There is more to a positive consumer experience in banking than the time it takes to do a transaction or the design of a mobile app. In a rush to innovate and improve channel delivery, most banks and credit unions have forgotten to take the time to think of how money and feelings are entwined.

At what point did the banking industry forget that people have strong emotions about their money? Today, consumers can feel this glaring oversight at every level of their interaction with institutions that build products with no insight, or even consideration, as to how the products emotionally resonate with consumers.

Unlike other consumer product industries, most financial institutions don’t have teams of behavioral psychologists pouring over slides of human expressions around the services offered. The industry forgets about the way people react to different financial situations.

Lit up eyes and a gaping mouth? This must be the expression of someone who came into an unexpected monetary windfall. They’re elated, with questions around what they should do next. Narrowed eyes, a staunch frown and clenched jaws? This must be the anxiety around an unexpected bill, defaulting on a loan or needing to borrow from an aging parent.

Not only are these teams non-existent at most financial organizations, but this type kind of thinking is missing in all but a select few progressive institutions internationally.

Community Bankers’ Top Priorities This Year

CSI surveyed community bankers nationwide to learn their investments and goals. Read the interactive research report for the trends and strategies for success in 2024.

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

Feelings Are Scary, Numbers Are Safe

Maybe the banking industry is too busy with other priorities to think about consumer emotions. Between the basic ‘numbers of banking’, compliance, competition, innovation and the unexpected surprise of the day, the industry is too busy.

We adjust APRs, we invest hundreds of millions, we count our clients (sometimes we do this twice), we agonize over the latest regulation and we scrutinize any of the four magic quadrants for answers that will provide marketplace success.

And while the industry invests significant amounts of money on consumer satisfaction ratings, somewhere deep down we know they aren’t truly happy. The expectations in banking are set rather low in the consumer’s mind, so ‘satisfaction’ may actually mean ‘non-dramatically-dissatisfied.’ And since few spend time finding the direct correlation between genuine positive emotion and dollar signs, we aren’t too sure we care about the distinction.

Buy Customer Service in the Digital Age

Fintech Firms Fill The Emotional Void

“We’re committed to helping college students succeed in their academic journey. That means we can’t get away with products CIOs love to buy … we need to build products students love to use,” stated John Kolko from Blackboard. While is a different industry, his statement summarizes how his company arrived at the understanding that the end consumer matters deeply from an emotional point of view.

There are financial firms that have committed to ‘Emotional Banking’ and have succeeded in the marketplace. Meniga has won numerous awards for their user experience that goes beyond clicks and graphs. A relatively new start-up, Hip Pocket, has built their entire solution around the consumer challenges of borrowing. And Simple was established by non-bankers frustrated by the way financial institutions treated customers and have identified that thinking about how the user ‘feels’ pays off.

Anyone who’s ever been to a Finovate event, where new Fintech firms show their products, has felt the magical moment when the entire audience connects with something they see on stage that makes them feel emotionally positive. These firms, and other new start-ups are doing the necessary legwork to build products and services that resonate with the emotional part of banking. Are legacy institutions prepared to think under these terms?

UX Lost Its Religion

Some would claim that this is the job of user experience (UX) teams in banks around the world. Unfortunately, UX as a discipline, seems to have had trouble staying true to its ‘make it better for people’ values recently.

In some cases, the efforts of these teams have gotten marginalized as the poor creative, slightly kooky cousin of more reputable departments that keep the cogs running. In other instances, the UX conversation seems to have veered off dangerously, sometimes exclusively, into conversations on how to optimise for the umpteenth device in a way that allows the user to see the full menu.

What the banking industry needs to do, more than anything, is to allow the UX teams to return to the roots of making sure we stop thinking features and again think about consumers’ emotional relationship with their money. In fact, it should be the job of everyone in the banking industry at this time of heightened competition.

Do We Really Need To Talk About Needs

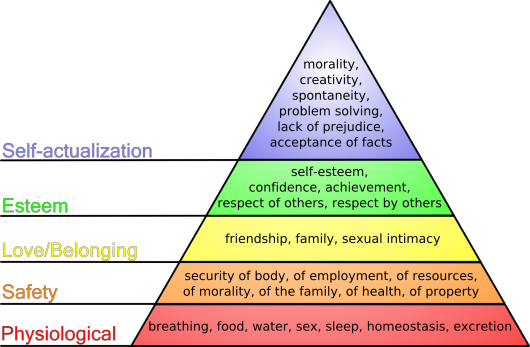

There are some in the industry who probably believe we spend enough time talking about ‘needs’ already. Everyone in banking is likely familiar with Maslow’s Hierarchy of Needs. At least three (and debatably all) of the levels are intrinsically connected to money.

People don’t ‘need’ products. They don’t have a checking or current account ‘need’. Consumers have Physiological and Safety needs that these products satisfy. Consumers also don’t have loan ‘needs’, but instead have Belonging, Esteem and Self Actualization needs that a loan would satisfy.

When did the banking industry decide that a consumers’ emotional experience is secondary to the devices it supports, the channels they promote and the payments they process? Would we go back to it once all channels were digitized enough?

What’s more puzzling is that emotional banking isn’t even the most complicated of exercises. The way we build products around consumer emotions should have already been in place, with the discussion revolving around how new technology can enhance the emotional experience. By now, we should have a generation of bankers who could discuss the proportional relationship between levels of anxiety and elapsed time that a customer experiences when unable to transfer money, depending on their respective segment and life circumstances.

If we had done our collective homework on how consumers truly feel, the Business Prevention Department (™ J.P. Nicols) would become the Business Enablement Department because Legal, Compliance, Procurement and Operations would already understand that splitting a bill is a Money Fact of Life ™.

The Rise Of The Empathetic Banker

There are multiple theories excusing the lapse above. They range from the rush to build physical and digital services to the fact that banking traditionally feels mandated to see themselves as in charge of numbers and safety, or guardians of unquestioned trust as opposed to builders of trust.

One thing is clear – bankers need to do a much better job thinking about themselves as a consumer. Bankers imperatively need to analyse how they feel themselves, and translate those feelings to a desire for digging into others’ relationship with their money as well.

As an industry, we need to roll up our sleeves – we need to talk about the consumer attachment to savings, investments, day-to-day money, and how to move towards Invisible Banking. We have to think about how money impacts anxiety, joy, and goals.

How do we encourage consumers to embrace good money habits and get them out of bad ones? How do we make consumer’s lives richer and more connected to us … emotionally? How can we delight them, answer their emotional money needs and, most importantly, how can we become invisible empowerers of Money Moments ™?

Emotional Experience (EX) is the next step after UX. While the emotional connection should have logically superseded UX, this is not so in banking. In fact, understanding, and responding to, the consumer’s EX should precede the building and delivering of products, the development of customer service units and even the building of our core systems. But it is not too late.

It is time to become more empathetic and dig deep into our customer’s hierarchy of needs and build an Emotional Experience that can be a differentiator in the marketplace. It will help us compete against new entrants (who are building products with EX as the foundation) and will guide future business initiatives.

We should get excited about the journey ahead, discovering how to make EX bigger than all the other acronyms banking has been meaninglessly throwing at a consumers. If we were to succeed, having the consumers’ feelings about money validated will translate into more tangible results on the bottom line for the successful organisations than anything we have done in banking over the past several years.