Today, about 70% of consumers shopping for deposit products do some or all of their research online. Despite their affinity towards online research, most of these online shoppers will end up opening their accounts at branches. Why? Most believe it’ll be more convenient. Not surprisingly, these shoppers usually choose a bank or credit union with a branch near where they work or live.

Even though consumers transact less in branches than in the past, most still perceive institutions to be “convenient” based on where their branches are located. Mobile banking is driving wholesale change in the financial industry because mobile bankers are different. Case in point: shoppers on FindABetterBank that “must have” mobile banking are less likely than other shoppers to select an account because the institution has convenient locations.

The perception of convenience correlates strongly with purchase intent. So a strategy to reduce the number of branches must include a strategy to establish the brand as convenient for features and attributes that aren’t associated with physical locations.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

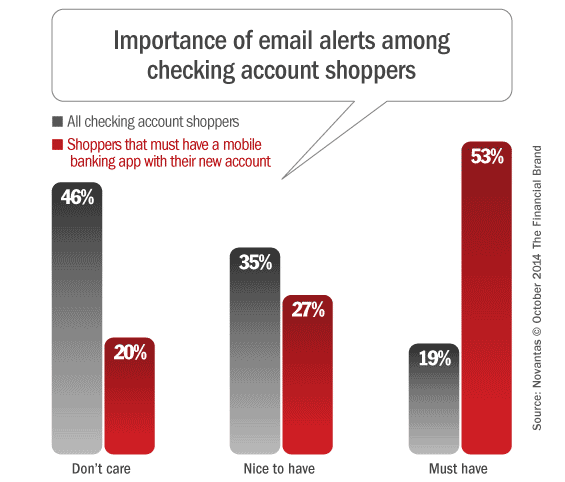

Focusing on the non-physical features today’s mobile bankers want is a good place to start. For example, mobile bankers demand email and text alerts more than other shoppers do. Fifty-one percent of shoppers that must have mobile banking apps also must have alerts – only 16% of non mobile-centric shoppers have the same requirement. Women tend to show more interest in alerts than men, as do people who are more tightly managing their finances (lower income households, older consumers).