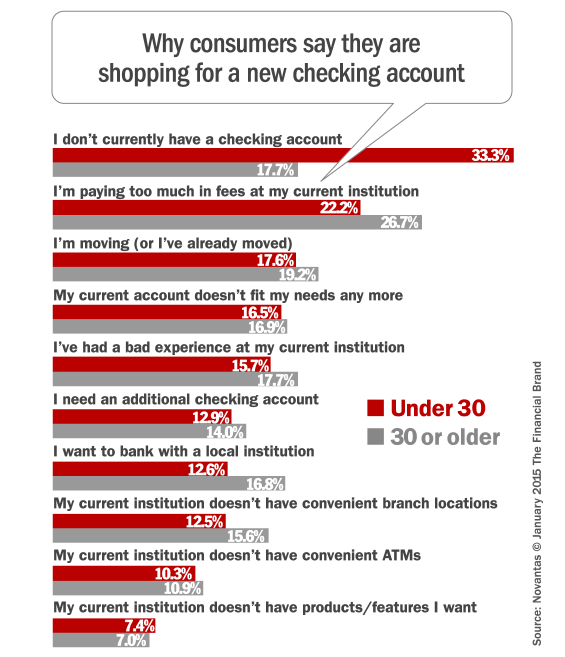

In December 2014, a survey fielded to bank shoppers on FindABetterBank asked them why they were shopping for a new checking account. One-third of shoppers under 30 indicated that they don’t currently have a checking account vs. 18% of shoppers 30 or older. Other significant age differences include:

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Dissatisfaction with account fees. Account fees are a big reason why shoppers are dissatisfied with their institution, but shoppers 30 or older were more likely to indicate high fees as a factor in their rationale.

Locality is important to younger shoppers. Nearly 18% of shoppers under 30 cited moving as a rationale for shopping. Clearly, this group of young shoppers associates banking with physical locations. And while older shoppers indicated more sensitivity to branch and ATM locations, it’s not by much.

Bad experiences creates churn. Bad service is a major cause of attrition, and these data show that younger shoppers are slightly less motivated to switch because of it. However, switching because of a bad experience correlates more strongly with income than age – over 30% of shoppers with incomes greater than $175,000 cited bad customer service compared to 15% of shoppers with incomes under $50,000.

Small institutions appeal more to older shoppers. This is not great news for community banks and credit unions. The bigger “brands” resonate more with younger shoppers. As opposed to 10 years ago, some banks are national brands (e.g., Bank of America, Capital One) and more recognizable to younger consumers. Banks like BofA and Chase have been able to extend the notion of convenience beyond the physical realm to digital channels. This message appeals more to younger shoppers.