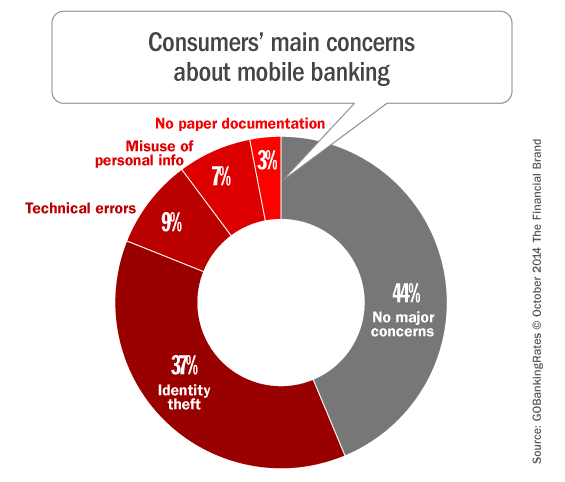

GOBankingRates investigated how secure consumers feel about banking over their smartphones. They found that, while 44% of consumers say they aren’t worried about mobile banking, the majority have major concerns about accessing their bank accounts over their phones. GOBankingRates’ poll, which asked respondents about their biggest mobile banking fears, revealed consumers’ concerns include technical issues, missing funds, misuse of information, and lack of paper documentation.

Reality Check: It’s going to be difficult convincing consumers to adopt mobile payments and mobile wallets as long as the financial industry continues to have security issues. Between phishing scams and hacks at retailers like Home Depot, consumers see a ton of risk.

“It hasn’t been a great year for cybersecurity,” says Edward Stepanyants at GOBankingRates. “From Target’s Black Friday hacking which compromised the personal information of 110 million customers, to the security breach at JPMorgan Chase affecting two-thirds of American households, data breaches have become such a common news item that they now seem to warrant a monthly roundup.”

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Gender

In the study, women were 65% more likely to worry about technical errors resulting in missing funds. Men were 4.1% more likely to be concerned with identity theft, 85% more likely to be concerned with lack of paper statements, and 37% more likely to be concerned with misuse of information than women.

Age

Those ages 45 to 54 had the fewest concerns about mobile banking, proving (yet again) that it is not the Millennial generation who is most comfortable with digital banking technologies. Respondents ages 55 to 64 were those most likely to have major concerns — no surprise there. Gen X respondents were most likely of all age groups to be concerned with having paper documentation. Those under the age for 45 were 43% more likely to be concerned with misuse of personal information than those who were older.

There was a clear, positive correlation between concerns over identity theft and age. The 18- to 24-year-old age bracket was least likely to be concerned with identity theft by a solid margin, while respondents ages 55-64 were most likely to be concerned with it.

Those ages 18 to 34 were far more likely than any other groups to be concerned with technical errors resulting in missing funds.

Income

The lowest two income brackets polled ($0-49,999) were most likely to have no concerns about mobile banking ($0-$24,999 at 45.16% and $25,000 to $49,999 at 45.34%), while those making $100,000-$149,999 were least likely to have no major concerns (at just 16.67%). In other words, those making $100,000+ were 172% less likely to have no major concerns than those making $0 to $49,999.

There was a positive correlation between income and fear of identity theft. Those making $100,000 are most concerned with identity theft, misuse of information and technical errors (but 0% were concerned with lack of paper documentation).

Geography

Urban respondents were most likely to have no major concerns, followed by suburban and rural respondents, respectively. All three subsets were almost equally concerned with identity theft (within a fraction of a percent). Urban respondents were also most likely to be concerned with the misuse of information, followed by suburban and rural respondents, respectively. On the other hand, rural respondents were most likely to be concerned with technical errors, followed by suburban and urban respondents, respectively.

Western and Midwestern consumers were more likely to have no major concerns than Northeastern and Southern respondents. Respondents in the Northeast and South were more concerned with identity theft than those in the West and Midwest. Those in the Northeast were the most concerned with misuse of information by a strong margin.