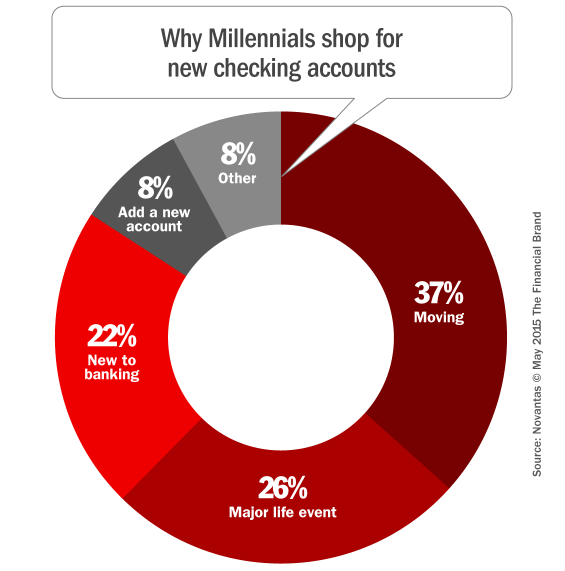

Millennials, consumers aged between 18 to 34, make up more than half the market of those who are opening new checking accounts. Last month, Novantas fielded a survey on FindABetterBank to understand the consumers who visit the site, and to learn more about why they’re shopping for a new checking account.

The study revealed that one of the most common reasons why Millennials open new checking accounts is because they are moving out of the area where their current institution is based. One in four Millennials (26%) are pushed into shopping for a new checking account by life events like getting married, moving or having babies. Not currently having a checking account drives 22% of this group to shop for their first checking account.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Major Motivations That Push Millennials to Switch

They’re paying too much in fees at their current bank. 34% of Millennials leaving their current checking provider cite high fees. While high fees is the biggest reason Millennials are moving away from their current institution, other reasons for switching include bad customer service experiences and products that don’t fit their needs.

Millennials are on the move. 19% of Millennials indicated that they’re shopping for a new checking account because they’re moving. Of all the life events that push Millennials to shop for a new bank or credit union, this is the #1 reason.

Millennials are most likely to be new to banking. 22% of Millennials shopping for new checking accounts indicated that they don’t currently have an account. 80% of these Millennials report household incomes under $50,000.